"In the falling away from the Darty deal, in which FNAC prevailed, Steinhoff owned so many shares and were bought out at the higher level. Meaning that shareholders extracted a pretty sizeable and unexpected gain. So why would that be considered "unlucky"? Anyhow, Darty is gone, the group are making a go for a smaller UK listed company called Poundland."

To market to market to buy a fat pig Whilst we were having a day of very careful reflection, loads of things were going on around the financial and of course political world. The tragedies of 1976 were front and centre, when I tried to explain to my kids that this is what happened, their question was simple, "why didn't they arrest the police who did that?" And when you explain that the government had full control of the police and used them as an instrument, they asked a better question, why didn't they vote the government out? Indeed, food for thought.

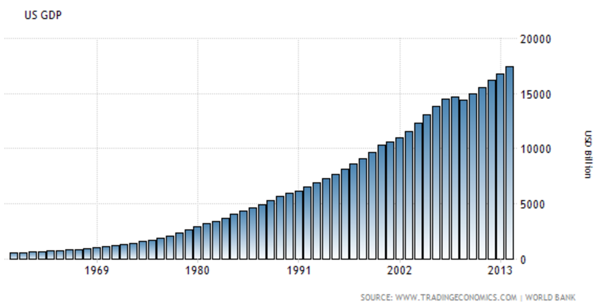

As an outsider when you hear people shouting that American must be made great again, or it is time for Britain to be "won back" all I hear is bigotry and racism. Sorry, that is what I read and see. If people want to exclude those with skills and drive (and no plan B) in some of these territories, then you are missing a giant piece of your humanity. Last I checked, the US registered their biggest GDP ever last year - see Trading Economics. How does this graph look to you?

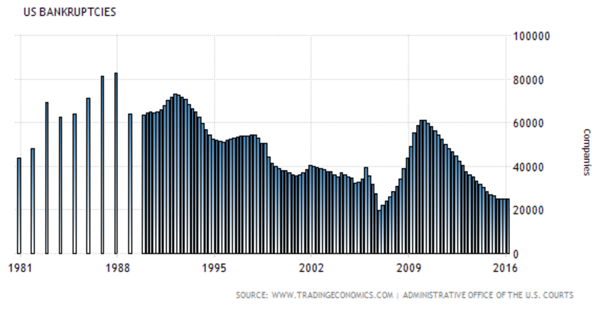

And then, according to the Migration Policy Institute (source): "Immigrants in the United States and their U.S.born children now number approximately 81 million people, or 26 percent of the overall U.S. population." Basically, by telling one in four Americans that you want to make the country great again, you are insinuating that immigrants (or someone else) made it bad. Yet with unemployment at a historical low, and if you used businesses folding as a measure, you would hardly think that America needed to be "great" again, right? Check this out -

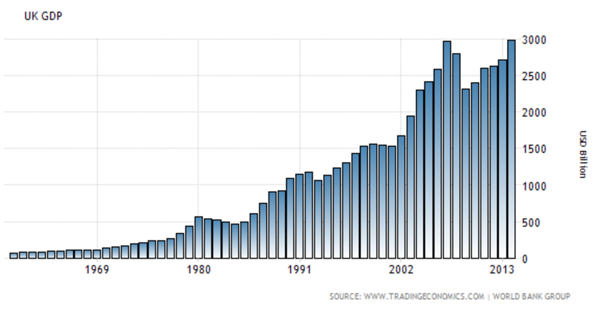

And Britain? I mean the United Kingdom, where two out of their three football teams won yesterday, it would have been three, except two had to square up against one another. With all the shouting from (insert whatever you want here), the longer dated GDP growth seems to benefit from being inside of Europe, see below.

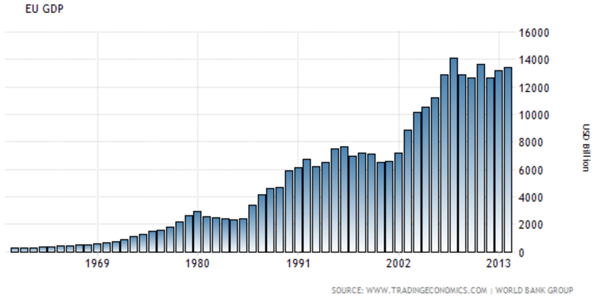

And then lastly, how has the Eurozone done over a longer dated period, how has that done? See below, again, thanks to Trading Economics for all these highly useful charts.

What does become apparent however is that the last six years have been somewhat of a struggle for the common union. After a doubling of the economy inside of a decade, there has been what market types call "consolidation". Over the long (long) term, European GDP has hardly grown, it is a mature market. Which is why immigration to the area should be encouraged to the area, both skilled and unskilled labour. And also to boost productivity and create extra demand. The fact of the matter is that whilst headlines suggest that Europe is finished, the very sad truth (and reality) is that people die to get across the oceans to Europe, from war torn areas. It is better in Europe, there are more opportunities.

The tragic death of a member of parliament in the UK (not to mention mum to two young children) has lent a hand to the Bremain crowd. Bremain being the opposite of Brexit of course. I feel desperate for all those around the family. It is our job to squash hatred, as individuals.

Scoreboard check quickly. On Wednesday when we closed for business, the Jozi all share index was 1.23 percent higher. 123! There were several big news stories of the day, including Steinhoff and Naspers (as well as Tencent), we will deal with those below. Resources were leading the charge, gold stocks have been on fire! The gold price breached 1300 Dollar an ounce after Janet Yellen suggested that rates may stay low for a long, long time. There was some older trade data from the session before that continued to weigh on the currency.

Across the seas and far away, stocks in New York, New York, reversed a four day losing streak through the course of the session. Whilst the half a percent gain on the day is hardly earth shattering for the Dow Jones Industrial, at the worst point stocks were down nearly 1 percent on the day. The broader market S&P 500 added nearly one-third of a percent, the nerds of NASDAQ just over one-fifth of a percent by the time the bell rang for the close. Stocks across Asia are looking better, as a result of the heroic comeback in US markets.

Company Corner

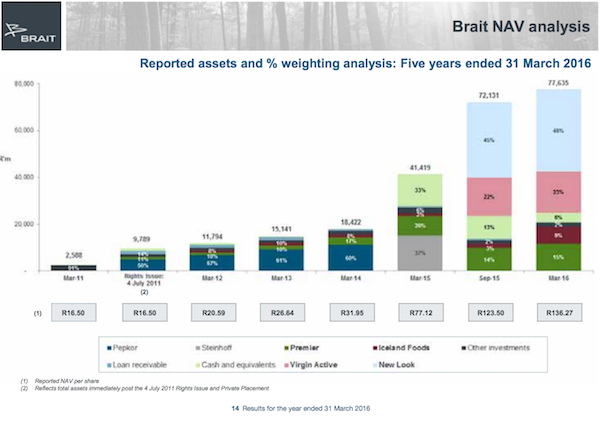

We saw the full year numbers from Brait on Tuesday morning. This caps off another busy year for the investment company with the purchase of Virgin Active, New Look and upping their stake in Iceland Foods from 19% to 57%. Given that the company is an investment company the figure that matters the most for the year is the growth in Nett Asset Value (NAV), over the 12 month period management did not disappoint. NAV went from R77.12 a share to R136.27 a share, a more than "solid" 77% growth.

A big chunk of the gains came thought increases in the value of their investments, the investments grew R22 billion of the total R30.5 billion in gains. Then given that most of the assets are offshore, gains from the weaker currency are around R9 billion of that, so by no means a small number. Here is a quick look at the breakdown of the weightings of each asset, the image is unfortunately poor quality but the colours give you a good idea which are the important ones.

The most important assets are now their two new acquisitions. The value of New Look has increased substantially since they bought it thanks to a reshuffle of debt. Using the balance sheet of Brait, management has been able to reduce weighted average interest cost from 9.4% to 6.3% and extend the average maturities from 3 years to 7 years. This puts New Look in a far stronger position and upping its value nicely.

Some numbers from New Look, their online sales grew by 28%, 41% of woman in the UK have shopped there in the last year and they are adding 50 stores in China to their already 85 stores.

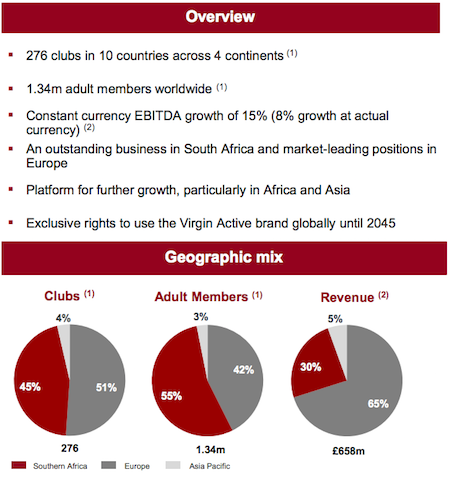

A quick look at Virgin Active in the image below.

Europe is where the money lies for this business, even though South Africa is the bulk of the members is it only 30% of the profits. As the globe becomes more health conscious so will the value of this business increase.

If you want a more in depth look at each of the businesses have a look here - Audited Final Results Booklet. Management have demonstrated through their two acquisitions this year their ability to increase margins significantly, add revenue streams whilst using the Brait balance sheet to the advantage of their subsidiaries. This company is still a buy in our book.

Naspers was in the news Wednesday. Once with a trading update ahead of the results, which I think are next week Friday. By this time next week, we should have a clearer result of where all the spend is taking place in the newer businesses. Remember that now, the company has said that they will report in Dollars. Here goes a copy and paste of the "core" and "headline", as well as earnings per share. Why does Naspers use all the different metrics? And which one matters the most? The company, when they have reported in the past always suggest that "core" headline earnings matter the most.

The company reported that "We expect core headline earnings per share to be between 15% (38 US cents) and 20% (51 US cents) higher than the comparable period's 255 US cents."

Headline earnings per share are expected to be flat, earnings per share will likely be 20 to 25 percent lower. As they say, results next week will give us clarity. Stand by for our coverage next week.

And then "source" close to Tencent said that the company nears $6.6 billion deal to buy majority stake in Supercell. We have spoken about this over the last few days or so, Tencent are a world leader in online gaming. In fact, one of Tencent's games are at the top of pops - Most played PC games on gaming platform Raptr in November 2015, by share of playing time.

Nearly one in four minutes globally is spent on League of Legends. Smashing World of Warcraft and Counter-strike. Sorry serious chaps, the size and scale of the Chinese market, and specifically League of Legends put this into perspective. Entertainment comes across in all forms. Whilst we may pooh-pooh certain activities, do so at your peril!

And then another set of news from Steinhoff, I saw somebody calling it "third time lucky". What? In the falling away from the Darty deal, in which FNAC prevailed, Steinhoff owned so many shares and were bought out at the higher level. Meaning that shareholders extracted a pretty sizeable and unexpected gain. So why would that be considered "unlucky"? Anyhow, Darty is gone, the group are making a go for a smaller UK listed company called Poundland. The first announcement is where Steinhoff "confirms that it is considering a possible offer for the entire issued share capital of Poundland."

Steinhoff have been busy, in a further announcement - Statement Regarding Possible Offer for Poundland Group PLC. The company points out that they already own 22.78 percent of Poundland. They will no doubt announce an all cash offer soon.

Linkfest, lap it up

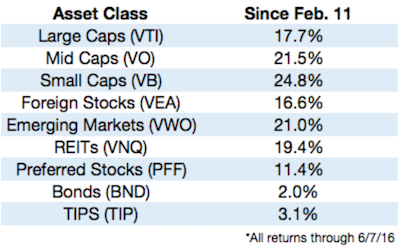

Ben Carlson, makes the point that the world was ending in January and February if you looked at the headlines in the financial media. Since then markets have done rather well - While You Were Worrying. . . The markets are currently under pressure at the moment due to Brexit concerns, given that most of the companies that you own have no direct link to the UK these market pull backs are a good time to add again.

Given the challengers of operating equipment deep under the ocean there are still many things that we have to learn about our ocean floors - China plans massive seal 10 000 feet underwater

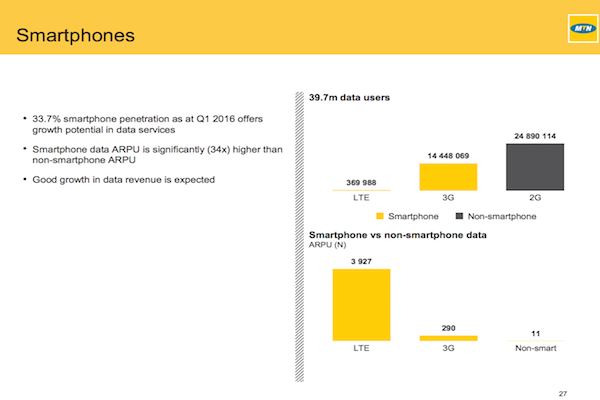

We have been chatting about this article in the office over the last week or two - Humans are about to eat through an unprecedented amount of mobile data. One of the main companies to benefit from the data growth is the telecommunication companies, MTN being one of them. Have a look at how few people have LTE in Nigeria and then look at how much more those people with LTE spend than those with just 3G.

Home again, home again, jiggety-jog. A negative start to the day here locally, I am a little surprised. I cannot wait for Remain (Bremain) referendum to be over, done and dusted. Dumbness prevails and then opportunities always knocks.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment