"So whilst governments want to slap an export tax on raw materials, or a resource rent tax, or a super tax on super resource profits. In my mind it is crystal clear, if you are far away from China and suddenly there is huge demand from that part of the world, be grateful for the business and try and get them as much of the stuff as they need, but know that you had nothing to do with the volume and price increase of the raw materials, that was the Chinese government."

To market, to market to buy a fat pig. The first day of the second half was greeted by stampeding bulls, the local equities market was boosted by the Resource companies which in turn had rallied sharply on an improving Chinese manufacturing landscape. The truth is that China is still difficult and very tricky to understand, there are many who do not believe what they see, perhaps because they do not want to. In other words, because the pendulum of economic prowess is swinging once again to the East, that is disconcerting if it is you who it is being wrestling away from. For consumers and businesses worldwide I think that it is fabulous, it presents consumers with cheaper options and for businesses it presents many more opportunities. We all really like opportunities and choices.

For the stronger resource complex however it was a day of gains in what has been a slow grind back since the financial crisis (what crisis?) of 2008/2009. Over a ten year period as a collective the resource index is up 240 percent, but the highs in that time were reached in May of 2008. That is over six years ago and for many retail investors that is a lifetime ago. If you have not been owning BHP Billiton or Sasol, or even more apt in this discussion Anglo American since 2005 and you bought them more recently, the returns have not been that good. The index has been flat since the end of 2010.

If we measure from the top (humans love to draw lines in the sand and use that starting point to forward their argument), from May 2008, the overall index is down 23 odd percent from the highs. The overall market is up 56 percent (and a touch) over the same time period. It really has been a poor time to hold the overall resources index. Anglo American is down over fifty percent from that high, in other words in Rand terms the value of your Anglo American shares have halved. In Pound Sterling terms, from the same date the stock has performed even worse, down nearly 58 percent.

The BHP Billiton share price in Rand terms has gained just over 15 percent since May of 2008 ("the top" of the resource index), in Pound Sterling it is less flattering, in fact it looks ugly, down 9.9 percent since the peak. Sasol might be up nearly 23 percent since then, but in US dollars, the ADR share price is down over ten percent. So. To compare apples with apples, the BHP Billiton ADR (the PLC and not Limited) price in Dollars has done even worse, down 17 odd percent since the end of May 2008, whilst the Anglo American ADR (it trades in the OTC markets) is down 62 percent over the same time. Quite clearly it was FAR better to have owned BHP Billiton and Sasol rather than Anglo American, but as they say in the classics, I can't eat negative returns.

What that means is that whilst the first two have been a much better investment than the second one, in hard currency, Dollar terms, the companies are nowhere near their all time highs. The weakening Rand has helped us, when measuring in local currency, but relative to the rest of the equities market both here and almost everywhere, resource companies have been a very average investment. In part it is about trying to understand the exact same economy that fuelled higher resource prices with higher demand, not ever seen on that scale.

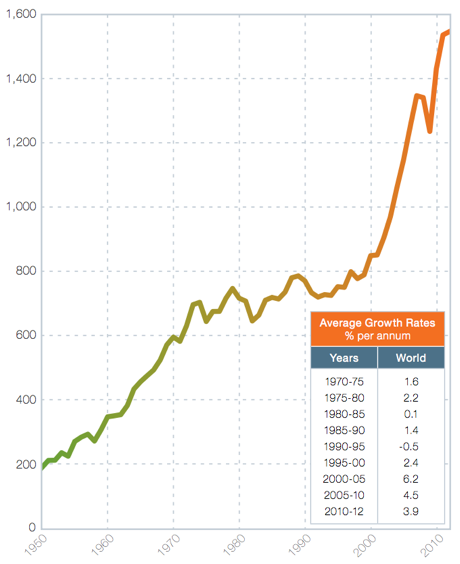

The steel demand from the Chinese is mind blowing, especially when you put it over a longer time frame. Here are a few pieces of literature and graphics that I managed to dredge up across the internet (the best library ever) a few statistics on steel consumption, first a graphic from World Steel association.

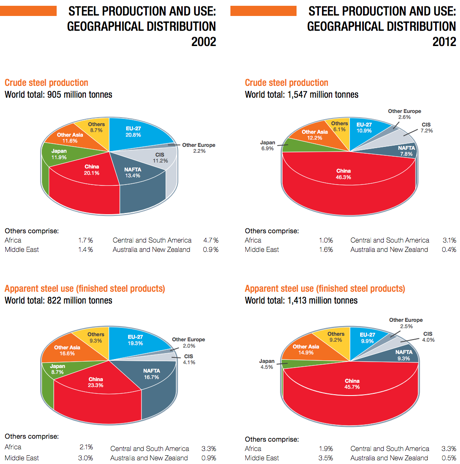

But when you see the next graphic, of steel production and usage from the same publication, and you see China in the apparent steel usage segment jump from 23.3 percent of 822 million tonnes of global steel production, that amounts to 191.56 million tonnes in 2002, to 45.7 percent of 1413 million tonnes, which equates to 645.74 million tonnes in just a decade. Everything to do with Chinese demand has happened in the last decade, that is why iron ore prices and metallurgical coal prices have gone absolutely nuts. Here goes, two separate graphics around steel production from 2002 and 2012 and usage at the same time:

So whilst governments want to slap an export tax on raw materials, or a resource rent tax, or a super tax on super resource profits. In my mind it is crystal clear, if you are far away from China and suddenly there is huge demand from that part of the world, be grateful for the business and try and get them as much of the stuff as they need, but know that you had nothing to do with the volume and price increase of the raw materials, that was the Chinese government.

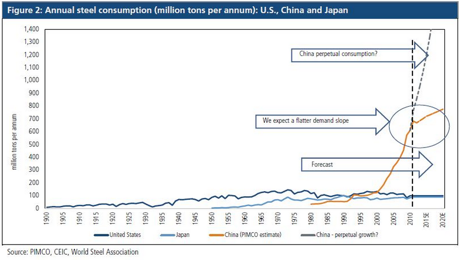

More importantly however, what does the demand look like into the future? I do not know and you do not know, we can make predictions on how we perceive future demand. Last graph. An oldish Pimco report titled The Chinese Hangover: As Infrastructure Spending Drops, So Does Demand for Chinese Steel has a fabulous graph trying to predict this:

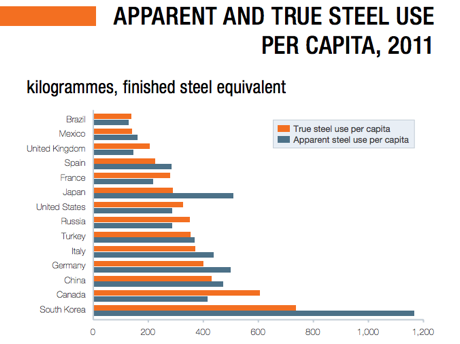

Pay attention to the orange line and not the dotted line. If the demand were to slow, as almost everyone anticipates, it is important to note that a new level is vastly different from the old level. In other words, having put in the base for the new higher level of steel consumption, China will still require vast quantities of raw materials, it just won't grow at the prior breakneck speed. I expect the new level to be what it is and continue to creep higher as China continues to industrialise, steel usage per capita will continue to grow. It is still pretty low on a per capita basis, steel usage in South Korea, which is heavily industrialised is much higher, this last image courtesy of that World Steel association report.

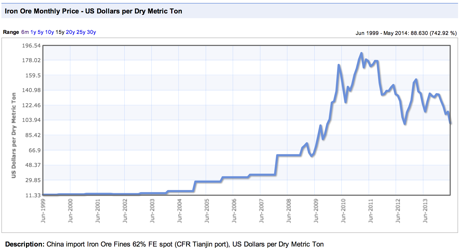

So whilst you might have seen iron ore prices get absolutely crunched this year as a result of much higher steel demand over the last decade leading to the supply side responding accordingly, the new base for China has been put in. That should mean that the companies with high grades and by extension fatter margins than their peers continue to benefit with what are historically much higher than average prices. Last graph, from IndexMundi, which represents a 15 year price of iron ore, notice how the change from a contract negotiated price to a spot price: Iron Ore Monthly Price - US Dollars per Dry Metric Ton.

Keep calm and carry on, iron ore prices might be significantly lower than their peak, but they are significantly higher than their lows. Low cost producers like BHP Billiton will continue to grow volumes and the prices will eventually find a floor that ironically will render many more marginal producers without the ability to grow volumes, because cash flows are limited.

Byron's beats are bigger than Dr. Dre

We have an ongoing chuckle in the office every time a bank has to pay a fine. Not because it is funny but because it happens nearly once a week. Yesterday BNP Paribas was ordered to pay a whopping $9bn after breaking US sanctions and doing business with countries such as Iran and Sudan. to put things into perspective $9bn is the market cap of Bidvest. In the banking world maintaining good relationships is integral for the business because lets be honest, it's an industry with no borders. Hence BNP have little choice but to pay the fines. Regulators in Switzerland have also confirmed action against the Swiss unit of BNP.

Other fines we have seen recently include HSBC for money Laundering, UBS, RBS and Barclays for Libor rigging, JP Morgan for a trading scandal, UBS for tax Fraud, Goldman for misleading investors as well as many others for breaking sanction agreements. Even here in SA where regulations are tight and our banks are well behaved we saw R125 million worth of fines handed out to the big four for non compliance with certain regulations.

You get the picture. Not only are these banks taking chances but the chances they take are all in different fields. This means that the temptations for banks to get involved in grey areas are numerous. In fact the options are almost endless.

And this is exactly why we do not consider banking as investment. There is no doubt that they have the ability to make lots of money. And they do make lots of money, for a lot of the time. But as investors you need to understand and know what your money is invested in. There are just too many closed doors within a bank to know what they are up to. And by having so much available to them (their primary function is to hold money for clients) with so many temptations available, I will not be surprised to see more and more fines imposed. So much so that banks are regulated to the point where those volatile abnormal returns of the past will stay in the past.

Home again, home again, jiggety-jog. Markets have rocketed higher as a result of a huge session overnight in the US. Pity about their football team, their goal keeper Tim Howard was fabulous. There are fireworks for the rest of the week, ADP data today, a half session on Thursday in the US on Thursday because of the July 4th off on Friday. So Friday should be quiet, today and tomorrow, ironically off days for the football, will be very interesting for equity markets.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment