To market to market to buy a fat pig. Waking up this morning a couple of the news apps on my phone had the breaking news that North Korea had fired another missile over Japan. The missile flew over the north island of Hokkaido. If you are a Netflix subscriber and not sure what to watch next, I highly recommend Wild Japan, one of the episodes is purely focused on the beauty of the Hokkaido island. Asian markets dipped briefly on the news of the launch but shook it off and moved back into the green.

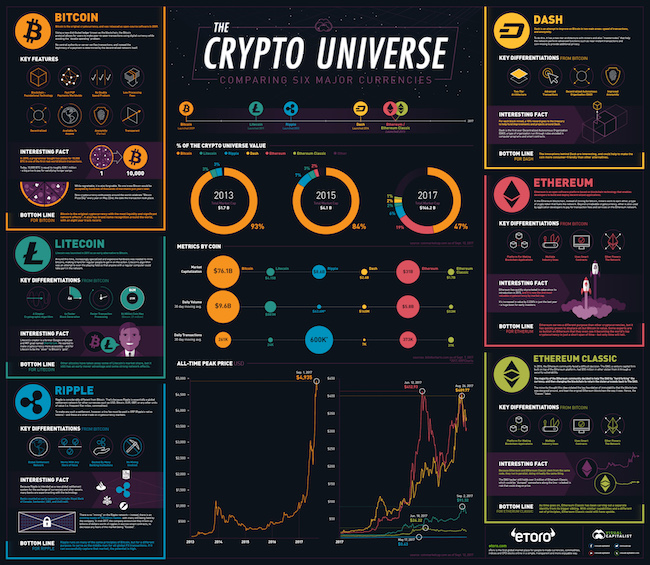

When we look back at 2017, one of the things it will be remembered for is the rise of the cryptocurrency. Before I go further, I think the following disclaimer is in order. In 2014 when Bitcoin first made financial headlines, we looked at it with the conclusion of avoid because there were just too many unknowns. PLUS we are equity investors so it does not fall within our domain. Yesterday Bitcoin was tumbling after Chinese regulators say an exchange ban is certain, since 1 September the price is down 25% but still up a whopping 300% for the year. I personally think that Bitcoin is in bubble territory, purely based on the number of adverts I see for trading the coin.

We see first hand how human nature reacts to price movements both up and down. Human nature is to sell the stocks/assets that are down and to buy more of the stocks that are up. Translating that to Bitcoin, because its price has been on a one-way trajectory to the top right of your screen, people can't get enough of it, which then fuels the next round of price appreciation. Now that the price has suddenly dropped, the initial reaction will be a camp of people buying because the coin is suddenly much cheaper and they feel like they missed out on the first buying opportunity. So they make sure they won't miss out again. If those buyers outnumber and outlast the sellers in China, then I think the price will get back above $4 000 again. However, if the Chinese selling persists and then more people start selling because they bought at the peak, then I think human nature takes over, where more and more people sell just because the price is down.

The biggest reason I have never bought a Bitcoin is that I can't see where the value of the coin sits. There is a big difference between creating value for society and capturing some of that value for yourself. Cryptocurrencies and blockchain technology will have an increasing role to play in society; I can't see the likes of Bitcoin capturing the value that they create though. As I have said before, Bitcoin is either hugely undervalued or extremely overvalued, are you willing to take a bet on which one?

New York, New York didn't make it four days in a row of record closes. Here is the scorecard, the Dow was up 0.24%, the S&P 500 was down 0.09%, the Nasdaq was down 0.48% and the All-share was down 0.59%. The one stock bucking the trend was Aspen after their full year results yesterday, the stock finished up 8.5% and is up another 1.2% this morning. It has been a rough ride as a shareholder over the last 2-years but it looks like the company has now got through the growing pains of becoming a truly international company. More about Aspen on Monday.

Linkfest, lap it up

One thing, from Paul

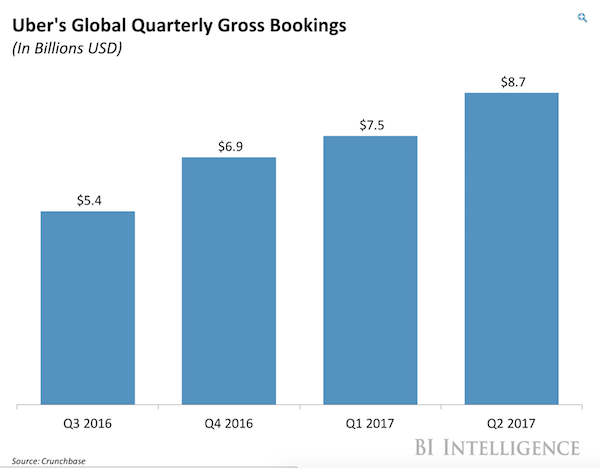

I've previously said that I would love Uber to list on the markets in New York, so that I can buy them for myself, and so that Vestact can buy them for our clients.

