"Confidence in purchasing new capital equipment, hiring new people, expanding your business. A lot of people, instead of looking for local opportunities, have been investing offshore or sitting on cash, both of which do not boost the local economy."

To market to market to buy a fat pig In the middle of the night .... I go walking in my sleep. Remember the Billy Joel lyrics from the song "The River of Dreams"? When politics dominates my Twitter stream, then I guess you know what is on the go! I cannot comment on politics. Every single time you try and put forward a view, you paint yourself in a certain colour. Many different people have different views. We at Vestact project capitalism and market friendly policies. Capitalism is not perfect, it is far better than Napoleon and Snowball the pigs. You know, from Animal Farm, that book written by George Orwell around the end of WW2 in response to him being extremely uncomfortable with the relationship that Britain had with the USSR.

What I can tell you is that businesses and individuals make real life decisions based on what and where they invest. Confidence in purchasing new capital equipment, hiring new people, expanding your business. A lot of people, instead of looking for local opportunities, have been investing offshore or sitting on cash, both of which do not boost the local economy. That lack of demand has kept a cap on inflation, even as the Rand was weak and imported inflation would have been higher. These events have real life repercussions, business confidence this morning is possibly rattled. Inside of that, there are always opportunities of course. For the record, from Business Day - Fired, moved and retained - Who's who in Zuma's cabinet.

OK, so what is likely to transpire for the markets here this morning? I am guessing that it is a case of push and pull. Pulling from the SA inc stocks, the "pure" businesses that have Rand earnings. The companies that have primary listings offshore, or that derive most of their revenues from offshore, those will benefit. Although it is important to contextualise this "plunge" in the Rand. The Rand to the US Dollar is trading at the same level as (drumroll) ..... late January. Two months ago. I guess not all global markets have "woken up" yet. So ..... financials, banks, SA inc. stocks, retail and industrial local businesses will no doubt experience a bout of selling.

Rating downgrades and all of that? Selling of local bonds, higher interest bills and inflation starting to get out of the comfort zone? All those things, do not jump to conclusions at all. Wait. Don't shoot first and then ask questions later. No. Think. Gwede Mantashe has basically said on the wireless this morning that this list was made elsewhere, and that the party was not consulted. That is pretty big ..... don't you think? In Paul's letter at the beginning of the year, this was one of his points: "This year could bring more changes in SA politics. Things are more fluid now than before. This is good." Well .... you can view this in many different ways. For the time being, think with a clear head. Those who rush for the exits do themselves few favours.

What about the market yesterday? There was an interest rate decision. It seems so insignificant now, doesn't it? You can read it: Statement of the Monetary Policy Committee. Inflation outlook has improved. Domestic growth is muted. A line in there: "However, the rand is likely to react further to unfolding developments until a greater degree of certainty and confidence is restored." And: "Overall, the MPC assesses the risk to the inflation outlook to be moderately on the upside, mainly due to the high degree of exchange rate uncertainty." So ..... they are standing by.

Session end, the All Share index fell just over one-third of a percent, financials added over half a percent. Industrials dropped over a percent. Anglo American was at the top of the winners board, up over two percent, AngloGold Ashanti was at the bottom of the boards, down nearly four percent. Ouch. Brexit uncertainty, hard walls and the like (hard Brexit, which is worse than hard boiled eggs) meant that Mediclinic and Bidcorp (businesses in the UK) were impacted. Today .... it is going to be all over the show.

Over the oceans and deep blue seas, stocks in New York, New York ended the session modestly better than where they started. The Dow added one-third of a percent by the close, the broader market S&P 500 and the nerds of NASDAQ trailed the Dow by just a smidgen. Industrials and financials leading the charge, up ahead of the rest of the market. Healthcare stocks were marginally lower whilst utilities were the hardest hit. Trump and Xi, they are meeting next week, how is that going to go? The FT has a pretty *nice* article (subscription only, sorry), check how the pictures look the same - Donald Trump warns of 'very difficult' Xi Jinping summit.

Questions are starting to be asked about the "Trump trade". Well, I suspect that having had a setback of sorts, and perhaps not being able to do what he said he would (why is anyone shocked by that), there is a strong chance that not all the regulations and rewinds can take place. I suspect that even if not everything can happen as stated, confidence and the like is rising. Stay the course, do not be invested for politics and the like. There were results from Lululemon at the end of the session prior, the stock was trashed. I shall have a look at the results soon, and we will get back to you. Our initial thoughts are that the share price has really come back to what looks like better value.

Linkfest, lap it up

This is very interesting. How Morale Changes as a Startup Grows. "Founders can cherish the culture that they have in the honeymoon period, but must also understand that the culture will have to adapt as the firm grows - and so will the "early-adopter" employees as the next set of employees are added. "

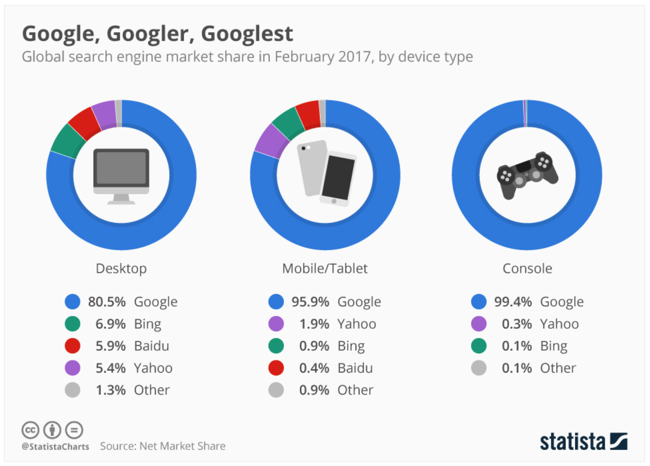

Google is still the winner in search. Via Statista, here is a chart of global search market share.

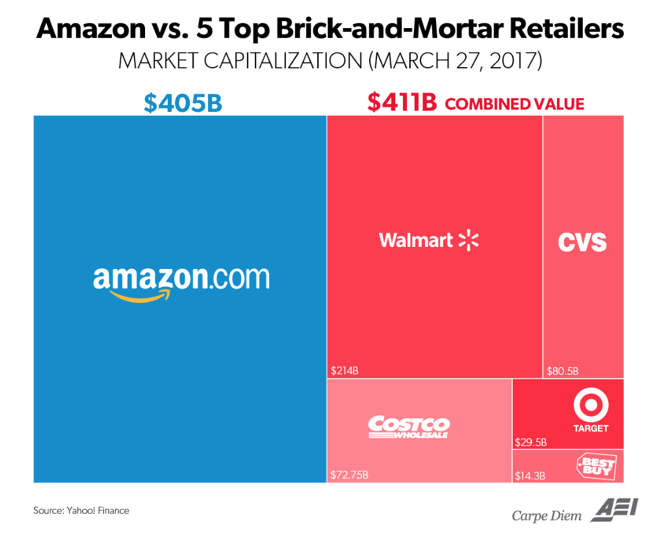

Another cracking graph of Amazon and the expectations of the market in the coming years. The market cap is now beyond 400 billion Dollars. Question is ..... is Amazon a retailer?

Home again, home again, jiggety-jog. Worse than a cabinet reshuffle is that Eddy Elfenbein is "on the road" and that there is no Friday message. What? I cannot believe that. A divergent market to begin with, the likes of Woolies and Discovery down 4 odd percent, Naspers and Richemont and the like up over two percent. Wait for the end of the weekend to see what transpires next, some people think that this is strength, others think that it is weakness. Stocks are up initially around three-quarters of a percent.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment