"Junk is not investment grade. Junk means that the pool of lenders is smaller, those willing to take sovereign risk at that level is less. It also means that any new debt has to be issued at a higher interest rate, to compensate the investor for the risk they are assuming. Which means that the government pays more in debt, rather than using the funds for infrastructure development."

To market to market to buy a fat pig You've been junked! I mean punk'd. Whatcha gonna do with all that junk, All that junk inside your trunk ... One is a Black Eyed Peas song and the other is a TV show from over a decade ago, that ran on the MTV network here. Yowsers, that old? The other, the junked, well .... that is real. The credit ratings agency, Standard & Poor's decided South Africa Long-Term Foreign Currency Rating Cut To 'BB+' On Political And Institutional Uncertainty; Outlook Negative. You may well need to sign up, it is for free and you get to read the whole statement.

It is an opinion. Investors of course can do what they want, there are another two ratings agencies that are likely to act in the coming days possibly. Most importantly for us, as per the release: "We are therefore lowering our long-term foreign currency sovereign credit rating on the Republic of South Africa to 'BB+' from 'BBB-' and the long-term local currency rating to 'BBB-' from 'BBB'." So local debt still carries a credit worthy rating, the foreign denominated one comes with a warning signal. Junk is a strong word for non-investment grade. It doesn't mean you cannot pay your debts, it means that you are going to struggle to pay your debts.

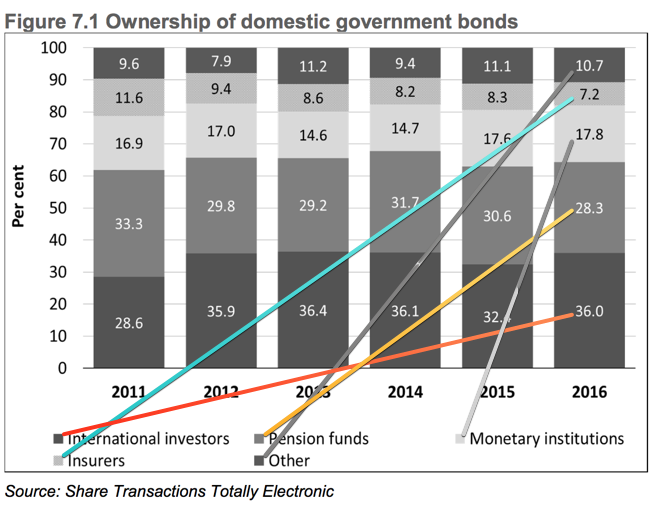

Government debt, like in many places around the world, has risen in recent years, S&P does expect it to stabilise in the coming years: "On a stock basis, general government debt net of liquid assets increased to about 48% of GDP in 2017 from about 30% in 2010, and we expect it will stabilize at just below 50% of GDP in the next three years." What does local denominated debt look like? Michael found a "nice" graphic which I tried my best to draw lines on:

As per the Standard & Poor's release, it breaks it down: "Although less than one-tenth of the government's debt stock is denominated in foreign currency, nonresidents hold about 35% of the government's rand-denominated debt, which could make financing costs vulnerable to foreign investor sentiment, exchange rate fluctuations, and rises in developed market interest rates. We project interest expense will remain at about 11% of government revenues this year."

There may be investment mandates by some of those holding Rand denominated debt that does not enable them to own debt at a certain credit rating. They may be forced sellers at some level. Although, having said that, the credit default swaps (insurance on our sovereign bonds) spreads have been widening over the last "little while", as per this Bloomberg graph below (Traders Prepare for South Africa Credit Downgrade to Junk: Chart):

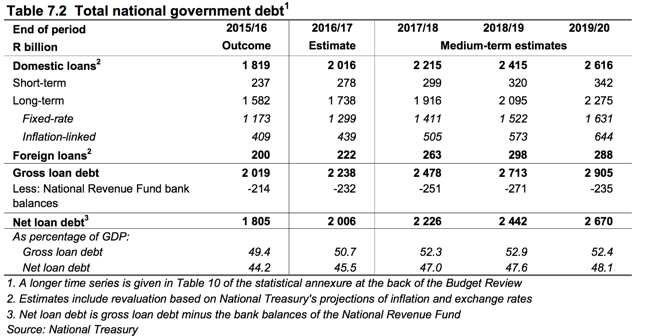

What about the foreign denominated debt? The one that has been downgraded to "junk"? Estimates by Treasury are that 222 billion Rand in foreign loans, relative to 2.016 trillion Rand in Domestic loans. If the medium term estimates expect that to grow, it may well come at a cost. Here is a table that Michael captured from the full budget review in February 2017:

It seems that in recent days and weeks, folks were preparing for this. Which is natural, the market does anticipate events. OK, so what does this mean? Is junk bad? Junk is not investment grade. Junk means that the pool of lenders is smaller, those willing to take sovereign risk at that level is less. It also means that any new debt has to be issued at a higher interest rate, to compensate the investor for the risk they are assuming. Which means that the government pays more in debt, rather than using the funds for infrastructure development, for instance. Greater infrastructure advances economic growth, which equals higher tax collection as a result of greater economic activity. Which equals more money to use for social programs.

In the end the poor pay the price of a lack of policy. A lack of investment and a lack of growth means higher borrowing rates and more money spent paying interest, currently we pay 11 percent of revenues by way of interest. Less money for schools, clinics, roads and so on, if you are paying more interest. Equally, imported inflation means that we have to pay more for food and energy. The projections, at least by Standard & Poor's, point to a low growth trajectory to 2020 and an inflation rate around five and a half percent. There is little wriggle room for the Central Bank to provide stimulus.

As we look at it, the Rand is trading at nearly 13.90 to the US Dollar, having lost over ten percent in 8 days. 17.26 to the Pound Sterling. 14.82 to the Euro. These are levels seen at the end of last year. You can imagine that there is likely to be a continued negative reaction that may result in further weakness. Know that, not necessarily by design, our portfolios are more geared to a weakening currency. As such, we expect client values in Rand terms to not be as impacted in this weaker environment, this is also due to our lack of exposure to the banks and financials, that part we have chosen. If you have queries and questions, feel free to direct them at us.

Across the seas and vast blue oceans, in New York, New York, stocks finished comfortably off their worst levels of the session. The Dow Jones Industrial average lost 0.06 percent, the nerds of NASDAQ was down nearly one-third of a percent, whilst the broader market S&P 500 ended the session in the middle of those two, down 0.16 percent. The biggest story on the session was without a doubt the Tesla production numbers (see yesterday - Q1 production numbers), as well as the seemingly cryptic tweet from Elon Musk:

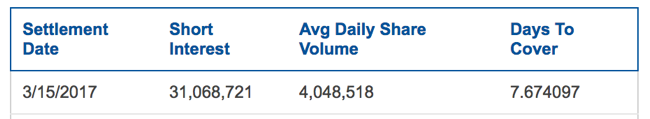

What does he mean by all of that? Well, for starters, check out the Tesla, Inc. Short Interest.

And the upshot of it all? Tesla stock up seven and one-quarter of a percent. Bigger than Ford, the market cap that is. A short squeeze. The message is that Tesla are morphing into something else, the share price may have run exceptionally hard, and is very volatile at the best of times. As a holder, you have to accept this. Josh Brown, aka the "Reformed Broker" responded to someone when making the comparison to Ford and Tesla: "Apples and Oranges. Tesla is a battery company or a platform company I am told. Ford makes metal carriages." And there you go.

Linkfest, lap it up

OK, this is complicated. Very complicated. Worth a read and maybe you have an opinion on this - Age Makes You Happier - And Poorer. The short message, don't get grumpy and conservative as you get older, as an investor that is. For kids and dogs running on your lawn, that is different.

How much would you pay for a piece of history? It turns out quite a lot: Relatively Pricey: Einstein Letter Fetches $54K at Auction.

This was a fun read this morning, it shows the weird logic that is used when the investment community is compared to every day life. There seem to be some double standards - What If Other Areas of Life Operated Like Wall Street?

Home again, home again, jiggety-jog. We have started marginally better here, around one-third of a percent to the good. Banks and SA inc. are down, Rand hedges are flying. It is a tale of two halves, again.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment