"Whilst a few years ago many were talking about a successor for Brian Joffe, that thinking has been proven old school in modern times. As long as the Magician of Melrose Arch continues to be given their stamp of approval by the board of Bidvest, I think he has the energy and gumption to continue to allocate capital prudently and in the interests of long term shareholders. I also think that there are many quality people who could run that business, we are blessed with the brilliance of Brian Joffe currently."

To market to market to buy a fat pig. Last week was horrible at the beginning and much better towards the end. A much better than anticipated US GDP number Thursday did a lot to settle things, I guess. I was a little bemused by two stories that essentially are the same thing at face value, worlds apart for many other people who are equally observers of the markets. One, the Chinese attending to their market slump by actively buying securities, lowering rates in order to again be settling frayed nerves. I saw many on Twitter (or is that, The Twitter thingie?) suggest that Chinese government intervention in markets was absurd and this will end in tears.

At the same time I saw an un-newsworthy report that said that the Norwegian sovereign wealth fund was down 5 percent for the month. Yes, and? So were many money managers I bet, from those supposedly hedged to those who are long only. The idea that Norway can own stocks on behalf of their citizens (third time lucky it seems), China however cannot, is something I find strange and very old school (olde worlde) in thinking. I will concede that the 5 odd million people in Norway are far richer on a per citizen basis (per person the fund is around 170 thousand Dollars), aren't the objectives the same for the state? The richer your citizens are, the more resources you can raise in order to maintain the high levels of medical standards, educational standards, the infrastructure and so on. I know that Norway is not China and equally China is not Norway to borrow a line from Spanish Prime Minister Rajoy, the state owning assets on behalf of citizens trying to achieve the same objectives, is that not the same thing? Or am I missing something?

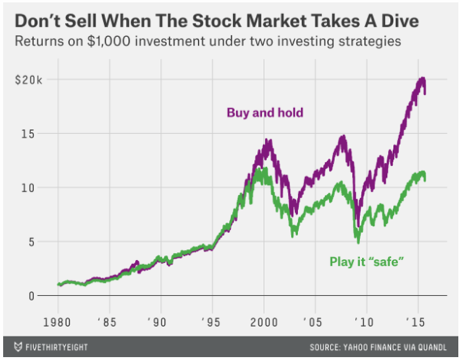

A quick wrap of markets from Friday, New York, New York, the S&P 500 closed marginally higher in a choppy session, the nerds of NASDAQ ended up one-third of a percent, whilst the Dow Jones lost just over a handful of points to close up shop nearly 10 percent adrift of the year highs. The S&P 500 is still 3.4 percent down for the year, notwithstanding the heroic second half of the week, last week. Chinese stocks, a worry about the slowdown of Chinese growth, off admittedly a much higher base and of course worries about emerging markets are all mixed in with a pending rate hike in the US, will the Fed raise in two and a bit weeks or will they raise towards the end of the year. Or raise at all this year. Will they stand pat? Who knows, you should not let it impact on your decisions to own stocks, what the Fed does.

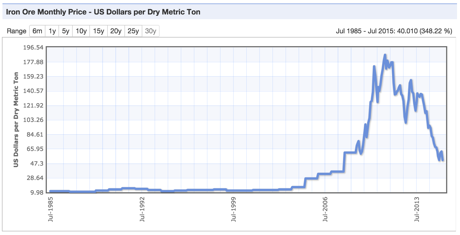

Jozi, Jozi. The overall market roared ahead and into the green for the year Friday, the Jozi all share added over 1.7 percent to end 33 points short of 50 thousand. We are ten percent off our highs for the year, resource stocks may have had a better second half to the week, for the year as a collective the commodity index is down nearly 14 percent. Wish. Slim pickings. Anglo American stock in Johannesburg is down 30 percent for the year, BHP Billiton in Joburg (in Rands) is down 8.6 percent. I am guessing that is before about that same amount in South32 distributions (8 odd percent of the value), so I am guessing out loud that BHP is flat in Rand terms for the year. Glencore in Rand terms is down 44 percent. Yech. Sasol is flat for the year.

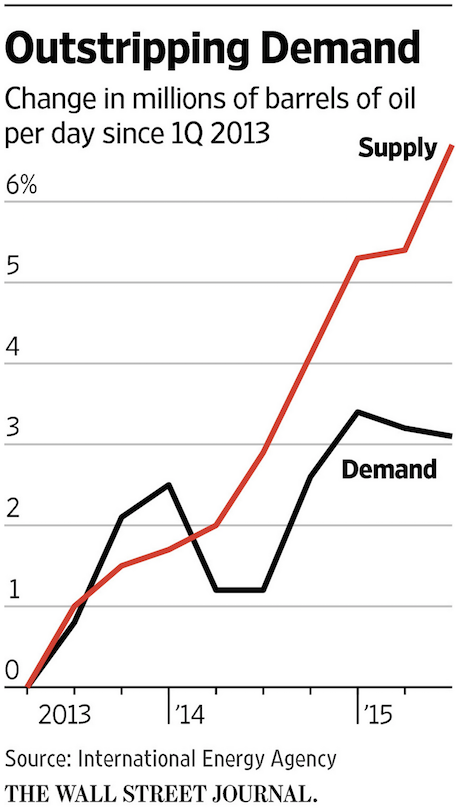

In London, in terms of their respective listings there and measured of course in Pound Sterling, Glencore is down 50 percent. What that means is that the companies share price has to double in order to get back to break even from where they started the year. BHP Billiton is down 18.4 percent in London, Anglo American is down 38 percent in London. It has been a torrid year for the global producers of commodities, from bulk commodities to the oil majors, projects aplenty have been shelved and billions of Dollars in exploration shelved as the current prices dictate that the purse strings are kept tightly shut. I guess that means that future supply will be impacted with less investment, that goes without saying. Whether or not we can utilise the same resources (or less) more effectively with technological advances I guess remains to be seen.

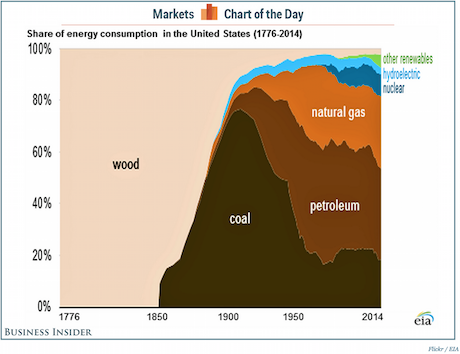

Amazingly Warren Buffett sold all of their Exxon Mobil stock in the fourth quarter last year. At an average price of somewhere in the region of 93 odd Dollars. Exxon Mobil trades at 75 Dollars, down 18 percent for the year. Well done Berkshire, Warren and Charlie and I am sure a whole host of other people when making this decision to sell. Of course one of the big holdings that Berkshire have been adding to, IBM, is down 7.77 percent year to date. This is however a longer dated investment call on oil, its abundance relatively to usage and current oversupply, the shift to alternatives and more importantly the ability for these businesses to operate at the same margins as before.

Exxon Mobil trades on a 13.3 multiple currently, with a yield (pre tax) of 3.9 percent. IBM trades on a 9.9 times multiple and has a yield of 3.5 percent, also pre-tax. For the time being, "old tech" companies are stuck in a funk, unable to grow revenues as they respond to the new world of tech. I am pretty sure that they will all adapt and evolve as they have before, and by they I mean SAP, Oracle, Microsoft, HP, Cisco and the like. I have however seen stories that Microsoft will have to borrow money in order to meet their dividend obligations. No worries, lots of cash there, most of it is offshore, that is somewhat of a problem. A nice problem to have. For the record, a growth business like Apple (at least I think so), trades on a multiple of 13 times and has a dividend yield of 1.9 percent. I still love that story that Warren Buffett read the annual report of IBM for 50 years in a row before he actually made a single investment in the company. That is what you call tenacity, investing like Gary Kirsten. Sometimes you don't have to look flashy to outperform.

Company corner

You know that I am not the biggest fan of quotes and that I believe that you should make your own, this is more a statement from Brian Joffe, the CEO of the Bidvest Group, who reported results for their full year this morning: "We strive to turn ordinary companies into extraordinary performers, delivering strong and consistent shareholder returns in the process. We understand that people create wealth and that companies only report it."

That sounds pretty simple, what it takes is extreme skill, patience and capital allocation second to none. Sweat each and every Rand. I did notice that Bidvest had taken down the sign in their foyer: "We refuse to participate in the Recession" and they had given it (the foyer) somewhat of a revamp. It looks nice, next time I go past I will take a picture and post it to Twitter. So here are the numbers, follow the link as per their website to get to the earnings number.

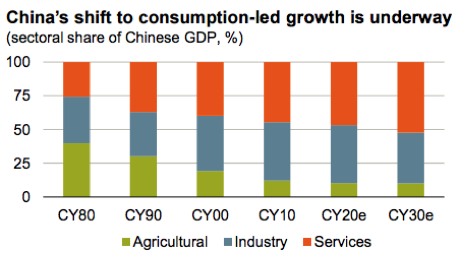

I agree, these were tough operating conditions and the group certainly has delivered. Bidvest Namibia a laggard, come on the Welwitschias, pull up your socks. I remember that company used to have the most incredible margins in that country. Small market, great operator, delivering, the fish in the sea are harder to fish (82 percent of profits in Namibia are derived from Bidfish, obviously their fishing operations). When you do a detailed read through the results you can see that it was not only the South African business that had troubles, the currency "wins" in the UK and more specifically European businesses mask how tough it is there. Some of the emerging market reporting segment (around 8 percent of group sales) tells you what you know already, China is shifting to a services based economy, Brazil is in a whole heap of you know what, the Middle East is moving forward notwithstanding the obvious problems (lower oil prices and regional violence).

Numbers, HEPS increased to 1882 cents per share, up 8.6 percent on last year, the dividend for the second half declared is 483 cents (after tax that equates to 410.55 cents), payable on the 28th of September. The interim dividend paid was 4.26 ZAR, add the two together you get to 9.09 ZAR. After 15 percent dividend tax, on a 305.02 ZAR share price (close Friday), the stock trades on a yield of 2.53 percent. The price to earnings multiple is 16.2 times. Is that expensive to pay that many years worth of current earnings for a company that has one of South Africa's best allocators of capital? Yes? No? I certainly think not, the company is well positioned to take advantage of a global upturn after a long period of muted growth.

The acquisitions are well thought out, "things" seem to be going better at Adcock, which I think has been overstated in the bigger context of the company. Although as the release points out: "the impact of the acquisition of Adcock has been a negative 2,7% on HEPS." That is not a lot, not nothing equally. The 37.7 percent stake in Adcock (current market cap of 8.86 billion Rand) equals 3.34 billion Rand, relative to the Bidvest market capitalisation of 102.23 billion Rand is 3.26 percent. Hardly worth talking about all the time in the context of this business, yes? I suppose that the products that Adcock produce are household names, like Panado, Compral, Corenza, Bioplus, Vita-thion and Citro-soda, it is no wonder we think it is a "big deal".

In the current financial year, two purchases were made in the UK and Italy, announced last year in July, remember we wrote about it: 2 not so small acquisitions. In aggregate the purchases were 95 million Pounds, or around 1.95 billion Rand at current prices. That is around 1.9 percent of the entire value of the Bidvest Group and yet, how many times do you hear about this one? Very few.

So what to do? Do you still carry on holding your Bidvest shares? I am going to go one further and say that they are still a buy on any weakness. Whilst a few years ago many were talking about a successor for Brian Joffe, that thinking has been proven old school in modern times. As long as the Magician of Melrose Arch continues to be given their stamp of approval by the board of Bidvest, I think he has the energy and gumption to continue to allocate capital prudently and in the interests of long term shareholders. I also think that there are many quality people who could run that business, we are blessed with the brilliance of Brian Joffe currently. As long as he stays in good health, no reason to believe contrary, we should continue to reap the rewards as shareholders.

Linkfest, lap it up

Some fun for a Monday morning - How Cartoonists Covered the Market Crash

If you drive really slowly and accelerate at a snails pace you can drive a Tesla around 500 miles (728 KM to be exact) - Two guys drove a Tesla almost 500 miles on a single charge

Textbooks don't follow the normal supple and demand model, your lecturer says "buy this one" and you have little choice but to get your hands on it some how - Are Savvy Students Sabotaging Big Textbook?

I always enjoy Josh Browns humour and insight. This time he is talking about how rigid systems have a tendency to blow up when markets don't act 'normal' - Computers are the new Dumb Money. The one quote he points out from Buffett is worth a reminder: "Paradoxically, when 'dumb' money acknowledges its limitations, it ceases to be dumb."

This was pretty amazing to see a very young Mark Zuckerberg talking about what Facebook is likely to be in years to come, this in 2004. Let us just say, that with the benefit of hindsight, he was very wrong in a very good way. CNBC video, July 2004.

Home again, home again, jiggety-jog. Markets is Asia are mixed to mostly lower, US futures are pointing lower for their start in the afternoon. In fact as a collective, this has been the worst month for stocks in Asia for over three years. Our market may be buffered a little bit by a weaker currency here.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939