"Visa results from Thursday night, let us flesh these out a little. The company reported Q2 revenues of 3.6 billion Dollars, that was 6 percent higher than the year prior. Visa reported adjusted quarterly net income of 1.6 billion Dollars, 68 US cents per share diluted earnings. Volumes are important here, each little swipe makes the business (and shareholders) money. "

The latest blunders video was released Friday: Blunders - Episode 11. It includes Intel, Coke Zero, gold in Australia and the Costa group, remember the cruise liner that sank? Watch it, it will make you smarter, I think. Subscribe to the Blunder Alert! and never miss a season, you will get the email delivered to your inbox.

To market to market to buy a fat pig Stocks were sliding away the whole of Friday, locally in Jozi we ended the session off three-quarters of a percent, down below the 53 thousand mark. Just as we were threatening to get to new levels next week. The reasons were in part the weaker than anticipated results from some huge global companies in the US overnight Thursday, and also in part a failure to launch from the ECB Thursday. Expectations were elevated. Who would have thought? Stocks that caught a serious bid were BHP Billiton, Sasol and SABMiller, all up on improved commodity prices and a weaker currency. At the other end of the spectrum was a mixed bag, Amplats, Woolies, Aspen, Steinhoff all got sold off three percent or more.

I did read someone say that it was "risk off". That supposedly means that emerging markets are a poor flavour currently. Part of the reason given was a strong read Thursday of weekly employment claims, a weekly release by the labour department in the US that points to better than anticipated labour market. Or let me rephrase, continued strength in the labour market in the USA. And that points to a rates rising scenario sooner. Oh my word, this is circular, over and over again I hear the same thing, second guessing the Fed. It is tiresome, it works both ways, however. Since the release of the last Fed minutes, markets globally have done well.

Stocks across the ocean and far away, in New York, New York, ended the session mixed. Some of the heavyweight tech stocks that reported Thursday evening got smoked, Microsoft down over seven percent, Alphabet (Google) down over five percent, Facebook (they report this week) down over two and a half percent. Notwithstanding that drawdown on tech stocks, that caused the nerds of NASDAQ to sink four-fifths of a percent. Believe it or not, strong moves from the energy stocks, utilities and financials (rising rates not altogether a bad thing) led to the broader market S&P 500 being completely flat on the session. Sorry, up 0.1 points, which didn't register a percentage move gain. The Dow Industrial Average gained 0.12 percent on the session.

This week there is another Fed meeting (every 45 days), more importantly for us, there are earnings, big ones for us here at Vestact. Good stuff! Apple on Tuesday, Facebook on Wednesday (a holiday here) and Amgen and Amazon on Thursday. We will keep you updated during the course of the week, with all these results, we owe you a Google/Alphabet update, that will come tomorrow no doubt!

Company corner

Last Thursday night we received second quarter results from Starbucks. But before we delve into the numbers let us look at some of the hype created here in South Africa after the first Starbucks was opened in Rosebank. Check out the SAStarbucks twitter account for some pictures of the opening. Apparently there were queues until the early hours of the morning and there still are. The brand strength is incredible and the drive for quality coffee, especially in developing markets is growing like China (that analogy should be used more often, no, China is not finished, as you will no doubt see in the numbers below).

Back to the global business, revenues grew by 9% to a second quarter record of $5bn. Operating margins were also at a record 17.3%. Operating income grew 11% to $864 million which equated to an 18% increase in Earnings per Share to $0.39. This company is still dominated by the Americas, 69% in this quarter to be exact. And that is where a lot of the excitement lies. Firstly, the US business is very healthy, growing revenues by 10% in that region. Secondly, the opportunity to expand around the globe with their fabulous brand is huge. As we can see here locally.

Stores are popping up all over the place. They opened 350 in the quarter (that is nearly 4 a day!) to a grand total of 23921. Shem, that makes the big deal in Rosebank feel a little small. It's big however to the Taste holdings team and coffee enthusiasts (hipsters) in the Northern Suburbs of Johannesburg. It's all relative.

China is a big story for Starbucks. Revenues grew 14% in the region. They have opened 884 new stores in the past 12 months in China and Asia Pacific. This inherently tea drinking region is loving the coffee craze. Starbucks is the Nike/Apple of coffee and the allure created around the brand is massive.

The company also sits at the forefront of payments innovation through the Starbucks App. A whopping 8 million Mobile Order and Pay transactions are processed per month. There are now 12 million active loyalty subscribers in the US which is growing 16% year on year. People love to get free things, even if they have to buy 10 coffees to get 1 free. Using your phone is easy and keeps you coming back. I am sure this will be implemented throughout their global operations.

As expected, you have to pay up for all this good news. The stock trades on 27 times next years earnings. But they are expected to grow earnings by 16%. The story is certainly compelling and we feel that they will consistently grow and justify this multiple as they push stores throughout the globe. At this stage 90% of revenues comes from company operated stores. The other 10% is from licensed stores or franchisees. Using guys like Taste who will take the capital risk to push stores in smaller regions will help them with this cause. And I am sure Starbucks are able to negotiate favourable terms for themselves. We reiterate our buy rating on this stock.

Visa results from Thursday night, let us flesh these out a little. The company reported Q2 revenues of 3.6 billion Dollars, that was 6 percent higher than the year prior. Visa reported adjusted quarterly net income of 1.6 billion Dollars, 68 US cents per share diluted earnings. Volumes are important here, each little swipe makes the business (and shareholders) money. A look back to the March quarter saw the constant year on year change in Debit and Credit cards payments volume increase in the low double digits, 12 percent. The total transactions increased by the same amount, 12 percent. The total number of credit and debit cards as of the end of last year was a pretty staggering 2.490 billion. I have three in my wallet.

It was also a busy quarter for the company, they bought back 1.8 billion Dollars worth of shares during the March quarter, the average price paid was 72.23 Dollars (for the full 24.2 million shares). At the end of the quarter, the company still has 23.4 billion Dollars worth of cash and cash equivalents, and available for sale investment securities. Treasuries, and the like. A quick reminder, the market capitalisation as per the Friday close was 189 billion Dollars, a fair chunk of cash percentage wise, 12.8 percent.

Let us discuss valuations quickly, the stock currently trades on 30 times historic earnings, the market is always expecting good things here. With a mere 14 cents a quarter dividend payout, the yield is a paltry 0.71 percent. Better than some negative government yields in Japan and Europe I guess. Market consensus sees the multiple unwind to 24 times next year, expectations are for 3.28 in earnings next year. Is that too rich? Methinks not at all, the company projects annual revenue growth of 7-8 percent, I saw Bright get excited about that number over the desk! With operating margins remaining in the mid sixty percent, free cash flows of 7 billion Dollars, this is a healthy looking business.

I was paging through a report on "cash", from a crowd called Europolcik, Germany issues an enormous amount of bank notes, relative to their GDP, 16 percent in 2013. France and Italy had numbers of 4 and 9 percent respectively. Also, there are around 1 trillion Euros worth of cash in issue in the common currency area, one-third of that is made up of 500 Euro notes, yet over 55 percent of respondents in a survey said they had NEVER seen such a note. The problem is that the notes are often used for illegal activities. Luxembourg issues nearly double their relatively small GDP in banknotes. The point is that Visa is going to have a big business in Europe and that they are going to be encouraged to keep the paper trail.

On that score (Visa buying the European business), the European Commission came back and said that the terms should be changed slightly. The deal is now likely to be delayed, and not expected to be completed by June 30, the cash consideration is set to be boosted by 1.75 billion Euros (nearly 2 billion Dollars). Let us just say that the wheels of bureaucracy are bigger and turn slower in some parts of the world!

This is a fabulous business, the thesis remains intact. More and more transactions will be made electronically, eliminating the need for cash, which comes with a whole host of security issues. We continue to accumulate this business, it is a strong buy in our books.

Linkfest, lap it up

At Uber's last valuation the company was worth $62 billion dollars. Part of their growing pains has been a law suit from some drivers wanting to be recognised as company employees and not as independent contractors - Uber will pay up to $100 million to settle suits with drivers seeking employee status. It is important for the Uber business model that drivers remain as independent contractors.

There is so much data out there that whatever your argument is for the market you will be able to find a stat or a graph that proves your point - Expensive Misconceptions.

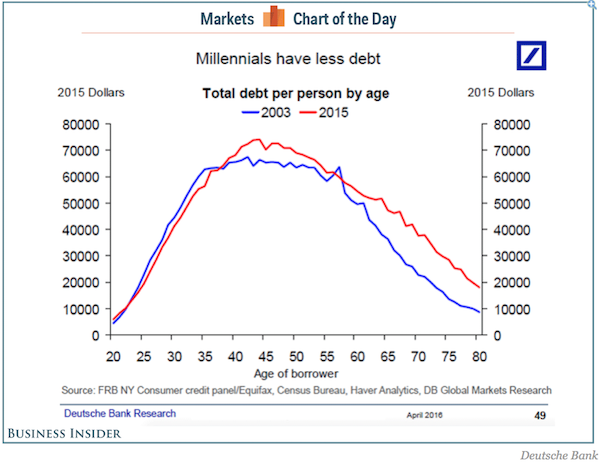

The current state of the global economy is always a hot topic, the debt levels of the youth is one of the things being brought up - The idea that millennials have more debt is an 'urban myth'. As pointed out in the article, millennials have a higher percentage in student loan debt and less in mortgage debt. If I had the choice I would much rather have my studies paid for and my disposable income going to paying off my house.

Home again, home again, jiggety-jog. Leister City, the football club march on. I have heard that if you wanted to buy a ticket from a scalper for the last game, it would set you back around 15 thousand Pounds. That is more than 300 thousand Rand, for tickets for the last match against Everton. If Spurs win tonight, they have a slightly easier run in to the end of the season. I found a really funny link via an unlikely source: 11 things that were OFFICIALLY more likely than Leicester winning the Premier League. They haven't won yet, they are almost there.

Stocks are likely to open lower here, stocks down across the board across Asia I am afraid. It may well be another week of waiting and watching the Fed until Wednesday evening, a day that we can reflect on 22 years of Freedom.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment