"I really feel that Amazon now have the size and scale for world domination. The Prime membership is genius. You have 80 million users who have logged in their credit card details. All it takes is one click to make a purchase. You can attract more subscribers with incredible content such as movies, series, gaming and live sports. They are in all the right pockets of growth. Once you are a member, the services available are amazing."

To market to market to buy a fat pig Wow, what a day to have off yesterday! The trump tax plan, earnings flowing thick and fast on the US front and then Mediclinic coming out with some good news pushing their London share price up 16%! First things first, our market had a strong finish to Wednesday finishing the day up 0.8% with the likes of Mondi and Richemont reaching their 12 month highs.

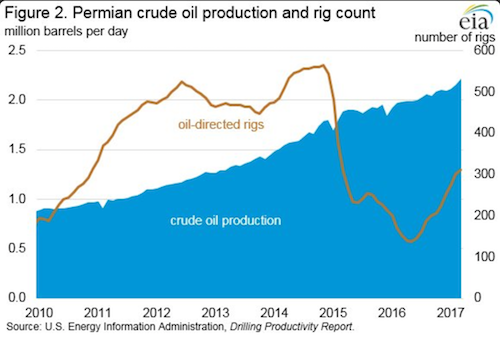

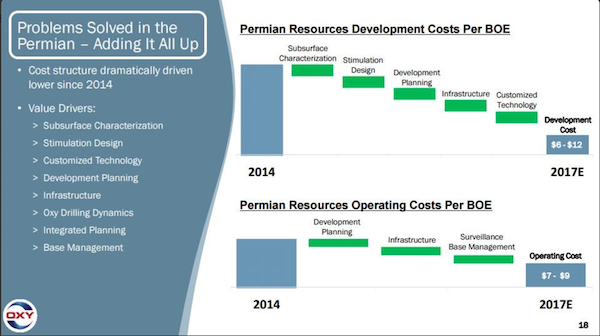

Onto the news pushing Mediclinic up 16% in London yesterday. When oil prices dropped from over $100 a barrel to $30 a barrel, government coffers in the UAE where under pressure. To help a bit with a budget shortfall, Abu Dhabi implemented a hospital co-payment of 20% on the 1 July 2016 if citizens went to private healthcare providers. The impact of the co-payment was estimated by Mediclinic management to be around AED 150m (around R540m) on revenues for the 2016/17 financial year, the final numbers for that period will be published on the 24 May. The co-payment seems to be dropped now, here is the official SENS from the company.

"Mediclinic International plc, the international private healthcare group, notes statements made on 26 April 2017 by His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces. His Highness has ordered the waiving of the 20% co-payment for holders of a Thiqa medical insurance card, when receiving treatment at the private healthcare facilities in Abu Dhabi, with immediate effect. The statements have been reported on the official news agency of the UAE (Wakalat Anba'a al Emarat). The Group awaits to receive precise details of the changes from the Health Authority Abu Dhabi ("HAAD")."

So still some uncertainty around exactly what will happen but if this does come to pass, it is good news for demand of healthcare services.

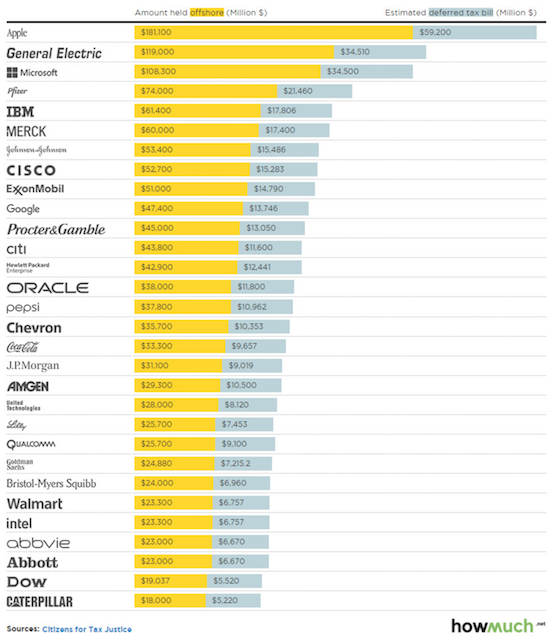

Then there is Trumps new tax plan, which looks to cut corporate tax rates from 35% to 15% along with changes to personal income tax and inheritance taxes. The plan is still light on details, particularly around what will happen with offshore earnings. Even if offshore earnings are taxed, as is the current system, the gap between tax friendly jurisdictions and the US will narrow considerably, meaning that the problem of paying a huge tax bill to bring money back to the US is not really there anymore. Lowering taxes means that the budget deficit looks to be getting bigger, the argument though is that lower taxes leads to more economic investment which leads to more economic growth and then higher tax collections. Economists are very divided on that logic, either way business leaders are very happy to be paying less tax. Even though the current tax plan is very light on details, the few political analysts I have read don't see it getting through congress. A light version, something that doesn't mess with the long term debt situation of the US could be passed by just Republicans, assuming that they are all on the same page and vote together. Getting bigger tax restructuring done will require a handful of Democrats to vote in favour of the change. In short ,expect deal making levels to go up in Washington as a bill is hammered out, time will tell how much if any change will come.

Company corner

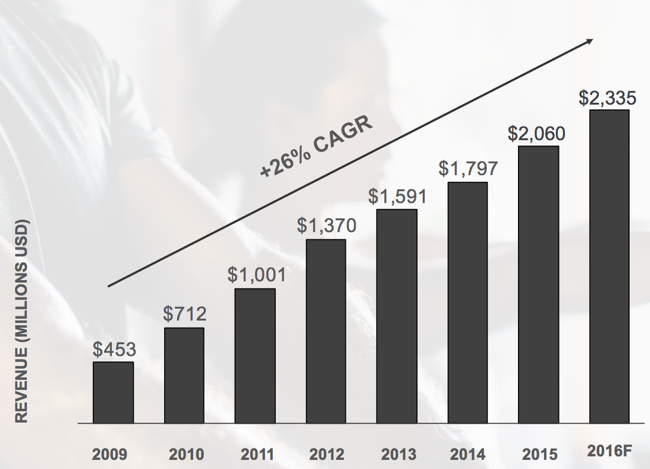

Amazing Amazon just continues to thrive. They reported first quarter 2017 results last night which the market took kindly to. The stock is up 4% after the close, touching on $954 a share! Before we go through the many highlights, let's look at the numbers.

Revenues came in at $35.7bn which is up 22.6% yoy beating consensus of $35.3bn. Operating income breached $1bn while operating cash flow grew 53% to $17.6bn. Earnings per share smashed expectations, $1.48 vs consensus of $1.08. As you can see, price to earnings is off the charts. But Amazon is still in it's infancy. Quite incredible for a company with a market cap of $440bn.

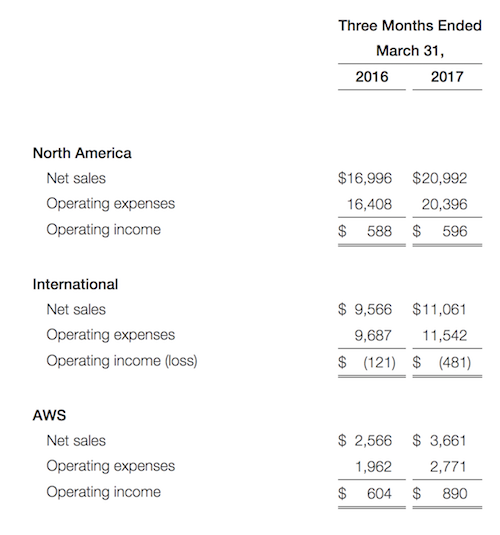

The company reports in 3 segments. North America, International and AWS (Amazon Web Services). See the image below for the break down.

Note the huge growth in sales in it's most mature market, North America. The International segment is still fresh and new. They have invested heavily in India, here is what CEO Jeff Bezos said about the region.

"Our India team is moving fast and delivering for customers and sellers. The team has increased Prime selection by 75% since launching the program nine months ago, increased fulfillment capacity for sellers by 26% already this year, announced 18 Indian Original TV series, and just last week introduced a Fire TV Stick optimized for Indian customers with integrated voice search in English and Hindi."

When I was there a few months ago I noticed a big Amazon presence. To avoid the traffic in that place, buying online is a no brainer!

AWS is also thriving and is their biggest profit driver. Web services is a competitive industry with the likes of Microsoft and Google also getting in on the act. But Amazon have a fantastic reputation and will continue to leverage off this cash cow to grow other parts of their business.

When Amazon reports results they list a bunch of highlights for the quarter. Considering that this is for a period of 3 months, the highlights reel is always impressively long. A few that stood out for me in this report are the following:

Amazon signed a deal with the NFL as it's exclusive partner to deliver live streaming of Thursday Night Football to Amazon Prime subscribers. The race to stream live sports is on and with Amazon's resources and an estimated 80 million Prime subscribers, I think they may win it.

Launching Prime in Mexico with over 20 million products available.

Amazon Fresh (groceries) is now available in Japan, the UK and 21 Cities in the US.

Original content breaking viewership records in Japan and Germany.

I really feel that Amazon now have the size and scale for world domination. The Prime membership is genius. You have 80 million users who have logged in their credit card details. All it takes is one click to make a purchase. You can attract more subscribers with incredible content such as movies, series, gaming and live sports. They are in all the right pockets of growth. Once you are a member, the services available are amazing.

Now all they have to do is spread their wings and grow globally. India makes sense with it's untapped 1.2 billion people (of course China has Alibaba and Tencent providing similar services). At least content does not require massive logistic and infrastructure spend which allows them to easily operate in many new regions (like South Africa). But I am sure that they will target online retail wherever they go in time. The concept of buying online is relatively new but the shift is real.

There are many competitors out there with regards to online retail, content, web services and hardware. Many of them are Vestact recommended stocks. In my opinion there is enough room and enough growth off a very low base for all these businesses to thrive. With Jeff Bezos at the helm, Amazon will dominate for many years to come. Investors should hop on for the ride.

Linkfest, lap it up

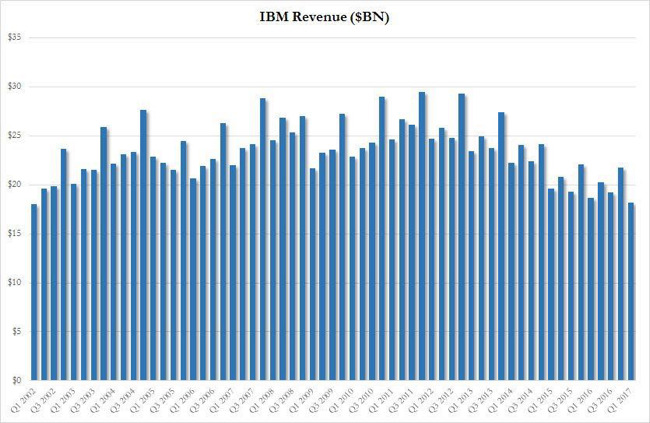

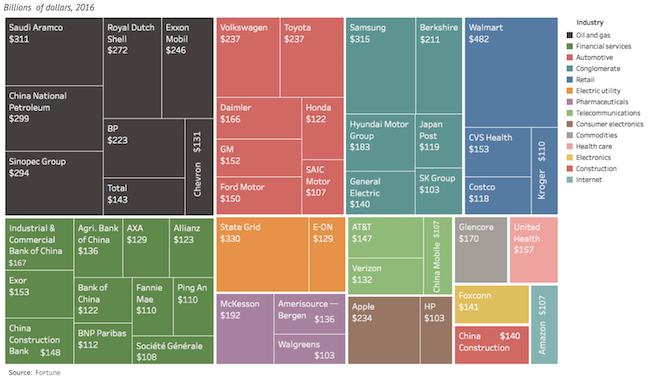

Here is a look at the revenues of the largest companies in the world, to give you relative size, remember that South Africa has GDP of around $300 billion - The World's Largest 50 Companies by Revenue

I was surprised to see the production cost differences between Apple and Samsung - Samsung's Galaxy S8 Is Expensive to Build

You will find more statistics at Statista

You will find more statistics at Statista

The downtime that commuters have is turning out to be lucrative for e-tail, the busier the better! - Busy commute equals increased buying. I'm not sure how someone even operates a cellphone when they are sharing a square meter with four other people.

"On average, across all the trains, the purchase rates went up 45 percent when we went from two people per square meter to five people per square meter."

Home again, home again, jiggety-jog. Numbers also out from Cerner and Alphabet looked good, the stocks are currently both up 4% in after hour trading. Starbucks on the other hand missed what analysts were hoping for, the stock is down 4.5% in after hour trading. We will cover all these numbers in the coming days, for now enjoy the long weekend ahead!

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063