"Obviously the iPhone releases will be key to ramping up revenues. The business tie up with IBM is interesting, the company plans to roll more of their products across business and noted that the likes of Medtronic, which has developed over 175 internal apps for around 16.5 thousand iPhones used by its employees and Nestle who's employees use over 25 thousand iPhones are committed users already. The products are beautiful, the markets are still big."

To market, to market to buy a fat pig. We have been talking here in the office for a while about the format of these messages, I am pretty sure that for most of our clients the market segment is *nice*, are the company updates more useful though? We often trumpet from the roof tops that whilst short term geopolitical events, domestic political economic policy, sentiment around what central bankers are going to do next and so on, that determines sentiment, but not the collective value of the companies.

The index is just a number. For whatever reason it is quoted widely along with the gold price. What does it mean to you when the price of gold is quoted and you hear it on the wireless? The oil price and the currency are more relevant to South Africans as that indicates what you are likely to pay for petrol in the coming months. Of course that has a lead/lag impact on what consumer pay, more especially the prices of what food is likely to be in the coming months too.

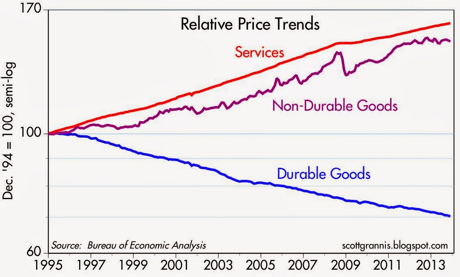

Whilst inflation is above the place where the MPC are comfortable with, food and alcoholic beverages are 20.8 percent of the basket. Housing and utilities account for 24.5 percent of the basket. Transport, 16.43 percent of the basket. Add those all up and you can see why energy prices are expensive and a big constituent, whether it is your electricity at home or the petrol you fill up with. Or the goods you buy.

To end this segment off, do you the readers enjoy where the markets closed yesterday, is that important to you? If not then we can deviate a little off the S&P was up X or the local all share is down Y and so on. Whilst the market movements are important to many on a day to day basis, if you ask ordinary people about market levels (do it) see what the answer is. For the record, the all share index added nearly a percent to close near the all time highs, just below the 52 thousand mark. The S&P 500 closed within a whisker of their all time high, 1983 and a half points.

Apple results for their third quarter hit the screens last evening, post the market close. The Investor relations page has been spruced up since I last visited it, certainly looks better. In the traditional clean and crisp Apple way. How do they do it? The beautiful look, they are so very good at it.

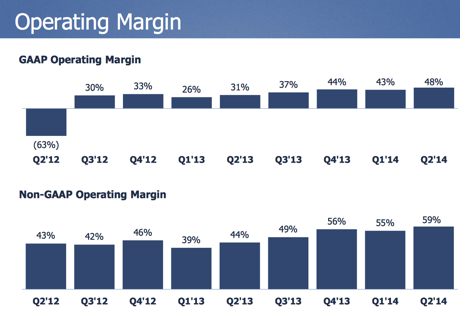

Remember that the company did a share split, 7 for 1, so the earnings on a per share basis, as well as the dividend are adjusted accordingly. Revenues clocked 37.4 billion Dollars for the quarter, profits a whopping 7.7 billion. Yowsers. At the same period last year the numbers were 35.3 billion Dollars worth of sales and 6.9 billion Dollars worth of profits, the 2.1 billion Dollars represents only a six percent increase.

On a per share basis, the company earned 1.28 Dollars (1.07 at the comparable stage) and the highest growth rate in seven quarters. The dividend has been guided higher to 47 cents a quarter, which amounts to just shy of a two percent yield at this share price. Not a king's ransom by any stretch of the imagination, but consider that the company only paid their first dividend on the 9th of August 2012. Not their first ever, but their first in the current cycle. The dividend cycle was broken from November 21 1995 all the way through to that one paid in 2012.

The company has pots of cash, they generated 10.3 billion Dollars of cash during the June quarter and returned in the aforementioned dividends and share buy backs around 8 billion Dollars. Yowsers, that is serious. Cash on hand? 164.5 billion in cash and marketable securities, with 26.8 billion Dollars of that in the US. That means that Apple has cash of 137.7 billion Dollars worth of cash around the world. Oh I would love to know how the Apple hedge fund operates.

Historically the company trades on a price to earnings multiple of 15.8 times, if you strip out the cash (cash represents 28.8 percent of the market cap), then it is closer to 11.2 times. Wow. In my humble opinion this company is still cheap.

Apple sold 35.2 million iPhones, which is a third quarter record and an improvement of 4 million on the comparable quarter last year. That is a healthy 13 percent increase. Remembering that the rumour mill is suggesting a newer iPhone, in fact the rumour mill suggests two newer models with larger screens. As long as it still fits in your pocket. The iPhone still represents 70 percent of the business, it is their most important product. As such the next one is always going to be highly anticipated. Always.

They also had a record quarter as far as Mac sales are concerned, 18 percent higher year over year, selling 4.4 million devices. What makes those Mac sales even more mind boggling is the fact that (on the conference call - read the transcript - Q3 2014 Earnings Conference Call) according to a crowd by the name of the IDC, they estimate the PC market shrank by 2 percent. Apple Mac has gained global market share for 32 of the last 33 quarters.

We had speculated about this in earlier messages on Apple, wondering if when people upgraded they would get a Mac. Once you are in the ecosystem it is a whole lot easier. They are certainly beautiful devices, my MacBook is simply awesome. It is always on, no waiting for updates, no waiting for booting up. Simple, clean and easy to use. That is another thing about Apple users, they suddenly turn into sales people with the devices that they have. The success of the beautiful devices can be attributed to the company as well as the wonderful friendly user platform. I cannot wait for Yosemite.

Their fastest growing business? iTunes, where billings grew 25 percent year over year, and the last quarter was a record high. Once you are locked in and Apple have your billing details (genius) with a simple click of a button you can purchase an app, a song, a book and the list goes on. Movie? I have bought one of those before too. iTunes billings grew to 5.4 billion Dollars for the quarter, annualise that and you are closer to 22 billion Dollars for the year. From iTunes. Cumulative app downloads have passed 75 billion. And most importantly is that developers have earned 20 billion Dollars in sales through this platform. The larger the number gets, the more developers it will attract. The app gold rush.

The only blight on what are very good numbers are that tablet sales globally have tapered and are in fact decline, even though Apple have been shown to be the number one goto company as far as customer satisfaction is concerned. As per the conference call, where CEO Tim cook said "iPad sales met our expectations but we realized they didn't meet many of yours.". The company still managed to sell 15.3 million units which was better than the 14.6 million in the comparable quarter last year. Strong sales from the Middle East (sales up 64 percent), China (up 51 percent) and India (up 45 percent). Since the product was unveiled, the iPad that is, the company have sold 225 million. I remember many people were quite perplexed about the usefulness of the product.

The next powerful operating system and apps that can go with it are key for driving tablet sales globally, at least that is my sense. Having said that, people are so happy with their iPads. A crowd called ChangeWave surveyed iPad users and found a 100 percent customer satisfaction rate for users of the iPad mini with retina display (the crystal clear one) and 98 percent customer satisfaction for the iPad Air. Wow. Apple interestingly had internal data that suggested more than half of the iPad sales are to first time users.

Guidance for the current quarter was around 37 to 40 billion Dollars in sales (I think if I am not mistaken Mr. Market was expecting above 40 billion Dollars), gross margins of between 37 and 38 percent (inline with expectations). After all was said and done with the results and analysis and the conference call and the Q&A session (quite limited, but that is usual), the share price traded lower in the after hours session. Currently mooted to open at 94.15 Dollars, down 0.6 percent after having traded higher by 0.83 percent to 94.72 in the normal trading session. That tells you that these results were made of Goldilocks, the market got it right, not too hot and not too cold.

So where to next for Apple? Obviously the iPhone releases will be key to ramping up revenues. The business tie up with IBM is interesting, the company plans to roll more of their products across business and noted that the likes of Medtronic, which has developed over 175 internal apps for around 16.5 thousand iPhones used by its employees and Nestle who's employees use over 25 thousand iPhones are committed users already. The products are beautiful, the markets are still big. Margins should be maintained as the company does not discount the quality, it seems that will remain that way.

The company continues to be well placed, 29 other transactions have been done over the last 7 quarters, not including the one that was splashed out, the Beat's one of course. The company plugs away, always looking for awesome businesses to add onto their ever growing eco system. And whilst it is hard to tell, on the conference call Time Cook said that the Gartner research suggested that by 2018 tablet sales globally would be around 350 million annually with PC sales at 315 million, Apple aims to continue to add devices one at a time. We continue to buy this company.

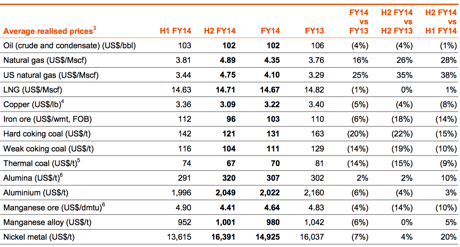

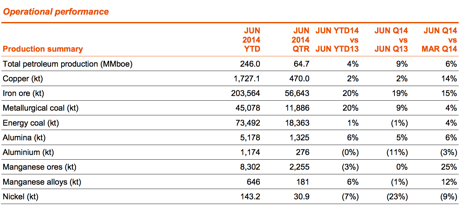

BHP Billiton have released their production report for their full financial year to end June 2014. Iron Ore production at a record of 203.564 million tons, the quarterly run rate suggests annual production of around 225 million tons. i.e. If the company were to maintain the last quarters performance, from an Iron Ore point of view.

For the next financial year the company is expected to ramp up to 245 million tons. I have seen suggestions that BHP Billiton breaks even at 53 Dollars per ton, according to a FT article that cites research done by UBS -> BHP mines record level of iron ore. The iron ore price currently 92.74 (all grades) as per the end of June. That follows from 114 Dollars a ton this time last year, but the price has been as high as 137 Dollars per ton during the year.

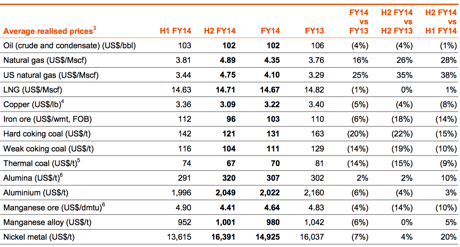

The average price of Iron Ore over the last 12 months has been around 122 Dollars per ton, but remembering that production was ramped up in the second half of the year where prices averaged 112 Dollars per ton. So obviously the volume increases do offset the prices and the margins remain elevated, if not as much as before. The average selling price that the company received for the full year was 103 Dollars. So what to expect from here is for the iron ore price to find a level. Chinese steel demand remains key to the equation and this is (whether one likes it or not) the most profitable business that BHP Billiton have. Guidance, as mentioned before is for a 11 percent increase in volumes for the 2015 financial year, which is almost a month old now.

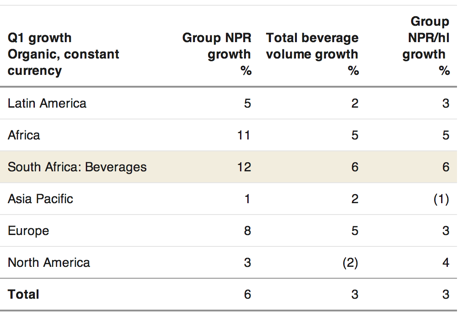

Total petroleum production, per barrel equivalent was a record 246 million barrels. In fact, rather than trying to spell it all out, let me take both the production table, which appears here:

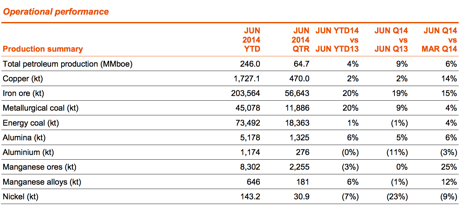

And then I will take the average prices for all of their products:

As you can see across the commodities complex prices fell. A company like BHP Billiton has little control over the majority of these prices, what they have control over is the cost of their various businesses and more importantly recognising which projects to pursue and which ones not to pursue. The obvious examples are the ramp up of the Pilbara iron ore project and onshore gas in the US. The obvious examples of assets that they own which they have not pursued as hard as we would have thought have been the potash project in Canada. No doubt that will come, with the Russians keeping a lid on prices, do not expect anything any time soon. Slow steps.

It is our core holding in the commodities complex, there is good diversity across the business, both geographically and products. Most importantly their capital allocation has been better than their peers and management is cautious, not really in the miners role. They are the biggest in size and scale and we should be so lucky that we can buy them here, as a result of historical reasons.

We are not active buyers of the company at present levels, nor are we sellers, we believe that if you held them historically they are bound to reward you handsomely with a greater dividend stream, last year the company paid 116 US cents, expect more this year, with the interim dividend having been 59 US cents already. I guess that means that the stock is currently trading at levels that you would call a hold, even though I dislike that term.

Byron's beats

It's been a tough week for McDonald's following the meat scandal in China which Sasha covered on Monday and then they released a disappointing set of second quarter results yesterday. Global comparable sales were flat, revenues were up 1%, operating income was flat and diluted earnings per share increased 1% on the back of share buybacks. This equated to $1.39bn or $1.40 a share. This is still a big and profitable business even though there is not much growth.

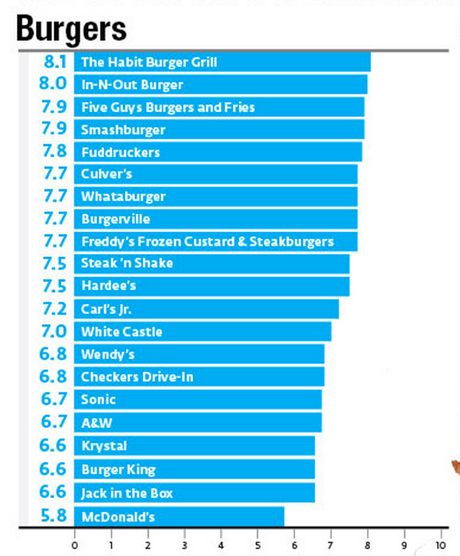

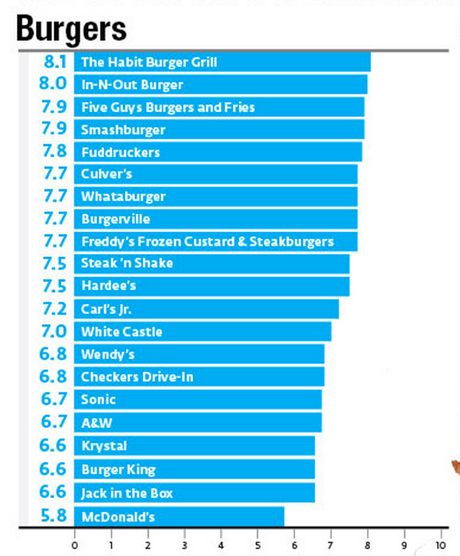

The biggest question to ask of course is why are sales flat? Is it an issue from the company or are consumers in general staying away from fast foods? From the surveys I have read and judging from the commentary from management the company has lost a certain amount of relevance with consumers. In fact I found this US burger survey the other day titled Best and worst fast-food restaurants in America. As you can see from the image below McDonald's burgers got the worst rating out of the whole bunch.

The survey which covered 96208 meals at 65 different chains went on to say the following. "Americans are spending more than ever to dine out-topping $680 billion per year (South African GDP is around 385 billion Dollars). And they are demanding more for their money, higher-quality fast food, and greater variety than can be found at titans such as Burger King, KFC, and McDonald's."

It makes sense. The first movers in fast food have been caught up and now quality is more important. Fast quality is what is required. Although McDonald's can tinker with their menu, their unique taste is what defines them. Innovation of the menu is extremely important and it seems like management have fallen off the ball somewhat.

Don't get me wrong, McDonald's is an amazing business with a very special history and I have no doubt they will come up with solutions to change consumer perceptions of them versus their competitors. My biggest concern about this business however is something a lot more serious and which is mostly outside of McDonald's hands.

Peoples awareness of a healthy lifestyle has never been higher. Heart disease is by far the biggest killer in the US and there are big campaigns to eradicate this. A healthy and fit lifestyle means you live longer, feel better and sometimes more importantly to some, you look better. Unfortunately McDonald's find themselves at the forefront of this issue with lots of negative press.

The reason we liked McDonald's in the first place was because we love the theme of fast convenient dining, especially in developing markets. That theme is not going away and I still strongly believe in the thesis. But the world is changing in the way it views food. Calories, protein content, Tim Noakes, carbohydrates and many other dietary related terms are being thrown around more and more. It's certainly rife in this office. Maybe this issue is not as prominent in developing markets but the bulk of McDonald's sales still come from the US and Europe.

So to answer the question above, the issues McDonald's are facing are coming from both internal and external factors. The stock trades at 17 times this years expected earnings and sales are expected to be slow to flat for the next couple of years. Not cheap with no growth.

In light of all that has been mentioned above we advise you to sell this stock. As mentioned above, we still really like the theme but we see Starbucks as a much better entry. Their food and juice offerings are healthier and coffee is receiving more and more positive reports from health surveys. They are also coming off a much lower base. If you already have Starbucks, a healthcare stock or even Nike would be a good swap. Both these stocks will benefit from the negatives facing McDonald's.

Michael's musings: Vertigo

Two articles that I found very interesting, were relating to company valuations and the stock price vertigo that most people are currently experiencing. Personally I think that if people could only see the stock price today and not the movement of the last 5 years they would be less worried. Is human nature to say what goes up must come down at some point?

Here are the articles. Apple's 6,000% Rally Began With 'Stretched' P/E of 165 and Is the JSE really too high?

"...the stocks with the top 10 highest P/Es in the Nasdaq 100 a decade ago are up an average of 185 percent since"

"...the market was effectively flat between January 2008 and July 2012. In other words, three and a half years of the five and a half year bull run were actually just spent getting the market back to where it started"

If you have cash at the moment, equities are really your only investment option if you want returns. Property might give some return but it requires a large capital outlay and has large amounts of admin involved, so not an option for many people. These limited options mean that equities are worth more and part of the reason why multiples are higher than average.

Buying the quality means that even if multiples drop at some point in the future, you do not need to sell, earnings and dividends will continue to grow and the capital "loss" made during the pullback becomes inconsequential.

Home again, home again, jiggety-jog. The Rand has strengthened up significantly here. Perhaps that has nothing to do with the local reserve bank rate hike and everything to do with the fact that the Euro is trading at a 8 month low to the Dollar. That translates to Rand strength. A flat day for the equities market nevertheless.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Email us

Follow Sasha, Byron and Michael on Twitter

011 022 5440