"The reason to buy this company is because they are the leaders in an area of the market that is growing extremely quickly, Netflix expects to add 2.5 million subscribers over the next 3 months. The company is priced for this growth though, currently trading on a P/E 326. More and more people are cutting the cord of their cable or satellite TV subscriptions and moving to streaming. Europe, with a population of around 740 million, has the infrastructure and income to be the next big market to see growth in subscribers."

To market to market to buy a fat pig The S&P 500's turn last evening for a milestone, this time 2100 for the broader market, the index closed at that level. Same old story as the reasons I read yesterday? Perhaps, less worries about a global downturn, China specifically after their 6.7 percent print on GDP last week, less worries about the whole web connected to the oil price, notwithstanding another stalemate in talks between producers, this time in Doha over the weekend. Opulence, they hads it, now they donts. Say that last part in your deep DirecTV Russian guy accent. If you don't know what I am talking about, then be sure to watch it, an old classic -> Opulence, I Has It.

I suspect that it is none of those things, rather the fact that we are now in the guts of the best season. Not the IPL, that is a pretty great season every year, certainly not autumn here, whilst the lower temperatures are welcome, the lack of rain is not. No, my friends, we are in earnings season. Something that happens four times a year. It is when you get to see what companies say about their prospects, their last 90 odd days, how they see their specific operating territories stacking up, their business segments relative to their peers. And so on. That is what we get excited about here, after all, we are market nerds.

It was a mixed bag of earnings, Netflix missed some lofty expectations, Goldman Sachs earnings took a hit, it was however a beat, IBM missed badly and the stock was bashed, JNJ delivered a broad based earnings beat and the stock climbed to what looks at first glance as an all time high. More on some of those specifically in our company segment. There was also numbers from Intel after-hours, the company is shedding 12 thousand jobs as PC demand continues to hit the skids. In what looks like a low volatility session on Wall Street stocks eventually closed mixed on the day, the Dow managed to pull off another day of gains, stocks in the materials and energy sector drove the overall market higher, the nerds of NASDAQ weighed down by IBM and friends, closing off 0.4 percent. The broader market S&P 500 rallied just shy of one-third of a percent, the blue chip Dow Jones Industrial Average added a little over one-quarter of a percent.

There was a global story that attracted a little attention, the fact that Argentina were returning to the debt markets and were possibly going to see a serious oversubscription for their issuances. Yes, after a decade and a half of being shut out of markets, lengthy court battles, seizures of sailing navy ships in West Africa (yes, true story - Seizure of Ship From Argentina Forces Shake-Up) and most importantly a political change. A political change that has recognised that the crazy socialist economic policies, currency fudging, inflation covering up and so on, doesn't work, let the market of the collective decide. It is proof that change can happen, it takes rock bottom on what (in my view) are dumb policies that help nobody.

OK, away from that, let us take a peek at what markets did here in Jozi, the place where the sun shines a lot, the place that was founded on a large pile of gold. Gold that is still being extracted on the side of the M2 highway, as far as I understand it. By what are termed "illegal" miners. Perhaps it is best to call them opportunists and true capitalists, even if the desperation drives them to flirt with extreme danger. And bear in mind that the mines still belong to someone else, even if it is not being currently mined. Locally the market was a bit of a mixed bag, stocks rallied into a stronger close, up 0.4 percent as a collective on the day.

Not much by way of earth shattering numbers from any of the majors, there was of course the news that AB InBev had accepted an offer of around 3 billion Dollars for Peroni and Grolsch, from Japanese business Asahi Group. This is a continuation of the deal having to happen, sales of parts where there is competition, concessions here and there. This is expected, AB InBev stock rallied over two percent here. Over the last three months in Rand terms, the stock is down 3 percent, in Europe over the last three months (in Belgium), the stock is up 5.1 percent. The currency is a double edged sword, the difference is pretty huge between the two prices and their respective performances. AB InBev in Euro terms is around 8 odd percent away from the 52 week highs, whilst the Euro Stoxx 50 seems around 20 percent away from their 52 week highs. Interesting. Where is the love for European stocks?

Company corner

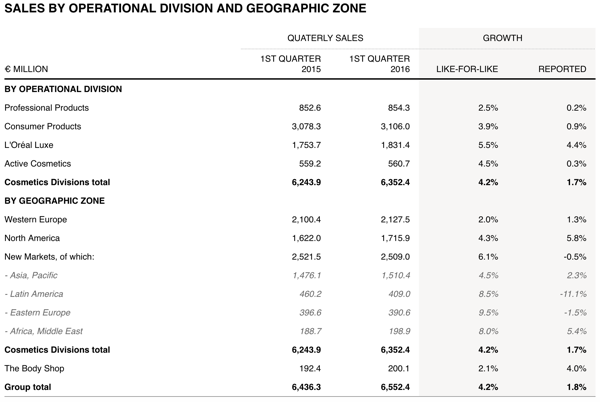

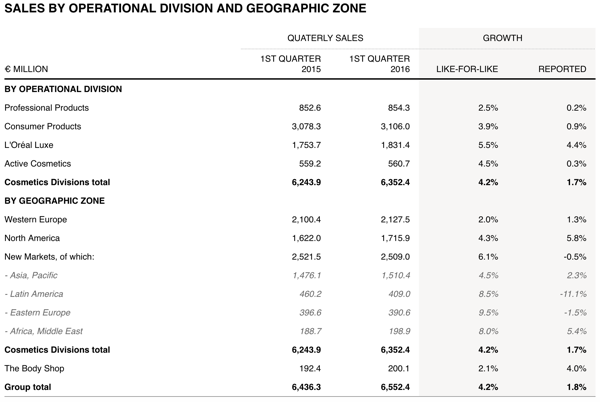

L'Oreal reported sales for their first quarter two days back, the stock has certainly caught a bid. Herewith the release, a fun read on what is a really great company that produces excellent products, known across the globe -> First quarter 2016 sales. A picture, or in this case, a picture of the table of sales tells you more than a thousand words. Strong emerging market growth, mostly Eastern Europe, Latin America and Africa and the Middle East. Kenya and South Africa get a mention there, solid expansion the company says. Here is a sales breakdown, by product line and by region.

Professional products, that is the retail offering that lets you experience the same sort of quality that you can in the salon, all brands for ones hair from Kerastase to Redken. Consumer products is possibly the best known of all the products, the makeup/cosmetics division, sold through their mass market channels. In other words, available in most shopping places. Garnier, Maybelline, and of course the big daddy, L'Oreal Paris. The stated goal from the company is to have over one billion customers. Waking up each and every morning and putting on makeup, for all skin types. Equally, with shampoos and conditioners, all hair care products have to meet the same standard across all hair types, if memory serves the company advances their hair care technology in Brazil, as that territory sees all hair types. The true melting pot of the world, as far as hair is concerned then.

There are two other premium brands, one a skincare, makeup and fragrances businesses called L'Oreal Luxe that sells well known brands. Many under licence from the fashion houses of course, no different to the way that Luxottica manufactures and sells sunglasses. These brands sold under L'Oreal Luxe include Lancome, the premium perfume and skincare house (subsidiary of L'Oreal since 1964), as well as manufacturing perfumes for Yves Saint Laurent (owned by luxury brand company Kering), Giorgio Armani, the Italian private fashion house, Cacharel (Anais Anais is nearly 40 years old now!), as well as many others.

Lastly, the Active Cosmetics Division includes well known brands like Vichy, SkinCeuticals, Roger & Gallet, Sanoflore and La Roche-Posay. This particular segment, as per their website, is the world leader in dermocosmetics. Loosely defined, dermocosmetics is the science where both health and beauty meet in the middle, a very fast growing segment globally. The products are designed to both enhance beauty as well protect the skin, with increased pollution and awareness around the damages that the sun can do, I expect this to be fast growing and adapt to changes.

This business ticks many boxes, high margins, attractive mass market appeal for an iconic global brand in the soft luxury segment. I think most importantly however is that the stock price has "done very little". Whilst this may sound counterintuitive, if you want to add to a position over a longer time, you want the price to be as low as possible. The stock is currently at 38.23 Dollars, the recently weaker Dollar to the Euro has been good for the Dollar price. Which is of course the one we own. The stock has basically "done nothing" since the middle of 2013. Over five years the stock in Euro terms, as per the Paris listing, is up nearly 100 percent, in other words, it has nearly doubled. We don't own specific stocks for the currency moves, those will normalise over time. We own them as a quality standalone business with huge growth potential, we have been patient holders, the stock is certainly not cheap, we believe the opportunity and thesis still remains. We continue to accumulate.

On Monday night we had numbers from Netflix whose content fills our living rooms on a regular basis. Here is a pdf of the Netflix 1Q 2016, Letter to shareholders.

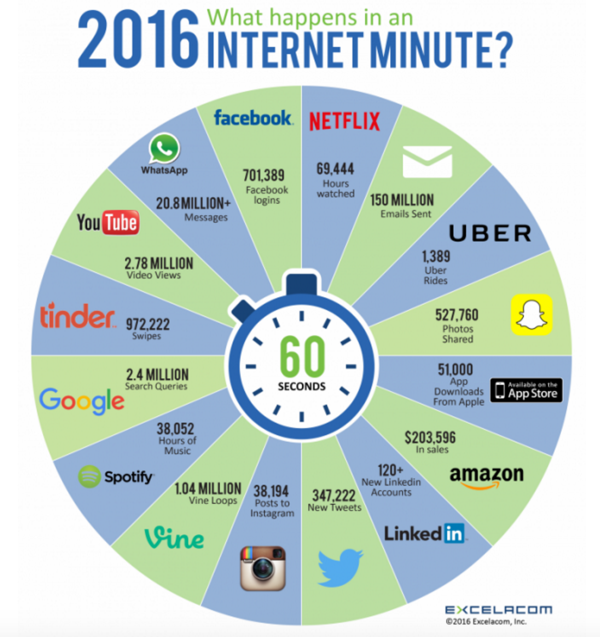

Netflix is not a stock that we talk about very often, so here is a quick run down of the company. The company started in 1998 as a DVD-by mail company. Basically you rent a DVD from them, they post it to you and then when you are finished with it, you post it back to them. Then in 2007 they started their streaming service, expanded the streaming service to Canada in 2010 and now 6 years later they are in 190 countries. The streaming service started with streaming just content from other studios, mostly sitcoms from the 80s & 90s. The big drive now is to produce your own content to attract new subscribers. Their most well know series is House of Cards, very addictive! The service itself isn't very expensive, you can sign up for $8 a month, much cheaper than Dstv, BUT there is no sport.

Revenue for the quarter was $1.95 billion up 24%, of that only $144 million is from the legacy DVD business which is currently fading quickly. Currently their subscriber base is 81 million million people and growing quickly. Over the last 3 months they added 2.2 million new subscribers in the US and 4.5 million International subscribers. The core of their base is still in the US with 47 million of the 81 million subscribers there, the major growth going forward will be the international market. Net income was only $27 million due to them ploughing large amounts into content creation but as the subscriber numbers grow so will their margins. Once the show has been created it is relatively inexpensive to stream it to an extra subscriber.

Going forward the plan to keep subscriber growth on the up is to spend $5 billion in 2016 on content creation and to focus on stepping up production of non-English series. The company has also been working on making their code more efficient, so that people with slower internet connects will be able to also be a client, their efforts have resulted in a 20% saving in data usage.

The reason to buy this company is because they are the leaders in an area of the market that is growing extremely quickly, Netflix expects to add 2.5 million subscribers over the next 3 months. The company is priced for this growth though, currently trading on a P/E 326. More and more people are cutting the cord of their cable or satellite TV subscriptions and moving to streaming. Europe, with a population of around 740 million, has the infrastructure and income to be the next big market to see growth in subscribers. Over the long run there are still around 4 billion people who are not connected to the web, each person coming online is a potential customer.

The stock closed down 13% on Tuesday because the market was expecting subscriber growth of 4.1 million people for the coming quarter instead of the forecast 2.5 million. Clearly high expectations on the company but if you are looking for a small allocation in your portfolio of a "next generation" stock considering buying Netflix. Streaming content is the future, no doubt about that. Will that translate into big profits for the content providers or will the market become too competitive? Only time will tell.

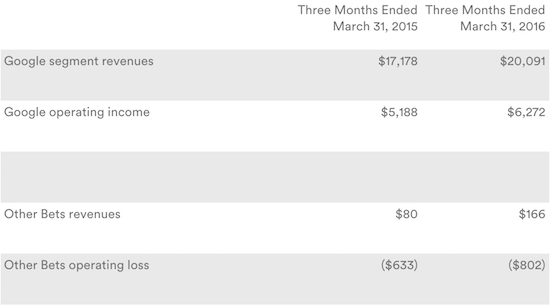

Home again, home again, jiggety-jog. Stocks across Asia are mixed, Shanghai markets were down heavily earlier, they have since recovered a little. Still down over two percent, at one stage it was as bad as four percent. Japanese stocks are marginally better as we speak, Hong Kong markets are down along with mainland China stocks. European futures pointed to a lower open there, so far we are down around two-thirds of a percent. Visa, Alphabet (Google) and Starbucks all with results tomorrow. How is it possible that three of the greatest companies in the world all report on the same day?

Sent to you by Sasha and Michael on behalf of team Vestact.

Email us

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063