"Interestingly, if you lay a graph of the share price performances of Standard Bank and Nedbank over that of Barlows, they look same-same. Perhaps the stock market, which is forward thinking (you pay today for future profits), is telling you that we are through the worst. Through the worst of the droughts, through the worst of the low commodity prices, through the worst of global politics (maybe debatable that one). There is little that you can do about many factors, much is beyond your control."

To market to market to buy a fat pig Stocks in Jozi ended the day lower, down one quarter of a percent by the close. An economic read pointed to low business confidence, we knew that business confidence was at the lowest level in decades, we had been told that already. Recession or not, it will take something special to get South African companies spending money locally, there is a slow moving bunny and headlights scenario, and I am not too sure which one is policy and which one is business (the bunny and the headlights). Is the economy the stock market and is the stock market the economy? The answer is no. You can read the whole thing here, StatsSA is equipped with good people producing good publications, like this - Gross domestic product - Fourth quarter 2016.

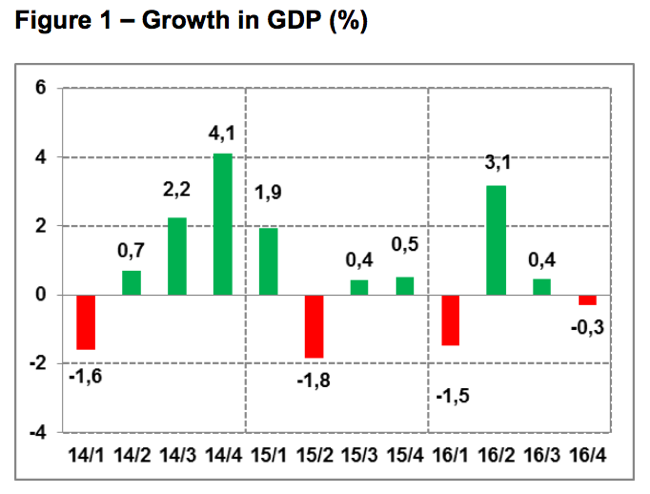

Economic growth has been a stop start affair over the last three years, we have experienced 4 negative quarters out of the last 12. And if the current quarter clocks another downer, i.e. a reversal in GDP (It always sounds strange, negative economic growth), then the technical term is recession. Somehow the standards are so low that "just avoiding" a recession seems like a good thing at the moment.

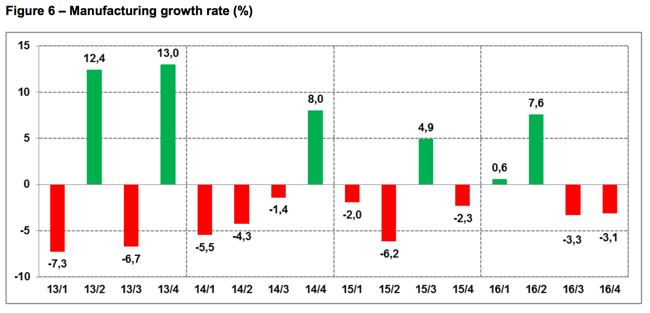

Manufacturing has been hit particularly hard, experiencing 10 negative quarters over the last 16. Technically we are in a manufacturing recession. And with mining having been so volatile, it looks a little ropey out there too. See the manufacturing graph that we are referring to in the release:

How does that stack up against Barloworld being at a 12 month high? They supply goods and services to these industries? Most of their revenues are from selling equipment and through their automotive business (rentals and motor trading). A couple of sessions ago Nedbank and Standard Bank were trading near 52 week highs too, they provide finance to businesses and consumers. Barlows (as they are affectionately known in the industry) are up nearly 70 percent over the last year, the stock is "only" up 41 percent in five years.

Interestingly, if you lay a graph of the share price performances of Standard Bank and Nedbank over that of Barlows, they look same-same. Perhaps the stock market, which is forward thinking (you pay today for future profits), is telling you that we are through the worst. Through the worst of the droughts, through the worst of the low commodity prices, through the worst of global politics (maybe debatable that one). There is little that you can do about many factors, much is beyond your control. In the end, and I think we can all agree, we should be doing better, if there was stability in politics and leadership stability and accountability, I am pretty sure confidence would be better. And as our colleague Byron said/says, confidence is the best form of stimulus. Look what has happened in the US as an example, consumer confidence hasn't been this high since Intel and Cisco were way cool.

Stocks in New York, New York were lower through the session, by the time the market ended, the Dow sank 0.14 percent, the nerds of NASDAQ sank nearly one-quarter of a percent whilst the broader market S&P 500 lost nearly three-tenths of a percent. Energy, materials and healthcare sank. The Tweet of Trump was at work again, a "wonderful new Healthcare bill" is on the way as well as Trump Sends Pharma Stocks Down With New Tweet on Drug Prices.

Whether or not it passes all the way through remains to be see. In our corner, where we bat for crude capitalism, all we are looking for is lower regulation and tax reforms. That would be good for businesses and by extension profitability and broader society. Or would it? The old trickle down effect?

Snap sank another 10 odd percent, the stock is down nearly a third from their highs intraday on Monday. Everyone is saying, "see, told you so", all of those everyones who didn't get stock in the different rounds earlier. Did you see this story - How US school turned $15,000 into $24m with Snapchat flotation.

Give the governing body of the school free lunch for a year, for agreeing to what would have been a pretty "risky" investment at the time. More specifically, a fellow by the name of Barry Eggers, a parent at the school at the time, and a VC fellow who on his LinkedIn profile says he is a partner and founder at Lightspeed Venture Partners. Who themselves became a shareholder (and rich on paper) in Snap. Research? Seeing how obsessed his kids were with Snap. Interesting, right? Same as Buffett and his Apple investment. Barry actually tells you the story himself via his LinkedIn profile - Five years ago my daughter told me about a new app called Snapchat and the rest is history. You may need to log into your LinkedIn account.

Makes you always think, investing home runs are sometimes under your noise. Mind you, it mattered who the investors were in the VC fund and proximity to the company itself, if this was a VC fund in India, do you think that they would have been able to meet Evan Spiegel and Bobby Murphy? And equally, if Evan and Bobby were not there (in the US), would they have been able to happen?

"Ten days after meeting Evan and Bobby, we made our seed investment in Snap. Later, we offered them a small space in our building to get going."

Regardless, the fellows over at Lightspeed Venture Partners have done pretty well for themselves, with multiple seeding capital provided for some pretty big ideas that have gone public and become big businesses. According to their Wiki page: "The fund has 24 early stage enterprise investments that have gone public, the most of any fund in the world." Although, who maintains the Wiki page? I still think that Wiki is a good model, fake and erogenous entries are marked as such. Lucky for Lightspeed? Nope, they ask questions it seems and it is more a case of when Barry met Bobby.

Linkfest, lap it up

When your portfolio goes up you think you are a genius, regardless if your share selection was flawed. It is like wining a coin toss 3 times in a row and then thinking you are a good at calling them, other the long term your flaws and wrong assumptions come to the surface. Remember that making a profit or loss in the short term doesn't say anything about how good your investment system is - How Bull Markets Affect Your Intelligence.

Here is another place that having access to the internet helps people. The internet provides information on where/ from whom to get the cheapest product offerings. Due to being poorly informed the more vulnerable in society end up with bad deals - Getting more consumers to switch.

This looks more like stuff out of science fiction, if it didn't come from Airbus, I might say "yeah right". As the article points out, the design of the vehicle is to have a drone "relieve you" of traffic. Wow. Futuristic. Airbus unveils Pop.Up: An autonomous transportation concept that uses drones to carry cars.

From the Geneva automobile show, comes a VW concept car named Sedric, no gears, no steering wheel and the headline says it all - This self-driving van concept from Volkswagen looks like a pissed-off toaster. Inside of ten years I think we will be using these vehicles, I have very little doubt about that.

Home again, home again, jiggety-jog. It is Women's Day today. Treat the special people in your life extra specially, ok? And make it a daily occurrence, rather than once a year. Treat each other nicely every day, and then we can all just get along. Talking of what day it is, Eddy Elfenbein has a short piece - The Bull Market Turns Eight. On an inflation adjusted basis that hardly seems "huge" now, is it?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment