"Lean in here, just to hear an amazing number. Total average deposits clocked 1.3 trillion Dollars (in a low rate environment), up 7 percent relative to the first quarter of 2016. Total loans ticked up 4 percent to 958 billion Dollars, again, an eye popping number."

To market to market to buy a fat pig The All Share went from green to red yesterday shortly after lunch, closing down 0.24%. The movers and shakers were Kumba Iron Ore up around 5%, clawing back some of the huge drop the day before. On the other end though we had Pick n Pay down around 4.5% after publishing their full year numbers. The numbers themselves didn't look too bad, HEPS and Dividend were up 18% but the top line number is what was the problem. They increased turnover by 7% or only slightly more than inflation. The stock is priced as a turn around story, meaning there is a high expectation for solid growth. You can only improve operating costs so much before you need strong sales growth to be the driver of increased profits.

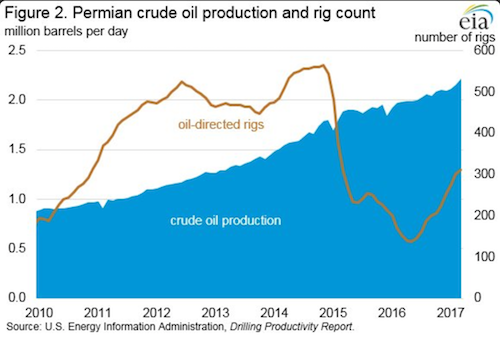

Good news for consumers, oil dropped by over 3.5% after data out of the US showed that oil inventories were decreasing much slower than forecast. The implication is that the OPEC deal to cap production has sprung a few leaks, continued support for the production cap may be limited, what a twist. Even as global demand for oil has risen the impact of production caps from OPEC have become less and less significant thanks to the Frackers. Here are two graphs about how things have changed for the frackers over the last few years. First, here is what production numbers have been over time. Note how even though rig numbers fell at one point the production output didn't.

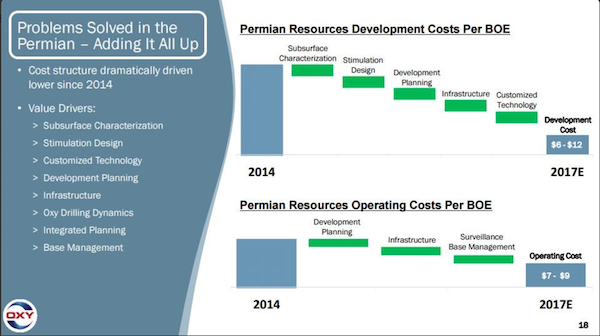

A more significant graph is how the costs relating to fracking have plummeted. Remember that OPEC's original strategy was to push oil prices down thus causing the frackers to go out of business? Thanks to technology, less and less producers will be impacted if that strategy is implemented again. If anything OPEC member nations will sink first with lower oil prices.

Company corner

Wells Fargo reported numbers last week. At the same time, Berkshire, the biggest shareholder, sold down shares to below 10 percent. Reason being is in part that the shares in issue have reduced, as a result of buybacks from the company. Fewer Wells shares in issue means higher holding by Berkshire, as they are not a seller. Regulations then forced Berkshire to sell down its position. The numbers themselves were OK. The company of course has been in the news for all the wrong reasons, recent executive clawbacks of shares are a step in the right direction of normalising the behaviour of the staffers in question. Of course the stink associated with the scandal meant that the chief was axed and the board moved swiftly to restore credibility.

To the numbers for Q1 2017! Net income was flat at 5.5 billion Dollars on revenues of 22 billion, relatively light for what the market expected. Earnings per share registered a Dollar exactly, the market consensus was three cents lower than that. Lean in here, just to hear an amazing number. Total average deposits clocked 1.3 trillion Dollars (in a low rate environment), up 7 percent relative to the first quarter of 2016. Total loans ticked up 4 percent to 958 billion Dollars, again, an eye popping number.

Credit quality improved, provisioning expenses were lower by 44 percent. Good news! Consumer balance sheet repair continues. What is more interesting is that online and secure sessions (what we know as internet banking) continues to gain momentum at the expense of the branch visits. I am sure that when people eventually come around to being less interested in the physical interactions, and more at peace with the online transaction, that costs can be further curtailed. Branch interactions are actually up from Feb to March, down heavily year-on-year though.

The real question arises, why own this company? And is the stock fairly priced at these current levels? Firstly, the USA is where animal spirits are encouraged. The USA is a place where capitalism and risk taking is encouraged, and has been for the last 250 odd years. The champagne socialists will tell you otherwise, the real hardcore two-piece short sleeve Mao suit wearing socialists will believe otherwise. The truth is, more people have been lifted out of poverty by forward economic momentum of the capitalistic kind than at any other point in humanity. The US continues to have a growing population, forward momentum in terms of household formation, and a growing economy. Wells Fargo is a good proxy for housing in the US, it is a good proxy for the economy in the US. Until recently, they were a good proxy for the gold standard in risk free banking ownership (of the stock).

What about the price? The stock fell in response to the earnings. Recently the chair and the CEO bought shares in the business after the price fell, around 5 million Dollars worth. I suppose that is as good an endorsement as it gets. This is Stephen Sanger (chair) and new CEO, Timothy (Tim) Sloan. The stock trades on 13x historic earnings, with a pre-tax dividend yield of close to 2.9 percent and around 12.2x forward. It is hardly expensive, yet lower rates may well mean that interest earned may be lower than anticipated. i.e. the idea that the Fed won't raise rates as much as anticipated. We own the stock as a stable part of the portfolio, reliable, yet a proxy for the US economy. We continue to be patient, the share price should expand later into the year as the US economy improves, and interest rates rise.

Linkfest, lap it up

A current topic that has grown momentum over the last few years is the level of global inequality. One part of the discussion that many people forget is how quickly the global pie has grown over the last century - 2016: the "Year of the 1%" or the Year Poverty Fell to a New Low?

When cars crash, wealth is destroyed in society even if it wasn't your car in the accident. An increase in accidents means higher insurance cost for you, higher cost of the materials that go into cars and increased time in traffic - Study confirms we all use our phones while driving. With a phone addicted population self driving cars can't get here fast enough?

"It is estimated that a 2-second distraction increases the risk of a collision by 20 times."

I'm not sure if my wife would be keen to stay here, it looks like a huge opportunity for Disney though - Disney wants to launch a 'Star Wars' starship luxury resort, and it looks like a fan's dream.

Home again, home again, jiggety-jog. The Rand is having a strong morning, getting closer to that $/R 13.00 level and below the Pound/Rand 17.00 level. With the UK parliament green lighting an early election expect some Pound volatility for the next few months as political parties woo voters with promises about the future.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment