"Debt issues were tackled and growth levels were lowered to 6.5 percent per annum. The pundits were disappointed to see fewer economic reforms. For whatever reason, people see the growth number as "slow", when the base is clearly much higher and bearing in mind that China accounted for 30 percent of all the growth globally last year."

To market to market to buy a fat pig Stocks were mixed Friday in Jozi, financials were up, industrials sank half a percent, resources lost over a percent to send the overall market down just over one-third of a percent. Nedbank was top of the pops, as was Woolies and Old Mutual, Amplats, Kumba and AngloGold Ashanti were not. I suspect that rising interest rates supports the overall appeal for the US Dollar and the excitement around commodity prices wanes a bit, that is the way that the flows gravitate. There was a PMI read for the month of February, six months in a row of expansion, this one was "close", and marginally in the black.

Of course there was an annual meeting of the Chinese top dogs this weekend, where they set the new run rate for the economy, reforms and the like. It is called the "work report" and the delivery by Chinese President, Li Keqiang is delivered to the National People's Congress, the Chinese parliament. Debt issues were tackled and growth levels were lowered to 6.5 percent per annum. The pundits were disappointed to see fewer economic reforms. For whatever reason, people see the growth number as "slow", when the base is clearly much higher and bearing in mind that China accounted for 30 percent of all the growth globally last year.

I found it interesting that the Chinese were looking to shutter steel capacity and cut coal output (China Plans to Cut 500,000 Jobs This Year in Smokestack Sectors), some slow moves toward making the environment better, suggesting that blue skies were also important. Bloomberg had an interesting piece: China Sets Growth Target of About 6.5% Amid Pledges to Ease Risk. That fellow, Tom MacKenzie in the clip at the top of the article was tweeting from the NPC, you can follow him on Twitter - @TomMackenzieTV.

I was interested in some of the photos that he (Tom) took and disseminated, there is a whole English piece of the statement. The one I found most interesting was "Hold high the banner of socialism with Chinese characteristics." Hmmm .... are we not told that their version of parliament is composed of multiple billionaires? See this CNBC report from a few days ago - China's parliament has about 100 billionaires, according to data from the Hurun Report. If the Hurun report is right, then how does that stack up against "Chinese characteristics" for socialism? All people are equal, some are more equal than others however .... ??

It is natural that more and more reforms come to China, the flows will ultimately dictate. Visiting the Hurun Report page on UK Luxury Brands in China Report, there is a paragraph there that makes this economic miracle (not for all) unstoppable:

"By May of 2016 , the number of millionaires (defined as individuals with personal wealth of CNY 10 million, equivalent to US$1.42 million) in China's 31 provinces, municipalities, and autonomous regions, apart from Hong Kong, Macao, and Taiwan reached 1,340,000 - an increase of 130,000 from the previous year, an increase of 10.7%."

The number of millionaires saw an increase of 10.7 percent in an economy that "only" grew by less than 7 percent. Ai shem, sounds like a terrible, horrible no good hard landing to me.

Why is this all important for us? As a commodity exporter, we will know that we cannot always be reliant on the same sort of growth as yesteryear. We are lucky that our economy is not the same as some of the highly commodity exposed economies. In the same way that China need to steer their economy towards services and consumption, away from infrastructure and government, we need more of the first three. Mr. Market is not "unimpressed" with the outcome, I guess for many it is just a talk shop and a pat on the back. Remembering that the communist party has been large and in charge for nearly 70 years now in China, it is a very different country over the nearly seven decades, having gone from substance farming to the second largest economy on the planet.

Across the seas and oceans in New York, New York, stocks eked out a gain after a poor early showing. The Dow Industrials just squeaked into the green, up 0.01 percent by the close. The broader market S&P also just snatched a late winner, up 0.05 percent by the close. The nerds of NASDAQ fared a little better, not by too much, up 0.16 percent by the close. Materials were the strong movers, infrastructure plans to boost commodity prices, albeit against the backdrop of slower Chinese demand. What is equally astonishing is that Goldman Sachs (according to the FT) people smuggled and sent around 1.1 trillion Dollars abroad from China. Words escape me when I heard that number, no wonder property prices in desirable places are sky-rocketing.

Snap Inc. followed their fabulous debut on Thursday with another 10 percent gain Friday, it did come back over two Dollars a share from their highs, someone is down over ten percent already, whilst someone else locked in a 60 odd percent gain from IPO. For the record, Snap Inc. has a market cap of 35 billion Dollars, around the same as Adidas. Bigger than Beiersdorf, the owner of the Nivea, Eucerin, Labello and Elastoplast brands. Call me a sceptic, and perhaps I am way wrong here ..... remembering that the Zuck tried to buy this company a long time ago. I am happy to be proven completely wrong, a company with less than one billion Dollars of turnover and incurring about the same in losses is certainly juiced up to perfection prices.

Linkfest, lap it up

The silver lining to oil spills is that we now better understand our oceans - The BP oil spill led scientists to discover 60 new animal species living in the Gulf of Mexico

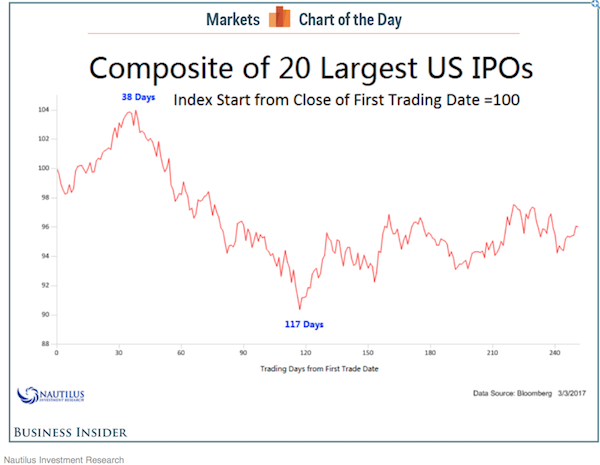

Some clever stats people sat down and worked out how long on average the euphoria around an IPO stock lasts. That is, how long is it until "I must own that stock" mixed with limited liquidity starts to fade - Snapchat is still rallying - here's how long it takes on average for a hot IPO to crash. Remember that this is just the average, Facebook went negative basically from day one.

As China has become wealthier, it can afford to focus more on clean energy - China Softens Coal Focus in Bid to Clean Up Its Skies. For context, China plans to cut around 50 gigawatts of coal produced electricity, around the amount Eskom produces a year, that will only remove 4.5% of the coal produced capacity from the system though!

Home again, home again, jiggety-jog. US Futures are lower, not by much. French politics looks like we expect, with much flavour and excitement as French people can be. Locally the SASSA "crisis" could come to a head in days, a favourable outcome not necessarily for the taxpayers and treasury, rather the 17 million people who depend on these flows.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment