"Tencent is an entertainment, communication, news services/online videos, payment systems and advertising platform, with newer businesses such as streaming and content origination. They also offer cloud based solutions, music and of course the original social media platform, QQ and Weixin/WeChat."

To market to market to buy a fat pig It was not pretty out there yesterday, mostly as a result of the resource complex (down two percent), not that the other sectors performed better. A broad based sell off catching up to the US markets having sold off heavily the session prior is what we were faced with. Stocks as a collective ended the day better than the midday print. By the time the gates closed shut for trade, the Jozi all share had slipped one and one-quarter of a percent. Kumba and BHP were down around five percent apiece, the iron ore price sliding from 90 odd Dollars a ton. MTN was down over three percent, the stock was trading ex the dividend, which is payable Monday. Three working days for settlement nowadays folks, that is the good news.

Only the gold stocks were on fire, as a collective they were up over three percent. For all the volatility, you have been poorly rewarded over a longer dated period, down over 50 percent in the last ten years. For the last five years, the gold stocks as a collective have returned a negative 45 percent. So it pays to be diversified, right? Wrong. The resources ten is down 38 percent over five years and down 36.5 percent over the last ten. Industrial stocks might have "gone nowhere" for over two years, the return over five is 115 percent to the good, and over ten, a whopping 264 percent.

Despite the poor day as a collective, Discovery clocked a new 12 month high, it certainly has been on the radar for the buyers post what were good results, for the recap, remember our write up - Discovery 6 month numbers - Investing in technology. The all time high for the stock is around ten percent away from here, over 150 Rand a share was reached in November of 2015. Since the results, just over a month ago, the stock is up 15 percent, year to date the stock is up a whopping 20 percent. It is true that the stock is down 9 odd percent since November 2015, it always depends on where you draw your line in the sand.

At the other end of the spectrum, reporting at around the same time, was the JSE (the business itself), that stock is down 15 odd percent in a month. And like Michael and I discussed earlier, they didn't actually look "that bad". At these sort of levels the stock is almost in a territory that one might consider good value. They do face some headwinds, and they are definitely a fixed cost business. I retract my comments about the business not needing to be hugely profitable (which was met with disgust by Byron), the higher the costs for the brokerage houses and broader financial services sector, the greater the competition. And if viable competition does actually emerge (which I think is highly unlikely, I may well be proven wrong), then the smaller and more nimble operator would be best placed to attract new business. Somehow I just do not see it happening.

Results that certainly sparkled yesterday were from the education group ADvTECH, I am not too sure what is up with the small v, perhaps someone can shed some light on that. See the results here - Results FY 2016. I like the segment as an investment theme, the more affordable private education offered in a South African context, the better for all of us as a collective. The pricing point is critical. The company is probably a little bigger than you think, the market cap is nearly 11 billion Rand, the stock has been on a tear over the last year, remember that Curro was once lurking in the wings whilst the group was having serious management issues, perhaps that is a "floor" of sorts now. With a mid twenties multiple, the group is going to have to keep up the rate of growth for investors to feel comfortable.

Over the oceans and seas, across the hemisphere (and around 12800 km away) stocks were mixed to better by the end of the session. For the record, according to timeanddate.com, the furthest place from Jozi is Wailuku, Hawaii at 19,265km away. For reference sake, the two cities furthest apart on earth are Chincha Alta in Peru to Siem Reap in Cambodia, around 20 thousand and ten kilometres apart. Followed closely by Cordoba in Spain to Hamilton in New Zealand, almost exactly 20 thousand km apart from one another. I do not feel so far from New York, suddenly.

Session end the Dow jones Industrial Average had lost a handful of points, Nike down over seven percent dragging the rest of the index with it. Nike had a tough trading session yesterday, we like the company's stock price more at the lower levels, of course, see the write up from yesterday - Nike 3Q numbers - beat on bottom line, miss on top. China is where the growth will emerge.

The nerds of NASDAQ enjoyed a great session, spurred by gains in the largest listed company in the world, Apple, which added over a percent. The nerds of NASDAQ closed nearly half a percent better off, the broader market S&P 500 added nearly one-fifth of a percent. For the record, Apple is a constituent of the NASDAQ, the S&P 500 (obviously) and the Dow Jones.

Apple was out the session prior with a whole set of new products, depending on who or what you read, it was either awesome or underwhelming. A red iPhone 7, a new iPad and several new watch straps. Or, you could buy this Vintage Apple-1 Computer Could Fetch $300,000 at Auction. No thanks, I would rather have the amazing new Mac for a whole lot less, collector item or not.

Company corner

Tencent released numbers after the Hong Kong market had closed yesterday and before the US market had opened. As such, there was only a single platform where to see the reaction, and that was here in Jozi. Naspers own a little over one-third of Tencent, in one of the best initial investments known. The results for the full year to end 31 December 2016.

Revenues for the full year grew 48 percent to 151.9 billion Renminbi (22 billion Dollars), profits grew 42 percent to 41.4 billion Renminbi (just over 6 billion Dollars). The stock is listed in Hong Kong, so the basic earnings per share number of 4.383 Renminbi translates to 64 US cents per share or 4.94 Hong Kong Dollars per share. At 220.80 Hong Kong Dollars (where the stock trades now), the historic multiple is 44 times. Which is expensive, it is certainly not dirt cheap. And this has always been the case. However, if you take a PEG ratio, it is closer to one than you think, earnings growing at over 40 percent over a multiple of 44 times is just a smidgen over one. In this case, you would have to say that the Tencent share price is "about fair". The stock did clock an all time high in the Tuesday trading session, anticipating results of this nature.

Tencent is an entertainment, communication, news services/online videos, payment systems and advertising platform, with newer businesses such as streaming and content origination. They also offer cloud based solutions, music and of course the original social media platform, QQ and Weixin/WeChat. In terms of entertainment, it is gaming, PC/Mobile, online or offline. It sounds like a whole host of businesses that we know exist independently of one another, from Facebook Messenger, Google to Netflix. Their streaming equivalent businesses grew three fold to have over twenty million users now, and the company generated some content that was well received.

There is also an element of machine learning that will bring all of the platforms closer together, more cloud storage options for the users, expanding the popularity of mobile games, offering more bolt on services. The company is still essentially a gaming and social network one (entertainment) with Value Added Services contributing 71 percent of group revenues, advertising 18 percent of the business with the balance 11 percent. Gaming is around 46.6 percent of all group revenues. That phone and those games sure are addictive. The company is spending a lot of money on their newer businesses, those are basically in "ramp up" mode.

The company continues to evolve into a more recognisable and more diverse business that is becoming more dominant and easier to understand. We should be so lucky that through Naspers we can own such a business. Good business, great growth rates (around 30 percent expected), priced at about the right level. We still accumulate Naspers on the basis that it trades at a pretty significant discount to the sum of the parts.

Linkfest, lap it up

It is just a tool for checking and liking your friends photos. Wrong. Visuals are far better than text. Instagram had an announcement yesterday: Welcoming one million advertisers. Suddenly the 1 billion Dollar price tag in 2012 (in cash and stock) for 600 million users currently (and the platform turns 7 in October) does not seem like a high price. One million active monthly advertisers, reaching potentially 600 million users. Advertising platform, not "social media". We continue to stay long Facebook, the owner of Instagram, great timing of the purchase friends!

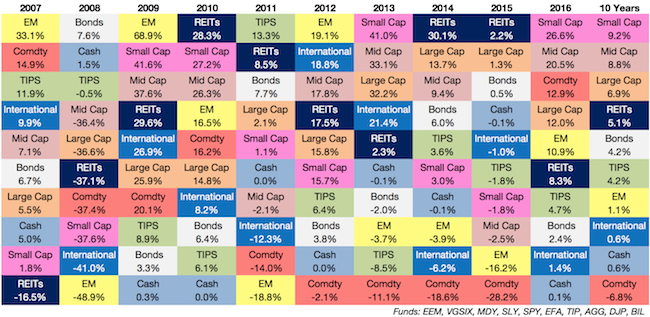

Here is how different asset classes have performed over time, in Dollars. Very interesting reading how each sector has its day in the sun. Note how commodity stocks were doing well going into 2008 and since then they have suffered badly - Updating My Favourite Performance Chart for 2016

Having less fake news is a good thing for society. Less people peddling snake oil - This is now what happens when you try to post fake news on Facebook. You need to trust the independent news verification companies now.

Home again, home again, jiggety-jog. Stocks across Asia are mixed to slightly higher, the US futures are marginally higher. We should start better here, the Rand is certainly catching a bid!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment