To market, to market to buy a fat pig. Shutdown, what shutdown? Our market ended flat on the day, resources dragged industrials and financial up to see the ALSI end a touch higher, up 0.05 percent on the day. Over the seas and far away the markets on Wall Street clawed their way back from a percent lower to close (at least the broader market) a touch lower. As I sit here and type, the futures market in Europe is pointing to a higher opening. What, they solved their problems over there in Europe Washington DC? No, but at least they are talking! The Washington Post's headline reads as follows: Focus shifts to looming debt-ceiling deadline as shutdown talks at White House go nowhere.

The question then remains, will the Republicans hold on until the debt ceiling debate is closer? Maybe. That is around two weeks away. So the thinking is that there could be one big deal here and not two separate ones. i.e. solving both problems with concessions from both sides. If you are still confused as to why we are here, here is the simple explanation. When Obama came to power the Democrats controlled the house and the senate (collectively congress) and as such could pass the laws that they wanted. The Democrats lost control of the house and a rowdy bunch of tea party conservative types have pushed their fellow Republicans hard on fiscal discipline and discretionary spending, entitlements and so on.

The "Great Society" ideals that JFK put forward I suppose, that debate still continues today. But to argue that one ideology should not be funded over another and not passing a budget, sure the Republicans should reign control and then repeal them? I don't know, all you have to know is that it will not last forever. In a month time we will be not talking about this. So strap in, there is nothing that any of us can do. And this might pass today or tomorrow or over the weekend. And then it will all be fine, until the next time of course!

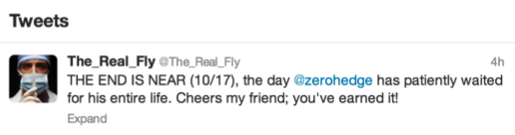

I absolutely loved this tweet from earlier from the really, really crazy crazy person who tweets under the Twitter handle The Real Fly. Follow him knowing that he is strictly PG18! You get what you ask for on Twitter that is for sure! His tweet kind of sums it up:

What the fly is suggesting, is that all the fear mongering that ZeroHedge (must be very tiring mentally and physically) engages in each and every day, this is his moment. I am, pretty sure that the Fly is being facetious. The end is NOT nigh. And if you continue to believe that the world is always ending and we are always on the brink of financial ruin then you would be tempted to always be hiding physical money (but probably the only "real" currency - gold) under the bed. Of course next to the shot gun shells and baked beans.

I think that the simple point I am trying to make is that is someone seemingly knows the end of the world scenario, or is seen to have that type of insight (almost always wrong) then that line of thinking is likely to attract more attention than the person telling you that the S&P 500 had an average return over the last 25 years of a little less than 10 percent per annum. For a quarter of a century, when "things" we are actually not all that rosy, Saving and Loans crisis in the US in the early 90's, Russian debt crisis, Asian debt crisis, tech bubble bursting, 9/11, SARS (flu) crisis and then the big daddy, the financial crisis of five years ago, sovereign debt crisis in Europe.

It is all enough to make you weep and NEVER invest a single cent. But ..... applying that simple rule of 72, divide 72 by 10 and basically you can double your money every 7 years and 10 weeks. More or less. If you tell someone that those were the returns of Mr. Market with all those horrible things in-between that hardly is going to capture their attention as much as someone seemingly knowing something about a pending crash in equity markets or a sovereign default of epic proportions. And then you are really going to lose you shirt, you know. In conclusion you should ask yourself, should I listen to Bob Doll (who used to be in charge of a trillion Dollars plus) and Bill Miller (ex Legg Mason value fund fellow who crushed the S&P for 15 years in a row) rather than Nouriel Roubini, who predicted this year that there would be an escalation of the Eurozone crisis.

Yes, and Roubini predicted a hard landing for China, yes he said that, tax increases and spending cuts in the US would see the largest economy in the world go back into recession and yes, Iran would be involved in a war. And emerging markets would slowdown. Well, tick one off, the last one, but last I checked growth in the US was sluggish but not recessionary, the ECB are doing whatever they are going to do to "save the Euro" (not that it needs saving, as a collective it is the world's biggest economy). It is far easier to be seduced by that fear type tactics rather than steady equity markets over time.

Because let us be frank here, people who sell themselves as predictors NEED these set of crises to continue to be relevant. He will be relevant at a later stage, he is amazingly clever and insightful (far more so than myself), he is just wrong at the moment. Keep calm and keep investing, remembering that the quality of what you buy is far more important over the medium to long term than worrying about a shutdown of government in the US, or a hard landing in China. I am not saying do not give those issues the time of the day, but rather listen to people who actually invest money. And ask yourself the question, how much money do those fear mongering types actually manage? In other words, could their actions based on their insight actually move the markets? No. That is the answer. But if Warren Buffett said it, now there is a different question altogether!

Michael's musings! The sum of it all

- As Sasha said in yesterday's piece, "We love companies" and by extension capitalism. The basis of capitalism is that a free market can distribute resources more efficiently than a central body/ government, resulting in the greatest wealth for society and technology innovation. Also drawing from my piece yesterday, of the world moving to a global village, where capital isn't as restricted to move between countries as before. In order for South Africa to attract foreign investment we need to offer better investment opportunities than other countries.

I heard a US official say that if South Africa want to be a world class player, then we need to act like one. He was referring to the current strike in the automotive industry, that has now dragged on for 8 weeks, not the greatest advert for our country which is made worse by the foreign customers who are not receiving their cars. The upside is that the less money people invest, the weaker that the rand gets and the more our local companies get for their imports.

The IMF released a report about South Africa on 1 Oct, which has been highly criticised by trade unions. (You can find summary and report here). The basics of the report were that South African growth is lagging other comparative countries in terms of growth due to structural problems in our economy. The structural reasons given, were that basically our education system is failing to equip our workforce with the necessary skills, and those who do have skills have the wrong skills. The line that is causing a large amount of criticism is “A social bargain should include wage restraint in return for industry's hiring commitments” Unions are saying that what the IMF suggests will lead to the further exploitation of labour.

The IMF report wasn't all negative, they also had some good things to say about us, saying that we are making progress in other areas. I am not worried about South Africa, we have shown that we are an innovative and resilient people. For example, to get around the inefficiencies in the labour market (I will not get into the causes and solutions because that debate will take many pages of writing), labour broking has become a key player in the market, with the greatest growth in employment coming from them.

Growth is good for investing, and even with all South Africa's inefficiencies we still managed a real growth rate since 2009 of 3%, and when government finds a way to remove all the inefficiencies (in my opinion, not if but when) our growth rates will climb. If government doesn't step up to the plate, the private sector will still find a way. As investors we are in the fortunate position that if South Africa lags in growth we get to enjoy the awesome local weather and have our money work for us offshore.

Home again, home again, jiggety-jog. There is no government collapse in Italy. No, the People of Freedom decided internally to go over their supreme leader's (Berlusconi) head and then vote to continue the reforms that Prime Minister Letta continues to make. Good. That sounds like progress to me. Oh, and I am sure you will find this exciting, Services PMI from Europe this morning was at a 26 month high! Hurrah. Green shoots in Europe, some more of them.

Sasha Naryshkine and Michael Treherne

No comments:

Post a Comment