"280 billion Naira, over three years, how much is that? On a relative basis? At the official Rand Naira exchange rate of 13.09 Naira to one Rand, this equals 21.39 billion Rand. That is still monster amount and in my opinion unreasonable"

To market to market to buy a fat pig It is Monday. Raining in the city of gold, excuse us people from Cape Town, this is highly unusual and your friends from the highveld will talk about this as some sort of event, OK? The weekend included tragic events, I am not too sure what to make of it, I feel incredibly desperate for all concerned. We all have differences, we are all made up of the same "fibre". I shall leave it there.

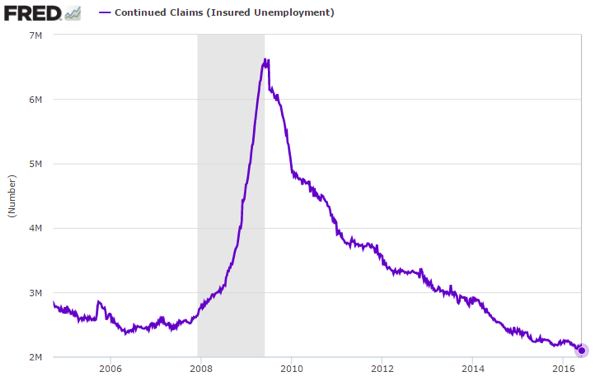

Stocks this week are likely to be swayed by two specific events, first and foremost (front and centre) will be the Federal Reserve meeting this week. Since the last jobs number, the likelihood of a rate hike at this meeting has dropped significantly. If you look at this set of graphs from the The Daily Shot, the one that stands out the most for me is this one (the first one), total unemployment claims chart over ten years:

I would like to points out that the last "disastrous", with monster emphasis on the inverted commas, jobs report needs to be taken into context with this graph above. It hardly looks like tens of thousands of people are queuing up for unemployment benefits. And as we also highlighted with the jobs opening report (the JOLTs report), the skills shortage is actually the problem and not the lack of jobs (or people being actually employed) out there. If the Fed raised rates, if they felt the timing was right, there is certainly nothing that you or I can do about that. Nor should we get anxious about it. They are the best people for the job.

Once this "event" is over, the second event of the coming days can be dealt with by the same experts on every subject, the matter of a Brexit. The smart acronym made up for Britain voting to exit the Euro common trade area. If ever I have heard an incredibly dumb idea, this may well be one. Around this time last year the Greeks were voting for or against austerity, remind me how that went? Oh yes, the Greek people said no (Oxi) - Greek bailout referendum, 2015. I was actually in Greece on the day of the vote. The ATMs had money. In case you were not paying attention, in-between then and now, the Greek people have implemented further austerity in return for further funding. We are currently on the Thirteenth austerity package (Greece).

Being out of the "zone" will create unintended consequences. How does one tell what the odds are at the moment of a Brexit happening? The mud island has a bet on everything approach, not so? So go and check out Paddy power - EU Membership Referendum. In favour of remaining in the EU has odds of 2/5 and in favour of exiting the EU has odds of 2/1. So, if you take a percentage based approach, the chances, according to the bookmakers who will be paying out real money if they lose, there is a 33 percent chance of the vote suggesting that Britain will exit the EU. Remaining in, 71 percent.

The polls are far closer than Paddy Power - Brexit poll tracker. Apparently with 10 percent undecided, those choosing to leave are polling higher than those apparently staying. Remember the Scottish polls? Expect volatility in the coming ten days. In polls, people are likely to shoot from the hip, rather than think these things through a little. There are hundreds of thousand of Britons in Europe and hundreds of thousand of Europeans in Britain. Better to be in than out, right? Like many things that people are experts on, we will hear tens of experts on both Brexit and the Fed. We purport to be neither, we will just be watchers.

So what is going to, or more likely happen in the lead up to the Brexit vote? Emerging market stocks and currencies (and bonds) are likely to get sold off, "safe" currencies like the Dollar, the Swiss Franc, the Japanese Yen and the like are likely to experience major strength on a relative basis, volatility is likely to spike, and in general stocks are likely to experience softness, whilst gold prices are likely to catch a bid. And what should you do about Brexit, the Fed or any other event in the market? Nothing. Remember that doing nothing is an action of an important kind. Ignoring noise, seeing through the mist.

Scoreboard check quickly from Friday, the Dow Jones closed two-thirds of a percent lower (goodbye 18 thousand), the broader market S&P 500 lost 0.92 percent, whilst the nerds of NASDAQ sold off quite heavily, down nearly one and one-third of a percent. Locally we lost just over one-third of a percent. The biggest story by a country mile you can find below. It was all about MTN, the stock closed the day up 13 percent to 140 Rand.

Company Corner

MTN have finally announced a settlement with the Nigerian government slash communications authorities. The announcement is pretty simple (excuse the poor format, not ours) - MTN - Nigerian fine update & cautionary withdrawal. As you can see, the fine is tiered, in terms of payment. The company will pay 330 billion Naira over three years. What amazes me about the release is this excerpt from the sentence detailing the fine - "the equivalent of USD1.671 billion at the official exchange rate and USD902 million at the Lagos Parallel Market Rate".

WHAT? The company talks openly about the unicorn rate (the so called official rate) and then the real rate that you get on the street, the "Lagos Parallel Market Rate". In other words, the rate that real people use when they change money. As is always the case, the collective knows the prices and rates better than governments do. If the government in Nigeria were to devalue their currency that would head in the direction of something resembling the "Lagos Parallel Market Rate", then the quantum of the fine is reduced. Perhaps if you know someone who lives in Nigeria to explain how it actually works practically, right now. I lived in Mozambique in the dark days, I know how it works, you rock up and change Dollars (or Rand) for the local currency and then use that to purchase goods and services. Of course if they were available, thanks to the awesomeness of communism, many things were unavailable.

How does it work however for a company? They cannot go along and change a ton of Dollar bills (here are my Benjamins!!) for a few thousand tons of Naira. Surely they just have to pay the Nigerian government the fine at the prevailing rate? What is good news for shareholders, in terms of this fine is that the company will fund this internally. There is also talk of a listing in Nigeria. If the government becomes an owner of a stake, that may well benefit the company in the medium term. Less regulatory hurdles to overcome and less pushback. All countries are weary of external influences, and somehow think their ways are best.

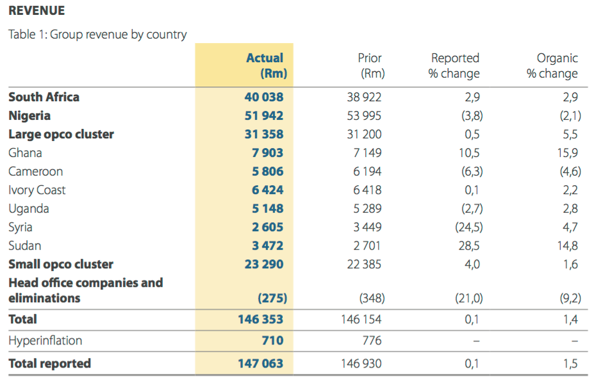

280 billion Naira, over three years, how much is that? On a relative basis? At the official Rand Naira exchange rate of 13.09 Naira to one Rand, this equals 21.39 billion Rand. That is still monster amount and in my opinion unreasonable. Watch the FDI flows, they are likely to be, errr .... not strong. Mind you, there are many external circumstances, including a change of government, and more importantly a crashing (and subsequent recovering) oil prices. First things first, from the recent MTN results, group revenues, including Nigerian revenues:

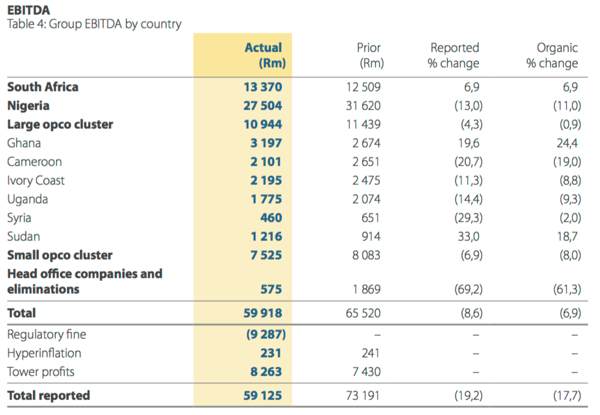

And then, remembering that group margins are around 40 percent, Nigerian margins are much higher than that, it is truly a very profitable territory for them. Herewith EBIDTA by territory:

So, doing quick and back of the matchbox calculations, last year EBITDA (2015) in Nigeria, relative to fine payable of 21.39 billion Rand is 77 percent, that is still left to pay. And in terms of turnover, it is around 63 percent of revenues that the company has been fined, that includes the "goodwill" payment that they have already made. If you don't disconnect your customers, in a country that has first world FICA requirements for cell phone users and a place where the rate of exchange from government is not believed, you get fined a significant amount of your revenues. Whilst we are still upset at the quantum of the fine, we are happy that it has been resolved. We will continue to monitor the ongoing results and advise accordingly.

Linkfest, lap it up

All hail to Uber. We are not referring to the massive Saudi investment announced recently, rather the company now lets you reserve a cab up to 30 days in advance - Flight Booked. Bags Packed. Ride Scheduled. It is going to take a while to be available in all territories. What now Cape Town and Joburg taxi drivers?

3D printing will be a game changer for the manufacturing industry. One of the big advantages is that there is very little wastage and printing something is generally faster than any other manufacturing method out there - Airbus presents 3D-printed mini aircraft. For the airline industry where there are many moving parts, it is safer to have one part printed than a comparable part that needs to be assembled (which can become many parts with unforeseen events).

Amazon's push into India is good from the point of view of an Amazon shareholder. As a Naspers shareholder though it means that they (Naspers / Flipkart) have increased competition in India - Bezos says Amazon to up India investment to $5 billion

Sticking with Amazon, as they add services like this, the gap between them and their competitors widens - Amazon is launching its AmazonFresh food delivery service in London

As the debate rages on about how big of an influence humans have been in the warming of the globe, new ways are being devised to cap greenhouse gases - Turning air into stone

Home again, home again, jiggety-jog. Whoa, markets across Asia are being crushed, Shanghai stocks are down 2 percent, Japanese stocks are down three and a half percent. Hong Kong, that is down nearly three percent. You guessed it, all major markets across the globe are going to retreat into the background in anticipation of something bad. Tighten your seatbelt, here comes the Brexit ride and it is not pleasant.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment