To market to market to buy a fat pig. At the start of the US trading this week, their markets shifted from what is known as T+3 to T+2. Some may be familiar with the term because the JSE moved from T+5 to T+3 last year, to bring our exchange in line with global standards. Now that the US, along with Europe, Hong Kong, Australia and New Zealand are all at T+2, I hope the JSE is also working to toward that mile stone. I visited the Egyptian Stock Exchange in 2010, where they had recently introduced T+0 (same day) settlement for a handful of securities, which they were very proud of and rightfully so. I see on their web page that they settle all the other securities on a T+1 basis, a very impressive feat.

The reason for long settlement periods was due to the need to create physical share certificates every time share holdings changed and then the need to get the money from one bank account to another, before the days of electronic banking. Just the thought of all the admin required to keep a system like that going, makes my mind boggle. Imagine all the paper needed. Paul tells stories of the muddle ups when it came to dividends; it wasn't always clear who owned what on the date of payment. Now when you make a trade, electronic share records are updated and money changes hands, without a human needing to do anything.

The last point to make is that a settlement of even five days, is blitz compared to the settlement on many other asset classes. How long does it take for you to get your money when you sell a property, three months? Even selling a private business, there are mounds of paperwork to sign, lawyers to pay and then money comes free. Thanks to public exchanges, settlement is guaranteed, it happens in days and the cost of the transaction is negligible. It is due to these reasons that publicly listed companies have premium valuations. The ease of making a trade, lowers the risks involved, so investors are willing to pay more for that asset.

Yesterday there were very few local stocks in the green. The All Share started the day weak and just weakened as the day went on, lead by Vodacom who finished off down 8%. The good news though, is that US markets were in the green yesterday thanks to the US debt ceiling worries having been moved from the end of September to the end of December. Trump and the Democrats hammered out a deal to postpone the debt ceiling and the arrange emergency relief for hurricane affected areas. Here is the scorecard, the Dow was up 0.26%, the S&P 500 was up 0.31%, the Nasdaq was up 0.28% and the All Share was down 1.18%.

Linkfest, lap it up

One thing, from Paul

The chief executive of Deutsche Bank, which employs 100,000 staff around the world, says that a "big number" will lose their jobs as robots take over. That sounds rather significant, but he went on to clarify that the jobs were mostly clerical, involving paper shuffling and adding up numbers - Deutsche Bank boss says 'big number' of staff will lose jobs to automation

Perhaps more significantly, the use of smartphone apps by retail clients will reduce the need for bank branches. Remember that as investors in banking stocks (we hold lots of Wells Fargo for US clients, and Discovery for SA clients), we benefit from these measures to lower costs and improve profit margins.

Michael's Musings

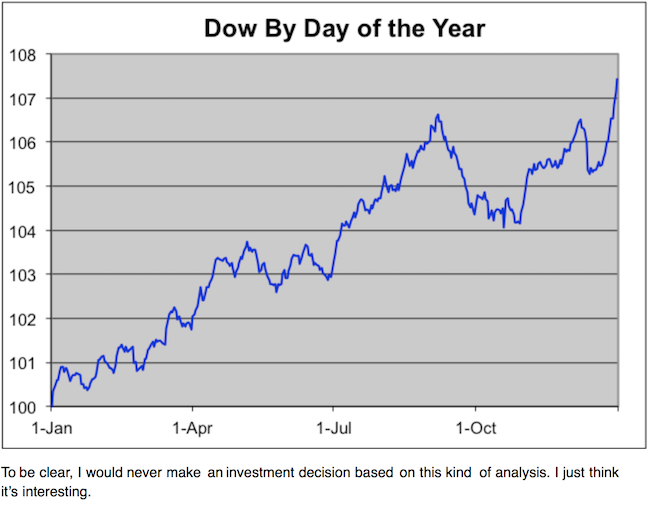

Eddy has crunched the numbers of the average return for the Dow, on each individual day, using data since the Dow was created - The Worst Time of the Year for Stocks.

Sometimes we forget the basic truths about investing in the stock market. When prices are soaring or they are plummeting, our emotions get the better for us and the mind gets clouded - 36 Obvious Investment Truths. See some of the truths below.

This is a huge step in brining self-driving cars to a retail market. Have a legal framework to work within, provides certainty which leads to more development - The House just passed a bill to put thousands of self-driving cars on the road each year.

Bright's Banter

These are some of the best insights from different personal finance experts about saving and creating wealth - Top 5 Investment Mantras On Creating Wealth

Home again, home again, jiggety-jog. Asian markets are mixed this morning, some are up and some are down. Our markets unfortunately has following the down path, currently 0.1% lower. A weaker Dollar over night means that gold has reached a new high for the year and our exchange rate is sitting at $/R 12.80. Later today, the news flow focus is on the EU. A GDP read from the area is expecting 2.2% growth and the ECB is expected to keep interest rates the same.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment