"There is also some interesting "stuff" in there on contributions of those who have been assessed. Individuals contributed the bulk, and personal income tax rates revenue growth was 10 percent more than last year. 35 billion Rand more. Pat yourself on the back. VAT is the second biggest contributor - 281.1 billion Rand."

To market to market to buy a fat pig A mixed bag of stocks once again on the local front, with the grand outcome being that the all share index closed a smidgen lower (down 0.07 percent) on the session to just above 50 thousand points. Smidgen is more cooking terminology, perhaps I should use a wee bit. Sliver? Whiff? Nah, let us stick with smidgen or whisker when describing levels in the equities markets.

The most televised event of the day locally was the outcome of the ANC NEC meeting, I am not too sure what people were looking for. Somethings will happen by process, others ..... not so much. Anyhows, best leave politics to those who are in the interest of watching the board and wondering which piece is likely to move first. I did enjoy these two things going on yesterday, first a tweet from two evenings back from a prominent member of an opposition party:

That tweet is fully loaded with all sorts of animal references. And then unfortunately the spell checker got things horribly wrong over at Bloomberg, and made a reference to a big cat. I took this screenshot and somehow could not help myself. Sorry to all incredibly hard working journalists out there. One mistake ....

We do not have Pumas here now ..... only when the Argentine rugby team come to win town. So it is settled then? President Zuma the Puma?

Locally we had numbers from Omnia, which is a stock we used to hold. It is tough out there, agriculture looking a little worse for wear, as is mining (explosives). Revenues were three percent higher, gross profits were 11 percent lower, the dividend payout was lower, 160 cents now relative to 180 cents last time. An interesting line in their results: "The volatility in the rand continues to be difficult to predict and plan for and management remains conservative in its planning processes." And then another: "Recent events suggest that the outlook for a resolution on the political and economic deadlock that has plagued South Africa for several years is more encouraging."

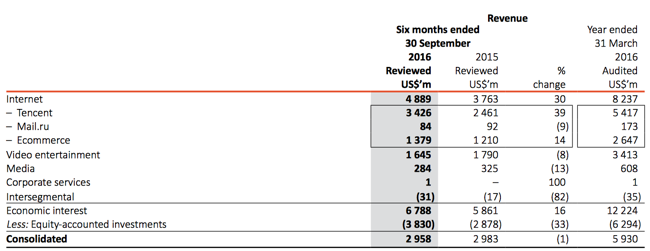

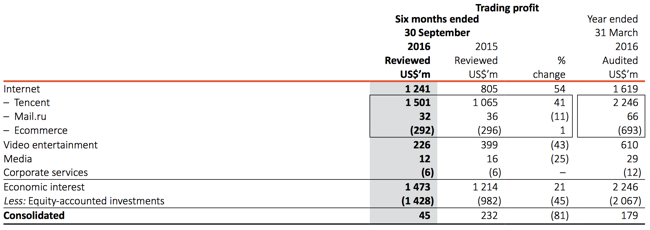

What this means however is that there is improvement, at least from a sentiment point of view. A deadlock and lack of clarity in politics spills over into the business world. Which equals a lack of long term decision making and a lack of planning from business. Which means lower tax receipts, we could see that in the SARS numbers, released yesterday - Joint Media Release by the National Treasury and the South African Revenue Service. Some interesting statistics in there. As a percentage of the overall tax collections, companies now account for only 18.1 percent, down from the peak in 2008/2009 at 26.7 percent.

There is also some interesting "stuff" in there on contributions of those who have been assessed. Individuals contributed the bulk, and personal income tax rates revenue growth was 10 percent more than last year. 35 billion Rand more. Pat yourself on the back. VAT is the second biggest contributor - 281.1 billion Rand. There it is. Notwithstanding companies reporting tough times out there, notwithstanding the political shenanigans, notwithstanding the lack of direction on policy, the total collections rose 8.5 percent to above 1 trillion Rand for the very first time. 1.07 trillion. Certainly we could do a whole lot better though, and if the economy is firing on all cylinders, all taxes will be higher and all social programs can be funded in full. And be better. Not so?

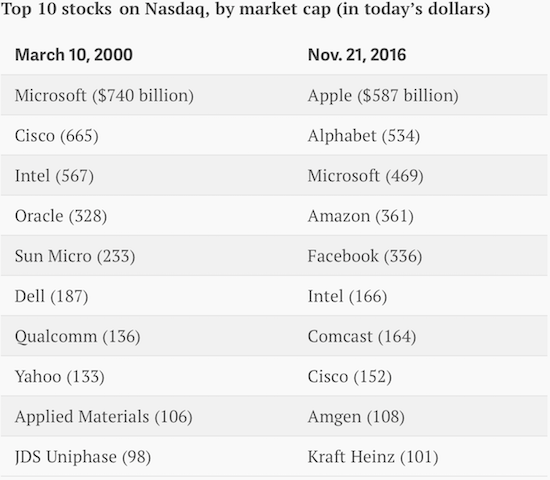

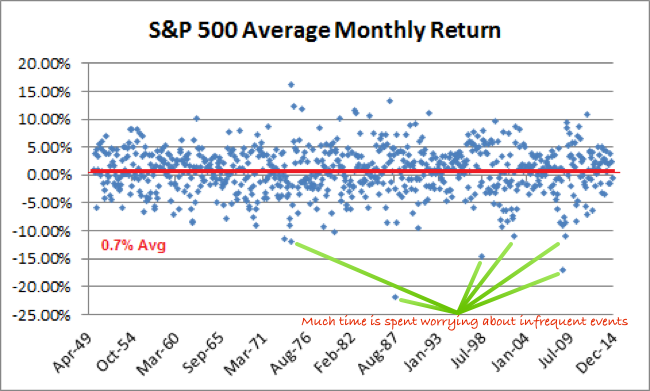

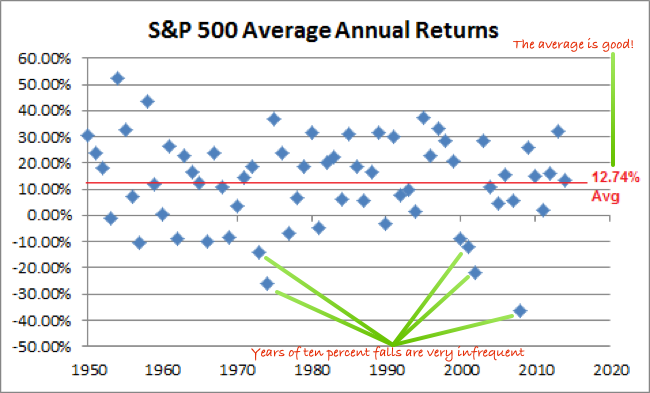

Over the seas and far away in New York, New York, stocks closed the session out a little better than where they started, well off the best levels of the day. The Dow added 0,12 percent, the broader market S&P about the same and the nerds of NASDAQ added just over one-fifth of a percent. There was a strong GDP read, the second look at the third quarter in the US that crushed expectations, 3.2 percent year on year seems like a grand old number to me, doesn't it?

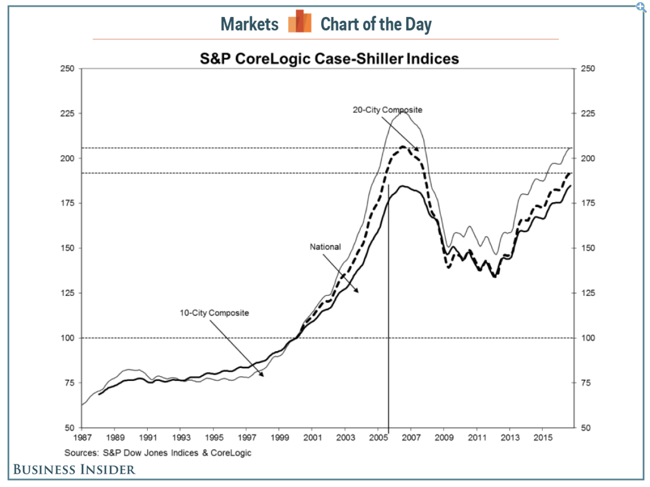

There was also a Case-Shiller index release, that is what measures the value of the US home prices in certain areas. This index is now at the highest since mid 2006. Of course people are far better off now than then, not so? In fact, that graph is worth taking a look at, this courtesy of the Business Insider - A key measure of US house prices shot past the highest level since the eve of the last crash. I am not too sure about the headline though, the Business Insider feeds off gems like that!

So, there are some buyers who would have been underwater on their mortgages (the outstanding debt worth more than the actual selling price), this metric is starting to shift pretty quickly. By my reckoning, at a national level (if you follow the bigger solid line) that 16 years after the turn of the last century, house prices in the US are around 80 percent more now than they were then. By the same measure, stocks have not really done as well. The S&P 500 is up 50 percent since then.

I guess on paper those are not the worst returns in a very low inflation environment, you would expect more, not so? Consumer confidence also reached the highest level since mid 2007. It was all happening as Bill Lawry would say. All this seemed to spur stocks on, the march continues. All the while the Donald is looking for more people to fill posts, these are some great pictures that I saw on Twitter of dinner pictures with Mitt Romney. Yip, they met at the Jean-Georges restaurant, a three star restaurant in the Trump International Hotel. Lovely area.

And we even know what Romney, Trump and Reince Priebus (he is the incoming White House chief of staff) ate. Yes. Steak and Lamb chops for the main course. Scallops, frogs legs and garlic soup for entrees. Who looks like the frog legs guy? - Mitt Romney, Donald Trump Dine at Exclusive NYC Restaurant Amid Cabinet Speculation. Sigh. Does it matter what they eat? Really?

Linkfest, lap it up

There is no doubt that Uber has shaken the taxi industry. Part of Uber's success is based on it being a market place where willing drivers offer up their services and willing customers request the service based on real time information about each party. The driver does not have to accept the ride if the customer has a poor track record with other Uber trips and visa versa. This market system means that pricing fluctuates with demand and it means that Uber the company does not get bogged down (and need to charge more) dealing with labour relations issues. - Uber in landmark E.U. court battle to escape strict rules. More rules in this case will be a bad thing.

Sticking with Uber, they subsidise the drivers in India to increase the number of taxis available, which improves the user experience for customers, where hopefully a large customer base is built to carry the number of cars on the road - Ola and Uber are pampering customers with new features but Indians only want discounts. It is a brave business model to run at a substantial loss for a number of years to hopefully make a profit on very small margins.

Holidays bring happiness and rest to most people. Once you have taken a holiday your productivity levels at work are better than when you left - Forget your wedding day or even having a baby, travel is the secret to true happiness. Based on the title of the article you can see that a travel company paid for the research. The fact remains though, holidays bring happiness to people.

Home again, home again, jiggety-jog. It is ADP numbers today, that is the payrolls people estimate of the non-farm payrolls number that hits the screens mid afternoon Friday! There is also something that regularly arrives every 45 days called the Fed Beige Book, which gives a summary of economic conditions inside of the Fed districts. Next one, January the 18th! Standby for what is a busy week of economic releases!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063