"Is the company going to be bigger and more profitable in 2, 5 or 10 years time? Yes? Then how much are you willing to pay for that growth? It is a fools errand to think you can know exactly what the growth/ profit number will be in the future. All you can do is have an assumption of what the future will look like and then pick a management team to get the most of the opportunities coming their way."

To market to market to buy a fat pig. The news all over my screen this morning is how economists surveyed by Bloomberg are of the opinion that China's GDP 'only' grew by 6.3% in the first quarter as opposed to the official data which indicated growth of 7%. While the growth numbers from China have always been questioned, this is the biggest gap I have seen between the official number and people's view of what it is. While you would like the number to be as accurate as possible, the problem with stats is that there are always assumptions and data collection errors in the final results. The other argument being made at the moment is that GDP is a poor measure of the growth in wealth of an economy. Luckily for us there are numbers further down stream that are easier to capture, like the record sales of iPhones in China or the record volumes of iron ore being exported at the moment.

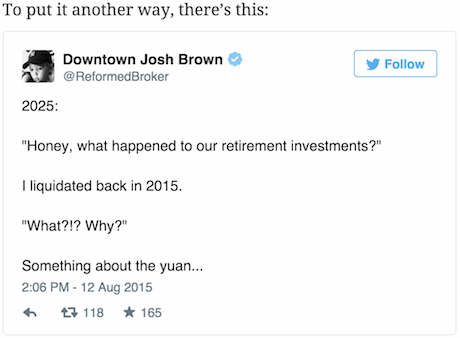

The point I am trying to make is that even if the Chinese GDP number is wrong, there is nothing you can do about it and it won't matter in a weeks time. Market prices of commodities or equities may change to reflect the new assumptions but with a long time frame to your investments it doesn't matter because there will be many many, many more adjustments to assumptions about the future. Prices will reflect the assumptions, there will be volatility as there is a mass change in assumptions and then a new trajectory will be set for the market.

Remember that the short term share price moves are all based on emotions, where the long term share price moves is based on the fundamentals of the company evolving. If I feel great about a company today, I start buying it and so does the rest of the market, it's share price goes up as a result. I feel even better about the company now because the share price move 'confirms' my views. In two years time, if the company shows poor fundamental data the share price will be based around that as opposed to the warm feeling I got when myself and the rest of the market was buying the shares. Is the company going to be bigger and more profitable in 2, 5 or 10 years time? Yes? Then how much are you willing to pay for that growth? It is a fools errand to think you can know exactly what the growth/ profit number will be in the future. All you can do is have an assumption of what the future will look like and then pick a management team to get the most of the opportunities coming their way. If the future looks very different from what you anticipated it to look like then sell the share because things have fundamentally changed for it.

What to do about the market's emotions? Well nothing, accept that you can not predict the future and that the market is even less predictable. The key is to be adding regularly! There will be times that you buy at inflated prices and there will be times you get a great discount but most of the time you are probably getting fair value. By adding regularly you remove the luck factor which impacts once off lump sum investments, where timing matters to your long term performance. Remember that most of us will probably get to around the 90 mark given the rapid advancement in healthcare, long enough to ride out any market slump but also if you plan to retire at 60, you will need a sizeable asset base to live off of. Get investing and saving - Why Save?

Company corner

Looking at SENS this morning we had Anglogold Ashanti Limited - Report For The Quarter And Six Months Ended 30 June 2015. The numbers look solid enough given the tough environment for gold and gold producers. The shares are up 7.8% at the moment. The company unfortunately still made a loss given high interest costs but on an adjusted basis made a small profit. The other good news is that they brought their all-in costs down from $/oz 1 155 to $/oz 1021. If all the different costs reported confuses you as much as me, here is how they are calculated - Gold companies' cash costs and all-in sustaining cash costs.

Linkfest, lap it up

This is a very interesting video from the Business Insider. The book captures the economic environment felt in the US when it was written - Here's the real, forgotten meaning of 'The Wizard Of Oz'

Here is another way technology and apps are helping people to save - Digit automated savings plan adds cash rewards for hanging on to your money. Having small amounts of cash come off your account every few days means most people do not even notice that they are saving. The small amounts add up over time.

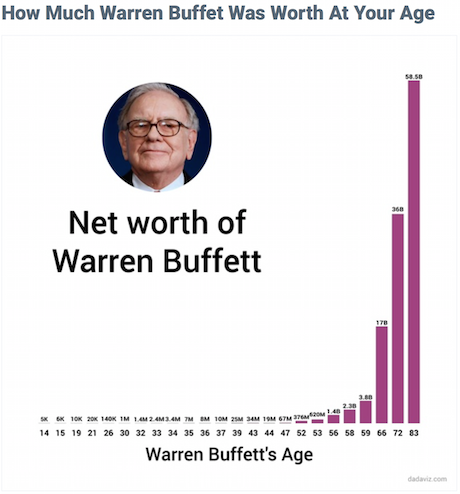

This ties in nicely with the savings discussion above, note his NAV at retirement age - How Much Warren Buffet Was Worth At Your Age

Is this proof that we are more 'caveman' than we would like to admit? - Why Do Deep-Voiced Politicians Get More Votes?

Home again, home again, jiggety-jog. Our market is up 0.5% this morning with Naspers up 1.2% and MTN up 1.6% (just below that phycological R200 mark). The Rand unfortunately is looking a bit battered dropping to R/$ 12.87 with R/$ 13.00 looking more likely. I see that Morgan Stanley has a 'Troubled 10' currency list and the Rand is one of them. The Malaysian Ringgit has had a worse time though, down about 5% to the USD over the last week.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment