"Yesterday we received a very positive trading update from Massmart for the first half of the year. In fact it was great when you consider the current tough consumer environment we are supposedly facing. For the period ending 29 June 2014 sales grew 10.2% to R35.7 billion. Inflation came in at 4.8% while comparable sales increased 7.1%. Here is the divisional breakdown."

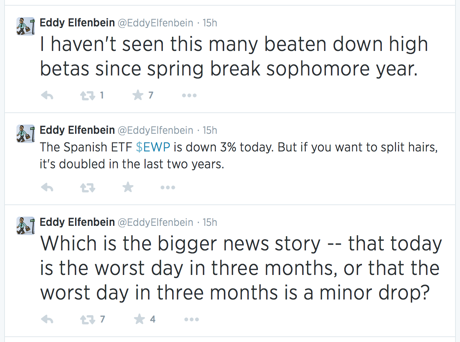

To market, to market to buy a fat pig. My word, there was certainly some to-and-fro on Twitter yesterday, Eddy Elfenbein's feed was full of the bear hating. Take a quick look:

If you are wondering what was going on, then look no further than the Holy Spirit. Remembering that yesterday we said specifically that we were going to avoid the issues related to religion and politics, specifically when the two were mixed. What does the Holy Spirit have to do with equity markets yesterday? Well, there is a little bank in Portugal, that perhaps 99.9 percent of us had not heard about until then, called Banco Espirito Santo SA, listed on the Lisbon Stock Exchange. The literal translation of the banks name means Holy Spirit. It pretty much operates in all activities that any big financial could operate in. The anxiety is actually a level higher, it involves the parent, Espirito Santo International SA, which is a Portuguese conglomerate that owns 25 percent of Banco Espirito Santo SA.

It, being the parent company, has delayed the repayment of short term debt that it had sold to its client inside of a private bank (its own) in Switzerland. Check out the details in the WSJ, in an article titled Espirito Santo International Delays Repayment of Debt to Private-Bank Clients. And then another one I saw this morning: Espirito Santo discloses $1.6 billion exposure to GES.

So what happens? I mean, what happens when a Portuguese conglomerate is strapped for cash and cannot pay investors for short term issued debt? What happens when more specifically this conglomerate does not need to comply with market participants (outside of the usual structures) because it is not listed? I will tell you what happens. Global markets sell off and it becomes global news. That is how connected we are nowadays. The Germans sold off 1.52 percent. The French were off 1.32 percent. Lisbon, with their 58 listed companies, sank 4.18 percent collectively.

The bank in question, Banco Espirito Santo SA, sold off 17.24 percent yesterday, their five day performance, down 32.31 percent. One month? Down 54.2 percent. Three months? Down 57.24 percent. Five years? Down 76.7 percent. It looks like a steady slide. The upshot is that this bank, with a market cap of 2.8 billion Euros, or in Dollar terms 3.81 billion Dollars. 41 billion Rand. I do not want to poo-poo the importance of confidence in all banks in Europe, but it seems a little flimsy to suggest that all banks are kaputsky, because one conglomerate is in trouble.

In the end, US markets, the S&P 500 ended the session down 0.41 percent. Hardly sounds like a sell off of epic proportions? I am seeing loads of people suggesting a market correction is imminent this summer, being Northern Hemisphere summer of course. Get a globe, turn it upside down. See that there is little land down here. That is sad. So what should you do, if there is a sell off of around 5 percent? Panic? No. There may or may not be anything coming by way of a market correction. It is inevitable that markets sell off from time to time. Just stay the course. Anyhows, the Portuguese Stock market is up nearly two percent today.

Bidvest announced two separate deals yesterday. First things first, Bidvest are buying a 60 percent interest in an Italian foodservice provider Gruppo Dac S.p.A. or DAC and a significant controlling interest in a chilled product storage and distribution business in the UK, PCL 24/7 for 95 million Pound Sterling. I guess a significant controlling interest is around one quarter to one third, but it could be as much as 49 percent. In this case I reckon 30 odd percent is a good guess.

95 million Pounds is equal to 1.741 billion Rand, roughly 1.86 percent of the market capitalisation of Bidvest. It is neither hugely material, nor is it very small, it is a lot of money to anyone. It raises two interesting points, one, the group is not finding too many opportunities in food services around these parts, meaning Europe is still an attractive destination to Brian Joffe and his fabulous team, and two this is classic Bidvest. When we covered and explored the size and scale of the Bidvest consortium buying a stake in Adcock Ingram, 34.5 percent of the current market cap of the pharma company is a mere 3.13 billion Rand.

Roughly speaking, this deal announced yesterday is 55 percent of the value of the current Adcock Ingram stake. But yet it hardly gets a mention anywhere. The Adcock deal was huge, from a talking point of view, but in monetary terms it is hardly bigger than this. If you recall our write up on the company, Bidvest that is, we wrote about The Magician of Melrose Arch and the full year results. 29.6 billion Rand revenue (out of 89.6 billion Rand at a group level) came from their European Food services segment, with the Asia Pacific sales 16.4 billion Rand.

Collectively, their international food services businesses represent 51.3 percent of group sales. At an operating profits level however, these two regions represent only 29.4 percent of the group. South Africa, all the collective businesses here (other than food services), still constitute 56.6 percent of group profits. So whilst revenues for their international businesses are far greater, their profits are not. Small bolt on deals like these will see to it in time that this business becomes more international and looks to grow the Bidvest culture across the globe. And of course diversify your country risk.

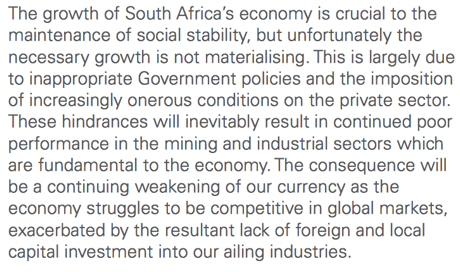

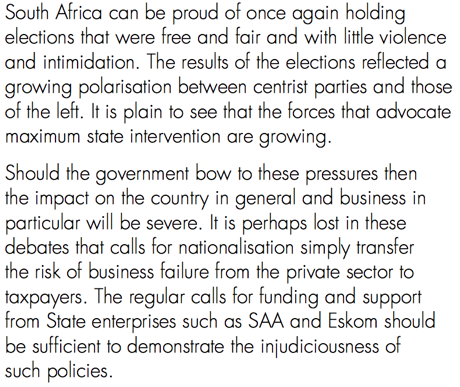

Why is that important? I have noticed the more that I read annual reports, business feels somewhat alienated from government and economic policy. Here are two examples taken from the last two reports that I read, from Omnia and Holdsport, one business supplies explosives and fertiliser to the market, the other sporting equipment, they could not be further apart from one another, as far as industries are concerned.

First, in the Omnia chairman's report, Neville Crosse said the following, a screen grab I took:

Holdsport then, in their annual report and letter to stakeholders, written and signed by both chairman Syd Muller (who had the same role at Woolies once upon a time) and CEO Kevin Hodgson said the following:

The only point that I am trying to make is that businesses adjust their risk taking accordingly and spend capital where they think their shareholders will get the best return over an extended period of time. If that means outside of South Africa, because of the uncertainties (even if perceptually or real or otherwise, depending on where you stand on the issue) that prevail, then so be it. A lack of local investment could be bad for the economy here, but the businesses that can are still investing and you can benefit by being a shareholder.

There is sometimes "stuff" that I cannot understand. Let me rephrase. Most of the time there is loads of "stuff" that I cannot understand, the older I get the less I beat myself up about not being able to understand it. A "company", and the reason for the inverted commas is because there is apparently no business, one director and employee, no revenues associated with this business and no assets, has seen their share price soar 24 thousand percent in 16 days to now have a market value in excess of 6 billion Dollars. Yes. You were not dreaming, you just read that.

The company is called CYNK Technology. I have taken a screen grab of the important metrics from the CYNK Google Finance profile. It is nuts. Completely nuts. It looks like a classic pump and dump scheme, Investopedia explains:

"A pump and dump scam is the illegal act of an investor or group of investors promoting a stock they hold and selling once the stock price has risen following the surge in interest as a result of the endorsement.

The stock is usually promoted as a "hot tip" or "the next big thing" with details of an upcoming news announcement that will "send the stock through the roof". The details of each individual pump and dump scam tend to be different but the scheme always boils down to a basic principal: shifting supply and demand."

This will do two things. One, it will validate those calling social media companies a bubble, they will use this as an example of I told you so, because even I have no doubt that this will all end in tears. Two, it will once again underscore that greed trumps common sense in almost all cases, I expect to see the SEC involved shortly. This is the curious case of CYNK, the Business Insider stories have been many, here is one with an explanation: A 'Social Networking' Stock Has Exploded 25,000% In A Few Days, And It's Not Even Clear If The Company Exists.

Byron's beats are bigger than Dr. Dre (and Apple)

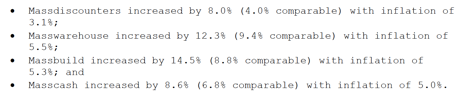

Yesterday we received a very positive trading update from Massmart for the first half of the year. In fact it was great when you consider the current tough consumer environment we are supposedly facing. For the period ending 29 June 2014 sales grew 10.2% to R35.7 billion. Inflation came in at 4.8% while comparable sales increased 7.1%. Here is the divisional breakdown.

As you can see all the divisions showed nice growth but Massbuild and Masswarehouse were the biggest contributors. It actually paints an interesting picture. Massbuild (Builders warehouse, Builders express) and Masswarehouse (Makro) are their strongest brands and are more geared towards the higher LSM groups. Inflation has, as always had a much bigger impact on the lower income groups. But even so Masscash which is almost directly targets the lowest LSM groups has shown some decent growth and the price increases have been absorbed.

My humble opinion is that the big shock of a weaker Rand has been absorbed and we saw those numbers come through last year. The consumer is making a comeback and many of the other retailers have also hinted this. The big question is whether this is sustainable or not?

At current growth rates as well as the inflation picture I wouldn't be surprised to see retailers under pressure again. But we don't base our long term investment decisions on macro events. That is because macro events swing up and down, they are after all cyclical. We prefer to stick with quality businesses and ride the swells.

Back to Massmart, lets not take away anything from the management team who I am sure have been working very hard behind the scenes to deliver such numbers. Lots of work has been done as far as their distribution is concerned and as mentioned above many of their brands are very strong. I guess the only concern for us is Game. We would prefer them to rebrand Game to Walmart at some stage and leverage off such a strong brand. Time will tell but we continue to hold this quality retailer.

Home again, home again, jiggety-jog. Markets are flat here, but we are essentially in recovery mode for the companies and sectors whose prices have been under pressure this week. Resources are holding us back a little here, the Rand is firmer, commodity prices are a little lower. Earnings today from Wells Fargo, one of the larger US banks, that should set the tone I guess for the rest of the day, their numbers are due pre the market.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment