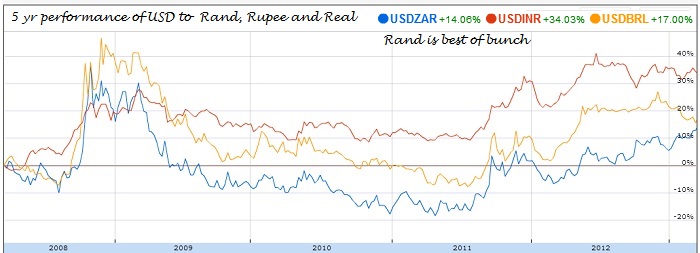

To market, to market to buy a fat pig. We finally caught a bid here in Jozi, partly because we had been drifting lower in the face of better and better global markets. The Dow Jones Industrial Average closed at another all time high last evening and the S&P 500 ended the session within a fraction, a point and two thirds away from the all time high. The top ten companies in the S&P 500 are nearly 21 percent of the overall index. And Apple is a whopping 4.44 percent of that, at the end of the LAST quarter, not presently. So, if Apple was at 700 odd USD a share, that would imply that the S&P would be around 24 points higher than we are now. And that record would have been surpassed. It is amazing really how those individual companies can make that kind of difference. Equally, amongst the other big constituents, Exxon Mobil peaked at 95 odd Dollars in late 2007, it is currently just above 90 Dollars a share. Exxon Mobil is a 3.25 percent constituent of the overall US market, with a market capitalisation of 403 billion Dollars. Or, in local currency terms, at an exchange rate of 9.28 to the US Dollar, 3.739 trillion Rand. If you take all the stocks from places 6 on the ranking tables down to place 25, from MTN all the way through to RMB Holdings, the collective market cap of those businesses are 2.744 trillion Rand. This is still a whole one trillion Rand less than Exxon Mobil.

I have purposely excluded the top five listed companies on the exchange, because British America Tobacco might be a trillion Rand market capitalisation company, but of the shareholder base only around 14 percent are South Africans, check out page 100 of the 2012 annual report, the exact number is 14.03 percent, excluding treasury shares. So roughly 140 billion Rands, a very significant value, is owned on the South African register. BHP Billiton have been excluded because of course there is a listing in London and Sydney, a plc and limited, but here we reflect the London listing. So whilst BHP Billiton on the local share register might look like a smaller entity than BATS, that is not actually the case when you add the two. If you check on Google finance the market cap of BATS ADR it is around 103 billion Dollars, 67.9 billion Pound Sterling, but if you add the two ADR programs of BHP Billiton in New York (BBL and BHP) you get to 173 billion Dollars.

BHP Billiton is a much bigger business than what is reflected here in this market. Their detailed annual report does not give me the information that I need, but Blackrock as their biggest shareholder own around 5 percent of the overall business. I had not had too much joy, so I called an investor relations contact in London, he said roughly one third UK and Europe, one third US investors, one third Aussie investors, five percent South Africans and five percent Asia/other. So we have good reason to exclude that, BHP Billiton too. SABMiller, that has a market cap of 55 billion Pounds, roughly at 14.04 to the Rand is equal to 772 billion Rands. But, and this is actually a big but, Altria (an American listed company) owns 27.39 percent of SABMiller, BevCo Limited (the holding company of the Santo Domingo Group, the Colombian business empire) own 14.98 percent. BevCo, I wonder where that is domiciled? From a little snooping, it looks like BVI. Ha! A little more on that very issue later!

But as you can see quite quickly, SABMiller is not a South African owned business anymore, it has global reach. The PIC however still is a significant shareholder, but "only" owns 4.49 percent of SABMiller. And then Anglo American, you will recall from that piece that we wrote last year, titled Anglo American and their platinum headache: "See that!!! Nearly two thirds of Anglo American shareholders are either from the UK, North America and Europe. Those people actually own the business. As a business owner, you have a right to appoint the best person for the job. And if the best person happens to be South African, to take the business forward, then by all means, choose that person."

Anglo American is not really a South African owned business either. And then Richemont, where locally we get the opportunity to own global depositary receipts (GDR), 10 GDR's equals one share in Zurich. According to the Annual report from 2012, page 40, roughly 21 percent ownership is from our shores. It is fair then to say that Richemont is NOT a South African owned company either, and we should be so lucky that we have access to these global giants.

So, having taken those five companies out of the reckoning the entire rest of the market capitalisation of the companies sixth to last on the ranking tables tallies up to nearly 5 trillion Dollars. What is so very sad then is that Exxon and Apple market caps combined are probably worth more than the entire equity holdings of South African investors, given what I have just explained above. The two biggest US companies by market cap are more valuable than our entire stock market wealth. Perspective, sometimes not altogether fun.

What is good enough for Warren Buffett/Berkshire Hathaway is good enough for me. Or is it? Because around here at Vestact we are sceptics when it comes to being investors in big financial institutions. They are prone to more than just a few problems, provided of course that they can suck it up, then you should be fine. Is a trading loss of 6 billion plus dollars equal to a mining project gone wrong and the associated write downs of the project? Same thing? Different types of risks associated with these businesses means that you should expect volatility from time to time, but surely even mining companies have a greater deal of clarity than perhaps a single person and a position worth billions of dollars?

That is perhaps a different argument altogether, and perhaps there is no clear cut answer, rather invest in something that you understand well. Berkshire made available funding to Goldman Sachs at what looked like very attractive rates for the Omaha based conglomerate, back in 2008. In the middle of the crisis. It was a time of need for the under pressure financial powerhouse, pressure from Washington DC, and pressure from all sides in credit markets that were essentially in the deepest ice age perhaps ever seen. Buffett stepped in, understanding that a then 139 year old institution was better run and better capitalised than their market peers. But who was to know in a time when normal didn't apply. So when Goldman Sachs struck a deal with Berkshire, back then, preferred stock yielding 10 percent, and convertible warrants at below current market prices! If you read this WSJ article: Berkshire Set to Get Big Goldman Stake, you will see that the deal is good for all considered. Which is good I think, you always need a balance. So Matt Taibi, what do you think about that? Please write a 100 page piece that not everyone is going to read, but rather quote bits and pieces of how evil Berkshire and Goldman are. Thanks Matt, keep writing your clever stuff.

Wow. This is pretty amazing. At least I would like to think: Most foreign investment in BRICs isn't foreign at all—it's tycoons using tax havens. Just a little aside, just as we thought a few days ago, Russian PM, Dmitry Medvedev was quoted (Reuters story) as saying in a meeting with government officials in Russia: "The stealing of what has already been stolen continues". Wow. Tough and strong words I guess from a fellow that I thought would follow that line, that is why I thought the Cypriots looking to the Russians for help was a long shot. Hope.

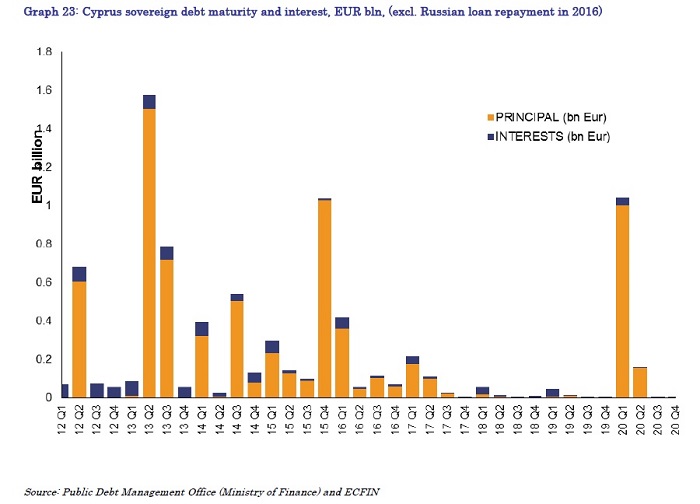

But back to that story about BRIC investments not being foreign, but rather dressed up as FDI with internal money. So just as rich Americans are looking to have investment companies in the Cayman or Bermuda, rich Indians are able to do the same into India. And the risks to these places, these small economies with large financial centres are essence at risk, if the home base tax authorities decide that this is a definite no-no. I know that the Indians put the Mauritians under scrutiny in the past, dare we even speak about Cyprus? Yes, because I am guessing that the governments of these BRIC group of countries could not really care that someone is looking to avoid the local tax authorities. Phew, but I can also imagine business connections have strong political connections. And as such, we will have to watch these things closely. But then I am often reminded that companies like Apple, Microsoft and Cisco have more than three quarters of their cash offshore, outside of the US.

Crow's nest. We were trading up strongly at the open. Not anymore, perhaps some Italian political manoeuvring and a little more clarity for the Cypriot depositors. And locally we had the government suggest that Eskom is going to struggle through the winter here. How should we say, not good.

Sasha Naryshkine

Follow Sasha and Byron on Twitter

011 022 5440