"That is all very nice and theory is excellent (who doesn't love a good equation?), what does it mean in practice? The consequences might actually see a conservative banking sector pull their horns in even more, to reduce risk. And that may well mean that unfortunately Mr. and Ms. Consumer will find it harder and harder to borrow money."

To market to market to buy a fat pig Local banks were sold off, again. A downgrade on banks debt, local banks that is. Banks in South Africa have always operated in a very favourable environment, from a regulatory point of view. They have always been well capitalised. They have always been prudent. They have always been well managed, they certainly attract some quality people. Whether or not the seven banks and financial institutions are at a "price" that is right, that is different.

S&P - Ratings On Seven South African Financial Institutions Lowered Following Similar Action On Sovereign.

"We lowered our ratings on the financial institutions because we do not rate South African banks above the foreign currency sovereign credit ratings. This is because of the likely direct and indirect influence of sovereign distress on domestic banks' operations, including their ability to service foreign currency obligations."

There was a special HotStocks show yesterday, our own Paul was unconvinced that all the bad news was baked in the cake. So whilst the stocks have taken a leg down, there may be major bumpiness in the coming weeks and months. Here is a piece that has Paul and Adrian Saville, with Bronwyn Nielsen asking questions - Despite downgrade S.A's banks are well capitalised.

Mike Brown, the CEO of Nedbank was also on the box, trying to explain the downgrade. Standalone view of the institution first and then a wraparound at a country level. Brown speaks of a valuation metric called the Gordon growth formula (Dividend discount model), which takes into account the ability to grow the current dividend. Of course, the model does not take into account a situation where dividends are flat, lower or even suspended. It is basically to find the net present value (the share price today) based on the future dividend flow.

Heck, your guess is as good as Gordon and Shapiro, the two folks that put the valuation metric forward in 1959, based on work done pre the Second World War, by a chap called John Burr Williams. A doyen of fundamental analysis, Williams is not spoken about enough. Williams "invented" the theory of discounted cash flow analysis, which utilises the concept of time value of money. Now, and bear with us a little, the weighted average cost of capital (WACC) or just the "cost of capital" is the cost of the companies funding.

And in this case, the banks cost of funding will increase as the risk is heightened. i.e. they (the banks) will have to pay more. And as such, Present Value (the current value of the share prices), must be lower to compensate for the higher cost of funding.

That is all very nice and theory is excellent (who doesn't love a good equation?), what does it mean in practice? The consequences might actually see a conservative banking sector pull their horns in even more, to reduce risk. And that may well mean that unfortunately Mr. and Ms. Consumer will find it harder and harder to borrow money. Sadly that does not bode well for local economic growth. That is what we think may happen. Of course, the situation is very fluid. Stand by for more volatility in ZA inc. stocks, in particular the banking stocks.

Let us try and look at their returns in Dollar terms, we know their Rand returns since last Monday, when the Rand clocked 12.30 odd to the US Dollar. Currently around 13.81 to the US Dollar. We don't have access to all of these share prices, as they are not all listed in different places. Investec and Old Mutual are. Old Mutual in London is down nearly 17 percent in 9 trading sessions. Investec is down nearly ten percent. Standard Bank has a rather illiquid ADR program, it trades in the OTC market under the ticker SGBLY in New York. Since last Monday, the stock is down 22 and a half percent in Dollar terms. For the record, Standard & Poor's do not rate Standard Bank. There is an unsponsored FirstRand ADR with no liquidity whatsoever, that is down 25 percent since last Monday. I would not take anything from that, the liquidity is horrible.

So the offshore holders of FirstRand, Standard Bank and Nedbank, and the others, have taken a caning. The banking index has lost over ten percent since last Monday. And in Dollar terms, much worse. I feel for the Chinese and their investment in Standard Bank, they (ICBC) bought and subscribed for new shares at an average price of around 123 Rand. The Rand to the Dollar was around 6.80. 18 Dollars a share, more or less in October 2007. The Dollar price of Standard Bank shares is around 9.90. In a decade, the Chinese bank, who bought an African powerhouse in the banking sector, has lost nearly half of their money.

Session end, our markers had given back 0.14 percent, financials had lost half a percent, banks gave up one and three-quarters of a percent. Industrials were up a little. There were unfortunately a whole host of new twelve month lows, Coronation, Life Healthcare, Remgro and Italtile. In the 12 month high category, Sappi, Exxaro, Northam and Kumba, exposure to resources and geared to the Rand.

Over the seas and across the oceans, stocks in New York, New York, registered a marginal gain. The Dow climbed 0.07 percent, the nerds of NASDAQ added one-quarter of a percent, whilst the broader market S&P 500 added one-fifth by the time all was said and done. Amazon finally lost some ground, that story knocking around about Bezos looking to fund his rocket business coming to the fore. Blue Origin is the name of the business, it has been around for 16 years. Bezos apparently spoke about space in his valedictorian speech. They (Blue Origin) have had many launches. They have some collaborations with Boeing and NASA. Imagine, a little guy from Joburg and a little fellow from Albuquerque are shaking up the space race.

Evan (Ev) Williams, the Twitter co-founder is selling 30 percent of his stock. That sucks for long term holders. He is the largest single shareholder at an individual level. Check out his post - Why I'm selling some Twitter shares. Reasons:

"It actually pains me to be selling at this point, but this sale is all about personal context, not company context. Here's the short story: I like to invest a lot in things I care about. For example, I'm the largest LP at Obvious Ventures, which has invested in over 35 world-positive companies. In addition, my wife and I have done a fair amount of philanthropic giving and-especially in the last year-upped our political donations significantly"

Obvious Ventures? Ev, good luck with that!

Linkfest, lap it up

The speed of fast retail is something that astounds me, it is amazing that from start of concept to in the customers hands is less than a month - A new generation of even faster fashion is leaving H&M and Zara in the dust. Quick, cheap and only valid for 1 season is where the retail industry is currently sitting.

Making things as easy as possible for entrepreneurs to get going is important, it helps fuel growth and job creation - $9 billion startup Stripe is automating the complicated process of starting a company. Have you recently tried to open a company bank account with all FICA hoops to jump through?

Given that Visa is one of our core holdings, it is always good to know which card people search for the most in each country - Most Popular Credit Card By Country: Visa, MasterCard Or Amex.

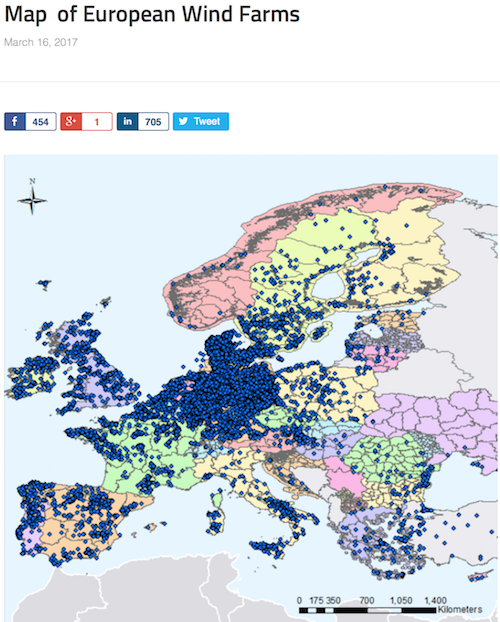

I didn't realise that Europe produces so much power from wind - Map of European Wind Farms. For perspective Medupi will produce around 4 800 MW of power, once it is completed.

Home again, home again, jiggety-jog. Non-Farm payrolls today. Yes. That is the truth sports lovers. Nice rain everywhere last night. Marches, if you are partaking, good luck with that. Give it your best.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment