To market to market to buy a fat pig. To go with the new warmer season, the season of new life, our GDP read yesterday showed the economy has green shoots again. Hello growth. Goodbye recession. The headline read which is a quarter on quarter, seasonally adjusted and then annualized number (phew take a breath after that mouth full) came it at 2.5%. I personally prefer just to look at where we are today compared to where we were last year, there are less moving parts and you can very quickly see if we are better or worse 12-months on. The year on year number showed growth of 1.1%, below the 5% we need to make a dent in unemployment but much better than being in a recession.

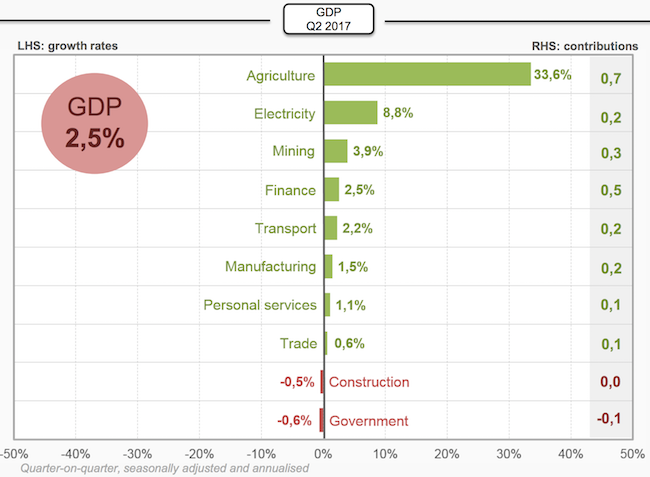

Have a look below at which sectors did well over the last quarter, Stats SA does a great job making the data easy to read. Agriculture has had a strong bounce back after last years drought, the extra you are paying for electricity is also making a positive impact on GDP growth and mining is enjoying the rising commodity prices.

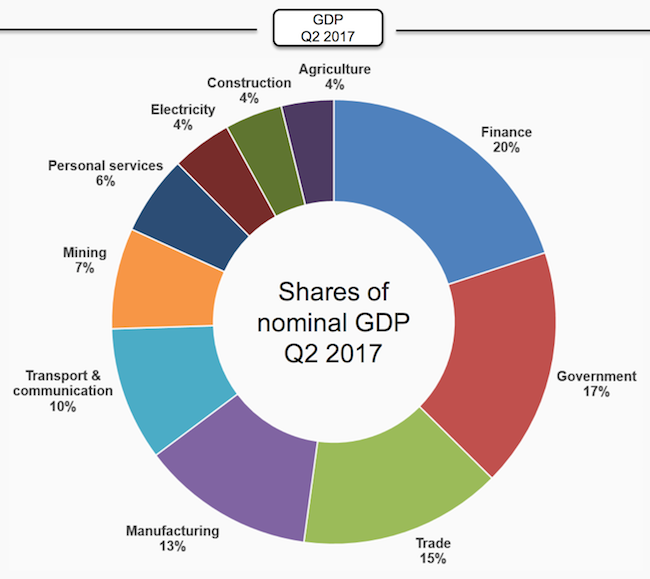

Part of the presentation from Stats SA is a breakdown of our economy. Long gone are the days when we were mining and little else, the economy has diversified into the territory and services sector, which is a good thing.

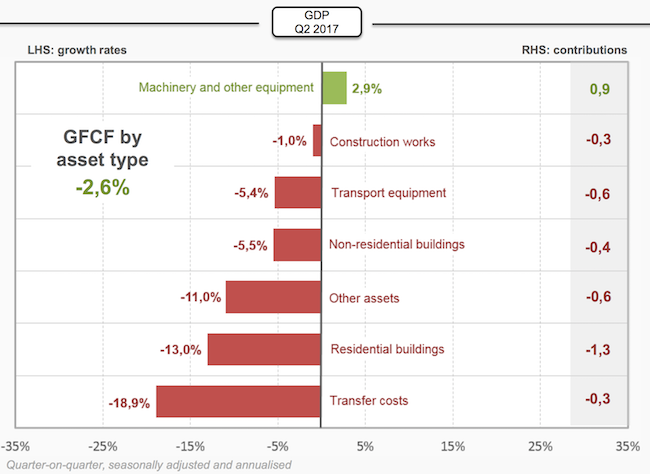

Then lastly, Gross Fixed Capital Formation (GFCF) which is a measure to some degree of the current confidence level in the economy. If you are low on confidence around the long term prospects of South Africa, your money is not going to be committed to costly long term projects. From the graph you can see that the residential housing market is under pressure, I suspect there has been an oversupply of properties built coupled with the slow upward movement of the family unit wealth. A Seeff report recently said they had 18-months worth of properties currently on the market.

After their break on Monday morning, US markets were playing catch up with the rest of global markets who had already sold off on Monday. Here is the scorecard, the Dow was down 1.23%, the S&P 500 was down 1.15% and the Nasdaq was down 0.93%. Our market was mixed yesterday but ended the day down 0.3%.

Linkfest, lap it up

One thing, from Paul

Conventional wisdom has it that change is accelerating, but economists studying productivity dispute this view. Robert Gordon, in his book the "The Rise and Fall of American Growth: The U.S. Standard of Living Since the Civil War" notes that electricity and the internal combustion engine were two key general purpose technologies which fundamentally changed humanity, and lead to a surge in productivity between the 1870s and the 1950s. This was aided by military innovation in the period of WW2.

Computers were another general purpose technology which accelerated workplace productivity in the 1990s, through the introduction of work tools like email, computer-aided design tools, relational databases, spreadsheets, word processors and the Internet.

Since then, productivity has slowed, paradoxically. Robots have only made marginal improvements to manufacturing output. Our households utilise much the same machines. Personal computers have become more powerful and smaller, but not allowed us to produce significantly more. This is counterintuitive. Perhaps the next surge lies around the corner? I think so. What a time to be alive!

Michael's Musings

Imagine having a highly sought after, high paying job and then only having the ability to rent a room of 30 square meters - Sky-High Rents Force Hong Kong Bankers Into Dorm Life. Space is something that I think South Africans sometimes take for granted.

Share incentive schemes don't always have the result of making management rich. I agree that if realistic targets are not met, bonuses should not be paid - No incentive payments for Woolworths executives. What is normally forgotten when top executive pay packages are analyzed is how much wealth has been created for shareholders in the process.

As a cricket fan, I am sad that Facebook didn't win their bid to stream the IPL. It does show that Facebook are going after the live sport market, we will have to wait to see which sport they will win the rights for - Facebook bid $610 million for the rights to streamIndian cricket matches.

Bright's Banter

Scott Galloway is one of the best human beings to follow on social media and to listen to on Barry Ritholtz's Masters in Business (a Bloomberg Radio Podcast available on iTunes). Watch his video on career advice, and tell me I'm wrong - Career Advice From Professor Galloway

Home again, home again, jiggety-jog. Our markets have opened deep in the red. Vodacom announced that Vodafone sold 90 million shares as part of the Safaricom deal. The sale was to bring Vodacom's free floating shares inline with regulations, the stock is still down 7% this morning. There is US trade data and manufacturing data out later today, which will give us a better idea of how their economy is running. Congrats to Kevin Anderson for winning his quarter-final match this morning, making him the first South African to reach the semi-final of the US Open.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment