"Anyhow, believe it or not, the market had anticipated that the ratings agencies would follow this track, the finance minister had said before the announcement that he believed they had done enough. As such, we saw a big rally ahead of the non-event, essentially."

To market to market to buy a fat pig The Twitter seemed to thank the finance minister for South Africa averting a ratings downgrade on Friday, the next review in half a year, provided that we take action and turn to a more positive growth pattern, the less likely we are to gain the lower investment grade the rating. Most people I spoke to on the weekend were collectively relieved and when told about the 15 year ago "junk" rating, seemed to never remember that time. It is human nature to worry about the present and forget that it wasn't so bad then. I am sure that the finance minister will be the first to tell you that it is a team effort and not a single person who was standing tall, it was many.

Either way, us folks down here view the finance minister as the fellow who represents everything that we want government to be. Controlled, conservative, makes the right noises, a true public servant. We forget also that he is 67 years old, and whilst he has plenty to add to South Africa, there must be times that he feels tired and wants to spend quality time with his family. Having served the country ably, he finds himself in a power tussle, even though we are led to believe that no such struggle exists.

Pravin Gordhan represents the yin to our collective sovereign financial yang, if that analogy makes sense. Opposite and connected at the same time, whilst you part with hard earned money by way of taxes, you want to know that the fellow that controls the purse strings isn't a savage spendthrift. Gordhan represents exactly that, the opposite of a spendthrift, there are stories of him flying economy (we should all). Ironically, in the Wikipedia entry, Karl Marx was described as a spendthrift. Although I can't find too much reference to those points. As ever in life, it is far easier to spend someone else's money.

That heavy load dodged for now, we are far from out of the proverbial woods. We may still have to be captured by the witch in the gingerbread house and find a way to show the hungry lady some chicken bones through the cage. See the closing snapshot of the press release: "The outlook remains negative, reflecting the potential adverse consequences of low GDP growth and signalling that we could lower this year or next if policy measures do not turn the economy around." In order to read the full report, you are going to have to sign up and then find it, it is all for nothing (nix). The long and short of it all is that there are areas of concern, that include electricity supply, political meddling in institutions and heightened tensions, labour reform and the new mining code.

Remember that this is someone else's opinion. And Standard and Poor's stress that, it is their opinion. Heck, our muddle through may well work better than their suggestions. Each territory and country has different ways of dealing with issues, some good, some disastrous and to the detriment of their citizens. I am pretty sure that if you told the citizens of North Korea in the 1960's that they would end up here, they would have worked hard to change it. Sadly with slow creep, things change a little each and every day, mostly for the better, as in cases around us, sometimes to the worse. Again, be proactive and do something about it.

Anyhow, believe it or not, the market had anticipated that the ratings agencies would follow this track, the finance minister had said before the announcement that he believed they had done enough. As such, we saw a big rally ahead of the non-event, essentially. There was a huge event during the course of the afternoon happening, one in which the world cared more about, and that was the non farm payrolls monthly event. It generates huge excitement. Before we get into the nitty gritty, the outcome of the Friday trade locally was the Jozi all share index adding just over a percent to comfortably over 54 thousand points again. Resources were on fire as the Dollar weakened, as a collective, led by the gold and platinum counters, resources closed up 2.63 percent.

Non-farm payrolls numbers were whack, and way out of where the estimates were expected to be. The headline number of the amount of jobs created in the prior month (38 thousand) was a multi year low. The unemployment rate of 4.7 percent was a multi year high, the participation rate was lower. The average hourly wages surged to a number much higher than most people anticipated. And some of the revisions were lower for the prior months. So what does it all mean? The Daily Shot describes it in a bunch of visuals *nicely* for us: - The Daily Shot.

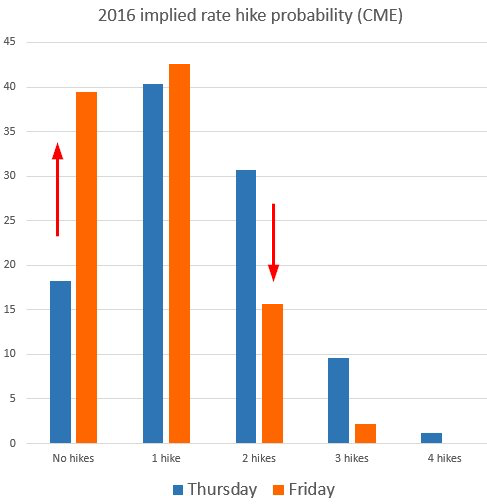

It is not all scientific, most especially when making some spelling mistakes and looking at the Rand (we had external factors Friday), it is however an indication of where the US labour market is right now. I think that the most important graph from there, and hopefully all the publishers (@SoberLook, @CMEGroup and the Daily Shot) would be fine with me republishing this:

The long and the short of it all is that the market that trades what rate hikes are likely to take place this year changed markedly, with the no hikes camp rising to nearly 40 percent, the 2 hikes camp falling sharply to just above 15 percent and one hike rising "a little". The Dollar weakened, the US dollar index was weaker with almost all global currencies stronger to the greenback. Weakness in the US currency equals weakness in the greenback, which means stronger commodity prices. The only question is, will this be a once off, or part of a trend now? Time will tell, I suspect that it won't be long before we find out. Ironically, all the other jobs numbers have been strong, weekly jobless claims, the JOLTS report and so on. Some have even cited the Brexit event as caution in some hiring across the US. Really? All I can say is that this report is volatile, do not read too much into this.

US markets closed lower, understandably on Friday, they were comfortably off their worst levels. The Dow Jones closed off by just shy of one-fifth of a percent, the broader market S&P 500 closed just below 2100, down 0.29 percent on the day, whilst the nerds of NASDAQ fell 0.58 percent on the session, dragged lower by Google and Microsoft. Understandably the financial stocks took a pasting, they were off the absolute worst on the session, there was a whipping at the beginning of the session. By the end the likes of Bank of America, down three and a half percent, Citigroup, down by nearly the same amount, Goldman Sachs, off by just over two and one-quarter percent and Wells Fargo (down 1.82 percent) saw to it that financials were down over three-quarters of a percent as a collective. Does that make sense to you, the higher interest rates, the higher the point where the companies will start making more as a result of higher net interest earned. Got it?

Anyhow, you need loads of perspective with this report. And you always must measure the raw data against the headlines. The Jobs openings report, the so called JOLT reports shows that jobs in America can't get filled. Skilled jobs, there are too few people to meet those requirements. The weekly jobless claims are at their lowest levels since the 1970's, see the image below. That doesn't quite sound like the doomsday scenario in the headlines. Remember that the weekly jobless claims graph too? Here it is below. Feel better about jobs now?

Company Corner

An announcement from Norway over the last few days in which the country has put forward a white paper in which the country is looking to ban sales of petroleum based vehicles for commercial purposes from the year 2025. My Norwegian is non-existent, luckily for us there is an English resource - White Paper on Norway's energy policy: Power for Change.

Ironically this comes from the Ministry of Petroleum and Energy. So why is this in the company segment? First and foremost, the deluge of oil arriving (and the OPEC decision to not set a ceiling) on the market and the reluctance of the Norwegian Sovereign Wealth fund to invest in oil and gas, represents a shift in ones investment landscape. To not own oil and petroleum (and commodities as a whole) products is a shift in investment strategy, we have been reluctant to hold any for nearly a year now, and in fact have been active sellers.

Equally, whilst one door of opportunity closes, another opens. Elon Musk tweeted: "Just heard that Norway will ban new sales of fuel cars in 2025. What an amazingly awesome country. You guys rock!!" Of course he is talking his own book, as a manufacturer of electric motor vehicles, he would encourage all countries to get rid of the old combustion engine and to be purely electric. We will have to of course replace refuelling stations with charging stations, something Japan has done actively already.

So, whether you like it or not, we are shifting to an environment where there will be more electric vehicle sales every year at the expense of the normal combustion engine, that is excellent news for humanity. Less pollution = better living conditions. Will Norway generate the electricity in a green way? In Norway almost all electricity is generated via hydroelectric power. No nuclear. The shift is afoot and you had better take note, and invest accordingly.

Linkfest, lap it up

As being healthy is becoming more and more important to society, running is ever gaining in popularity, all you need is a pair of running shoes and you are set unlike many other sports - The World's 15 Largest Marathons. I was amazed to see that around 300 000 people apply to run the Tokyo Marathon!

Installing software to block Ad's is on the rise, which is a huge problem for companies that rely on Ad revenues to stay a float - Attack of the Ad blockers.

There is a reason that investment bankers get paid so much. They have some crazy work hours - Credit Suisse is giving staff Friday nights off.

This is really powerful and not a read for the fainthearted. Plus it takes about 6-7 minutes to read, an eternity nowadays. You will be smarter after you read it, it is a very touchy subject for rich people and gives plenty of ammo to the left wing policies - Why Do the Poor Make Such Poor Decisions?

Home again, home again, jiggety-jog. The "I am the Greatest" boxer of all time checked out over the weekend, a sad event for everyone. He certainly did his bit for making us (the world) think about the collective and about social norms that existed back then. For the betterment of the world, that is for certain, you may not have agreed with him and what he said, he certainly got us all talking. Which is what we must do more of, talk more and complain less. And of course there was Djoko, who completed his cabinet, well done there. I was very pleased for him. Poor Serena just cannot get over that Steffi Graf line, perhaps she is destined to not do it.

There should be a positive start here for the local index, perhaps the firmer Rand will hold back some of the bigger dual listed counters. The outcome Friday is good for financials, for now, and good for the retailers, for now. Sasol had a poor trading update, the stock is down 5 percent. Telkom had results too, the stock is up over 6 percent. Whoa, neither set looked that bad or that good to me.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment