"The stock trades on a 16 multiple and is hardly expensive for a global business of this size and scale, the company has a market capitalisation of 236 billion Swiss Francs, around 242 billion Dollars. I guess with the growth rates relatively muted, the stock will trade at this sort of level. Also remember that the Swiss government gobbles up around one-third of the dividend, taxes that you cannot avoid, the pre tax yield is around three percent. Compare that to the Swiss government bond rate of nothing, then it is pretty good, in that context."

To market to market to buy a fat pig. I can think of twenty reasons to never buy stocks, I can think of very many more to own companies for the long haul. I have great admiration for the stock investors over the years that are able to shut out the noise and basically stick to the basics. Right now however, and we have been discussing this in the office at length, what are deep value investors thinking of the recent Buffett slash Berkshire acquisition of an industrial and manufacturing business based in the US at no less than 22 times earnings. If I remember correctly, anything around that area was a no go for Buffett. The analyst consensus on earnings for the stock sees a current year PE unwind to 18.4 times and then next year to 14.2 times. Certainly the companies earnings, even at the current premium to be paid on the stock price by Berkshire is growing fast, fast enough to justify them paying that multiple.

The price of any security that appears in front of you today is the traded price. We have options, either you own the stock, or you do not own the stock. Either you buy the company as you see it, provided that the stock price is NOT overpriced relative to your expectations, or you do not. That is why I think that a neutral or hold rating is a cop out. Over here at Vestact, we do not have a 12 month holding period. Guessing what the stock price could be in 12 months time and setting a price target accordingly, relative to enormously detailed work is always going to be hard to meet or nigh impossible to predict. How? If I told you that Richemont was going to be at 120 Rand a share in 6 months time I would be setting myself up for failure. If it stays at these levels I will be wrong, if it goes to 135 for any number of reasons, I will be wrong too.

Why would some of the smartest and most insightful people in the industry set themselves up for failure by suggesting that they know where the price is likely to go, by writing detailed research and brilliantly analysed reports? Is their job merely to generate trade ideas for their firm? If it is, then it sounds like a whole lot of wasted talent to me. Rather tell me what you think earnings, revenues, margins, investments in their own business, borrowings, growth prospects are likely to be, then we can decide whether or not that business is any good. Anyhow, at the end of the day one must always make up ones own mind, no matter how much detail you can absorb or read from a research report.

Securities analysis will always have a very significant and very important role to play in our industry, I just wish that less emphasis was placed on the 12 month price target. Recently, as the Google share price has rocketed ahead as a result of both a very good set of recent numbers, and a reorganisation of the business, there has been a whole host of price target upgrades. What happens if the price falls now 20 percent, will the same said analysts upgrading their price targets then have to back down again and lower them? That would be embarrassing.

Save yourself the embarrassment, most analysts out there who write huge detailed reports are really smart, make up your mind based on the price today and what their long term prospects are likely to be. Is it cheap today? Yes, buy it. Is it expensive today? If the answer is yes, then don't buy it. Period. If something changes with the business model, the future prospects look less exciting, sell it. Simple. Of course, as this is a market, not everyone will agree with everyone all of the time. If everyone agreed on which companies were champions of the future there would not be a single one to buy, as there would be NO sellers.

Quick markets update, here in Jozi yesterday we were in catch up mode to the session prior on Wall Street, stocks were up 1.6 percent as a collective. Industrials were up nearly two and a half percent, Naspers the large driver there, that stock was up sharply, 7.7 percent higher on the day, clawing back all the losses from the session prior. So whilst we have seen two days in a row of that order of magnitude, seven percent swings, the share price as it opens up on Friday morning is about at the same level as it closed on Tuesday evening. The intraday moves Wednesday were startling, down four percent, back flat to marginally higher again, and then down 7 percent on the day. The next day, Tencent is up like crazy, the stock ramps up seven percent. That is swings of nearly one fifth of the market cap in all directions in two days. Hardly comforting for anyone, if you caught all of the volatility then hang up your trading ice skates for the year, lest you fall on the hard ice.

Mind you, that is nothing. The 5 day action on some of the gold producers share prices is mind boggling, more specifically their ADR share prices. Last evening the ADR share price of GoldFields was down 11 percent plus, the stock was up 20 percent in three sessions from Monday through to the close Wednesday. All in all, the stock is down 2 percent in the last five trading days, yet the stock has had the most wild of gyrations that I have seen in a while. As ever, it depends where you draw your line in the sand. All the Chinese currency ructions, which are really non events have had everything to do with this. Another insightful post from a former Fed insider, Bob McTeer: The Yuan and the Dollar in which the conclusion sums it up:

Also, we must remember that in recent years China has allowed its currency to strengthen against the dollar, so its recent rise with the dollar was additional strengthening on top that. There are many things one might criticize China for these days, but I don't think their currency policy is one of them.

Equally, Cullen Roche puts it into perspective in a post The China Slowdown in Perspective

It's extremely odd to be getting worried about an economy that is growing at 7% per year. Most countries would love to have that "problem". China's growing even if it's not growing at the same rate. So, it's still positively impacting global growth even though the rate of change is slowing. Now, I wouldn't be shocked if that growth rate were a bit lower since the numbers are almost certainly massaged, but it's still useful to keep things in perspective. So far, we haven't seen big changes in the macro data in the USA. This doesn't mean China will have no impact on US growth, but it's likely far smaller than the media would have you think.

It was a big up and down session yesterday in the US, markets opened up fractionally, went lower, went higher and closed lower, losing all the gains in the last hour. The end. The S&P closed the session down over one tenth of a percent, the Dow Jones was marginally ever so fractionally higher, the nerds of NASDAQ sank over one-fifth of a percent. Over the seas in a North Easterly direction Chinese stocks are falling and off their highs in the session, Japanese stocks are down and Down Under stocks are under water. Let us hope that the Boks can win this weekend, it is pretty amazing how fickle sports fans can be.

Company corner

Tesla announced that they were going to be raising 500 million Dollars, Elon Musk is going to stick in 20 million of his own money to buy more shares at these levels. What for? I mean, what are they going to be using the money for is the better question? In the press release, titled Tesla Announces $500 Million Common Stock Offering: Tesla intends to use the net proceeds from this offering to accelerate the growth of its business in the United States and internationally, including the growth of its stores, service centers, Supercharger network and the Tesla Energy business, and for the development and production of Model 3, the development of the Tesla Gigafactory, and other general corporate purposes. So there you go, making progress and never sitting still.

Nestle released 2015 Half-year results yesterday, at the same time an Indian court dismissed charges of a noodle scandal in that country, further testing of the product is underway, an independent body will test whether or not the product is harmful. Maggi Noodles. As they say in the English release: In India, our withdrawal of Maggi noodles resulted in negative organic growth which will continue into the second half. We are engaging fully with the authorities as we work to relaunch the product. Do you eat boxed or packaged noodles?

Whilst sales growth has been muted, this is against a backdrop of struggling markets everywhere, developed and emerging. Yet, the company still maintained their growth trajectory across all of those markets, the strongest being in the Americas where pet-care products, coffee and creamers were the drivers. My dogs must be dumb, the excitement they get is the same day in and day out when I feed them, at least the two male dogs. The female husky must be smarter, if there are no "added extras" in her bowl she gives me "the look". EPS for the first half clocked 1.43 Swiss Francs, the Swiss Franc share price is 74.15, the ADR Dollar price is 76 (the stock was up 2 percent last evening). That is about spot on, 1 US Dollar is around 0.98 Swiss Francs.

The stock trades on a 16 multiple and is hardly expensive for a global business of this size and scale, the company has a market capitalisation of 236 billion Swiss Francs, around 242 billion Dollars. I guess with the growth rates relatively muted, the stock will trade at this sort of level. Also remember that the Swiss government gobbles up around one-third of the dividend, taxes that you cannot avoid, the pre tax yield is around three percent. Compare that to the Swiss government bond rate of nothing, then it is pretty good, in that context.

Why own this company? They are the gold standard (Maggi Noodle scandal aside) of food production globally, their infant care and coffee brands are solid, strong, in fact all of their brands are pretty amazing. Quality, definitely not quantity is the name of their 110 year old business. Yet global sales are expected to be in the coming years approaching 100 billion Dollars. At the current growth rates expected of around 5 percent per annum, you could easily see it there before the decade is out, 2019. We continue to believe that this business is well poised to continue to attract more customers over time, with their well known and quality brands. Buy.

Linkfest, lap it up

Eventually at some level certain "new" services become indispensable to you. This new study suggests Facebook, Messenger (is) Replacing Email, Phone, Text in Southeast Asia. The networks of course still supply the data and ability to send messages, the places that people are meeting in order to use the wifi is increasingly becoming public places, coffee shops and the like.

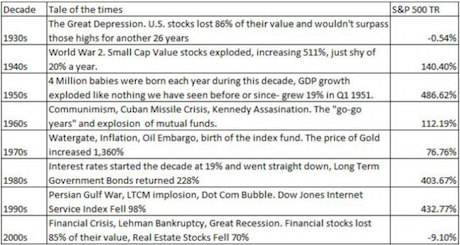

This is what we were saying yesterday, there are always head winds - a new "headwind" is born. Here are some of the major headwinds in each decade and how the market did:

It is nice to be reminded of human innovation - The 8 busiest airports in the world. The Chicago airport handled a staggering 888 000 flights in one year! That works out to 101 flights an hour or more than one a minute.

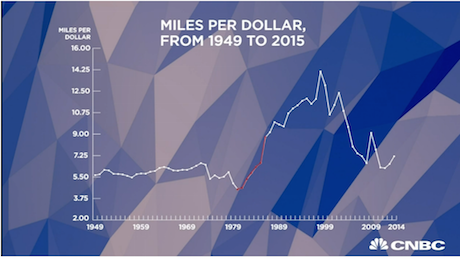

As cars become more efficient, the cost of traveling comes down. Oil prices haven't been playing ball though, until recently - Driving costs the same as it did in the '50s. Note how costs have been coming down over the last 15 years, even though oil prices have been going up.

Home again, home again, jiggety-jog. Markets are a little mixed here to start with, we are marginally higher on the day. German GDP was a beat, French GDP was not, both pretty anaemic however. Still, they are growing, that is what matters the most. Have fun out there!

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment