"In Nigeria, where the group has nearly 63 million subscribers (one fourth of the base), data is now 20.5 percent of all revenues. Margins decreased, mostly as a result of the selling of the tower infrastructure and a weakening of the Naira. The Nigerian currency translation is always going to be a problem. As Michael pointed out yesterday, the Rand has actually weakened to the Naira recently."

To market to market to buy a fat pig. Who cares? I mean, if a voting Fed member says that he is going to support a rate increase in September, readying himself for a rates normalisation, then it is going to happen, right? I am not too sure how many times I have seen the equities market act one way or another based on the FOMC statement, or a member saying this or that, or people trying to interpret words. I have shared this with you many times, I read a book called "It was a very good year" which takes the circumstances around why equity markets rallied. And a lot of the time, be in 1950 something or 1960 something or 1980 something, there was a lot of talk about what the Fed was going to do next.

Whilst the cost of funding for business is clearly going to go higher and there are going to be problems with some less quality company issued bonds, that is something that the market "knows", i.e. it has been priced in already. There is a lot of distressed company debt all of the time, based on fundamentals that are not in their favour. Take the onshore oil and gas sector in the US, it looks ugly right now. Those companies are used to the stresses related to volatile markets, their debt investors should know that too. I do not think that there is ever a reason to get freaked out by factors beyond your control. I have seen some pretty amazing reasons for "selling stocks", yet chasing your own tail is a terrible thing to do. We keep repeating over and over again, you are buying and owning real companies with real customers, not share prices.

The BusinessInsider had an interesting piece last evening, confirming that getting anxious about market moves (and acting accordingly) has poor outcomes: Panicking is a horrible investment strategy. It was back dated research from Merrill Lynch's Savita Subramanian, she is a rising star and I see a lot of her on the box. Her assumptions are that people sell on the first sign of volatility and then invariably when nerves have settled, they buy stocks back 20 days later. The massive underperformance of that strategy means that even if you do this once or twice, your chances of catching up are almost impossible. Keep calm and carry on. Stay the course. The Fed will do what they have to, the many more customers and clients of listed companies will do what they have to, we will cover that below with Apple, that share price has sold off lately.

After the dust had settled, once "market participants" had a chance to digest all of this, stocks closed off around one fifth to one quarter of a percent lower for all of the major indices on Wall Street. Locally markets had a "ripper", the Bill Lawry expression of an excellent delivery. From my reading, Bill Lawry was a very dour captain and equally boring as a cricketer, which makes his commentating style even more amusing. Boring as a participant, excitable as a commentator. Pretty much like all the experts around the fire (burning meat) on how Bafana or the Springboks (or the Proteas) can improve, yet their levels of participation does not extend much past Blikkiesdorp High School 3rd team. Possibly reserve for the same said team. The same could be said for armchair Fed critics, their economic prowess is possibly just beyond Economics 101. The Fed will do what they need to, pretty much like Bafana, the Springboks and the Proteas. There is a reason they made the team and we didn't. Except for Farhaan Behardien, that still puzzles me. Ha ha, there goes, right?

Off topic, the local market soared thanks to financials which were 2.5 percent higher as a collective. Sparkling results, no rephrase, better than anticipated results from Nedbank saw sympathy rallies across the sector. Nedbank has seen a LONG road back from the go-go days of involvement in the technology sector, the stock was up 5 percent yesterday. FirstRand participated and added three and one quarter percent, Barclays Africa up 2.8 percent, whilst Standard Bank added two and three quarters of a percent.

And remember the Nedbank slash Standard Bank merger that was rejected by the Finance Minister Trevor Manual, back in 1999. That could have changed things. And it was Nedbank trying to take out Standard Bank. Old Mutual have at points gingerly held onto their stake in Nedbank (a little over 51 percent shareholder) and it certainly has served them well, rumour after rumour (and HSBC was close) about the stake being sold have led to nothing. Current Nedbank CEO Mike Brown reminds one of a good old fashioned banker and certainly inspires confidence.

It wasn't always the case with Nedbank. In the year 2001, the Nedbank share price reached a high of 182.20 Rand. In 2004, the share price traded at a low of 52.40. The number of shares in issue between 2003 and 2005 increased from 293 million to 397 million, the company was forced to shore up funds by way of a rights issue. Tom Boardman took over from Richard Laubscher (who resigned and left on the same day, 8 December 2003), and proceeded to "fix". The company raised 5.152 billion Rand, issuing 114.48 million new shares at 45 Rand per share. In fairness it was oversubscribed. Mike Brown was appointed the CFO in June of 2004, at the time only 38 years old. Mike is a KZN fellow, having done his articles at Deloitte & Touche in Durban. I wonder if he is in that crowd with Stephen Saad and Gus Attridge? Gus went to Northlands Boys high, Stephen went to DHS (he is very active there I am told), Mike Brown went to Maritzburg College. Saad and Attridge were at Cooper & Lybrand, I am sure they knew Mike though, they are around the same age.

I think that the point that I am trying to make about Nedbank is that whilst it seems "amazing" right now, it was not always the case. Prior mistakes made by the management teams, including holding a 8.2 percent stake in Didata plc stock (valued at over five billion Rand in 2000). Those 103 million shares were sold at 3.4 Rand a share (less than 30 pence) by the end of October 2003. And a 20 percent share in the IS (Internet Solutions) was sold back to Didata in 2005. 103 million shares at 120 pence was well below the price Alan Gray and Venfin received in the middle of 2010 when NTT Docomo bought the whole company, Nedbank could have hung on for a fourfold increase from their selling price. I suppose it was a better idea to sell and clean up back in 2005 after the pain of 2001, it is another reminder that "things" do not always go your way. And I guess that is why after the last financial crisis that our banks are back to the basics, which is good for the broader stability of the financial system. Good work Mike Brown, well done.

Company corner

The Apple share price has taken a bit of a pummelling recently. The results themselves were good, the guidance could have been better, perhaps iPhones sold was a miss. Why, is the question? Is it a muted response to the Apple Watch that everyone is "worried" about, is it that the Apple Music rollout has not been that well received? No, can you believe that the main reason the stock sold off three percent yesterday, to sink to a six month low of 114 Dollars a share, is that the price crossed the 200 day moving average?

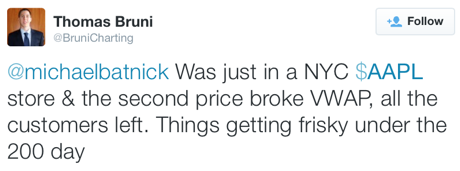

This Bloomberg article, titled: Apple's Trading Volume Is Exploding Today has this line from technical analyst JC O'Hara, which left me perplexed "When people start to see a stock everybody owns trade down, they don't want to be the last one selling it." That statement is so dumb in so many ways. You can never be the last one to sell. I can bet you that the company is buying back their shares like crazy at these levels, the stock trades on 13.24 times historical earnings, ex the 203 billion cash pile (30 percent of the market cap), it is around 10 times. Buy. Ignore 200 day moving averages. This tweet possibly sums it up the best:

Customers of the product do not care whether the price falls below the 200 day moving average. I don't even care. Whilst the stock price may fall, as it is down and that may mean there are some more forced sellers who may be leveraged (how do I know), do not worry, keep calm and stay invested on one of the most innovative companies I know. Plus their products are damn awesome and amazing. Technical analysis is a bunch of lines drawn on a graph of historical data. It tells you ABSOLUTELY nothing about the future. It would be naive to think that many people do not use technical analysis in their trading strategy. They do, thanks for the liquidity, I am sure that the company is buying back shares.

Cerner released results last evening. Whilst the company managed to meet the "expectations" of the market, the forward guidance was a disappointment. I for one do care what the market thinks in the long run (weighing machine, as Benjamin Graham said) and not the short term (voting machine, as Benjamin Graham said). We will take a closer look at these numbers and revert tomorrow, the stock has acted negatively, down over three percent.

MTN first half results were released this morning. The subscriber base is now 231 million across 22 countries. That subscriber base is bigger than any country in Africa, and as a standalone would be the fifth most populous country in the world. In fact, MTN offers services to 3.1 percent of the population of the globe. That is no mean feat for a company that is less than two and a half decades old. Quick check at the key numbers, group revenue decreased 4.9 percent to 69.2 million Rand (0.7 percent lower on a constant currency basis), EBITDA was down 10.1 percent (down 4.2 percent on a constant currency basis) to 30.2 billion Rand. For the half.

MTN EBITDA for the first half of the year is 89 percent of the Telkom market capitalisation. MTN invested 10.8 billion Rand in their infrastructure, an 18 percent increase from this time last year. HEPS was 10.3 percent lower than the prior corresponding reporting period, 654 cents per share. The dividend was actually hiked to 480 cents, the interim dividend that is (408 cents after paying a 15 percent tax rate). That is more than they paid in 2012 for the whole year, back when there were no interim dividends.

The average minutes spoken across the networks increased 11.2 percent, average billed price per minutes fell 25 percent, in Dollar terms. As we suspected, minutes spoken are still increasing across the board, the real growth driver remains data.

30.1 percent of all revenues in South Africa are from data. Margins expanded here too. The company spent locally, 4.678 billion Rand on their infrastructure. What amazes me is that whilst us urbanites demand LTE where ever they go, MTN is still rolling out 2G towers in South Africa, my reality and your reality is not the reality of other people. My wife renewed her contract in this time and even though it was in the middle of the strike, an awesome person at the store here in Melrose Arch helped me, I had NO PROBLEM. My signal never fell over as a result of the strike, as a consumer I was totally unaffected.

In Nigeria, where the group has nearly 63 million subscribers (one fourth of the base), data is now 20.5 percent of all revenues. Margins decreased, mostly as a result of the selling of the tower infrastructure and a weakening of the Naira. The Nigerian currency translation is always going to be a problem. As Michael pointed out yesterday, the Rand has actually weakened to the Naira recently. The Naira is pegged to the US Dollar, the Rand has weakened to the Dollar. So from a currency roundabouts and swings point of view, these normalise over time. You and I cannot control the currency, the oil price, nor the Nigerian government being reliant on the two. Over time the country will move further away from a commodities based economy to services, 160 million people need access to better telecommunications. The fact that the company is only rolling out 2G and 3G infrastructure means that there is no fast internet connections there. That tells you what you need to know.

Their third really big market, Iran saw data revenue increase by 44 percent, in total data represents 26 percent of all revenue. MTN Irancell is rolling out fibre, PLEASE can I have some here. The next set of businesses is the Large Opco Cluster, as they call it. This includes Ghana, Cameroon, Ivory Coast, Uganda, Syria and Sudan. The last two, as you can imagine, operating in difficult conditions. The rest of the territories, Zambia, Benin, Guinea Bissau, Congo-Brazzaville, South Sudan, Liberia, Yemen and so on, fall under small opco, collectively contributing 33.5 million subscribers.

Why continue to hold MTN? Why buy them at these levels, are they not "ex-growth"? As we pointed out at the year end stage, 84 percent of AT&T's revenues come from data. MTN has ARPU's far lower than the developed world. The countries and territories that the company trades in are high growth, tricky at best from a regulatory point of view, never mind politically speaking. There are very few investments that give you unparalleled focused access to this continent we call home, as well as the middle east. Fixed lines are non existent in the territories that MTN operates in, if Telkom is the best competitor across the lot, you saw the relative size and scale. Data will continue to drive the company, whilst they trend to being more "utility like", the margins are fabulous, the dividend flow should continue to be strong. Hold and accumulate on weakness, there is plenty of room for expansion of services across what is still a very low base.

Linkfest, lap it up

The future is here well at least one of the toys that we have been waiting for - WATCH: Lexus Debuts Working Hoverboard

One of the lessor know company's that Elon Musk is involved with - The Miracle of SolarCity. After reading the article you will want to buy some of the shares. The renewable energy space is a very exciting place to operate in at the moment.

Home again, home again, jiggety-jog. Stocks are up one-third of a percent here. Resources are up over two percent today, that is a welcome bounce. Markets still look pretty oversupplied however, no time of letting up soon from the big producers of bulk commodities. ADP numbers are today, that will be a precursor to the jobs data Friday which no doubt will reflect the timing of a Fed rate hike. Yes. And whilst you can watch with interest, do not let this bother you too much. Other than your coaching plans for the Springboks for this weekend and 7 weeks time, as we all know your plans for that team are sure to make our national team successful.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment