"Facebook. You may have heard of this business. You may use the products, Facebook being the core one, WhatsApp and Instagram following on their heels very closely. Heck, your Gran may use Facebook."

To market to market to buy a fat pig A pretty dramatic day by most standards here in the deep south of Africa. You cannot get further South in Africa, that is for sure sports lovers. Dramatic scenes on the telly and even more dramatic scenes from the chattering classes post the release of the PP report in the afternoon. I read it at a very high speed. I was so engrossed that I even skipped a residents meeting and only remembered when I was twenty minutes late. The thunder and lightning was an apt backdrop.

I shan't analyse the report, it is not our domain and we are not experts here, leave that to the masses the professionals. Read them all, make up your mind. I guess it all depends on what happens next that is important. It depends on what recourse there is. If someone was considering sticking in a full battery slash solar option in response to Eskom price increases and general unhappiness (a rich people problem), then I guess you may be more motivated to do this.

There was a Fed meeting yesterday. American politics and local issues trumped that. Things were so fluid, should I say, that the ADP monthly number release floated by. The ADP number is the precursor to the non-farm payrolls number which is tomorrow of course. ADP showed a contraction in construction jobs, perhaps a lack of building or a slowing ahead of the US elections, perhaps a lack of confidence in the two candidates. By the end of the session, the Dow fell 0.43 percent, the broader market S&P 500 lost two-thirds of a percent and the nerds of NASDAQ sank 0.93 percent. It has been a tough two weeks for equity markets.

So, what about the Fed? What did they say and do? See -> Monetary Policy Releases. Some people interpreted this, bar for a shocking jobs number Friday (this Friday), the Fed are likely to raise rates in December. No two ways about it. Or perhaps not. Heck, what does the market know? Five years ago everyone was suggested that a rate hike was close, that hasn't exactly turned out right now, has it?

Locally stocks were being trounced by the Rand rollicking along, interference from the state institutions is losing the grip, and this is seen as positive for the outlook. Resources sold off 2.2 percent, the all share index sank 1.21 percent. In the shares up and down department it was a mixed bag, again British flavoured shares were dealt a blow, Theresa May earlier in the week suggesting a "hard Brexit". Part that and part stronger Rand. Anyhows, what can you do about politics and currencies? Nothing.

Company corner

Facebook. You may have heard of this business. You may use the products, Facebook being the core one, WhatsApp and Instagram following on their heels very closely. Heck, your Gran may use Facebook. Your teenage friends (more likely kids and grandkids) may not, they go to school with their friends all day and every day, why do they need it? For the record, the folks who spend and are served ads, possibly have larger buying power. Over one billion people exclusively use their mobile phones to interact with Facebook. i.e. no desktop, no laptop. That in itself is amazing. 1.055 billion mobile only monthly users.

Equally amazing is when I see an advert insert on Bloomberg over the future of the internet, I am once again reminded that many people do not have access to the greatest leveller, the internet. As of now, according to Internet Live stats, only 46.1 percent of the world uses the internet. i.e. More than half do not. That means that more than 4 billion souls on the planet (including babies) do not use the internet. Over the last ten years global internet penetration has gone from 17.6 percent in 2006 to the 46 percent now number. And we have added 800 million people in that time, we the collective are breeding like crazy.

In short, the internet age may be something that we have always subscribed to (us reading this letter), I recall using the thing that Al Gore invented over 20 years ago. I can't recall being amazed, it was just there. I recall flat pages with no images (they took too long to download), moving parts only came later. Nowadays, we are all about videos and heck, you can even livestream. Some dumb idiot live streamed his "capturing" of a police car. Yes, this is 2016 and we are still dumb. Norway at 98 percent internet penetration is not Eritrea at 1.1 percent. For the record, South Africa is in the middle, at 52 percent. So more than half the population have and use the internet, the others neither have the resources to use it (no smartphone) or are not quite sure how. Either way, there is lots of heavy lifting for humanity to still do on the internet front. China has the same internet penetration as us, yet has the great overall number of internet users, at 720 million. And no Facebook.

To Facebook results from last evening. Revenues for the quarter were 7.011 billion Dollars, mobile ads are 84 percent of total revenue. Remember when they couldn't monetise mobile? This time last year it was 4.5 billion, this time in 2014 it was 3.2 billion Dollars. It has more than doubled in two years. Margins have improved and stabilised, operating income (GAAP) topped 3 billion Dollars for the first time. 3.122 billion Dollars. I recall people saying this business was a passing

So why was the stock down so heavily after market? Well, some people worry that average revenues per user are not growing as much. And Ad loads (not so easy to understand) expected to have muted growth. That is simply the amount of ads that can get served to a single user (on your organic feed), i.e. the feeling that your user experience is not compromised with too many adverts. The more you "use" the products, the more adverts you are served. I think that the next growth areas will be emerging markets and the "other" platforms. The analyst community has pencilled in around 37-38 billion Dollars in revenue and 4 to 4.10 Dollars worth of earnings. That means that the stock trades forward on 28 times earnings. Growing revenues and profits like gangbusters, this is a definite buy at these levels. Ignore the headline writers, almost always. Except our one.

Linkfest, lap it up

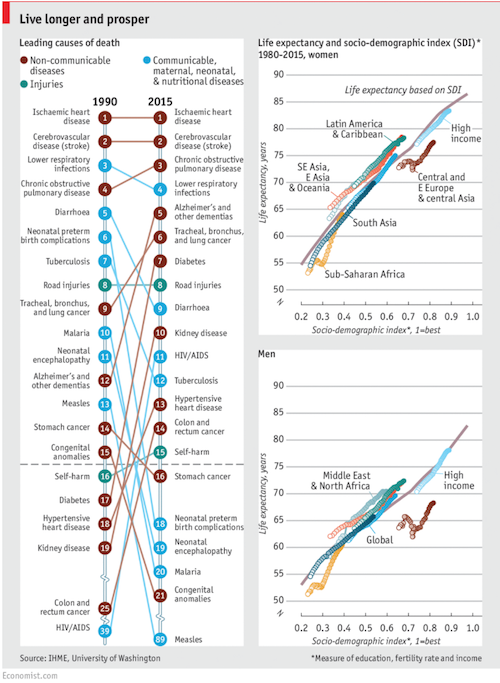

People are living longer, with more people dying of causes related to lifestyle and old age. Note that road deaths are in the top 10 and above that of HIV/Aids - The global burden of disease.

"Since 2005 alone, deaths from both HIV/AIDS and malaria have been reduced by 40%, and maternal mortality by 30%."

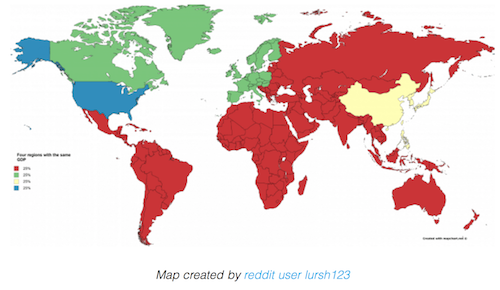

Here is a look how the globe is broken down based on GDP. It gives some perspective as to how big or small certain economies are - World Divided Into 4 Regions With The Same GDP

PC sales have been slowing thanks to technology advances. Having a computer in the form of your cellphone helps but also the upgrade cycle has slowed. No longer is your PC out of date after 2 years - The PC's Misery Hasn't Affected Apple. With the upgrade cycle slowing, it makes sense to spend more to get a Mac.

Forget the World Series Baseball and the Cubs winning for the first time in 108 years, the League of Legends (LoL) World Championship took place in Los Angeles at the Staples Centre a few days back, watched by 20 thousand fans. IeSF president: "Our biggest goal is to make esports an official Olympic event"

Home again, home again, jiggety-jog. Stocks have started lower again, the all share is in danger of slipping below 50 thousand points again. Not good! I guess that we will have to all sit and wait and see what transpires next at a politics level, be that here, or the US elections or the ongoing Brexit talks. In the meantime, we will do our best to try and chat about earnings and the companies that we hold.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

You will find more statistics at Statista

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

No comments:

Post a Comment