"Bondholders (i.e. who the company owes money to), are either forced to take a haircut (cents in the Dollar) or take equity. Equity holders are normally wiped out. In the case of GM, they did (and still do) have major pension fund obligations to meet. i.e. to pay their retirees. As medical health has improved markedly, people live longer."

To market to market to buy a fat pig The Rand weakened overnight and then strengthened through the session. Politics and sentiment collide with the markets, there are people making real life decisions on the ground. Whether or not to invest in something that is cheaper and lasts three years, or whether to buy the equipment or install something that lasts 5 years or more. There is much that has changed for the positive in South Africa over the last quarter of a century, a lot of it is a vibrant and cheerful youth, that is demanding. You get to see a lot of that in the urban areas.

And then there was a report by Moody's, another one of the ratings agencies - Moody's places South Africa's Baa2 ratings on review for downgrade. That was a couple of night's back. Their rationale is simple and I guess to the point: "Changes within a government do not generally signal material changes in a country's credit profile. Here, however, the timing and scope of the reshuffle raises questions over the signal they send regarding the prospects for ongoing reforms, the underlying strength of South Africa's institutional framework, and the fragile recovery in the country's economic and fiscal position."

Why should one care about what a ratings agency thinks of sovereign creditworthiness? Think of it this way. You have a pension. Your pension fund has obligations to meet monthly, i.e. to pay out their pension fund holders their monthly salaries. They need income by way of dividends and interest payments from fixed income instruments, that includes cash, property rental payments and of course debt issuances by both governments and businesses. They can also sell assets to shore up cash reserves.

Some debt is more risky than others, for instance, General Motors, one of the most powerful businesses in the world once upon a time, went bankrupt and "reorganised". A Chapter 11 bankruptcy, mostly used by big institutions. At the time of the GM bankruptcy, the company reported nearly 173 billion Dollars worth of debt and obligations and only 82 billion Dollars of assets, you can read the Wiki entry - General Motors Chapter 11 reorganization.

Bondholders (i.e. who the company owes money to), are either forced to take a haircut (cents in the Dollar) or take equity. Equity holders are normally wiped out. In the case of GM, they did (and still do) have major pension fund obligations to meet. i.e. to pay their retirees. As medical health has improved markedly, people live longer. And pension fund obligations run longer than their actuarial calculations. In other words, they have to pay more people for longer. The successes of the healthcare industry was and is a series of own goals for the GM pension fund. The financial crisis was the last straw, sales cratered and the company folded.

In the lead up to GM folding, bondholders would have looked for advice of whether or not the rather "cheap looking" bonds of GM offer value. What is the ability of the organisation to pay back their money, to meet their coupon or interest payments? That is the function that credit ratings agencies fulfil. They let the investment world know. The advice is either the dumbed down press release, or you can actually buy (in this case, the Moody's document is 250 Dollars) the report. It may be the best (or worst) 250 Dollars you ever spend. Their advice is paid for, by investors who have much to lose or gain, by owning sovereign bonds of multiple different countries.

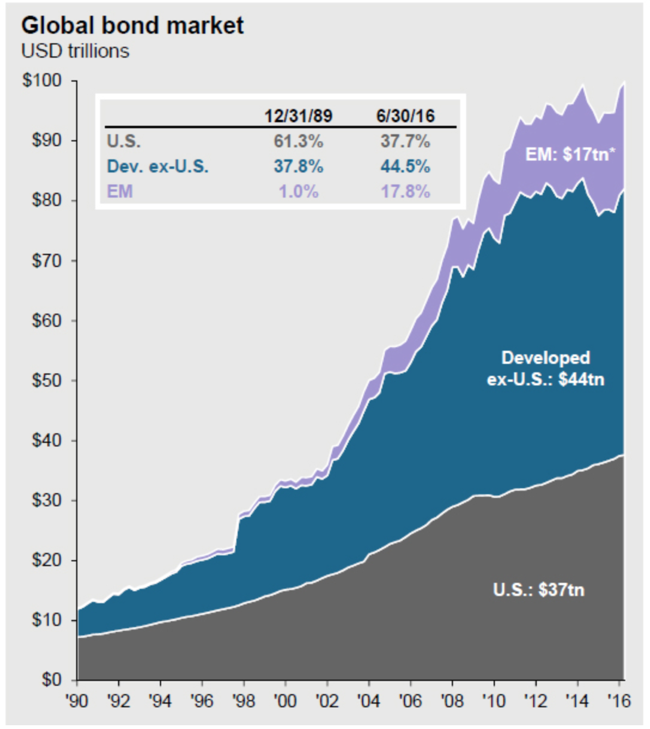

For instance, in the US (as per the third quarter of last year - Debt securities issues and amounts outstanding, in billions of US dollars), there is nearly 38 trillion Dollars in debt securities. Nearly 16.8 trillion is US government, 15 trillion of that is financial institutions and 5.83 trillion is non-financial corporations (like GM of course). The pool is very deep and very liquid. It suddenly makes our 2.3 trillion Rand (170 odd billion Dollars) competing for these flows look hard. South African debt issuance is less than half a percent of total US issuances. So ..... you see what I am saying? And if foreign ownership of Rand issuances is 35 percent, those folks have multiple choices. In a deep and liquid pool. See what I am saying?

There is apparently 217 trillion Dollars of global debt, 100 trillion Dollars worth of government debt. Our 170 billion Dollars is a drop in the ocean. Courtesy ZeroHedge (I know, my least favourite place), is the graph of the global bond market:

I think the only point is that people have choices. That is all that I am trying to say. If they are lead to believe that the debt is riskier, then they will go elsewhere. Remember of course that debt issued is an asset elsewhere, something that the person lending the money knows. They expect their capital and interest payments to be honoured, the person borrowing the money has every intention of doing exactly that, paying it back.

Stocks in Jozi, Jozi added nearly four-tenths of a percent by the close. Amplats, AngloGold Ashanti and South32 were the best performers on the day, Mediclinic, Bidcorp and Aspen were not. There were quite a number of 12 month lows, the JSE (the company) share price continues to rattle lower, Remgro too. Noticeably, Netcare and Life Healthcare (involved with rights issue currently) are on that trajectory.

In the 12 month high category, we saw Richemont, Sappi, Northam, Mondi and Exxaro, all companies that benefit from a weaker Rand. Exxaro may benefit from the flooding in the aftermath of the terrible weather in Queensland, Australia. How so? Well, with some of the big coal country being flooded and temporarily unable to produce, coal prices may head higher for a while. That is good for Exxaro, see - After Australian cyclone, coking coal spikes as China chases U.S. supplies.

Resources added nearly a percent and a half on the day, as a collective the 10 companies there are up nearly ten percent in 7 trading sessions. Over five years resources 10, the index of the 10 biggest, is still down around one-third. The overall market is up 56 percent in that time, Industrials are up 116 percent. It matters what you own, if you own the overall market and continue to invest over time, you will find the index helps most retail investors than structured products, that are expensive and opaque.

Stocks across the oceans, in New York, New York, finished higher, driven by energy and non-cyclical consumer goods. The Dow closed around one-fifth better on the day, the broader market S&P 500 and the nerds of NASDAQ had more muted returns, a winning session nonetheless. Did you see this? Richmond Fed President Lacker says he was involved with Medley leak, announces immediate resignation.

Amazon had another good session, news came late that they were going to be streaming some Thursday night NFL matches. Not really that big, in monetary terms, 50 million Dollars is not "huge". It is however another sign that the streaming businesses, in this instance, Amazon Prime, are looking at content in the sports arena. It may mean that the company has users that are able to pick and choose. Choice is a good thing for the consumer, it drives prices lower and improves the experience. For the record, Apple clocked an all time high. The market cap is now comfortably over three-quarters of a trillion Dollars. Or over ten trillion Rand, 10.242 Trillion Rand. Wow. That is quite a lot now, isn't it?

Linkfest, lap it up

How would this work, Robot tax? Surely the business pays taxes? One San Francisco Politician is exploring a tax on robots

My goodness. A diamond that is so big that it weighs your hand down. You could not really wear this, could you? Sotheby's Sells Record $71 Million Diamond to Chow Tai Fook.

Talking of streaming and sport, ESPN has the most to lose if they don't adapt to the changing landscape. This is a comprehensive look at ESPN, where they have come from and going - ESPN Has Seen the Future of TV and They're Not Really Into It

The story starts out as follows: "What can blind tadpoles teach us about improving organ transplants, correcting birth defects and curing cancer? A lot, it turns out." Migraine drug activates transplanted eyes in tadpoles. Not science fiction!

Home again, home again, jiggety-jog. Stocks locally have started marginally better. Stocks across Asia are higher on balance. The sun came up. Brexit was still real. And some less desirable candidates in France lost some ground in a presidential debate last evening. We shall see my friends.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment