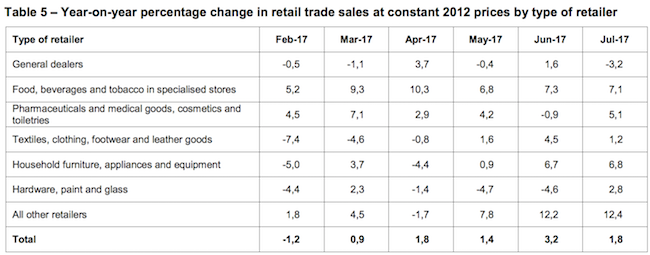

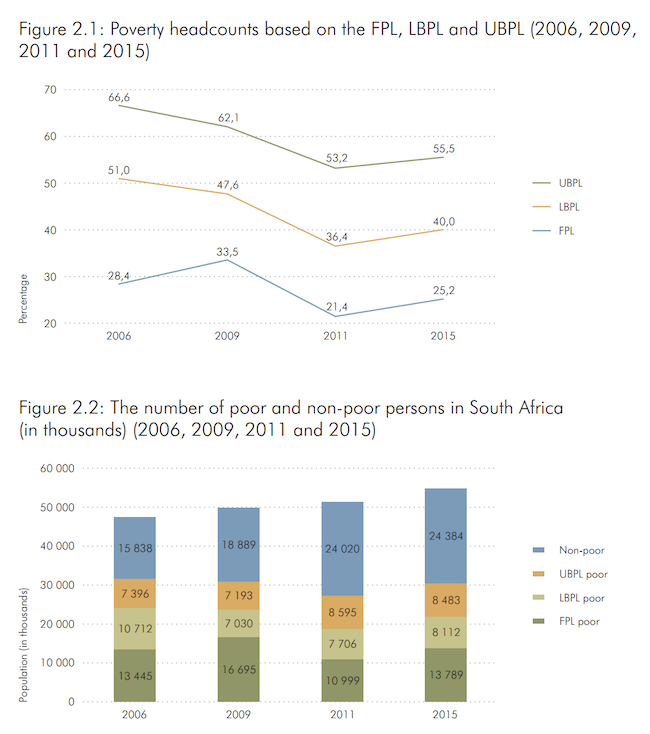

To market to market to buy a fat pig. Last month Stats SA published their Poverty on the rise in South Africa report. It makes for some grim reading and puts life for the average South African into perspective. The below image best sums up the report.

Here is a quick breakdown of what the different acronyms mean. Food Poverty Line (FLP) is currently set at R531; it is the amount they have pegged as the amount needed just to feed yourself for a month. Can you feed yourself on R17 a day? Lower-Bound Poverty Line (LBPL) is currently set at R758. It means that you have enough to feed yourself, but you don't have enough for other essentials, so you probably go without food so that you can afford the other non-food essentials. Upper-Bound Poverty Line (UBPL) is currently set at R1 138, the point where you should be able to feed yourself for a month and afford essentials.

The above image is saying there are 13.8 million South Africans that can't afford to feed themselves and 55% of our population don't earn enough to afford essentials and food. They have to choose one or the other. There have been significant improvements since 2006 when the first issue of the report was published. The problem now though is that we have gone backwards since the 2011 report was published. Corruption, state-capture and flip-flopping on finance ministers hits the poor much harder than the rich.

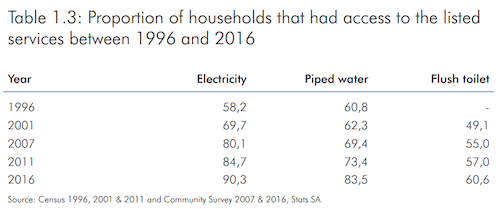

The only thing that will fix our problems is growth. Growth can't happen without economic confidence and certainty. To finish off on a more positive note, have a look at the substantial progress being made in getting people power and water.

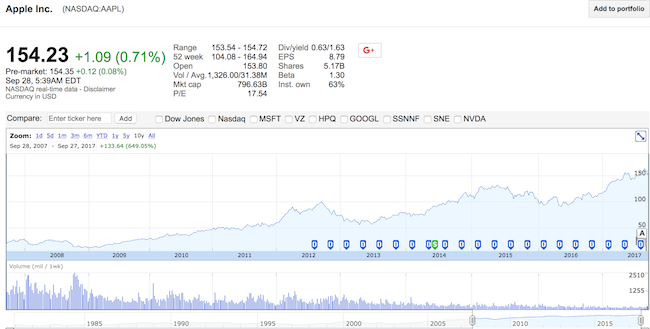

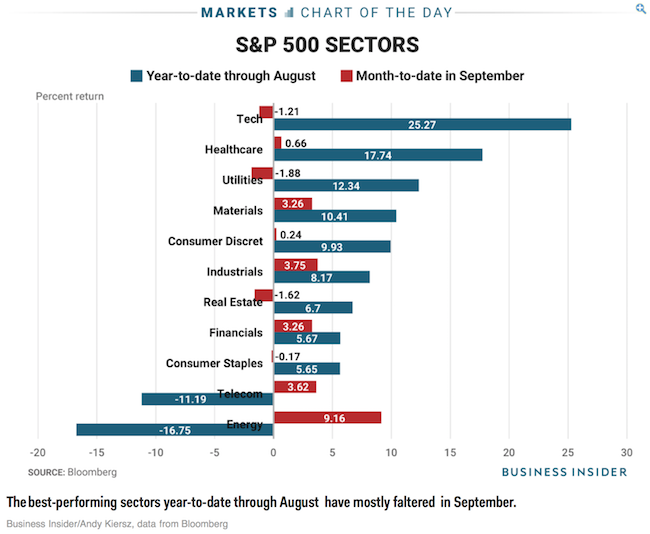

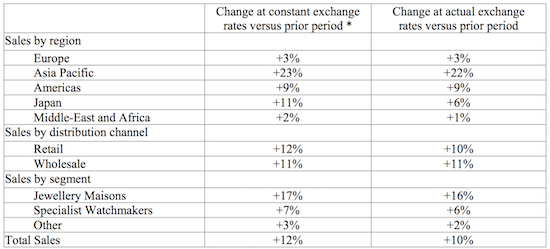

New York, New York. US markets kicked off the day in the red, to recover and squeak into the green. That means we have had two straight days of record high closes for all three major indexes. Here is the scorecard, the Dow was up 0.18%, the S&P 500 was up 0.12%, the Nasdaq was up less than a point and the All-share was down 0.4%.

Linkfest, lap it up

One thing, from Paul

Rheumatoid arthritis is a growing problem amongst older persons. As you know, pretty much everyone is living longer these days. It affects women more than men, and results in stiff, swollen wrists and hand joints.

For serious cases, Doctors prescribe TNF (tutor necrosis factor)-inhibiting, anti-inflammatory, biologic medications such as Humira, Enbrel or Remicade. Those drugs are made by US-based Abbvie, Amgen and Johnson & Johnson, respectively. Humira is the world's top selling pharmaceutical product. To put that in context, its annual sales exceed $18 billion. It really works, but it costs about $4,370 per person per month.

We own Amgen in US portfolios, which makes Enbrel and also wants to sell a Humira biosimilar called Amjevita. Remember that biosimilars are intended to be less costly versions of expensive biotechnology medicines. Because biotech drugs are made from living cells it is not possible to produce exact copies, which differentiates them from generic copies of simple pills that tend to be much cheaper.

Yesterday Abbvie and Amgen announced a legal settlement that ends their patent disputes, which resulted in both of their share prices going up. Amgen has agreed to delay the US launch of Amjevita until 2023. The product will be launched in Europe in October 2018. AbbVie will also receive royalties from Amgen - AbbVie, Amgen settlement sets Humira U.S. biosimilar launch for 2023

Byron's Beats

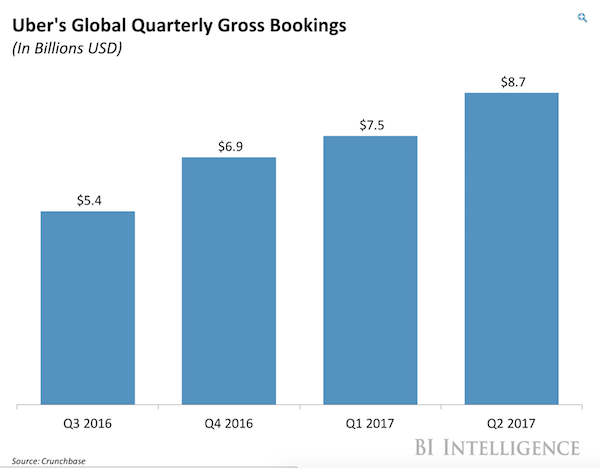

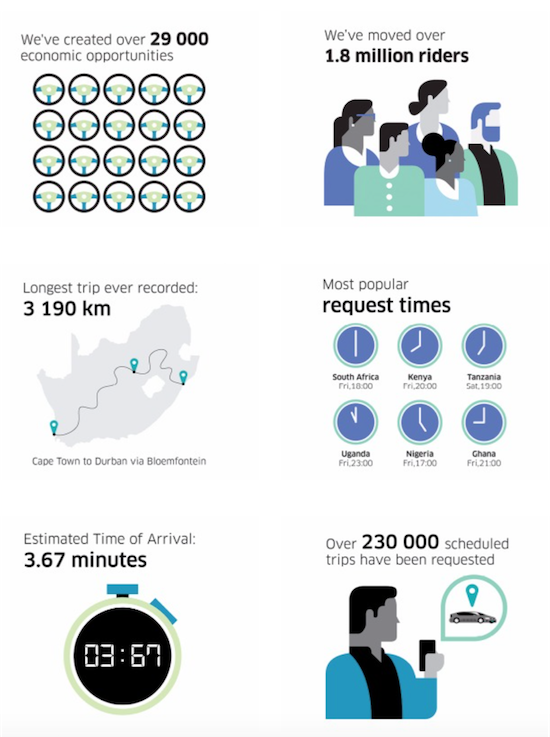

Yesterday Uber celebrated 4 years in Africa. If you are a client of theirs, I am sure you would have received the same email I did. This showed some stats that they have recorded over the years. Here is the image below. What I found interesting was the request times. In SA the most popular request time was 6pm on a Friday. I would guess that is because a lot of people go out drinking at that time. I would love to see the drinking and driving stats since Uber arrived here. I am sure they have declined.

Michael's Musings

Here is something lite for a Friday - Legalised Cannabis May Be a Windfall for McDonald's and Taco Bell. One of my favourite games to play in economics class was, "What are the potential unintended consequences of doing X ?".

Bright's Banter

This morning I'm reading a short piece from Cliff Asness Co-Founder of AQR, an asset management firm and hedge fund with over $165 billion AUM in Connecticut - Little Things Mean A Lot

Home again, home again, jiggety-jog. My heat map was all green this morning, I thought it might be broken. US GDP yesterday was a beat, coming in at 3.1% growth. UK GDP, just out, was a miss. They grew 1.5%. Good luck to the Bokke this weekend.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063