"The share price graph is flat. Expectations were great. This happens, where there is a run up into what seems like an amazing business (which it is), the market expects more. Now may well be the right time to strike (a pose). It seems we may have gone from a time of "sleeping hero" and "pigeon" (downward dog?) to locust and cobra. Know your yoga positions people."

To market to market to buy a fat pig A good day in Jozi for stocks, the all share index added nearly three-quarters of a percent. Financials added nearly a percent and a half, industrials as a collective added four-fifths of a percent. Kumba fell over six percent, Anglo dropped a percent. Amplats and AngloGold Ashanti roared ahead and were at the top of the leaderboards, the banks reacted positively, there was chatter that Barclays Africa would not sell at these depressed prices.

Two years out, all the major banks trade on multiples in the high single digits, with some yields pushing 8 percent (Barclays Africa). I mean, if the forecasts are right, Barclays would be selling "ABSA" at a current multiple of 8.1 times on a dividend yield of 7.2 percent (pre-tax). That hardly sounds like they (Barclays) would be getting a good deal. In fact, it sounds like a horrible idea. To be fair to the market and the present levels that Barclays Africa trades at, the multiple has been this low since 2014, the highest is around 13.5x in 2015. The stock hasn't got above a ten multiple this year, or 2016 for that matter. Mid single digit earnings growth is expected from the company this year, for a very cheap 7.5 times forward multiple. And a yield of nearly seven and a half percent.

It (Barclays Africa) is, at these levels over the last few weeks, trading at the bottom end of the "low" area. The market is still not convinced. Too much noise around .... credit ratings downgrades, political noise, general economic weakness and all in all, uncertainty. The kind of uncertainty that leads to business investment paralysis, of the kind that effectively sees people in freewheel mode. Capital has many choices, to lie and wait, to look for others pastures to survey the lay of the land, or to "get active". I am afraid that a lot of people are thinking along the first two lines. Once capital leaves, it is unlikely to return any time soon.

I saw a tweet from Wayne McCurrie (Ashburton Investments) that suggested that corporate credit markets are currently frozen. He said that MTN and Barloworld had to cancel issuances. He also suggested that Transnet was looking for 300 million Rand, and only got 20 million Rand. I am sure that when "things" settle, it will look a little more favourable for issuances. At least I hope so, if investors are shy, then things may get tougher. And added to that is the fact that we should see an 80 cents per litre increase (more or less) in the petrol price at current levels. So, it is possibly fair to say that in this type of scenario, with the consumer and business environment looking "sad", perhaps the banks are currently on exactly the correct rating. Meaning that the market is discounting the stock price based on the unknown-unknowns, to borrow a Rumsfeldian phrase. It is what it is.

Just this morning the folks from BHP Billiton have come out with a review of (the) Elliott proposal. The company views the proposals as a little short sighted. And what is interesting is the part about local (Jozi listed) shareholders:

"South African shareholders, who comprise 17 per cent of the BHP Billiton Plc register, would face particular risk as they would not obtain capital gains tax roll-over relief and might need to pay tax under Elliott's proposal."

Under that scenario, I would be totally against this! The ending is a "thanks, but no thanks" answer to Elliot. I suspect that they are going to have to do a lot more work than this, to get what they are looking for. As I said to some of the fellows in the office, for all we know, they have unwound the structure anyhow. The stock is down a little in Aussie, having fallen initially on the news, bouncing a little as we write this. Spot on Bevan, tell 'em to fob off. Unless Elliot can come back with more gunpowder and take a meaningful stake in BHP Billiton, they are just small shareholders. Sure, I buy the fact that they are owners of the business, then again so are the other 96 percent, and the current trajectory may be better for them, as owners of the business.

Stocks in New York, New York, ended better than the session start, closing marginally away from the prior session for the Dow Jones Industrial Average. Down 0.03 percent by the close for blue chips. The broader market S&P 500 gave up 0.14 percent, whilst the nerds of NASDAQ lost nearly one-quarter of a percent on the session. Losers included some of the major tech stocks that have had good runs YTD, Facebook and Apple losing a little ground.

Much of the weakness in equity markets was attributed to the geopolitical picture and the heightened risks in recent days. Syria and North Korea are the hot spots. The recent strikes on an airbase in Syria in response to a chemical weapons attack on civilians, and the deploying of a US aircraft carrier to near North Korea being seen as a sign that "stuff" is getting real there. China have sent 150 thousand troops to their border with North Korea. Is that to show solitude or just an act? Either way, this is somewhat reminiscent of the Cold War, chess pieces being moved all over the show.

The Chinese do not want the North Koreans to get friendly with the Russians, nor do the Americans. The Chinese do not want the North Korean regime to be friendly with the US South Koreans, and I am sure the Russians do not want that either (they share a border with North Korea too). It is a case of 25 million people living under a tyrant, who could do so much better with their brothers and sisters to the South. The South, for historical reasons, has a capitalist economy and high standards of living, due to the relationship with the US post the Korean War.

The North is ..... nothing short of a disaster. It forms an important geographical buffer for both Russia and China, away from "the West". Let us just all admit that it is complicated. The nuclear bomb aspirations of the North Koreans (or a few people to be precise) makes the Japanese very nervous. And it makes the people living on the West Coast of the US very nervous too. Let us just say that is the one thing that worries Warren Buffett the most, he has made that known several times. Syria? That involves the Russians and Americans too. And many fleeing citizens that have to put up with a hostile reception in Europe and further afield. Again, this is very, very complicated.

As we have said, many times in the past, and I am sure many times in the future too, politics is a tricky old business. It changes, it can be stuck, very fluid and definitely impact on markets. The trailing PE multiple of the South Korean market is around 12.5 times, it is cheaper than many of their peers across the region, bar for China. As a result of geographical proximity to North Korea and potential conflict, investors are always putting a lid on valuations in that region. Russia may be the cheapest market in the world, in Dollar terms at this stage. Again, as in the banks and South African scenario above, sometimes cheap for a reason.

Company corner

I have been meaning to write about this for over a week, the Lululemon Athletica results. There has been, how do we put this mildly, a lot on the go. Lululemon manufacture and sell high quality yoga and running apparel. It is not cheap, at 118 Dollars for a pair of yoga tights, 198 Dollars for a jacket, 118 Dollars for a swimming costume and even a simple visor costs 32 Dollars, this is at the top end of the apparel range. You can even buy a reversible mat, towel and water bottle for a combined 100 Dollars. Or a duffel bag for nearly 150 Dollars.

So who shops at Lululemon Athletica? Someone who wants and needs fashionable and comfortable items for athletic and general wear. You certainly have choices. I did a couple of searches, Yogasmoga for instance is more expensive. Nike, the same range tights are around 115 Dollars. Adidas sells cheaper tights. Under Armour sell cheaper and more expensive tights, depending on the quality.

At the end of the day, for a consumer that likes a luxurious product, that is durable and crosses over into fashion, they will be the core consumer of the apparel. Someone who exercises once or multiple times a day that likes to be comfortable, and the added style and comfort has a serious price tag attached to it. It is a fairly crowded space, equally, it is a space with room to grow. The brand has a loyal bunch of followers, the main gripe recently has been a lack of colour in the range. OK, time to have a look at the numbers.

Check out the Lululemon athletica inc. Announces Fourth Quarter and Full Year Fiscal 2016 Results. Revenues up 12 percent for Q4, 14 percent for the full year. The company net revenues clocked 2.1 billion Dollars. Gross profits increased 20 percent, to 1.2 billion, diluted EPS for the full year was up to 2.21 Dollars a share, an increase from 1.89 for the year prior. Mid teens growth across the board sounds like a really good outcome. Except, as is often the case, the market was expecting more from these numbers, as well as the outlook. The company expects 2.6 billion Dollars in revenues this year and diluted EPS to be 2.36 Dollars at the top end, 2.26 (which is hardly any growth) at the bottom end.

The share price fell in a heap after these numbers, down from above 66 Dollars to just above 50 Dollars, roundabout where the stock is trading now. On a low 20's forward multiple, the stock hardly seems like a steal currently. What they do have, is a growth road ahead. Although the market is relatively small and niche, the scope for multiple brands attracting a growing middle class hungry for comfortable and quality apparel is clear to see. There are multiple runways ahead for the industry.

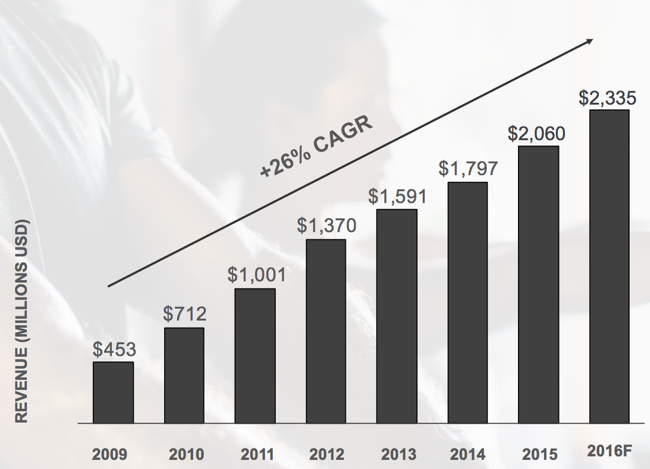

The stock has been priced right at this level. It has been stop-start for investors since 2011, the stock is up 16 percent in 6 years. Currently at 51 Dollars a share, the high in that time is 81 and the low is in the high 30's. We are more in the bottom half. From the annual report, see below the revenue growth, which is pretty astronomical:

The share price graph is flat. Expectations were great. This happens, where there is a run up into what seems like an amazing business (which it is), the market expects more. Now may well be the right time to strike (a pose). It seems we may have gone from a time of "sleeping hero" and "pigeon" (downward dog?) to locust and cobra. Know your yoga positions people. Any further weakness in the share price, somewhere in the region of 47-48 Dollars a share seems like good value, around 8 percent lower than now. Having said all of that, who knows where share prices go, I like the story over the next three to five years. It is now correctly priced.

Linkfest, lap it up

Here is why you should never buy/sell a stock based on what someone says on the TV or an article - Scammers Used SeekingAlpha for Bogus Stock Promotions, SEC Says. You have no idea what time frames or motives the person has for saying what they say.

We think Tesla is an amazing company and that Elon Musk is someone you don't want to bet against. Here is why people worry about the Tesla share price, note how much growing needs to happen just for the share price to stay at its current levels - The Numbers Behind the 'New Big Three'

You will find more statistics at Statista

You will find more statistics at Statista

AI is already changing our lives, even if you don't realise it. Here is how far the industry has come in a mere 5 years - Five years ago, AI was struggling to identify cats. Now it's trying to tackle 5000 species.

Home again, home again, jiggety-jog. Stocks have started better here, that is a good thing. Pretty much across the board. French elections in two weeks, those should be fun! Or not. The spreads on the French and German treasuries have blown out. i.e. The yields and the risks have risen in France. I suspect either way, Le Pen will come second and still claim victory at some level.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment