To market, to market to buy a fat pig. Sometimes you get days like yesterday, blood red across the screen as stocks sank locally for a number of reasons. First the commodities complex has come off the boil with lower commodity prices, part Iranian deal progress, part Fed pulling back soon and then a really horrible no good GDP read locally. Ugly. Although the release itself was around 11:30 local time, the market was considerably lower already. There were very few sectors that were spared, construction stocks and banks fell over two percent, perhaps a consequence of the rubbish GDP read. Not rubbish, but not good enough.

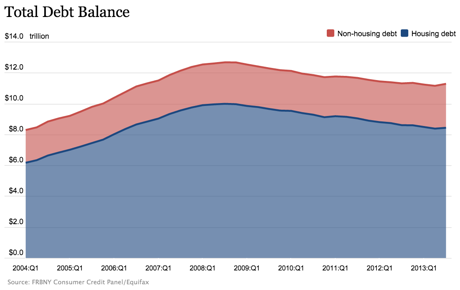

And not a peep from anyone in the mainstream, all the major online local media platforms have nothing on their front pages. Matters economic are seemingly not important. Yeah, like lets contribute to the pension fund, that will look after me in my retirement. No. Number one (ones self) is best equipped to look after oneself. And that is the truth. We do not talk enough about investments in South Africa, but I suppose that is a leadership thing, if politicians themselves cannot be fiscally prudent and drive modest vehicles walking the walk, then how/why should the ordinary rank and file citizen respond? See the piece below on financing a motor vehicle, I suppose when the handbook says you can own any car and more importantly it is not your money, it is FAR easier to just get it. The credit card generation, worry about the consequences later!

Let us look at the local GDP release -> Real gross domestic product at market prices increased by 0,7 per cent quarter-on-quarter, seasonally adjusted and annualised. The win, if you want to call it that, was a big bounce back in mining and quarrying activity, after the strikes in the prior quarter. The ugly was that economic activity in the manufacturing sector was the impact of strike season on the automotive industry.

Nominal GDP increased by 24 billion Dollars in the third quarter from the second to register 863 billion Rand. We do have, and we can be very grateful for this, a fairly diversified economy. Check it out:

The largest industries, as measured by their nominal value added in the third quarter of 2013, were as follows:Finance, real estate and business services - 21,4 per cent;

General government services - 17,2 per cent;

Wholesale, retail and motor trade; catering and accommodation - 16,0 per cent; and

Manufacturing - 11,6 per cent.

I hear you say that you wish manufacturing or mining were a whole lot more. And you are probably right. The truth is, at a manufacturing level we cannot really compete for the time being with the cheaper labour pools found elsewhere, if the deal is to create a higher wage economy, then we must go ahead and proceed along those lines. In recent times, over the last few years the parts of the economy that have been growing include retail, finance, business serves, tourism (accommodation) and not industry and mining. Oh, and three provinces, Gauteng (34.7 percent), KZN (15.8 percent) and the Western Cape (14.0 percent) contribute around two thirds of all economic activity in South Africa. Little Gauteng, big contributor. Makes sense, according to the StatsSA website 23.7 percent of the population of South Africa lives in Gauteng, 19.8 percent in KZN and 11.2 percent of the population is in the Western Cape.

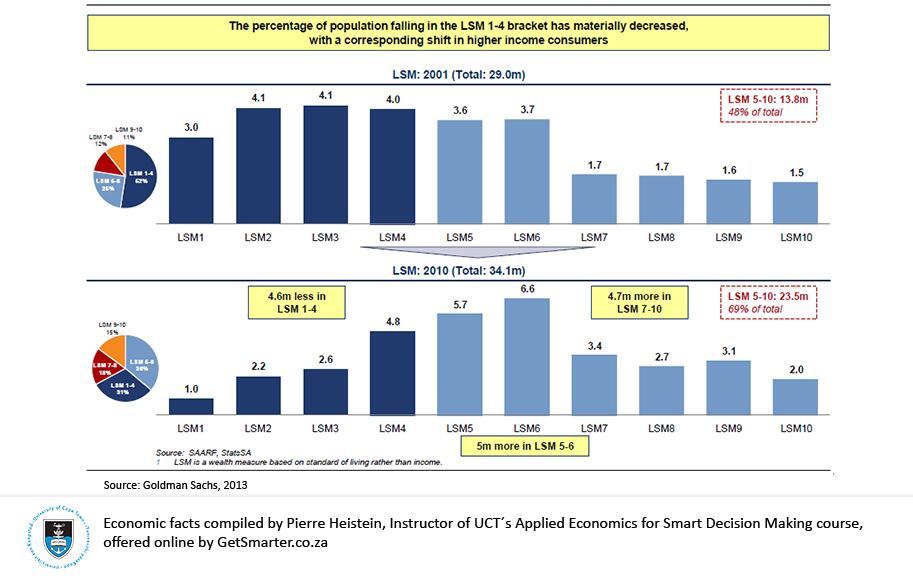

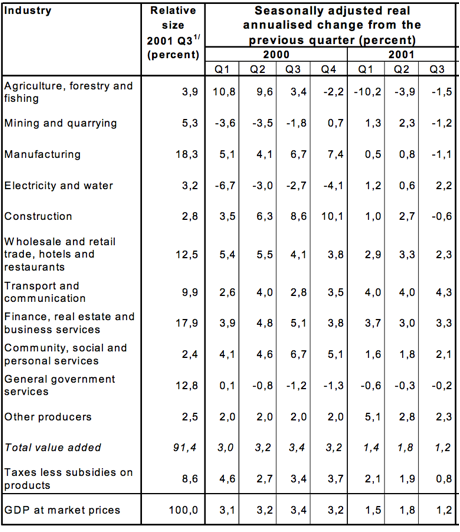

Back to 2001 and the relative size of the contributing parts of that economy relative to this one now, a screenshot tells a thousand words

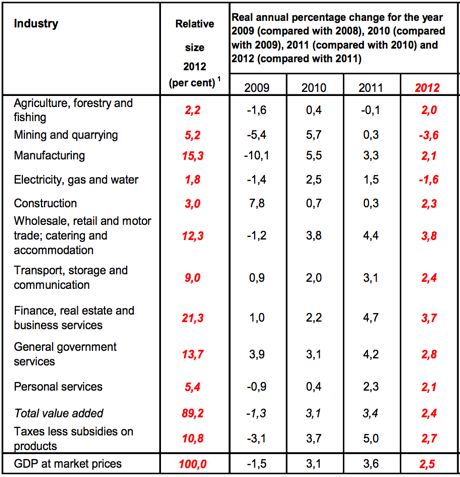

And then 2012, and what is more important is how this looks now:

So which sectors have been losers and which ones winners in over 12 years of economic progress? Agriculture as a contributor has nearly halved. The big winners have been finance, real-estate and business services and government services. Personal services, those have also grown strongly, as more people have got more money to spend on themselves. So richer people are emerging, people who are getting government jobs, retail jobs, jobs in finance functions. Less manufacturing jobs. Is it sad? I guess it just depends who you are, a union member might be horrified here to see this trend.

In June of 2011, I wrote this, which I think is worth repeating now on the matter of financing a motor vehicle versus saving for it and investing that money rather. And this follows on about the fact that many South Africans view financial success and translate that to the motor vehicle that they drive. Do not do it, see why:

We had a couple of interns here last week, a couple of university students who are clients too (good to save at such a young age), smart guys with multiple matric exemptions. I got them to do an exercise, a fairly simple one, because I wanted to show them what a waste of money a motor vehicle is. So, I am told them to take the instalments on their chosen vehicle (I think it was an Audi A5) and at a fixed interest rate (current prime), wee what their repayments would be over 60 months. And then I told them to check up the insurance repayments on that too, and then to add that into the equation. I told them to ignore running costs, because I figured that any car that they had would fill up and service.

And then I said to them, right, take the same repayments on the vehicle and the insurance payment (which would be a lot for any 20 something year old) and invest it in Satrix. And take the long term returns of Satrix, add in a two and a half percent dividend yield and see what you are left with at the end of the 60 months version. The vehicle "asset" was worth less than a quarter of what you would have in Satrix 40. Amazing. And then I said to them, take the annual yield on the saved amount and you can use that to finance a motor vehicle on a monthly basis.

The question that these two bright fellows then asked me, is if this is so easy and well known, why doesn't everybody do it? Ahhhh... that my friends is the biggest unknown-unknown of them all. Why indeed do people do this? The reasons are obvious. When you want something, like a car, you can get the finance right now. This is a gripe of mine, because if you were to say offer a portfolio of stocks (closed) right now to someone that they could pay off over the next 60 months and then they could own it outright (you could even factor in insurance, a short position on the ALSI 40) the bank would say nope, not for us. But a car, something that is worth a whole lot less at the end of the period, that is fine to finance. Because it is a consumer issue and not an asset issue.

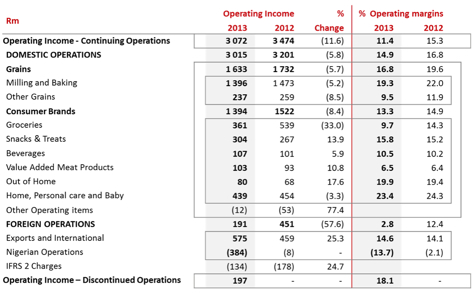

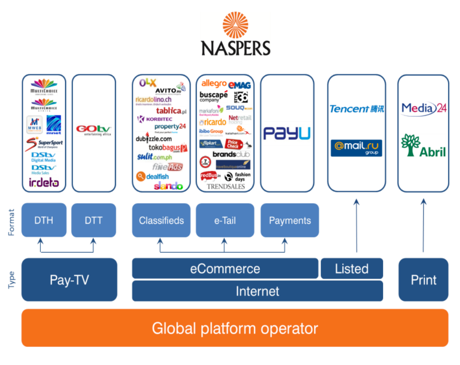

Naspers reported their six month numbers yesterday. But before we get into that, Meloy Horn, an ex analyst and now investor relations contact at Naspers and her team do a fabulous job in explaining what Naspers is. Here goes their business overview, Fact Sheet - November 2013 and here is the group structure, which segregates the business into pay TV, internet and print. Print is the local media 24 business (60 magazine titles and 50 newspaper titles) and the 30 percent stake in the Brazilian business Abril and a teeny weeny stake in two Chinese businesses. The Pay TV part of the business is where the company was able to lift their presence and drive acquisitions using the strong cash flows associated with pay TV into their internet businesses. Which are then segregated further into e-commerce (where CEO Koos Bekker thinks the next big growth is). As well as the significant stake in TenCent (which basically makes up the most of the current share price) and Mail.ru.

The internet businesses (e-commerce) are the ones that deserve the most airtime. There are the classifieds parts of the business, perhaps difficult for us here to understand but in places such as Russia, people love doing business through the classifieds. Perhaps it was being kept under communist rule for so long that drew people to wanting an active role in the trading of goods. Unleashing the inner entrepreneur in everyone, remember the last full year numbers which were very detailed covered the e-cmmerce push: Naspers FY numbers, ecommerce next big.

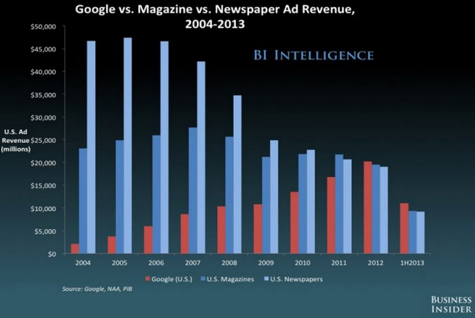

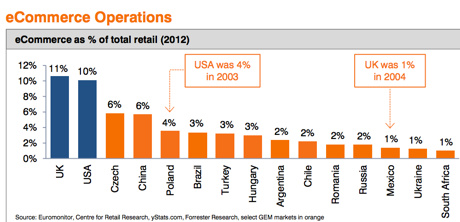

Koos Bekker acknowledged that whilst the pay TV business is very important, people in developed markets are shifting to the second screen, the so called two screen effect, where people interact with other viewers real time as they are watching TV. TV is a one way medium, there is NO feedback, no matter how loud you are in your living room, calling on the fleas of one thousand camels to infest the referees armpits, he is not going to hear or see that. But Twitter and Facebook make you able to interact with sports TV presenters during the actual match. Pommie and Haysie read out your tweets during the cricket, wow, imagine that five years ago. And the explosion of smartphones and tablets into your lives mean that you go about business very differently from before, interacting with friends and family differently, doing product research very differently. But the reason why this is important is that Naspers has a little graphic in amongst a whole lot of others in their A global platform operator, November 2013 snapshot:

There you go. We are at a very, very low level in terms of retail spend in some of their core new business opportunities, retail spend that is. Most trade takes place in a very formal manner, and that is still the case. That is part a lack of quality broadband and then higher broadband prices to boot, but that no doubt will catch up. Remember that Telkom have only 900 thousand ADSL lines in South Africa. That means that less than 2 percent of South Africa have fixed line broadband access in a small business and home environment. So half of them then shop online. And I guess that is what Koos Bekker and Naspers talk about, in the next big thing for Naspers and their e-commerce businesses. They say as much, move to mobile (fixed lines infrastructure worse in developing world) and step up spending. Total development spend this year is expected to top 7 billion Rand, or roughly one eighth of revenue, sizeable to say the least. But there is a shift in Capex spend, most of the spend came last year, and the two years prior in Pay tv, this is to be focused on their internet business.

It will however have a negative impact on earnings. Big fat note, the e-commerce business still makes a loss, but is growing aggressively: This segment is growing well with revenues almost doubling to R7,9bn. We are investing aggressively in marketing, people and product. Development spend was R2,3bn with trading losses of R1,8bn. So how do you value this business? A little like Amazon, where the ramp up and spend is making profitability next to nothing. Amazon trades on 2.86 times sales, this could give you a fair indication of how the market could possibly value this segment later. Interestingly eBay trades on 4.51 times sales.

This (e-commerce) business is probably already more valuable than the print business, even if you apply a 2 times sales valuation at around 16 billion Rand. The print business made 408 million ZAR, but continues to fall as a result of lower advertising revenues. So I guess if you afforded that business more than an 8 EBITDA multiple and you annualised this half, you get somewhere in the region of 7 billion Rand. Not to be sneezed at, and in fact that segment alone at that very modest valuation would be nearly three times bigger than Times Media Group, which has a market cap of 2.573 billion Rand. And a negative multiple, hardly making a profit at all. So that 2.5 billion market cap is perhaps flattering, but we will see how the restructuring goes.

But then the rump of the business, the part that really matters for the time being, TenCent and we are going to use the trusty percentage calculator:

TenCent market capitalisation is 821.94 billion HKD (Hong Kong Dollars) as at the close: Tencent Holdings Ltd (HKG:0700)

1 HKD = 1.31 ZAR - HKDZAR

Naspers own 34.26 percent of TenCent. Naspers value of that in Rands is (821.94 billion HKD x 34.26%) = 281.59 billion HKD = 368.89 billion ZAR!

Current market cap of Naspers (last evenings close) = 387.629 billion ZAR. 95.1 percent price you see today is TenCent.

Effectively the rest of the business, including a fast growing other businesses, not to mention a Pay TV business that is still growing strongly (generating trading profits for this half of 4.477 billion Rand, subscriber base of over seven million) is for nothing. So you see. Naspers could be undervalued. So why does the South African investment community continue to undervalue the company relative to their Chinese counterparts? Possibly. We continue to hold and add to where people are underweight. We will continue to do a detailed analysis of this business over the coming days, a series of parts on Naspers.

Michael's musings. Revenues blasting ahead

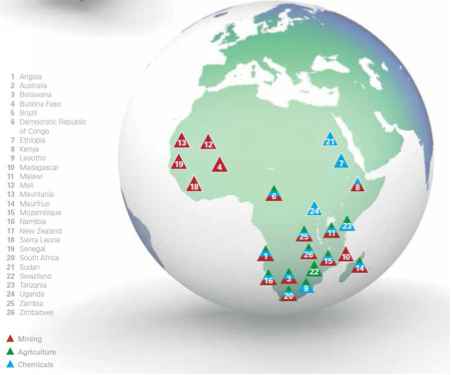

Omnia, the chemical manufacturing company came out with their 6 month results yesterday. As usual, I like to start with the company structure and operating reigns, so that you can have the big picture of the company when we talk about the smaller details. In their own words, "Omnia is a diversified provider of specialised chemical products and services used in the mining, agricultural and chemical sectors.". The mining sector sells mostly explosives, their agriculture division mostly sells fertiliser and the chemical division mostly sells domestic household chemicals. See below a map showing where they operate.

The highlights from the announcement were as follows:

- Revenue up 25.7% to R7.5 billion

- Profit for the period up 16.8% to R424 million

- Operating margin down from 9.1% to 8.4%

- Earnings per share up 16.7% to 637.0 cents per share

- Dividend up 23.3% to 185 cents per share

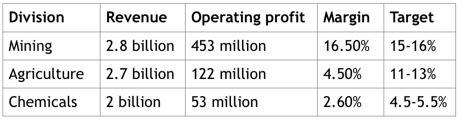

The mining division was their best performing for the period with revenue up 37%, compared to chemicals whose revenue increased by 15% with a stellar 130% increase in operating profit, and agriculture whose revenue was up 24% but operating profit dropped by 35%.

Mining and agriculture saw an increase in the average price of its products and an increase in the volumes sold, which is great because you want to be buying a growing company, and a company that can pass cost increases on. The chemicals business just saw an increase in its average price.

The reason for the drop in agricultures operating profit is because of what they call the unfavourable urea to ammonia ratio, which in layman terms means that ammonia is the product used to produce the fertiliser but fertiliser is priced according to the urea price. Other contribution factors was unrecovered plant overhead cost because the plant was shut down for longer than expected, and then they have introduced a lower margins wholesale business.

The 130% increase in operating profit from the chemicals division comes from bringing down overhead costs as a percentage of sales. The 130% increase is better than a slap in the face but comes off a very, very low base. The best breakdown of the company is comparing each division's revenue and operating profits.

The mining division has great margins, but the other two are below where you would want them, Chemical division does a lot of work to make only R53 million. To reach their margin targets, they still have a lot of work to do, but I think that they will make progress through them keeping costs under control, while increasing sales volumes. In the agriculture division they will not have the cost of the unrecovered plant overhead, and they should see increased sales in their wholesale business, both should contribute to better margins.

My only concern about the company is their current margin levels, but not concerned enough not to own them. So why own Omnia? In Sasha's words' "They are a great Africa investment", and by that he means that they have a presence in large parts of Africa, and in sectors that should be growing. As Africa and the world grows, food becomes more important. The advantage of their business is that they are not directly exposed to the risks of fluctuating food prices and the threat of land grabs. The chemicals division is also in a sector that will grow as the middle class does, and in the African case, there is much growing still to be done in the middle class.

Home again, home again, jiggety-jog. Markets are a bit higher here today, with a late surge in the US, which finished flat. Do not forget that this is a short week, so almost anything is possible. But improvement after a couple of days of selling is always welcome!

Sasha Naryshkine and Michael Treherne

Follow Sasha on Twitter

011 022 5440