As you probably know, their founder and controlling shareholder Travis Kalanick just stepped back from the CEO role, handing that over to Dara Khosrowshahi. He seems excellent.

Yesterday's news was that Japanese tech fund Softbank wants to buy about 20% of Uber through a combination of share purchases from the company and a tender offer extended to employees and existing investors. But Softbank wants a discount of 30% or more from Uber's last valuation of about $70 billion - SoftBank and Uber's deal talks have advanced under Uber's new CEO

Anyway, why would we want to own shares in a company which loses so much money? Uber lost $645 million in Q2 2017, despite $1.75 billion in adjusted revenue. Well, for starters those losses are declining. They lost $708 million in Q1 2017, and $991 million in Q4 2016.

Most importantly, they are still growing madly.

This is a company that is transforming mobility. They are changing the world. Car ownership is no longer essential, and even if you do own a car, you'll find yourself taking an Uber in all sorts of situations. Take a look at how much you personally spend on Uber. If your life (and your family's life) is anything like mine, you spend a lot of money with this company. One day they will be hugely profitable.

Michael's Musings

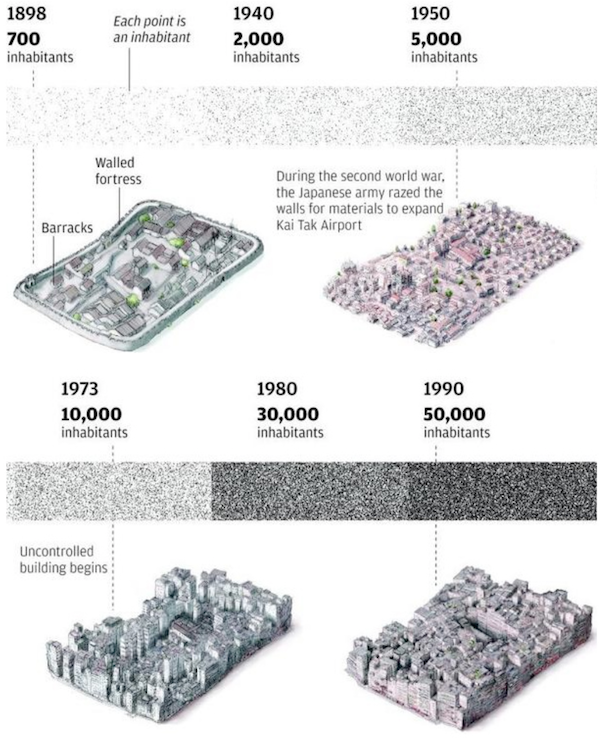

If you want to see what happens when there are no governments, have a look at this city in Hong Kong. It fell through the cracks when the British took control because China had a claim on that small piece of land - This Fascinating City Within Hong Kong Was Lawless For Decades. With less regulation, more gets done but at the same time consumers are at more risk.

Bright's Banter

We have been receiving a lot of emails from clients on cryptocurrencies and I think it's only fair that we get a basic understanding of these currencies and their differences from each other - Comparing Bitcoin, Ethereum, and Other Cryptos

There's an old market adage that says being too far ahead of your time is indistinguishable from being wrong.

As Howard Marks pointed out in his second most recent memo, Cryptocurrencies are where Airplanes were in 1910. Yes we acknowledge the fact that the airline industry changed the world but that industry only turned profitable in the late 1990's and is yet to be a good investment!

The same with Tech companies in the late 1990s, only now are we starting to see extremely profitable tech firms (and we own some of course). No doubt that Cryptocurrencies or the block chain decentralised network technology could potentially have a big role in society in the future, however, we must not confuse them with actual investable assets. In closing, I wouldn't touch these with a ten foot barge pole.

Home again, home again, jiggety-jog. Our market is down on the open today. Surprisingly, gold is down today even though North Korea was behaving badly. Yesterday's US CPI read was higher than expected, at 1.9% YoY change, part of the bigger increase in prices is being blamed on surcharge pricing when the two hurricanes hit the US. Being very close to the Feds 2% inflation target, the market is pricing in a 50-50 chance of a rate hike in December. Data to look out for today is US retail sales, which is expected to be up ever so slightly.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment