"I tried to think of other recent major events that the market was fixated on and also had countdown timers. Who remembers the US fiscal cliff? How about the end of QE? Then most recently, lift off from the FED? All these things received more than their fair share of media attention, which is a monster that feeds itself."

To market to market to buy a fat pig Ding, Ding, Ding! The countdown timer to the vote has reached zero (Vote countdown), tomorrow we will know what the future of Britain will look like. This tweet from Keith sums up our view well.

I tried to think of other recent major events that the market was fixated on and also had countdown timers. Who remembers the US fiscal cliff? How about the end of QE? Then most recently, lift off from the FED? All these things received more than their fair share of media attention, which is a monster that feeds itself. The more something is spoken about, the more other people talk about it and so the cycle continues. Oh! I almost forgot to include Grexit and the Scottish Referendum to the list. There is always something to worry about when it comes to investing, focus more on the companies and managers than the noise.

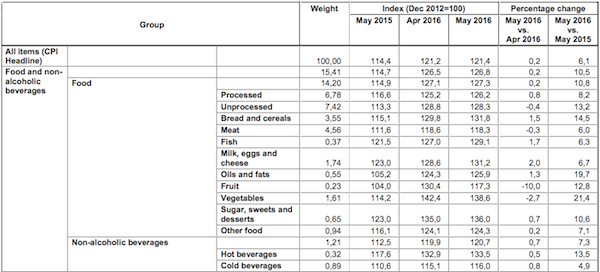

As mentioned yesterday, our CPI number came in better than expected at 6.1% yoy and lower than the previous read of 6.2%. The big contributors to inflation was food and non-alcoholic beverages sitting at annual inflation of 10.5%, water up 9.8% and then electricity up 11.2%. Here is a further breakdown of the food and non-alcoholic category, doesn't make for great reading if you are trying to eat healthily:

Jozi, Jozi had a very strong day yesterday, with the All Share finishing the day up 1.1% lead by financials and retailers. My guess is that our lower than expected CPI read lead people to believe that when the MPC meets next month, interest rates will stay the same. Keeping interest rates low should help in getting some growth out of our economy, with retail and financials being at the fore of that growth.

US markets started the day in the green yesterday but as the day went on they moved towards the red, with the S&P 500 finishing down slightly by 0.2%. According to the internet, it was due to people feeling more anxious about the Brexit vote because it is finally here. Markets generally move and then people find reasons after the fact, for the market moves. Solar City only finished up 3.3% yesterday and they are down 2% after hours which tells you the market does not think the proposed merger will go through. For Tesla, the stock was down 10.5% wiping more off their market cap than what they are looking to pay for Solar City, which tells you what Tesla shareholders think of the proposed merger.

Linkfest, lap it up

If a computer can know what sound an object will make when hit, then it can better 'understand' how hard the material is - MIT researchers built an AI that predicts what the world sounds like. There are some very clever people out there!

Good to see regulators catching up with technology. The next step is to set up regulations for automated drone flight - New FAA rules mean US companies can fly drones without a pilot's license

When people talk about Warren Buffett they normally only think about his time at Berkshire Hathaway but hardly ever mention his achievements running his investment partnership. Have a read about what he achieved before his Berkshire days - Going Out On Top

Here is a look at the last 100 years of political history and then financial history. It is good to remember how things have changed - No One Knows What Will Happen

Home again, home again, jiggety-jog. Our market is slightly in the red this morning, European markets are mostly in the green though. The Rand has been strong lately, currently trading in the $/R 14.50's, expect some currency and market volatility as more information comes out of Britain.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment