"The biggest move on Friday was the 6.6% move Northwards of WTI Crude all thanks to a drop in inventories of crude, traders were expecting an increase in inventories. Why do inventories matter? A drop in inventories means that more oil was used in the period than was produced, good needs on the demand side of things."

To market to market to buy a fat pig Markets finished off Friday in the green but still down for the week, with Monday and Tuesday last week being the worst 2 days since the lows we saw in Feb. The biggest move on Friday was the 6.6% move Northwards of WTI Crude all thanks to a drop in inventories of crude, traders were expecting an increase in inventories. Why do inventories matter? A drop in inventories means that more oil was used in the period than was produced, good needs on the demand side of things. Given the relatively large drop in crude prices over the last 18 months we have seen onshore storage fill up as trading & production companies store the oil with the hope of selling it later at a higher price. The oil price just needs to go up by more than the storage costs and you have made yourself a profit. Inland storage costs according to Google are in the range of 40 USc - 75 USc per barrel per month and with inland storage facilities have maxed out their capacity, traders have now resorted to using idle super tankers to store oil out at sea, the cost there seems to be $1 - $1.20 for this service. I have even seen reports where trading companies are using oil train cars to store oil, basically oil is being stored in anything that will take it. All this stored oil is also the reason that we will probably see oil prices stay around these levels for the foreseeable future. A drop in inventories is significant then.

Another surprise came from golf's biggest weekend, The Masters where Jordan Spieth gave up a 5 shot lead to end the tournament in second place. Have a look at 17 Things You Never Knew About The Masters. As Bright wrote on Friday, Spieth is one of Under Armours big names and his performances last year in the majors had a direct impact on the UA share price on the following Monday. We will have to see if the UA share price drops at 15:30 today due to Spieth finishing second.

Company corner

Sibanye signed a revised wage offer with AMCU over the weekend, which is better than the wage agreement reached with the other unions at the end of last year. The agreement means that strike action is avoided which is good for the short term. The precedent set though may be a problem down the road, these negotiations did not follow the old format of going through the chamber of mines and came after a wage agreement was reached at the end of last year. Sibanye also did a complete 180 after previously saying that they would not be giving a revised wage offer. What will the reaction be from other unions and will there be any value in signing 3 year wage agreements if renegotiation is on now on the table?

Linkfest, lap it up

I can't imagine spending 17 hours on one flight but given a lower fuel price, long haul flights are coming back - Long-Haul Flights Get Longer. The flight is Auckland to Dubai and is operated by Emirates.

This graph highlights why the Twitter share price has been struggling of late. Added to problem that people are not on Twitter as much as other social media apps, Twitter's growth numbers have also stalled at around 300 million mark - Twitter Falls Behind in Terms of Mobile Engagement

You will find more statistics at Statista

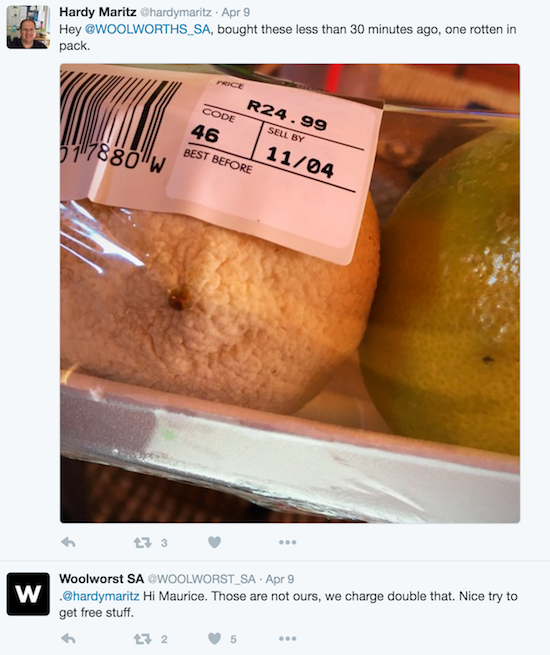

Speaking of Twitter, here is a fun and humours way to kick off your week - My addiction to Twitter parody accounts. Exploring one of the greatest pockets of Twitter.

On the local front one of my favourite parody account is WoolWorst SA, always good for a chuckle.

Home again, home again, jiggety-jog. After starting in the red our market is up a quarter and the Rand is looking good sitting under the R/$15 level. On the marco side of things it is a rather quiet week but after the US market close tonight we have Alcoa reporting their 1Q numbers, which unofficially launches the last quarters results. Phew, I feel like the last set of earnings has barely finished.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment