"The travel stocks all got a boost, I guess it goes without saying that fewer barriers = more people experiences, i.e. more travel. If you make it hard for people to travel to and fro, they are less likely to do it. Remaining in the EU, with greater travel is good for these travel stocks. The British banking stocks (we are sea hopping a little here) also caught a serious bid, Royal Bank of Scotland was up over 7 percent, Lloyds added over 8 percent, whilst Barclays added six and three-quarters of a percent."

To market to market to buy a fat pig It is the shortest day of the year. Of course for us in the Southern Hemisphere. Before you think it is a big deal, the bigger deal is that it is the Summer Solstice (the longest day of the year) for the folks in the Northern Hemisphere. Only 800 million odd people live in the Southern Hemisphere, roughly 10 percent of the global population. Excuse their excitement about the weather on Twitter and Instagram and all that, ok? The moon is the one constant, full here and there and everywhere. Lovely. So lovely that best we return to the markets, right? Which were pretty lovely if you were a bull, pretty mid winter Game of Thrones-like if you were bearish in nature. I don't watch that series, I am told I must. I know enough from my colleagues and the inter-webs to know that it is a big deal, and winter gets pretty cold in that fictional land.

Markets yesterday roared ahead as a new poll suggested that Bremain would be the order of the day, the flotilla would consist of Britannia ruling the waves along with their European peers. Polls are about as reliable as (insert your own biased view on a dodgy profession). As the recurring character, the Colonel (not Mustard or Sanders) in Monty Python would say - "Stop that! It's silly!" If you have forgotten or don't remember, (or haven't seen Monty Python - eeekkkk), then see the last part of this clip - Too Silly - Monty Python. It is exactly that, the polls swinging markets from this tree to that tree, lurching and pitching in the Brexit storm has all been rather silly for me to watch. Yet we sit here and pay attention, as it is important for markets, should the event happen.

Stocks locally roared, the Jozi all share added 1.71 percent by the time all was said and done. Those stocks with a distinctly British flavour (as the French say, rosbif, or any other variation of that) rallied hard. Mediclinic, Capital and Counties, Discovery and Old Mutual all "caught a bid" as they say in trader speak. There were a few stocks in the red, gold stocks sagged as the safety allure of the precious metal waned, less disasters = less excitement for gold. There was some very company specific news for MTN, we covered that yesterday and we will flesh it out a little lower. There was also country specific news weighing on MTN too, see lower.

Over the hills and far away in New York, New York, stocks lost a little fizz towards the end of the session, nonetheless, the green was still firmly on the screen. Both the Dow and the nerds of NASDAQ closed the session around three-quarters of a percent better, the broader market S&P 500 was a little less than that, Utilities were the only sector marginally in the green, laggards somewhat. The travel stocks all got a boost, I guess it goes without saying that fewer barriers = more people experiences, i.e. more travel. If you make it hard for people to travel to and fro, they are less likely to do it. Remaining in the EU, with greater travel is good for these travel stocks. The British banking stocks (we are sea hopping a little here) also caught a serious bid, Royal Bank of Scotland was up over 7 percent, Lloyds added over 8 percent, whilst Barclays added six and three-quarters of a percent.

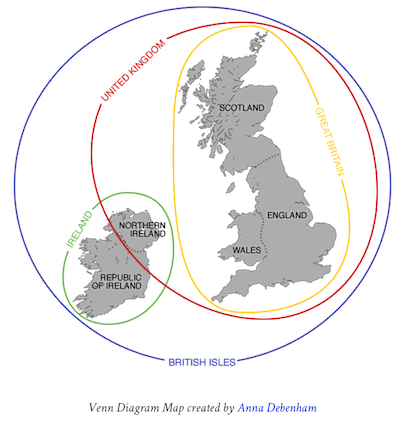

Bremain rules. We don't have long to wait, I wonder what the results are likely to yield however, in terms of the conversation overall. If you want a humorous view of it, then check out Last Week Tonight with John Oliver: Brexit. He is great that guy, excuse the profanity! It is fun to watch how John Oliver debunks the Brexit crowd, and in the end, his view is that it is no more than far right views. As you can see, even an "exit" means free movement of people and goods.

Company corner

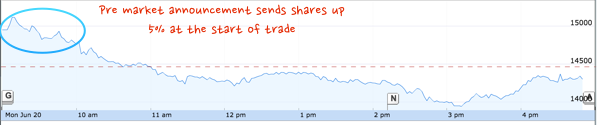

MTN in the news yesterday, firstly the Appointment of New MTN Group President & Chief Executive Officer was met with major excitement by Mr. Market, a man with a lot of experience and deal making activities, here he is - Robert Shuter. As you can see from a well maintained LinkedIn profile, Rob is currently Chief Executive Officer Europe Cluster at Vodafone. He was head of Investment Banking at Standard Bank once upon a time and for a long while was Managing Director for Nedbank Retail, before moving to Vodacom as the Chief Financial Officer.

Scroll down a little more, and you will find that Rob is a runner, as well as a competitor in other sports. Over to his Twitter account - @ShuterRob, his short bio is: "4 great passions family, business, health/running and storytelling. Proud husband and father. #LCHF #barefootrunning" Low carb, high fat and beach running is the way I read those hashtags. Perhaps he could do with a whole lot more followers! Do your best and follow Rob, OK? The market seemed to love the appointment, check the intraday graph that I got from Google Finance -

So why then does the price fall away like that? There was another separate event, something that we knew was happening, yet did not know what the quantum of the draw down would be. And in case you are very confused, then look no further than the Nigerian Naira to the US Dollar. That rate used to be fixed by the central bank, at a level of around 200 to the US Dollar. Except that there was a parallel market as it was called, the real rate of what people trade on the streets. See this Bloomberg story - Nigeria's Naira Slide Deepens Even as Central Bank Sells Dollars.

MTN has their biggest business in that country, the impact of lower Dollar revenues (even though in Naira it would be stable) would have to be factored into models. The rate, as you can see, went to around 281 Naira to the Dollar. In a day. The good thing is that the "parallel market" strengthened too, which means that the official rate will likely be the real rate in the end. Whilst this is painful for the people of Nigeria in the short term (it is arguably been set by the market already), from an official inflationary point of view. As hardcore capitalists, we welcome the liberalisation of the Nigerian economy. In the end the people benefit from a free and fair market.

Linkfest, lap it up

If you have been confused lately due to sporting events where there is an Irish rugby team which represents the whole Ireland island but in the football there is Northern Ireland and the Republic of Ireland, here is an explanation of how the United Kingdom countries work - England vs Great Britain vs United Kingdom Explained

As the amount of free time that people have diminishes and as having access to fast food increases, so has peoples spending on going out - No one cooks anymore. This is a trend that Famous Brands has seen and are gearing up for going forward.

The growth coming out of Facebook is amazing, four of the top 5 apps downloaded globally are theirs - The Most Popular Apps in the World

You will find more statistics at Statista

Home again, home again, jiggety-jog. Markets in China are mixed, the mainland is lower and the Hong kong markets are higher. Japanese markets are up over one and one-quarter of a percent. Stocks in Europe have started lower after the ripper yesterday! Loads on the go, perhaps we will probably leak a little into the actual vote. Oh, and you want to know why the internet was broken yesterday afternoon? Look no further - Telia engineer error to blame for massive net outage.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment