"Top line growth will return and as we have said over and over again, companies would have done all they can in terms of cost cutting, innovating and streamlining. An economic downturn is ironically not the worst thing in the world, the excesses are flushed and the fittest survive to drive economic activity even further. It always feels awful at the time."

To market, to market to buy a fat pig. After spending much of the day in the green we slipped at the end, perhaps some results in the US that were not up to scratch, I suspect however that the Ukrainian slash Russian slash NATO and the rest of the West "situation" is going to weigh heavy at some stage. The Americans and Europeans are gearing up for more sanctions, the situation in Gaza is hardly improving and lastly if you thought that capital markets were going to have an easy time of it, Argentina is about to default.

This would potentially be the third time in three decades, heck, they win the World Cup more often. I actually took a dig at a CNBC Africa producer who was wearing an Argentina football shirt, which had two stars above the logo. I said to him, is that how many times Argentina has defaulted since Messi was born? Not too far off.

An interest payment of 539 million Dollars is due on Wednesday. All I can say that if you have wonk economic policies this is the outcome. The FT points out here (Argentina braces for sovereign debt default) that the quantum of a likely default is not the same as 2001, it is smaller. Would you lend money to Argentina in your personal capacity? No from my side.

The issues of global tensions and wonk economic socialist policies aside, Eddy Elfenbein had this to say in his newsletter on Friday, which once again underscores why the markets are not really that impacted by these events in the long run:

"According to the latest numbers from Bloomberg, 77% of the S&P 500 companies that have reported so far have topped Wall Street's expectations. Also, 64% have beaten their sales expectations. The S&P 500 is currently on track to deliver Q2 earnings growth of 6.2% and sales growth of 3.3%."

What is quite different is that top line growth, although muted, is starting to top expectations. As we saw last week too is that margin expansion has had much to do with earnings growth. Correction, almost everything to do with earnings growth, widening margins. Top line growth will return and as we have said over and over again, companies would have done all they can in terms of cost cutting, innovating and streamlining. An economic downturn is ironically not the worst thing in the world, the excesses are flushed and the fittest survive to drive economic activity even further. It always feels awful at the time.

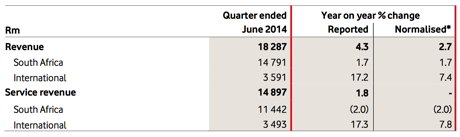

We skipped it last Thursday, there was too much going on at the time, rather late than never, here are the Vodacom Group Limited quarterly update for the period ended 30 June 2014. The table snapshot from the press release sums it up:

Clearly you can see that local revenue, South Africa at 80.88 percent, is still the lions share and unfortunately only growing at 1.7 percent. Why? In part interconnect rates having fallen and in part a fall off in prices of 25.3 percent (average price per minute is 68 ZA cents), the pickup in caller traffic (up 26.1 percent in outgoing traffic) however has offset that. Mostly however there was a surge in devices and accessories revenue which represents 21.4 percent of total revenue.

The company has invested a lot in infrastructure, adding a further 473 LTE sites and thereby increasing the fastest mobile internet infrastructure by 50 percent. Good work. Whilst data prices fell 30.3 percent per megabyte, traffic increased a whopping 70.1 percent. I can deduce that there are better and more expensive devices accessing more data as we converge towards the internet of everything, as Cisco term it. Data revenue continues to grow quickly and more and more South Africans are getting connected to the internet. There are now 8 million smartphones and tablets connected to the networks, with 17 million data users.

Data will continue to be the main focus. Whilst Vodacom still waits for ICASA and the competitions authority on the finalisation of the Neotel transaction (7 billion Rand for all of it, announced 19 May 2014), the offering to businesses is clear when Vodacom have their paws on the "other" fixed line operator: "The combination of Neotel and our existing fibre network and enterprise business will accelerate our unified communications strategy in addition to yielding substantial cost and capex synergies." I want faster and more reliable internet, we all do.

What next? Expect ARPU's to stabilise, I think we are close to the tipping point in terms of ARPU's starting to move higher. Calls are cheap, people are speaking more, data is cheaper, people are using more of it. Whilst Vodacom are going to continue to see their rest of Africa business move quicker and quicker ahead, it has a long way to go before picking up any slack offering here in South Africa.

Parent company Vodafone (65 percent holder) will continue to extract top Dollar, as a minority shareholder (alongside the South African government who own 13.9 percent), you can benefit from the superior dividend stream. The analyst community have the company on a forward dividend yield of 6.9 percent, the after tax yield is closer to 5.86 percent forward. For those who want to extract more by way of income, this is a good business to own in a low interest rate environment, MTN remain our top pick in the sector.

Home again, home again, jiggety-jog. Markets are higher here, the Rand has weakened a little after a fabulous run. Keep calm and carry on there!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment