"The last thing about equities and why we own them is simple, the long term wealth creation as a result of compounding earnings and dividends leads to higher prices in time. And Dollar cost averaging is important too, always be adding to the portfolio, as and when you can, for as long as you are employed. Companies access the capital markets in order to grow their businesses."

To market to market to buy a fat pig Friday was a relatively quiet day, both on the local front and the US. For the AlSI in JHB, it was down 0.41%, switching to the US, the NASDAQ was down 0.03% (or 0%), S&P down 0.14% & the DOW was down 0.24%. I saw an interesting factoid over the weekend, the US markets have not had a 1% or greater move since early July. Which is very unusual for our very hyper active modern market.

In the week ahead we have the annual Jackson Hole central bankers conference. Which even though it probably doesn't have too many market moving moments, will be broadcast and spoken about by all major news outlets. The highlight of the event for markets will be when Janet Yellon speaks on Thursday, with the big question on peoples minds, 'When will she raise interest rates?' Will it be before or after the elections? Interest rates will effect markets in general over a short to medium time frame. Part of the reason for the Dollar weakness (Rand strength) this year is due to US interest rates rising slower than people expected. Last year this time it was a fore gone conclusion that the FED would raise rates in December last year (which they did) and then raise rates another 4 or 5 times in 2016. At the moment we are on track for one rate rise, maybe. The result being that all the money that flowed into the US to take advantage of the higher interest rates is now flowing out in search of yield somewhere else, emerging markets are one of those destinations.

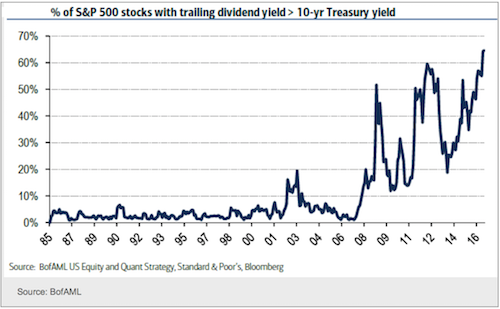

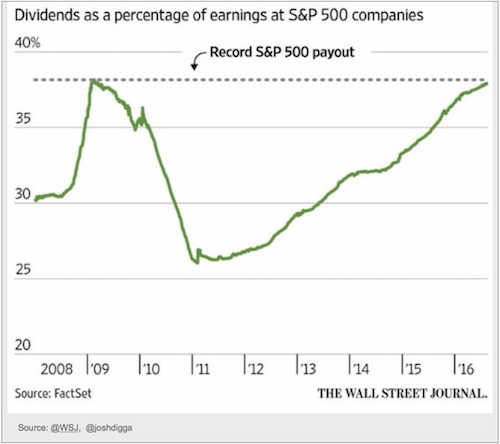

When the FED does decide to raise rates there will be certain sectors that are under pressure and other sectors that do well, increased interest rates are great for bank's margins and tech companies sitting on billions in cash. Companies that are currently bought for their yield might come under pressure (price wise) though, as people switch to safer assets. Equity markets are not isolated when looking at the asset universe, part of the reason for the above average valuations currently is due to very little or no yield in other asset classes. See the graphs below, companies are paying out record amounts of their profits and their yields are better than those of safe assets.

Source: Dividends Eat Up Bigger Slice of Company Profits

Source: Dividends Eat Up Bigger Slice of Company Profits

Sasha's Stash

Why do we invest in equities? According to a Deloitte report titled Brokerage Accounts in the United States, the number of households with savings and brokerage accounts dropped significantly from after the dotcom bubble through to the recovery post the financial crisis: "In 2013, 27% of households with brokerage accounts reported using the advice of a broker for saving and investment decisions, down from 35% in 2001." That means that the stock market is only really important or of any meaning for 1 in 4 households in the US. Which is pretty sad. The number back home is possibly much, much lower as a percentage point of view, I recall a post from a fund manager who went to Italy and found people had little, or no interest in the stock market.

Why is that the case? Why are there, in some countries like the US and more recently China, where there were by the middle of last year (according to the data I was reading) around 150 million brokerage accounts, many of those first time rookies. In fact, according to this article, not an April fools you know what - China Enters Stock Frenzy as Rookie Traders Open Record Accounts. See that? 2.8 million brokerage accounts opened in a single week, you will recall the pictures of vendors on the side of the road who were trading shares online (not too dissimilar from the 'Bucket shops' lining the US streets 100 years ago), Chinese equity markets are a crazy place. Yet, even in the infancy of the Chinese equities markets (it is just over a generation old), there is heavy participation. Lower as a percentage than the US, yet the entrepreneurial spirit means much higher than the norm in Europe. In that part of the world, most people are invested through their pension funds.

I guess you also wouldn't then be surprised to learn that the top 10 percent of income earners are the most concentrated percentage in terms of brokerage account ownership. 50 percent of top 10 percent earners have brokerage accounts in the US, in the bottom 25 percent of income earners, it is only 2.8 percent. The wealthy stay wealthy as they have the skills to earn the money and the foresight to save. My daughter asked me the other day a question about sunscreen, why do we apply it, she said? I said, in the same way that we save and recycle, you only see the impact much later in life, that is why we apply sunscreen. Same thing, right?

The last thing about equities and why we own them is simple, the long term wealth creation as a result of compounding earnings and dividends leads to higher prices in time. And Dollar cost averaging is important too, always be adding to the portfolio, as and when you can, for as long as you are employed. Companies access the capital markets in order to grow their businesses. There would be little or no reason to list if you didn't need public shareholders. What always amazes me however is the daily turnover, which while I am grateful for the liquidity, it doesn't seem right that a stock like Apple can trade on average 32 million shares a day. That is 160 million shares a week. Or 2 billion shares a quarter. And then the whole market cap inside of a calendar year. Does that seem sensible? Not to me.

I suspect that in a world of continued choices, equities will always be assuming more risk than cash or bonds, yet if you pick wisely and invest through the cycles, you will be "just fine". I don't own the index and possibly never will want to. For retail investors that have little or no chance of ever picking stocks, that is the best option. I am always amazed that someone thinks that a residential townhouse and having to place a tenant in one is of lower risk than owning Tiger Brands, a huge food producer with millions of South African customers of yesteryear and now. Tiger has been one of the best investments to have just owned and not needed much other than extreme patience. Even better, if you forgot and didn't know you owned them, that was the real clincher.

In conclusion, pay attention, not so much that you worry about the share price all the time. I once recall a gobsmacked Becky Quick of CNBC interviewing Warren Buffett, she asked him how often he looked at the Berkshire Hathaway share price. He replied, maybe two to three times a week. Her jaw dropped, the answer wasn't what she was looking for, yet it made perfect sense. There is little or no reason for him to look at all, other than once a week, the investment thesis will eventually come to him!

Linkfest, lap it up

Two of the dominant social media companies are Facebook and Tencent. The one dominates the Chinese market the other dominates everywhere else, here is a look at how they stack up against each other - How China's Biggest Tech Company Compares to Facebook

You will find more statistics at Statista

As more airlines take to the sky and as aeroplanes get more efficient, the price to fly across the globe drops. This is particularly true for popular routes where there is higher competition - Delta is building suites for business class, and it could make in-flight luxury cheaper on all airlines

Two interesting stories out Friday on the CEO front.

The first is from one of Christo Wiese's smaller holdings, Invicta - Change And Restructure To The Board

"Shareholders are hereby advised that, following a heart attack earlier this year, Byron Nichles has decided to relocate to Cape Town with his family in order to pursue a new and more balanced lifestyle."

Byron is in his mid 40's, so by modern standards still has another full career ahead of him.

Then one of our US holdings, Solar City (soon to be Tesla) announced that their CEO and CTO have requested that their salaries be slashed to $1 a year (do you think it is an annual payment or a monthly payment of 8c?) - SolarCity slashing costs, including CEO pay.

Home again, home again, jiggety-jog. Our markets are slightly in the green this morning. On the commodity front Brent Crude is above the $50 a barrel again but is down 1.5% this morning, probably on the news over the weekend that the Oil rig count climbs for 8th straight week. The data shows that fracking operations in the US are profitable with oil in the mid $40s, which will help keep oil around the $40 - $50 a barrel range for the foreseeable future.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment