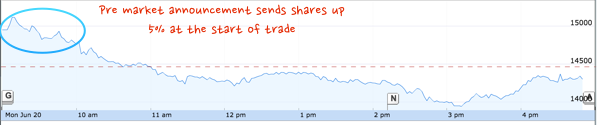

"What is happening here is that a massive overreaction is being met with an equally aggressive rally globally. The S&P 500 has just had a rip roaring rally of the sort not seen since the year lows in February. Remember what that market slump was about in February? The S&P 500 is 11.82 percent higher since the lows of February. Quick check, do you recall what the market slump was about at the beginning of the year?"

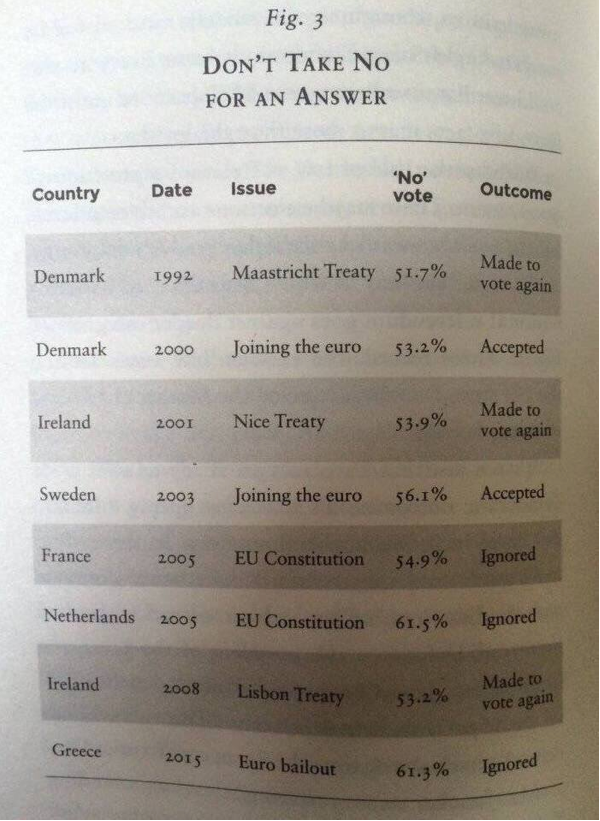

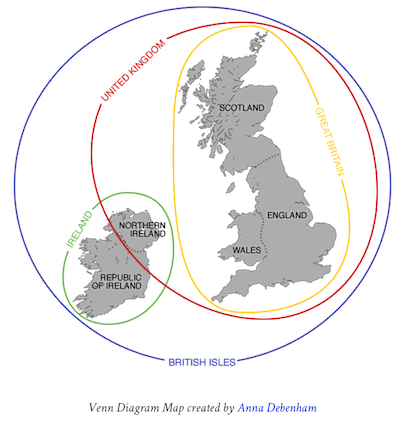

To market to market to buy a fat pig It is all rather head scratching material really, the British "exit" from the EU. On the one had you have people in the UK who are intent on getting this sad separation done, equally there are some European leaders that are urging haste, it is in the interest of none to have this linger around. Clean up the room is the mantra. The thing is, the lawmakers of Britain need to make this decision. Damned if they do, damned if they don't. They should have made the decision in the first place, a complex economic decision should not be left in the hands of many. Mind you, if you embrace democracy, you should respect the process.

What is happening here is that a massive overreaction is being met with an equally aggressive rally globally. The S&P 500 has just had a rip roaring rally of the sort not seen since the year lows in February. Remember what that market slump was about in February? The S&P 500 is 11.82 percent higher since the lows of February. Quick check, do you recall what the market slump was about at the beginning of the year? Global growth concerns mostly associated with the Chinese economy. Angst whether or not the Fed would actually have to employ the same tactics of the ECB and the Swiss Central Bank. And others of course.

So .... does this mean that the dust has settled? I suspect not at all. There are definitely some assets that have repriced, some stocks like Brait, Capital and Counties, anything with a British flavour are still comfortably below their "recent" prices. It will take a lot of time to value these assets correctly, to reflect for a weaker Pound and subsequently their Rand profits conversion. One stock that has "benefitted" from the weaker Pound is Mediclinic. The company reports in Pounds now, remember. So if the Pound is weaker and their main territory is Switzerland, there is a boost to that overall number. Hence that is why their Rand price is trading at these (very short history since February this year) all time high.

Bidcorp also caught a serious bid after having been smashed, remember that they have a significant business in the UK, that business is nearly two decades old. They are certainly not Johnny-come-lately. Talking about that, did you hear that in the new James Bond, the movie is three hours longer as he has to stand in immigration queues at airports in Paris, Amsterdam and Milan? Kidding! Quick scoreboard check on the local front, the ALSI closed nearly a percent and a half higher, led higher by resources and Anglo American in particular (that stock was up over six percent).

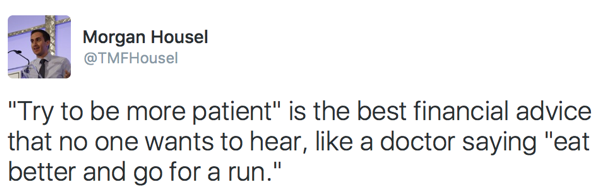

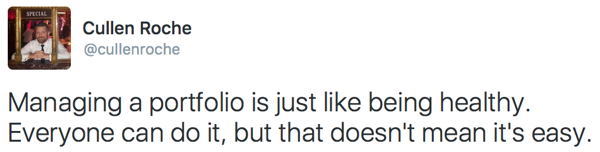

The Rand (and many emerging markets at that) are catching a serious bid, 14.88 to the US Dollar, 19.86 to the Pound Sterling and 16.49 to the Euro. Quickly, buy some of those! Kidding again! Own equities, save more, press the repeat button over and over again. Where all of this goes in the short term is a mystery to me. What is more of a mystery is how the headlines read like "Dow Jumps 284.96 Points as Investors Look Past Brexit Fears" Huh? Investors changing their minds all the time. Perhaps I shouldn't be so precious about the usage of the word investor, the Oxford English dictionary (the online version) has the following definition: "A person or organization that puts money into financial schemes, property, etc. with the expectation of achieving a profit"

If "investors" change their minds every two days with the expectation of achieving a profit, then is it at all different from all of us looking for long term capital growth? The definition of trader from the same dictionary source is as follows: "A person who buys and sells goods, currency, or shares." Perhaps OLX and Craigslist are better examples of what people can achieve when they trade like crazy. I would like to hear some of your personal experiences on these platforms.

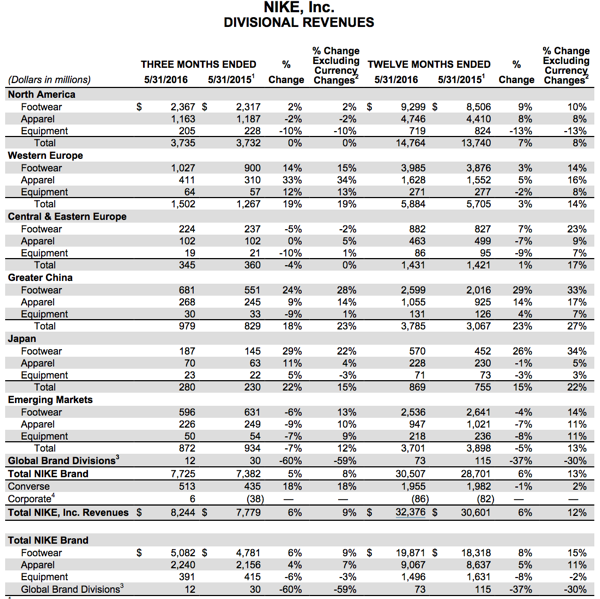

My craziness and stickiness aside, let us check the US scoreboard from last evening. All the major indices tacked on around one and two-thirds of a percent, the nerds of NASDAQ a little more. It was a broad based rally, Nike was even up sharply, the stock added nearly four percent. So perhaps the "sluggish" sales in North America were not really that bad after all. Sigh. We have to try and sift through all of the smog and make sure that the thesis remains intact. They are going to continue to manufacture and innovate on products that people really really want.

If you want to know why the Europeans are so intent on sticking together and reducing conflict, then you should be mindful that tomorrow is the 100 year anniversary of the battle of the start of the Somme. It started on the first on July 1916 and "finished" on the 18th of November 1916. More than a million folks were injured and killed, for little other than the wishes of a few connected souls. Who were interested in upholding the status quo. Nationalism and the inability to see humanity, rather than inward (backward) thinking led to the two most awful conflicts of our time. If you want to bet against the project that has started to galvanise Europeans (and to make sure that they do not see these conflicts again), then good luck to you.

I continue to believe that the "project" will work. Already with one central bank and one currency, no borders, no trade restrictions or movement of people. Ultimately the united economic zone will prove to be more powerful than people think currently. In terms of the original Why the Euro? question asked, the last one, the benefits of the Euro - "A tangible sign of a European identity" has not been fulfilled. People will still identify for a long time with their countries and territories and want to guard that fiercely. I suspect it will become less about countries and more about territories in time.

People forget the bombs and "terrorism" in Europe in Spain, Ireland, Italy, the United Kingdom of yesteryear. See this list to see if you can remember any of these - Terrorism in the European Union. Italy, France and Belgium have had their fair share of attacks over the years, even Greece has had a lot of attacks from Separatists over the years. There will always be people pushing their agendas. Unfortunately using violence has an impact. Let me be clear, humanity wins each and every time, groups have their day in the sun. Europe will not fail, they will collectively grow stronger. And that is my opinion.

Linkfest, lap it up

Can you classify these inventions as failures or just very weird ? - These Are The 12 Most Ridiculous Inventions From The 1920s.

It is amazing what you can learn from youtube, also shows that age is not a factor in our modern society - This Teen's Lawyer-Bot Is Busting Thousands Of Parking Tickets. Being able to program is a tool/ skill that I think will become more central going forward.

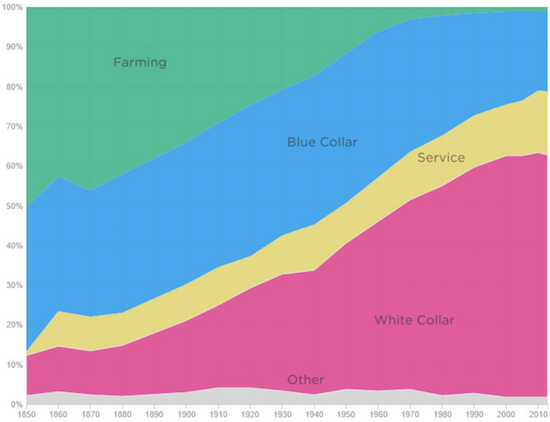

One of the topics coming up more regularly is how machines are having an impact on the labour market, with the end result still unknown. One theory is that machines will increase income inequality another is that machines will make entire populations better off due to the lowering costs - How Machines Destroy and Create Jobs

Home again, home again, jiggety-jog. Stocks are mixed globally, here they are up. In the UK they are down. Across in Asia it is a mixed bag. Italian banks (and European banks in general) are coming under scrutiny. British politics is going to be a talking point for a while. And where to next. So, it ain't over until it is over.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063