To market, to market to buy a fat pig. That is eight days in a row for the JSE to have been higher. Wow. Thanks mostly to US markets, which saw the S&P 500 register the most modest of gains last evening (does 0.16 points count?). But I guess that means that is another closing high. Should we be very concerned about the new highs? High after high, it sounds like a dangerous Quentin Tarantino masterpiece. The truth is that the underlying index constituents, the companies themselves, ultimately set the levels of quoted levels. Telling someone x or y index is at a specific level is as useful as telling people the gold spot price on the radio. How are those things useful for ordinary people?

But, if you tell someone that a specific company launched product x or y, well, now you have their attention. And what that is going to do to sales and profits, now you are talking. Identifying businesses that are going to change the way we do simple things and staying the course is of course more important than identifying the companies that can't evolve because their product is becoming less attractive, but it is critical to note that all these businesses make up the index. Always be thinking!

OK, so what has really changed other than the market mood? Are earnings set to race ahead? Sort of, but those predictions can always dashed, if we run into some headwinds from here all the way through to next year. So whilst we can be confident that there is less likely a scenario of the Eurozone splitting up, a marginal periphery country (like Greece) leaving, a hard landing in China or runaway inflation as a result of central bank stimulus, those scenarios have not yet reach the apocalyptic proportions we were led to believe by the finger waggers (krokodils?). In truth nothing has been done on Capitol Hill, other than delaying matters again, but the one thing that you can be sure of is that politicians are less likely to bumble and fumble this time, it is an election year next year.

General Electric reported their third quarter earnings on Friday, which was in market terms so long ago that people have forgotten already. Well, not really, but you get where I am going. This is possibly one of the most recognisable companies globally that is not an out and out consumer stock, and is associated with Thomas Edison and his inventions. It is indeed a company that traces its roots back to the US industrial revolution, post the civil war there of course, where many corporations had to catch up to their European counterparts, for obvious reasons. There were of course three extra founders, Charles Coffin, Elihu Thomson and Edwin Houston. I had also never heard that name, Elihu. It is a biblical name apparently, I was not paying enough attention in RE classes at school, apologies Reverend de Gruchy. What a nice guy he is! Three of them were engineers and inventors, the other, Coffin was a shoe salesman and businessman. Hey, the intellectuals need the business types to make sure that they run on an even keel.

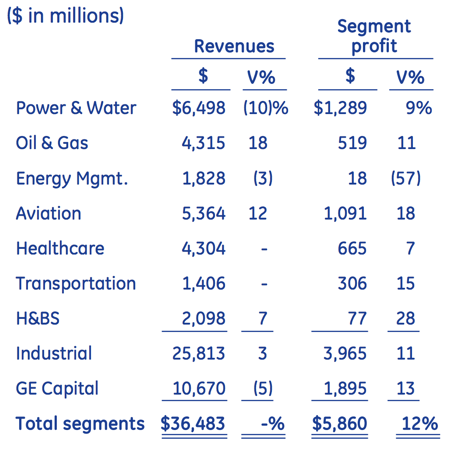

A quick run through the numbers here, for the quarter for GE. Revenues of 35.7 billion Dollars. Oh, why do all of that when you can give a graphical breakdown of the divisions! Their revenues and profits, so that you can see which ones are more important than the others.

GE Capital as you can see is an enormously profitable business. The parent company, as per the earnings call transcript, in which CEO Jeff Immelt had his prepared comment will receive around 6.5 billion Dollars in dividends from GE Capital. Wow. But this business is not exactly (at least the retail end of the market) what GE envisaged, I remember CEO Jeff Immelt commenting that they wanted the business to be only around a 30 percent contributor, they were not quite sure that the financial crisis was going to be the reason that GE Capital was going to shrink. Of course he meant that tongue in cheek.

Earnings, on a per share basis clocked 36 cents, a penny ahead of estimates. GE continues to pay 19 cents a quarter in dividends, less than 10 years ago, when it was 20 cents a quarter, peaking in 2008 at 31 cents a share, per quarter. That subsequently plunged to 10 cents a quarter during the dark days of late 2008 and early 2009, but as you can see, it has been ticking back up slowly but surely. During the course of this financial year, 18 billion Dollars will be returned to client through buybacks and dividend payments (around 2 billion a quarter). So the metrics currently are that GE trades on a 18 and a half multiple with a 2.9 percent dividend yield. Still cheaper than some of their global peers, United Technology is the obvious comparison, Philips and Toshiba perhaps less so.

Why own GE? Just because they are a diversified and are an enduring and hardy business, the longest surviving Dow Jones Industrial constituent, that should tell you everything you need to know, right? Perhaps a value unlock of the retail portion of their GE Money business, that would give the share price a lift. But perhaps more importantly, the quality of the operating divisions, that is why you want to own GE. General Electric has some high quality service businesses operating in the sweet spot of healthcare, aviation (more about selling the equipment to the marginal businesses that operate airlines), transportation (locomotives), energy management (smart platforms), appliances and of course GE Capital. GE Capital has the leasing and lending business to commercial clients, the consumer segment (136 billion Dollars worth of assets) and the real estate business. There are quality businesses operating in the power and energy generation space, healthcare, transportation, these are all growing areas of the developed and developing world economies.

GE Capital, expect some big announcements there, on the conference call, Jeff Immelt had this to say with regards to a question prompted by Scott Davis, a Barclays Capital analyst, referencing a WSJ article about GE spinning off their credit card business: You know, Scott, these things always take a little bit of time, but we are still planning staged exits of the value-maximizing platforms of GE Capital. We have got a big meeting set November 15 with Keith and Jeff; I think there will be more clarity at that time on the Capital side. And we continue -- and the rest of the Company continue to look at ways to make the Company more streamlined and more effective. But you are going to see those in good time. I think we just want to be thorough in our planning, and you will get a lot more details soon. So stand by for announcements in the coming weeks!

We continue to accumulate the stock at current levels.

I am a subscriber to many aggregators of web content, there are several that I find very interesting. I think that the likes of Josh Brown, Joe Weisenthal at the BusinessInsider, heck, even Time business does a great job. All of these people present their own ideas and thoughts, as well as adding various stories seen all over the inter-webs. The inter-webs is a big and intimidating place. We used to have a section called shorts, more specifically Bart's shorts and digest this. But that was too cryptic, you remember that Bart Simpson used to say, eat my shorts? That is where it came from. An interesting factoid, you remember the nutty professor from Back to the Future movies, "Doc"? Well, the character, played by Christopher Lloyd was voiced by Dan Castellaneta, the voice of Homer Simpson. One a clever eccentric scientist and the other a simpleton nuclear power plant safety inspector from Springfield. Where is this bit going? I would like to share some interesting bits (no more than five) of what I read that I had to share. That is where we are going. So, here goes, to paraphrase a big friendly purple dinosaur Sharing is caring.

Apple is set to unveil new iPads today, according to familiar people, I mean people familiar with the company, or something like that: Apple to Refresh IPads Amid Challenges for Tablet Share. And believe it or not, the Microsoft Surface 2 goes on sale today. And Nokia unveiled a tablet. Guess which one is capturing the headlines.......

This is always worth a rehash in light of dumb comments that I hear day in and day out from some folks, who should know better. Central bank stimulus being referred to as free or easy money. What? I asked Michael if he had seen any of this free stuff, and he said no. Me neither I said. So once again, a rehash: Where Does "Cash" Come From?

Michael sent me this simple piece, saying that Starbucks is still a buy on this basis: 11 Reasons Why You Should Drink Coffee Every Day. I am still mindful that coffee is a drug, the only (currently) daytime drug that people do not frown upon. Smoke outside. Drink a glass of wine at lunchtime? Phew, that is stretching it a little far, this is not (southern) Europe. But coffee, that is still OK. For now.

Michael's musings! Paying our dues

SARS has released the stats for the tax year ending Feb 2012. It can be found here http://www.sars.gov.za/AllDocs/Documents/Tax%20Stats/TStats%202013%20Highlights%20WEB.pdf

There are 13.7 million registered tax payers, of those 5.8 million are liable to submit a tax return and of those 5.8 million only 5.1 million submitted a tax return. SARS doesn't say what happened to the 700 000 people who didn't submit.

The income categories for the 5.1 million are; 0 - 60 000 (620 000); 60 001 – 120 000 (1.1 million); 120 001 – 500 000 (2.8 million); 500 001+ (427 000). Of these assessed tax payers they had a total income of R1 trillion and a tax liability of R206 billion, meaning that the average taxpaying South African pays 20% of their income to the taxman. According to Stats SA there are 13.6 million employed people in the economy, which translates to; of the employed population only 33% of people make enough to pay tax, or the inverse 67% of employed people earn less than R 60 000 a year.

When it comes to companies' income tax, there are 266 companies with a taxable income more than R200 million, put into percentage terms, 0.2% of companies' with a positive taxable income, contribute 58.2% of the tax collected. I was a bit shocked at this figure, but after thinking about it, the figure makes sense, I just don't like it. In order to have a stronger middle class and less unemployed people, there has to be a greater contribution from smaller companies'. A positive though in the companies' numbers was that about 100 000 of the 600 000 companies that were assessed, were Small Business Corporations, so hopefully those 15% grow and graduate to being normal tax payers.

From these stats it is clear that South Africa is a society of two worlds. If you are a skilled worker, it means that you are earning better than around 70% of the labour force, and if you are unskilled you are earning very little. Sasha and I were having a discussion yesterday about how do you get out of the low income earning category if all your income goes to transport and food, and we couldn't come up with a solution. If you are in the middle class, you have the opportunity to invest your money in order to increase your net wealth (it just takes discipline), but many South African are not able to do that.

On a brighter note, 70% of assessed people got a refund, so hopefully that was you.

Home again, home again, jiggety-jog. It is the 22nd of October today. Which means that it is non farm payrolls day, right? Well, that second part (and first part once off) is all true. The September non farm payrolls number will be released today, very late, but you know why, this was as a result of the government shutdown. Which is now over. That undoubtably will be the main event of the day.

Sasha Naryshkine and Michael Treherne

Follow Sasha on Twitter

011 022 5440

No comments:

Post a Comment