"Pushing prices up to protect those exposed to the industry is likened to someone calling for a restriction on the supply of computers to protect those exposed to the typewriter industry. Artificially inflating prices means that the market will find alternate ways to get back to more efficient clearing prices, pushing oil prices over $100 meant we saw the rise of the frackers."

The very new blunders video is out: Blunders - Episode 10. This week: a shocking new A$5 banknote, Berlin airport spokesman gets fired, GoFlow in Alaska and China's GDP at 6.7 percent. To never miss an episode, subscribe to the Blunder Alert!, and get the mail delivered to your inbox.

To market to market to buy a fat pig Big news for the weekend was the meeting of the top oil producing countries, around half of the worlds oil production was represented at the meeting. Rewind a couple of weeks and you will remember that the oil price started to climb due to this meeting being announced, with the possibility of a production freeze. The outcome of the meeting was that nothing is going to happen. Saudi Arabia doesn't want to be involved in any deal unless Iran is involved in the production freeze as well, which makes sense. Why would Saudi Arabia curb production, push the oil price up, only for Iran to benefit from the increased price as they ramp up their production by around 20%. The impact on the oil price this morning is a drop of 4%, still trading above the $40/barrel level though. Asian markets are in the red and so are US futures thanks to these lower prices.

As a consumer I have no problem with the oil price dropping. What I don't get though is why many people think it is okay for the oil producers to be gathering to discuss curbing production. If that happened in any other industry, regulators would be all over the producers and imposing fines. There is no scenario where a higher oil price is a good thing for the majority of the globe. Yes if you work in the oil industry or have lent money to the industry a higher price is good but your losses are minimal compared to the losses the consumer faces because of a higher oil price. Pushing prices up to protect those exposed to the industry is likened to someone calling for a restriction on the supply of computers to protect those exposed to the typewriter industry. Artificially inflating prices means that the market will find alternate ways to get back to more efficient clearing prices, pushing oil prices over $100 meant we saw the rise of the frackers and renewable energy projects find capital backers.

On to the markets for Friday, even though more stocks were red in the TOP 40 than green our market still finished up 0.36%. Most of our dual listed stocks were in the green thanks to a weakening Rand, most of which are big contributors to the ALSI. New York, New York was another day of very little change, S&P 500 was down 0.1%, Dow Jones down 0.2% & the Nasdaq down 0.2%. US Futures as I write are down around 0.5%, so it looks like a red start to the week.

Company corner

This is not a stock that we actively hold but the "Boere Buffett" needs a mention. Just before the market close on Friday Psg Financial Services Limited - Trading Statement came out, their sum of the parts value is up 14% since last year Feb. The share price is up 388% over the last 5 years, great to see.

Linkfest, lap it up

The Gigafactory is what is going to allow Tesla to reach new levels of economies of scale and also allow them to build those 320 000 Model 3's on preorder - 8 awesome innovations in Elon Musk's Gigafactory

Rewind the clocks 14 years and we get to a period where the SARS virus was on the prowl. One of the industries to benefit from this was technology companies, more people started connecting their homes to the internet, SMS numbers climbed and probably most importantly e-commerce numbers increased. Due to people being afraid of going outside, they took the hard first step toward ordering online - China's internet got a strange and lasting boost from the SARS epidemic

Cullen Roche is having a rant about how misguided and flawed the argument is relating to the US having more debt than it can sustain - Say America's Bankrupt One More Time!. Interesting read and puts big numbers thrown around into perspective.

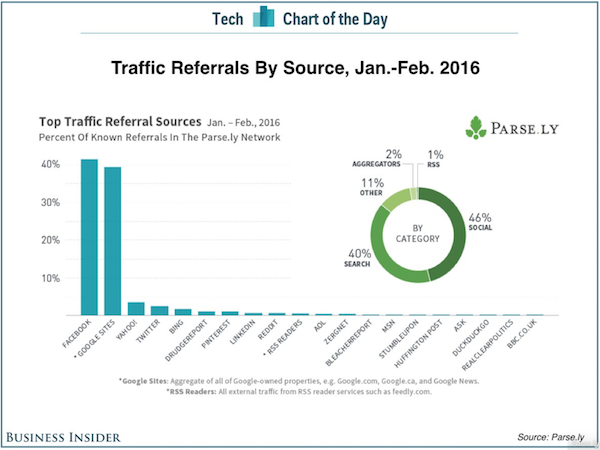

Here is the reason why Facebook and Google make so much money - The online universe belongs to Facebook and Google - the rest of us are just living in it. Getting customers to your site is a big component of making sales and is only getting more important.

Here is a fun video to kick off your Monday - The US Navy is catapulting trucks off aircraft carriers

Home again, home again, jiggety-jog. Expect our market to open in the red thanks to the big drop in oil prices. The Rand is also slightly weaker, trading in the R/$14.70's, maybe traders are in a "risk off" mood? Not much in the way of global numbers today. This week is going to be busy on the earnings front, after the US market closes we have Netflix numbers (expect a very volatile share price) and then the bigger, slower moving IBM.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment