"The rumours are that Russia and Saudi Arabia have agreed on a production cap, regardless on what Iran does. In last weeks oil rig report, the US showed the the number of rigs has dropped to the same level as November 2009 indicating that the lower oil prices are driving people out of business, the OPEC strategy is working."

To market to market to buy a fat pig Our market powered ahead yesterday, with the Alsi finishing up 1.23% and above the phycological 52 000 level. The human psyche is a weird thing, we are drawn to 'mile stone' numbers in share prices and indexes. Even though there is very little difference between 51 999 and 52 000, the bigger number sounds better. The result is that 52 000 becomes a resistance level because traders will rather say that they sold at 52 000 than 51 thousand and something. Over the long run these levels mean very little but in the course of the day when there is generally very little news out on the company to justify any share price move, traders gravitate to key levels and can create trading opportunities for people with very short time frames. As you know we are on the long term end of this spectrum and trying to time the market is not what we do. History tells us that you get as many right as you get wrong with short term timing.

The market in New York, New York also had a strong day yesterday, the S&P 500 closed up 1%, the NASDAQ up 0.8% and the old boy, The Dow up 0.9%. The big winner on the day has been commodities, with oil leading the way up 4%. The rumours are that Russia and Saudi Arabia have agreed on a production cap, regardless on what Iran does. In last weeks oil rig report, the US showed the the number of rigs has dropped to the same level as November 2009 indicating that the lower oil prices are driving people out of business, the OPEC strategy is working. With prices heading north again the fracking boys can bring some of their operations back online, increasing supply and capping the amount that the oil price can rise. The reports that I have been reading say that the cost of the average fracking operation is around $45 - $55 dollars a barrel, if I had to guess I would say that is where oil prices will settle until the next shock to oil dynamics comes around.

Company corner

There are rumours doing the rounds in local media that Phuthuma Nhleko, will be returning to a non-executive role next month, Nhleko's planned exit bodes well for MTN Nigeria. I would say that trying to predict when the MTN fine will be resolved is foolhardy, things still seem very messy in Nigeria.

The worlds largest private sector coal miner, Peabody Energy filed for bankruptcy this morning, Peabody Energy Chapter 11 Protection Information. Times are tough out there, too much debt and sliding revenues. The company points out in their filing that the coal prices have dropped heavily over the last 5 years. Having a look at a 5 year chart, prices have fallen from the $130 level to below $60.

Linkfest, lap it up

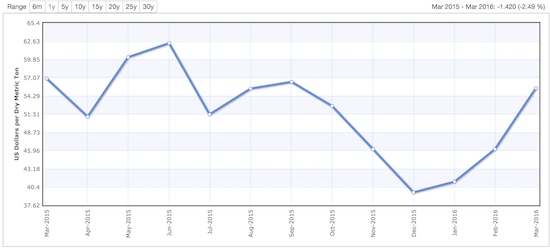

Continuing the commodities theme over the last week - Iron Ore Powers Toward $60 as Rally in Steel Fires Up Demand. Thanks to Index Mundi here is what the iron ore price has done over the last year, as you can see it is flat for the year and up around 40% from its lows. Over the same period Kumba is down 25%.

In the whole debate of private sector vs public sector, there is an area in India where the private sector is being put to the test. The land is basically totally run by the private sector, from disposing of waste to fire department and policing - Skyscrapers - but no sewage system. Meet a city run by private industry.

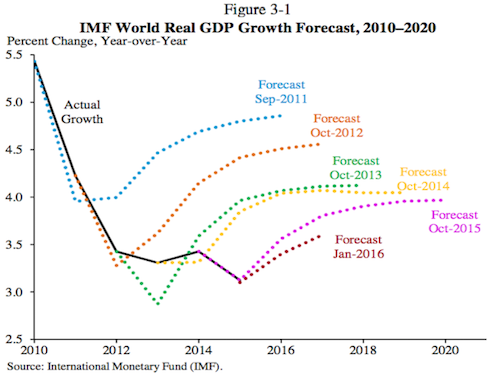

The IMF downgraded global growth again this week, here is how accurate their previous forecasts have been - This is the most depressing chart in the world. It shows that even some of the smartest people around still can't accurately forecast something that is more stable than most things. What hope is there of forecasting commodity prices or share prices?

Home again, home again, jiggety-jog. Our markets are flying high again today, following the lead of Asia, Hang Seng up 3.2% and the Nikkei up 2.8% thanks to strong export data from China. Anglo is up 9% this morning and up an amazing 150% since January! The next big data point for today is our retail sales out at 13:00 and then US retail sales out at 14:30. Enjoy all the green!

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment