"A stock that is doing well at the moment & trading under cautionary is Famous Brands, reaching a new all time high of R155 a share, great to see. The stock highlights the need to be patient when investing, the stock price stayed rooted to the R100 level for a chunk of 2013, all of 2014 and the start of 2015."

To market to market to buy a fat pig Friday marked the day when Janet Yellen spoke at Jackson Hole, CNBC even had a count down timer on their screen throughout the day. The speech was very over hyped, I think this headline sums things up - Janet Yellen's speech was wishy-washy. Now what?. All that hype and still not clear when the next interest rate hike will be. The Dollar strengthened as traders are still expecting a rate hike to happen this year, markets are indicating a 33% chance of a rate hike in September from 21% before the speech and then a 59% chance of a December hike from 52%.

All in all, the rate hike will happen when it happens, when the US economy is in a strong position. Rewind to this time last year, it was almost a foregone conclusion that September 2015 was going to be the month of the first rate hike in almost 10 years and that 2016 would see at least 4 more further rate hikes. In the end we only saw a rate hike in December 2015 and zero rate hikes so far this year. Don't focus on the FED for investment timing decisions, when the FED move they will do it based on what is best for the US economy, a strong US economy is then good for the long term performance of companies operating in that country.

Onto the market movements for Friday, our local market closed slightly in the green. US markets closed slightly lower (the NASDAQ was up 0.1%), with the S&P500 extending its streak of not moving more than 1% on any particular trading day. This week is jobs week again, this is where we will get a good idea of how the US labour market is performing and get a clearer picture of interest rate policy. Can you remember what the last jobs number was? It was an addition of 255 000 jobs for the month of July, ahead of expectations, the June number was also revised higher to 290 000 (People always forget that numbers are revised regularly).

Investment Lesson: A stock that is doing well at the moment & trading under cautionary is Famous Brands, reaching a new all time high of R155 a share, great to see. The stock highlights the need to be patient when investing, the stock price stayed rooted to the R100 level for a chunk of 2013, all of 2014 and the start of 2015. If I had asked you if you would take a 50% return (not to mention the very healthy dividend that that pay) over 3 years you would have jumped at the opportunity. We saw people getting frustrated with the stock and the company 'doing nothing' towards the end of 2014, where selling seemed like the required action for the stock. Returns in the market are normally chunky, where you don't know when that short period of outperformance will occur. This is the reason to not try time the market because emotions get in the way and you end up missing these periods of stock price increases. Buy the quality and then relax.

Linkfest, lap it up

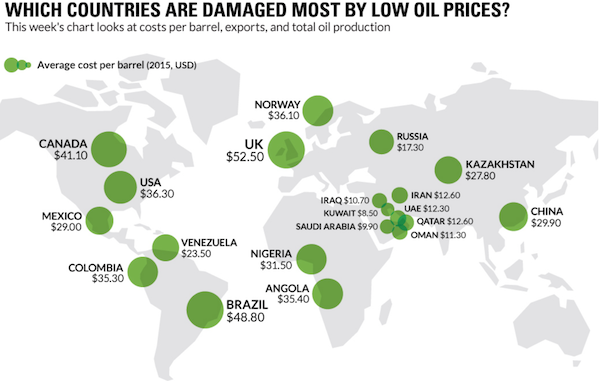

The term low oil prices is very relative, in 1998 it was at the $10 a barrel level. Here is an interesting look at the workings of the oil market, note the average production cost for each country - Which Countries Are Damaged Most by Low Oil Prices?.

Here is a list of some of the recent stock market crashes. Note how quick most of these crashes last, minutes in some cases and unless you were highly leveraged and paying very close attention you would not even know they happened - A short history of stock market crashes. Many research studies have shown that not looking at your portfolio regularly leads to better returns and less stress!

Have a look at how much time, trial and error goes into designing a new tech product - Inside Building 87, Microsoft's hidden mad science laboratory.

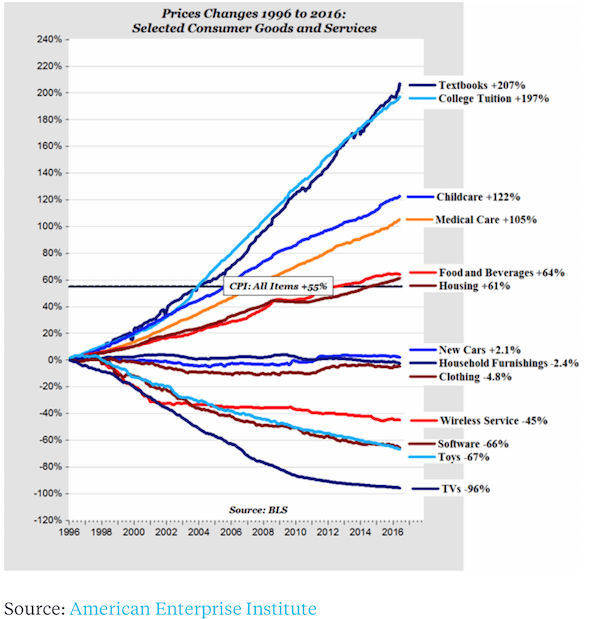

Global inflation levels have cooled off over the last few years, with the likes of Japan and Europe fighting to stave off deflation. Here is a look at the different price changes in different industries, the price changes show where there are demand and supply imbalances, like education - Why Gauging Inflation Is So Hard

Home again, home again, jiggety-jog. Our market is down today, the Rand is weaker too, what I should say is that the Dollar is stronger due to the speech from Yellen on Friday. A higher chance of an interest rate hike means more people want their money in US when that happens, hence stronger currency. US futures are also pointing to a lower open but most people there are not out of bed yet, so this may change between now and when their market opens.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment