To market, to market to buy a fat pig. Markets in New York slid from the record open, and oh yes, there was the FOMC announcement. Which I guess was a non event in some regards, doing the same. So Ben Bernanke will retire in a few months time as the chair of the Fed (if all things go according to plan) and then Janet Yellen will proceed as before. Easy. A non event as Professor Eugene Fama suggested, thinking that the impact of QE has been completely overstated. And even going so far to suggest that it has not had the desired impact.

The interaction that we pointed out yesterday when Eugene Fama basically took Rick Santelli apart does two things. Firstly, Fama is currently the recipient of the Nobel economics prize. So the assumption is that he must know what is going on, right? And by him telling Rick in no uncertain terms that QE has little impact. And so everyone droning on and on and on and on about easy money and liquidity sloshing around and so on, what will happen when folks realise that the recovery has been less induced by (by completely supported of course) the Federal Reserve, and more by companies having done better. When the Fed is finished their tapering of their bond buying program in two years or so from now, what will then happen? I can assure you that your guess is better than mine. Too much emphasis is placed on what the Fed is going to do and where interest rates are going to be in a couple of years, when energy should be focused on what businesses are creating new services and products that investors can get a piece of right now.

I read a book titled "It Was a Very Good Year: Extraordinary Moments in Stock Market History". In one of the years profiled by the author, I cannot remember the exact year but it was sometime around the late 1950's, the market participants were so anxious about what William McChesney Martin and the Fed were going to do next. Martin of course coined the phrase remove the punchbowl. If you are going to time your investments (which should be retirement in nature) around what the Fed are or are not going to do, then you are barking up the wrong lamppost. I mean tree. What are the Fed going to say or do in 45 days time? Who knows, who cares! Do you remember what Alan Greenspan said in 1995 and what the market did from there for those three months after? Probably not.

Facebook reported numbers last evening. 49 percent of revenue came from mobile, let us call it half. And I remember when everyone would get completely anxious that yes, Facebook would struggle to monetise mobile. Here is a headline from Fortune's website from July last year, which is hardly a long time ago:

Now having seen these results and with the benefit of hindsight, Facebook knew more than Fortune. In four quarters their number of daily mobile users have gone from 329 to 507 million users, I admit that I am one of those. But back to mobile. That is why there is Zuck and that is why there is Fortune magazine, with all due respect. I am not suggesting that an enduring brand, the publication first hit the news stands in 1930. So this is over 80 years old, whilst Facebook is zoning in on their first decade, having started in a dorm room. The parent company for Fortune is Time Warner inc., which has a market capitalisation of 63 billion Dollars. Facebook? 119 billion Dollars, nearly double.

Headlines I expect to see on Facebook, Fortune struggles to monetise their online offering. This is a case of new versus old, newer media forms where anyone can be an author with an ill informed dangerous opinions versus someone who has had their story overseen by an editor. That aside, and it is dangerous of course to believe everything that you read whether edited or not, you know the point I am trying to make. New media enables anyone to put their opinion across in a less formalised manner, sometimes with dire consequences, you know the old think before you speak.

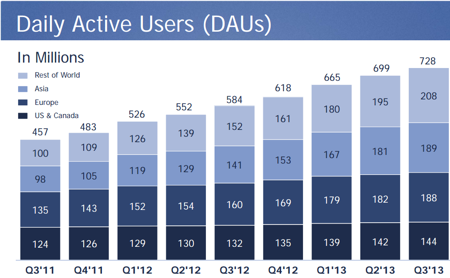

OK, but to the results specifically. Here they are, you are able to peruse them, thanks to the wonder of the internet: Third Quarter 2013 Results. Q3 revenue when measured against the corresponding quarter last year increased 60 percent to 2.02 billion Dollars, topping that number for the very first time. Monthly active users registered 1.19 billion. Roughly 56.6 US cents per user per month. That sounds like next to nothing, if you think about it, the company generates not even 1 Dollar per user per month. OK, firstly, who are these users? Check, from the presentation (Quarterly Earnings Slides) that came with the results:

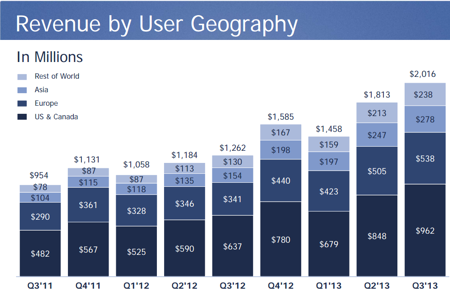

The growth in their numbers outside of the US and Europe has been pretty astonishing. In 24 months, the rest of the world Facebook users have doubled and some more. I am guessing that is people like ourselves. The number of Asian users has also nearly doubled in 24 months. These are daily active users of course, more interesting than the folks who are browsing by monthly, having a check. But what remains very important to me, anyhow, is that those users have not yet been monetised as aggressively as the one in the US. Check out this slide:

Revenue growth in the US has been huge, but their base was so much higher. I think that is what I am trying to get across. Think about Facebook from an advertisers point of view. I am not the best active user, but the company has a very good idea of who's posts I like. But some of my friends (yes, I have some) have long lists of their movie likes, their book likes, their TV series likes, their music likes, the businesses that they like and the list goes on. Facebook knows more about your activities than almost all other advertisers globally. If you change your status to engaged from in a relationship, that triggers a response for wedding photographers to advertise, you become a different audience.

What amazes me is that the Zuck thinks (at 29 years old) that his work is a long, long way away from being done, and that is reflected in the release: "(W)e're prepared for the next phase of our company, as we work to bring the next five billion people online and into the knowledge economy." Be clear here, there is NO Facebook in North Korea.

After hours the price was wild, really wild, up a lot, and then off a lot from being up a lot. To basically around 2 percent up as we speak. Why? Because on the conference call the CFO said that teens were not that active users anymore, younger teens at that. Wow. Personally, the way I see it, the folks paying the bills and holding the credit cards are not the young teens. And more users globally will continue to adopt and advertise through these channels. I have not met a single person who has advertised on Facebook yet. Paul has however and he said the experience (for that specific corporation) was absolutely fabulous. Real time money exchange and real time money out with an amazing backend. So there you have it then. The platform is young. The users are still not that sophisticated. But the advertisers are adopting at a rapid rate. This is not for the faint hearted, trades on a crazy multiple and no doubt will take time to make serious money. It will.

Starbucks released their finest brew in results ever last evening, post the market. This is the 42nd year of operation, the business was founded in 1971. The very first store opened in a spot in the Pike Place Market in the city of Seattle. I suppose that is a place that you desperately need coffee, or so you would think. In reality the city receives less rainfall than New York, or Boston or Washington DC. Fact. BUT, 150 days of the year the city gets some form of precipitation. Seattle is cloudy for 201 days a year, partly cloudy for 93 days a year. 70 sunny days a year. So now you know how the idea of Starbucks came about, a wonderful warm environment in which to drink your favourite brew and escape the cool weather outside. We will explore these results tomorrow when we have more time, like a good cup of coffee with friends, you do not want to rush anything!

Home again, home again, jiggety-jog. This is an ancient quote from Lao Tzu, who lived thousands of years ago. Yes, around 6 centuries BC. "Those who have knowledge, don't predict. Those who predict, don't have knowledge." Now I don't really do quotes, because I believe individuals must get their own preppy pieces together and live by those principles. Michael, who sits over the desk from me, is always pulling his hair out (he is still young and has lots of it) as he just can't get how and why ordinary folks cannot separate the core philosophy of trading and investing. They are not the same thing. When you understand that simple concept, you will find your inner investing Zen!! For now, just stay the course with the quality, do not overthink movements in share prices, worry more about what the companies do. Oh yes, and it is Halloween. Which is the day before All Saints Day, tomorrow. Hallowmas

Sasha Naryshkine and Michael Treherne

Follow Sasha on Twitter

011 022 5440