"And then lastly, I can't get involved in politics in this opinion piece, it is a very emotional topic in particular in South Africa as a result of our past. All I can say is that capital responds to the landscape accordingly and your investment opportunities are not confined to the borders in which you live and work."

To market to market to buy a fat pig We started OK, slid during the day and ended a little in the green. An equal number of red and green stocks on the ALSI 40, at the top of the pile were the resource stocks, better than anticipated PMI numbers from China gave some materials businesses a boost. South32, AngloGold Ashanti, Amplats were at the top of the pile, right at the bottom of the pile were big moves by the Banks, Barclays Africa lost 6.55 percent. Standard Bank was down over 3 percent, so was Nedbank. What gives? There was company specific news for Barclays Africa, the main shareholder of the business, parent company Barclays Plc. will ask their shareholders to give them the green light on selling down their stake in the company. The general meeting has been set for three weeks today. I am guessing the stock will be volatile in-between now and when announcements are made around the sale.

The other reason were the noises from ratings agency Standard & Poor's that government were taking their eyes off implementing policy. i.e. Dealing and lurching with other matters was preventing positive economic policies. I am not too sure about that, I would prefer government to do as little as possible in the economy, fewer rules and regulations, which would lead to greater innovation and more risk taking, which would lead to higher economic activity and higher revenue collection for supporting social security. Wake up each day, repeat. Unleash the human spirit rather than telling people to adhere to this and that, and to do this and that. Singles collectively are far better than all organisations with the best intentions, we are intrinsically selfish.

Enough about that, if the downgrade to junk status happens, the cost of issuing and servicing debt will rise, expenditure will be under pressure. For banks and financials, they would need to raise more capital in light of their government assets being more risky, that may include going to shareholders cap in hand. I trust that we won't get to that point, or at least I hope not. A banking pal of mine told me that the capital requirements might have to be beefed up 10 to 15 percent in the case of a downgrade to junk, I hope I heard him wrong. Quite simply as a result of the deterioration in credit quality of South African denominated debt. Until we get there, we wait I guess, some of the chattering classes are calling it inevitable.

Standard & Poor's also weighed in on household indebtedness being a problem, expectations are for retail loans to become more stressed. Hence the broad based weakness across the retailers here yesterday. Shoprite was also amongst the big losers on the day, bearing in mind however that the Shoprite share price has been on a tear. Amongst the retailers that we own for clients on the local front which includes Steinhoff (who have been busy and still look cheapish), Woolworths and Richemont. Most of their operations are certainly external to South Africa for the first and last companies, for Woolworths it is around half and half.

And then lastly, I can't get involved in politics in this opinion piece, it is a very emotional topic in particular in South Africa as a result of our past. All I can say is that capital responds to the landscape accordingly and your investment opportunities are not confined to the borders in which you live and work. The world has more than 55 million consumers, you need to be investing in businesses that offer multiple services and products to as many consumers as possible. If that means exporting money and owning stocks outside of your comfort zone, embrace that rather than seeing it as an obstacle. At the moment politics is reflecting grimly on us, we are littered with moments in our history that this is the case. You can't change that, so instead of getting glum about it, do something about it.

Over the seas and far away in New York, New York, stocks enjoyed a massive upswing in the second half of the session. Was it Jim Cramer shouting and getting excited about his hometown folks winning a countrywide college basketball competition? No. It was the release of minutes from the Federal Reserve's last meeting -> Minutes of the Federal Open Market Committee. What always amazes me about these meetings, and scroll through the attendees, is the sheer size. By my count, 72 people. 72 people listening in, the majority not really making a call on rates or policy specifically at this meeting, they are there of course there to learn, one day it may well be their time to implement policy.

Anyways, the Fed basically in these minutes signalled that a rate hike in April is not likely. Remember that the meeting itself was three weeks ago, starting on the ides of March and ending a day thereafter, that is the normal lead lag cycle between meetings and the minutes release. Some folks thought that they needed to raise rates, in other words the favourite question asked by South African journalists at the MPC meetings "was the decision unanimous", it certainly wasn't. This is another sign that the Fed will continue to monitor global economic activity and see how it unfolds from there. Sigh, I guess there are always going to be factors to prevent the Fed raising rates, will the world grow in lockstep with one another? There are of course moments when it does happen, for the time being, the majority of the Fed feel that they need to pause.

Mr. Market liked that, and stocks that were admittedly higher, went even higher. The Dow Jones Industrial Average tacked on two-thirds of a percent, the broader market S&P 500 added just over a percent by the time all was said and done, whilst the real action was amongst the healthcare stocks, many of which are actually listed amongst the nerds of NASDAQ, that index soared 1.59 percent by the close. Reasons differ as to why the stocks all caught a bid, one reason is that as a result of the tax inversion rebuff, some of the bigger businesses may well be hunting with elephant guns. i.e. Now that the deal with Pfizer and Allergan has been scrapped, smaller targets may be lined up and the bigger firms may well be getting inline. At least thats how the theory goes.

The Allergan CEO was on the floor on the NYSE doing interviews, he was being bumped and jostled by trader types. Why don't they just sit in front of screens? I guess the marketing of the floor, it certainly is an attraction. I have had the privilege of going there twice, it looked pretty quiet when I was there. Byron and I made snide remarks that the fellow who runs the company that makes Botox looks awesome, perhaps he is a user of their products. Not nice guys, keep it clean!

Valeant soared nearly 19 percent last evening after announcing that they wouldn't have to restate results further. A long way to go to 257 Dollars, the all time highs of 31 July from only last year. And then the tweet of Hilary Clinton, the investigations, gouging allegations, restatement of financials and so on, the bad news was never ending. Bill Ackman and his gang must be happy with the short term outcome, remember that he turns fifty this year, in around a months time.

Linkfest, lap it up

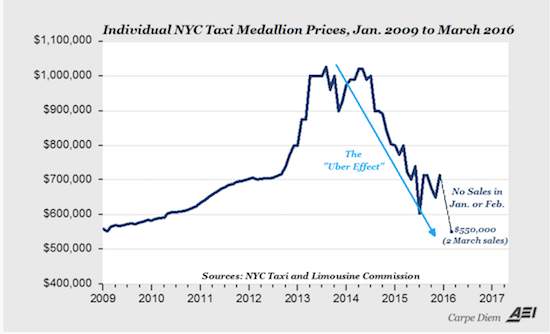

Uber has been a major disrupter in the taxi industry, the effect can be clearly seen on the medallion cost for the right to operate a taxi on the streets of NYC - Uber Effect

If you want to know how the medallion system works and who gets the money when a medallion is sold, have a look here - How NYC's Yellow Cab Works and Makes Money

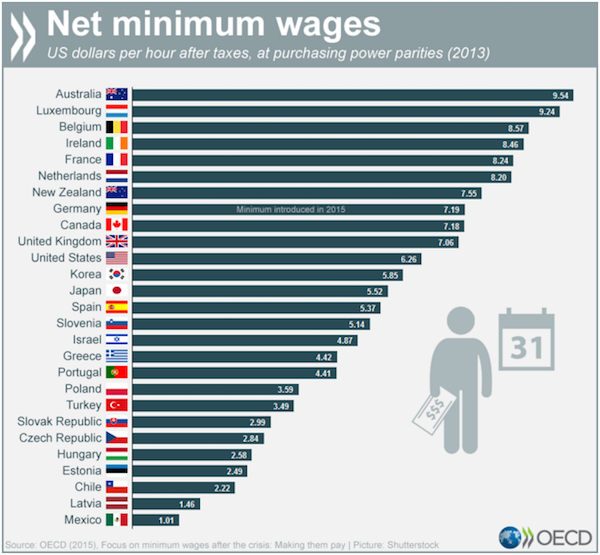

Here are the best places to earn a minimum wage. Surprised not to see the Scandinavian countries near the top - Where are the world's highest minimum wages?

Like to know whether or not you have passed through these? The World's Top 10 Busiest Airports. Atlanta, the Delta home, sees over 100 million folks smash through daily. And second, growing strongly is Beijing. Heathrow used to be top of this pile, no longer I am afraid, for them, down to fifth place.

You will find more statistics at Statista

Home again, home again, jiggety-jog. Stocks across Asia are a mixed bag, the Japanese Yen continues to be strong, not good for them I guess! Shanghai markets are down strongly. Hong Kong is up around one-third of a percent. Samsung sales were marginally better, as a result of the early release of their new handset, the stock is down. We should start better here, that would be good from the recent selling phase.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment