"There has been a big push recently by the international tax community to standardise tax codes, increase information sharing and close loop holes for companies operating in more than one country. Last year the OECD implemented their model tax convention, which all the OECD member countries and some non-member countries will aim at conforming to.

To market to market to buy a fat pig The big news out yesterday was the official tax bill that Apple will have to pay to Ireland (Europe), even though Ireland doesn't want the money. The investigation is less about Apple and what it owes and more about tax authorities setting precedence for how to tax multinationals. This topic is becoming increasingly important as the globe becomes smaller through technology, where do you tax a company that sells cloud storage to company X, has the server farm in country Y, has it's head office in country Z and then has the call centre support staff in country A?

There has been a big push recently by the international tax community to standardise tax codes, increase information sharing and close loop holes for companies operating in more than one country. Last year the OECD implemented their model tax convention, which all the OECD member countries and some non-member countries will aim at conforming to. A big part of the convention is sharing information between tax authorities on people and companies who have operations in more than one jurisdiction. Apple may have to face something similar, where other countries may come forward saying that Apple owes them tax based on this investigation.

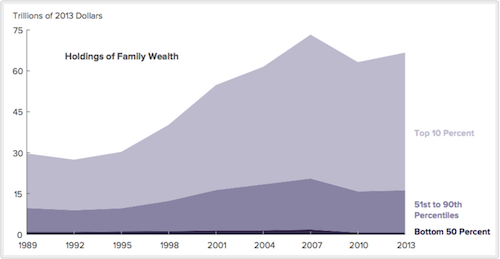

Part of the issues being argued by the investigators is that Apple had special treatment on the amount of tax that they paid, treatment that other smaller companies (potential competitors) were not able to receive. I agree that something needs to be done if the tax code subscribed to Apple is one of a kind and not available to other companies. Competition is the corner stone that a functioning economy is built on. It is key that operators who are inefficient are overtaken by more efficient and innovative operations. The same principal needs to apply to countries and governments though. If one country can charge a lower tax rate because their public offices are not bloated and the tax money is spent efficiently or like the case in Ireland where they want to be as business friendly as possible to create jobs, then the country should be able to have a low tax rate. Part of the Apple statement yesterday, touches on the jobs topic; "It will have a profound and harmful effect on investment and job creation in Europe".

To summarise, Apple will need to pay over $14.5 billion, plus interest to the Irish government, even before appealing the decision. This is neither here nor there for Apple, they have cash sitting at around $231 billion at last count, for other companies it may have been a problem because they might have needed to go to the debt markets to raise the cash. The way I understand it, the cash will sit in an escrow earning interest (if there is any interest to be earned) until the matter is settled. Both Apple and Ireland will be appealing the decision. Then lastly, the market doesn't seem too concerned about the news, the stock was down 0.77%. A good article that I read on this topic is - Here's What You Need To Know About Apple's $14.5 Billion EU Tax Bill.

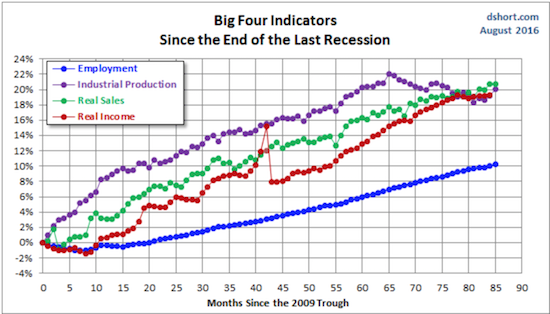

A quick look at the markets, another flat day for The Alsi down 0.2%, Gold stocks under more pressure, down 3% as a collective. For the US markets all three major indexes were down 0.3%, adding to the streak of basically no volatility in US equities. A positive close for The Dow and The S&P 500 today will mean 7 straight months of gains and 6 straight months of gains respectively. Remember the very rough start to the year where US markets were down 10% for the year? Markets are now up 6.5%, which shows the speed at which things can change, don't forget to throw a Brexit into the mix here too.

Company corner

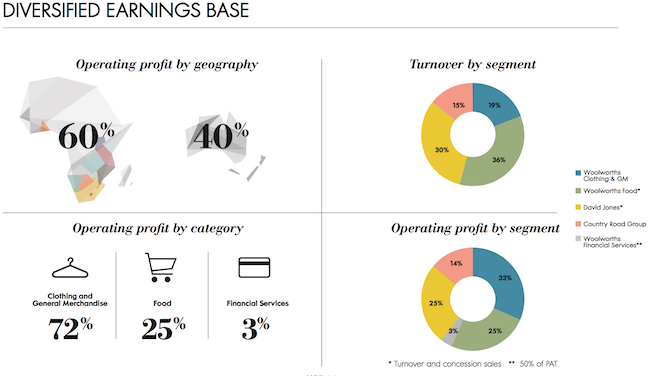

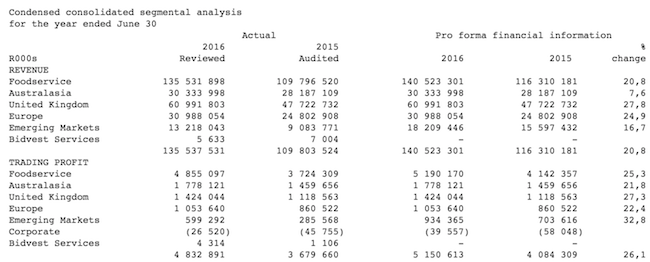

Steinhoff released their Unaudited financial update for the year ending 30 June this morning. The numbers look strong with a 33% growth in Revenue (now stated in Euro's) and a 32% increase in operating profit. From a global diversification point of view, 68% of their revenues come from Europe and Australasia, with the remaining 32% coming from Africa. If their purchase of the US based Mattress Firm goes through they will add even further diversification to their revenue streams. The large purchase of PepKor looks to be doing well, with constant currency revenues up 19%. Given all the moving parts with their acquisitions, issuing of new shares and taking on more debt we will have to wait until the 7 September to see the exact impact on EPS.

Linkfest, lap it up

Here is a graph putting Apples new tax bill into context - Apple's Foreign Tax Payments Since 2003

You will find more statistics at Statista

The one product that I am excited about is the Apple watch 2. I'm hoping that they boost the watches functionality for exercising, first thing coming to mind is having its own GPS. We will know at the product launch on the 7 September, here is a leaked spec, longer battery life - The new Apple Watch might have a longer-lasting battery.

Buffett turned 86 yesterday, to mark the occasion Business Insider complied some interesting facts about him - 14 stunning facts about Warren Buffett and his wealth

An interesting map showing how people tend to collect in major areas. It would explain why property values in cities have been skyrocketing over the last few decades - European Population Density: The Black & Blue Areas Have Identical Populations. I imagine that in the not too distant future, the way we work is going to change where we have to be. We may not be required in an office 5 days a week opening up the opportunity for people to move out of cities.

Home again, home again, jiggety-jog. Our market is down 0.5% this morning, being led lower by resource stocks. Steinhoff is also down following their trading statement this morning, down 2% as I write. Market moving news out today is CPI numbers out of Europe, the figure has a large bearing on what Super Mario does going forward with monetary policy.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

Source:

Source:

Source:

Source: