"Whilst there may be genuine concerns for the nine folks who have seen their phone bend, perhaps their bends are not quite accidents. Either way folks, the sales numbers will in the end tell the full story. And the new version of iOS was released Friday, requiring an update. Problem seemingly fixed."

To market, to market to buy a fat pig. I cannot believe that the biggest news Friday was the quitting of Bill Gross, who left PIMCO to join a small listed business called Janus, who had just started a bond fund in May of this year. Janus Capital stock soared 43 percent, the best levels seen for the stock post the financial crisis. Why? Rumour was that Bill Gross' outrageous behaviour (remember when Mohamed El-Erian quit his 100 million Dollar a year job as a result of his colleagues behaviour?) was about to see him given the boot, the legendary bond investor who founded PIMCO in 1971 and built it into a 2 trillion Dollars under assets business was about to be given the heave ho. Why? He had recently singled out and written a ten point letter to the rest of the team telling them how to improve. Gross himself is worth a staggering 2.3 billion Dollars.

This town aint big enough for the two of us, in this case Gross' ego had gotten too big. So he leaves Newport Beach, California for Denver, Colorado. Denver is nearly smack bam in the middle of the US, perhaps the (closer to the mountain) air and one-tenth of the assets under management will suit Gross better. At 70 years of age he still has the strength for it, according to a WSJ article ('Bond King' Bill Gross Loses Showdown at Firm) that I read, Morningstar had predicted that money would follow Gross to his new job, a lot of money.

Allianz, the German financial services business and biggest shareholder of PIMCO, sank over 6 percent on the "unknown unknowns". The prospects that many billions might follow Bill Gross to his new place of employment, boosting one firm and sending another lower. Various sources have suggested between 10 to 30 percent of PIMCO assets could follow Gross.

I am a little puzzled, Gross is clearly one of the smartest people in the fixed income markets, one of the best. If however his behaviour is outrageous and he just cannot get along with anyone around him, is it that they (the rest of the staffers) are not on his level (possibly) or is it that his ego is writing cheques his brain can't cash, to paraphrase a line from the movie Top Gun. I think I got that right. I mean, would you prefer it if your investment manager was a little more humble, or does it not matter?

Does it not matter how your money manager reaches the end conclusion, which is an acceptable return? PIMCO have been seeing outflows, perhaps just part of a rotation out of bonds and into stocks. 16 straight months (according to the BusinessInsider -> The Major Problems Bill Gross Was Having At PIMCO Before He Left) of outflows totalling 68 billion Dollars is probably a market related event. Either way, the ego, the style and the chasing all seem too weird for me.

The session in New York was boosted by Nike, the stock was up smartly, up 12.23 percent on a strong earnings beat and firm guidance. Or perhaps is was the second quarter, the third and final look at GDP that was the real clincher? The US economy recorded the fastest quarterly growth since 2011, the earlier cold weather and associated economic drawdown a thing of the past. The biggest excitement for the economic geeks was the news that whilst consumption had remained unchanged, investment in the economy (the US) had picked up sharply. Man, I wish we had some of the same here, we are pretty desperate. Locally, at the tail end of the market Friday, we caught the Wall Street rally and financials propelled the ALSI higher, closing a whisper away from 50 thousand points. I heard on the wireless that it was the worst week in 15 months for the local index. Wow.

Man. You have to wonder nowadays. We (we being humans and consumers) jump to conclusions all of the time. Byron spoke of the Apple "Bendgate" saga on Friday, the whole idea that the bigger iPhone was bending, the perception was that this was happening to thousands of users. Apple responded Friday to say that with normal use, the new model should not bend. I often laugh when people have tweets that their phone screen smashed when they dropped it from waist high. Newsflash, drop any device, electronic or even kitchenware and it will break. Don't drop it, ok? A crowd called Consumer Reports put together a piece on a few phones on the market (comparable) and tested them, a link that I found via one of my favourite aggregators, the BusinessInsider.

It turns out that the older iPhone 5 model is stronger than the newer thinner models. Equally the newer iPhone model are just fine too, withstanding more than an HTC One. The best? A Samsung Galaxy Note 3. Check out the Consumer Reports test results find iPhone 6 and 6 Plus not as bendy as believed and make up your own mind. All this anxiety via the web, all unwarranted and I guess well dealt with by the company.

The same publication, the BusinessInsider had another interesting piece from a Wall Street analyst, titled A Wall Street Analyst Walked Into An AT&T Store And Tried Bending The New iPhone, it turns out that it is not that easy. Not easy to bend the phone that is. The analyst in question (and who knows, talking his own book) suggested that the whole saga was ridiculous. There. Whilst there may be genuine concerns for the nine folks who have seen their phone bend, perhaps their bends are not quite accidents. Either way folks, the sales numbers will in the end tell the full story. And the new version of iOS was released Friday, requiring an update. Problem seemingly fixed.

One last one, CNET had an article titled iPhone 6 Plus takes on liquid nitrogen and a sledgehammer. Some fellow by the name of Richard Ryan put the phone through some extraordinary tests. In the end, Ryan (as per the quote in the article) says: "Out of all the devices I've tortured-tested in the past, this one has definitely held up the best." So much for all the excitement about the bending. The truth is though, the iPhone 6 plus bend test YouTube clip has had nearly 45 million views, the iPhone Bending: Consumer Reports' Lab Results YouTube clip has had only one million views. Humans thrive on negative news - don't be that human.

BHP Billiton released their annual report last week, towards the end and we get a chance to have a look at the business. Remember also at the same time the letter from the Chairman fleshed out a little more the proposed de-merger of none core assets, or splitting of the portfolio, whatever it is that you want to call it. Firstly, the 2014 annual report, follow the link to download it.

There are some juicy bits in the introductory parts, explaining how iron and steel making are important in developing economies, when steel intensity starts to plateau, how copper becomes more important and then lastly how incomes rising equals greater need for food and by extension agricultural products. Of course through the entire stages here energy is important. The one fact that I found mind blowing was that in BHP Billiton's opinion: in the next 20 years, we expect 1.7 billion people to gain access to electricity for the first time. Energy demand is expected to increase 30 percent in the next two decades, most of that from Asia (two-thirds), half of that from China and India alone. I suppose when one in three people around the world come from those countries, that should be expected.

Whilst profits for 2014 were lower than 2012 and 2011, they managed to bounce off 2013 lows, the dividend has increased every year over the last five. Attributable profit clocked 13.8 billion Dollars, net cash flows topped 25 billion Dollars, 25.4 to be precise. The full year dividend was 121 US cents, which was a modest increase on the prior year. In Rand terms however the payouts have been better, the weakening currency is a double edged sword.

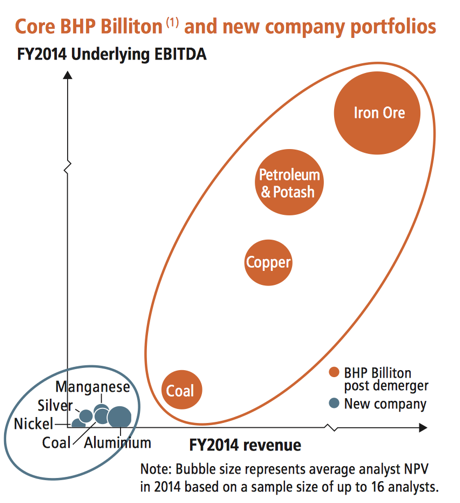

The de-merger gets a whole segment in the annual report, proposed of course. The company wants to have the new entity that is spun off with the noncore assets, aluminium, coal, manganese, nickel and silver and the core assets of iron ore, copper, coal, petroleum and potash to remain. As I understand it, from a location point of view, the noncore assets will be more than half of all the existing operations. Yet they only produced 4 percent of all EBIT, meaning that their profitability is really low compared to the long life high quality assets. Here is a *nice* graphic from the annual report on what the portfolio would look like:

Someone who is a smaller operator can probably sweat these assets a whole lot better than a group that is traditionally high quality, geographically stable. There is a misconception that they are de-Southafricanising themselves. If there is such a word. In South Africa there is a single Aluminium smelter at Richards Bay, Manganese assets in Hotazel and various energy coal assets here, as well as a corporate office. These noncore assets are potentially worth 17 billion Dollars by some measures, the company points out that they have sold 6.7 billion Dollars worth of assets at attractive prices over the last two years, the process was underway any how! Post a demerger, shareholders of the existing structure could expect the same or higher dividend payouts, with the higher quality assets.

So what to do about owning BHP Billiton? I would say that they look cheap, cheap for a reason. There is major uncertainty about commodity prices, I suspect that demand is just fine and specifically for iron, more so copper and lastly energy will continue to expand. Cleaner energy, in particular gas. There are more of us to feed, agricultural commodities will be more and more important. The pay outs are going to continue, the volumes should continue to grow and prices will definitely find a bottom, specifically iron. I suspect we may be in for a rocky two years, the dividend underpin (4.23 percent historic) in a low rate environment should see the share price stabilise too. What to do with the "other" company, post a proposed demerger is a separate question altogether. This company is the number one quality commodity producer in our minds, and the only one that you should own.

Things that we are reading, that we think you should be too

A very interesting article that shows you the amount of resources that we mine each year - 8 Stunning Images That Show How Much Natural Resources Are Mined Each Year.

The biggest reason why I think that governments should do as little as possible is because they have no incentive to be efficient and as a result they waste resources (our taxes) - 8 Public works wasted R35bn in five years

When it comes to stocks, what goes down must go up again ? This is not the case for many stocks and is a trap that many people can fall into - Some Stocks Don't Come Back. "since 1980, roughly 40% of all stocks have suffered a permanent 70%+ decline from their peak value.", this highlights the need to be in quality stocks and why doubling down on other stocks can be fatal.

Home again, home again, jiggety-jog. There are protests in Hong Kong, student ones around political freedoms. All the eyes of the world are trained on Hong Kong as it is more free, more visible. This week there are employment numbers, those are always fun, at the end of the week. There are also US PMI numbers and soon we will see company news, which is more important.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440