"Well we are at year 9 and the current score reads, S&P 500 is up 85% and the hedge fund industry is only up 22%. As the market adage goes about hedge funds, "a compensation scheme masquerading as an asset class". The push back on underperformance and high fees is starting to be felt in the US"

To market to market to buy a fat pig The All Share spent the whole day in the red on Friday finishing down by 0.38%, this is after having the best day of the year on Thursday. Thanks to the green year so far for the market, the list of companies reaching 12 months high is growing. The most noticeable is Capitec, which is a whisker away from R800 a share. In August 2014 when ABIL was going full throttle towards the wall you could have bought Capitec for around R215 a share! That means you could have almost tripled your money in a little over 2 years. I remember thinking I had missed the Capitec boat when the share reached the R120 - R150 levels, 7 years ago you could have bought the stock for under R100 a share.

On Friday I was on TV talking about the emerging Hedge Fund industry in South Africa, where a peer in the industry was saying that you should own hedge funds for diversification in your portfolio. The logic is that hedge fund returns are not correlated to the overall market and that they generally do better than the market in down years. Owning "insurance" assets to cover yourself in the down years means that you don't have a long enough time horizon. The stock market is not like a car, when you are in a car accident you do need insurance because there is permanent damage to your car. In the stock market, if there is a down year you can either keep your head down (not sell) until it passes or you can go out and buy more assets. So why then do you need "insurance"? Why spend the money on expensive products, which to add insult to injury normally underperform, for insurance that you don't need?!

I must say that I fall into the Buffett camp when it comes to hedge funds. Remember the bet that Buffett has where he bet $500 000 that the S&P 500 would perform better than hedge funds over a 10 year period? Well we are at year 9 and the current score reads, S&P 500 is up 85% and the hedge fund industry is only up 22%. As the market adage goes about hedge funds, "a compensation scheme masquerading as an asset class". The push back on underperformance and high fees is starting to be felt in the US, More Hedge Funds Shut Last Year Than Any Time Since the 2008 Crisis. It is interesting to note that the industry manages more money today than last year but it is being channelled to the funds with better track records and who are cheaper (I assume).

All in all, it is human nature to think that the buy and hold strategy is too simple to get good long term returns. It is at that point when the terms 'derivatives', 'Long/Short' and 'exclusive' get your attention. You then think the higher risk, higher fees and higher complexity will get you better returns. Don't listen to your ego when that happens, in this case simple is better.

Across the seas but not far away, US markets closed marginally down for the day. The Dow was down 0.1%, S&P 500 was down 0.13% and the Nasdaq was up less than a point or 0.0% change. The news for the day came on the data front with Consumer confidence jumps more than expected. The general theory is, the higher consumer confidence the more people spend which is good for growth and company bottom lines.

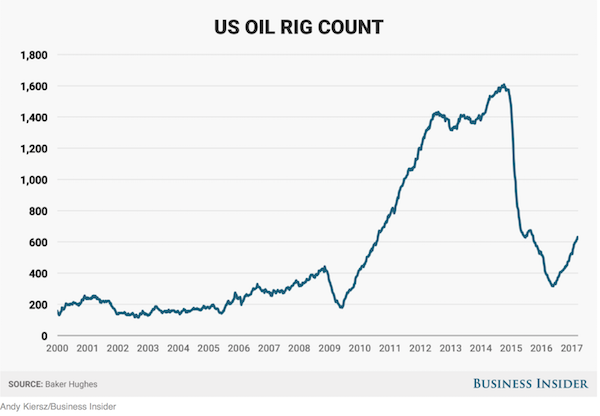

The next big piece of data is US oil rig count rises for 9th straight week. Thanks to the relatively higher oil price, more and more rigs are being added to the US production system. As you will see below, we are still very far away from the high rig numbers of 2014. It is important to note though, that thanks to technology the current rigs produce more than historical rigs. In 2016 when the rig count was dropping, the number of barrels being produced was climbing.

With the oil price being under pressure, the temptation for OPEC nations to cheat on their quotas increases. That coupled with the speed at which the Frackers can respond should see a cap on the oil price. A low oil price is good for the consumer, less money spent on transport and more money spent in other parts of the economy.

Company corner

On Friday before the US market opened we had the results from a large scale study on the effectiveness of Amgen's Repatha drug which lowers cholesterol. The results from the drug were positive but not positive enough for traders, the stock fell 6.4% on Friday (Amgen is getting whacked after disappointing study results for its $14,000 cholesterol drug). The big thing to note about this drug is that it costs between $8 000 - $15 000, depending on the dosage required. As you can imagine, insurance companies are not keen to shell out that kind of money without proof that the drug has benefits. The main benefit needed is a reduction in the number of people having heart attacks and needing to be hospitalized, which could cost insurers more than the cost of Repatha.

Analysts are expecting the drug to have a huge take up, currently one of the smaller drugs that Amgen creates but expected to be their second biggest with 15% of revenues by 2020. That sort of growth only happens with insurance company approval. One of the biggest positives about the drug is that it seems to become more effective as time goes on, which means that next year this time when the next wave of study numbers is released we should see an even greater impact and effectiveness from the drug. Another factor is that the regulators may list Repatha as a drug option of high risk cholesterol patients, which would basically force the insurers to start using the drug or face being sued by patients for negligence.

Amgen creates many life changing drugs, the reason that we own them. This will be a damper on the share price because it creates a bit more uncertainty about the future but given the vast drug portfolio that Amgen has, this is not a make or break moment. We are still holders here.

Linkfest, lap it up

Why is Facebook worth over $400 billion? The below graph shows you why, they own 5 of the top 6 downloaded apps. App usage means, "eye balls" and that means the ability to sell advertising - The Global Top 10 Android Apps

You will find more statistics at Statista

You will find more statistics at Statista

Sticking with online advertising, as the number of people on the internet grow it becomes harder to know who is real and who is fake, which is a problem for advertisers - The ad fraud issue could be more than twice as big as first thought - advertisers stand to lose $16.4 billion to it this year

Home again, home again, jiggety-jog. Our market is in the green this morning and our currency keeps gaining ground, currently the Dollar/ Rand is around the 12.65 mark! No major data releases today, enjoy the day off tomorrow.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment