"What is most interesting about all of this is that the Anglo market cap in Joburg is 211 billion Rand, whilst the Mondi Ltd. is 34 billion Rand and Mondi Plc. is 111 billion, collectively the packaging company is worth 68 percent of Anglo currently. Yet, it was worth less than one-tenth back then, in 2007. Jo, jo (pronounced yaw and not Joe), that is certainly a fall from grace."

To market to market to buy a fat pig. I was down with a bout of man flu yesterday, which as half the human population know is much worse than normal flu, the fellas at the office always do a wonderful job, I might as well throw in the towel. Man flu is dreadful. A quick look at the new Iliadin nose spray advert will confirm this, it sums it up. Some poor chap on the couch unable to do anything, as a result of man flu. Men do not give birth and whilst never experiencing the joy of childbirth, luckily for the human species women do, there is continuity.

I noticed something yesterday, that the market capitalisation of Vodacom now eclipsed that of Anglo American. Can you believe that? Here we have a company, Vodacom, that is basically as old as democracy itself in South Africa. And then we have a company, Anglo American, that is basically as old as modern mining is in South Africa, and for many people still synonymous with big business in South Africa. Sayings like, who do you think we are, the Oppenheimers?

Harry, Ernst and Nicky, people feel as if they "know" these people. 70 year old Nicky Oppenheimer moved the large majority of the family wealth out of commodities and into private equity, you have heard of Stockdale Street Capital and Tana Africa Capital, right? Tana is a 50/50 between Oppenheimer and the Singapore Sovereign Wealth Fund, Temasek. It owns investments in Food businesses, from frozen products to milk powder to pasta. Stockdale Street Capital manages the Oppenheimer private equity interests, I guess Tana is the Africa arm. I cannot find too much about it, the firm that is. From LinkedIn I can tell that people like Kevin Amoils and Paul Salomon (and I bet many others) work there. Heard of them?

That is why I love LinkedIn and their ability to continue to attract many people, who will keep their profiles fresh. I can quite quickly see who these people are, without knowing who they are at all. Back to the matter at hand, Anglo American fell heavily yesterday, along with the rest of the sector, down nearly 6 percent to touch a Rand level below 150 Rand, at one stage. Ending 39 cents better than that. I remember in May of 2003 when Anglo fell below 100 Rand shouting that you must load up, as you may never see it at these levels again. Well, stranger things do happen.

What is different between now and then is that Anglo reduced the number of shares you would have owned, and spun out Mondi in the second quarter of 2007. Which was a while ago now. Shares in issue of Anglo reduced from 1.541 billion to 1.402 billion, if I remember for every 100 ordinary Anglo's that you held, you got 91 "new ones" (without the Mondi). You then got Mondi Plc., and Mondi Ltd. shares, as well as a demerger dividend. What is most interesting about all of this is that the Anglo market cap in Joburg is 211 billion Rand, whilst the Mondi Ltd. is 34 billion Rand and Mondi Plc. is 111 billion, collectively the packaging company is worth 68 percent of Anglo currently. Yet, it was worth less than one-tenth back then, in 2007. Jo, jo (pronounced yaw and not Joe), that is certainly a fall from grace.

As we tried to point out a few days ago however using Steinhoff and Harmony as examples, this is not the demise of a company, this is part of a natural cycle both in a company and country/economy. Vodacom being bigger than Anglo is a good thing, Steinhoff being many times bigger than Harmony (it used to be smaller 10 years ago) is a good thing. Many more jobs being created in different parts of the economy, that is also a good thing.

The sell off in commodities stocks (all related to growing pains in China, and more specifically consumption of raw materials) as a collective saw the Jozi all share end down a little over four fifths of a percent, resources as a collective down three and two thirds of a percent. As a collective they are now at a level that we have not seen since the great washout of late 2008. And before that, in the first half of 2006. Yikes, the commodities sell off has been swift and brutal, the index is down 41 percent in 12 months. Who would have thought?

New York, New York. Over the seas and far away, stocks bounced off their worst levels during the session, blue chips closed around half a percent lower. The nerds of NASDAQ and the S&P 500 lost around one quarter of a percent. The other big news that the financial world was fixated with was the guilty verdict and subsequent 14 year sentence handed down in the Libor rigging case of Tom Hayes, a former UBS and Citi trader. This is the harshest penalty since the financial crisis (I guess the Madoff one was different, that was life), all of the jury found him guilty. Hayes argued his bosses knew, what is going to happen next I guess is that the trial of other brokers is about to begin in September, those folks must be feeling worse for wear. The message sent is a good one, integrity and honesty above all.

So Tom Hayes becomes the fall guy, some would argue this is only the beginning. What did Peter Parker's Aunt say, with Great Power come Great Responsibility. The fact that an interbank rate, which sets ordinary folks borrowing costs, could be manipulated by so few is a weird idea. Where were the law makers when all of this was happening, and why did it take so long? Whilst the Financial industry has quite clearly some of the very smartest people that I know, this is hardly a success from an ethics point of view. Greed may be good for Michael Douglas in the first Wall street movie, if only us humans knew how to help ourselves from ourselves. We don't. There will be many more incidents of this nature in our lifetime.

Company corner

Yesterday Tiger Brands's, Dangote Flower Mills (DFM) released their 3Q numbers. Revenue is up 15%, cost of sales is down 13% and gross profit is up 49%, so things in the operating department are moving in the correct direction. That is where the good numbers stop though. Thanks to the weakening currency (Nigerian Niara) their operating loss worsened by 66% compared to the same time last year and the loss per share went from 89.89 to 181.31. Given how big their losses have been they currently have negative cash flow which means that they are having to borrow to keep things going. The only good news from the weaker currency is that it makes it cheaper for Tiger to send funds to the Nigerian operation. I don't see the oil price recovering anytime soon and as such I don't see the Nigerian Naira recovering. What is required now is a stable currency, which is tricky given that there is a black market rate now. Expect DFM to be a loss maker for Tiger for the foreseeable future.

Linkfest, lap it up

With a FED rate hike on the horizon what should your strategy be? Well, nothing carry on as normal - Pay Attention, Ignore the Fed.

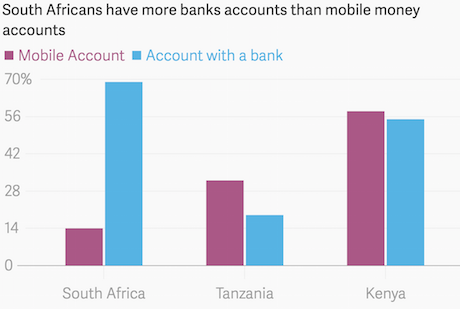

This is an interesting read about the banking environment in South Africa. Given our solid banking system there is very little room for Mpesa to succeed - Why South Africa's largest mobile network, Vodacom, failed to grow Mpesa. The graph below shows how key mobile banking is to other African countries; shows why Bill Gates is so excited about mobile banking.

Given that there hasn't been a huge jump in flight technology for the last few decades we are hopefully due for one in the near future - Airbus just patented a jet that could fly from London to New York in 1 hour. Given that some of the flight will be spent in the vertical position I don ot see this being a huge commercial success.

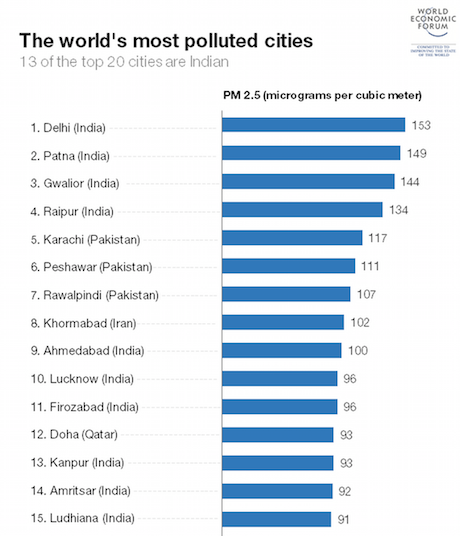

Which city do you think is the most polluted? Most people would go with a Chinese city, probably because of all the attention their pollution received with the hosting of the Olympics. If you thought China you were very wrong - Which is the world's most polluted city?

Home again, home again, jiggety-jog. Asian markets are trading lower, all except for the Shanghai exchange, that is up one and three quarters of a percent. Tencent is trading lower again, I certainly think that we are closing in on opportunity territory for Naspers here. It has been a tough old year for local stocks as a collective, not even up 4 percent, resources are down nearly 17 percent, following the same fall last year. Prior to that it was two flat years for resource stocks, it certainly has not been a happy place to have been invested. The S&P 500 on the other hand has returned less than two percent year to date, the Dollar return of the local market has woefully underperformed. We are certainly not alone, globally emerging market currencies are plumbing 14 year lows to the US Dollar.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment