"The company is focusing their efforts to double the speed at which they deliver their products to the consumer on a direct basis (more through the online platforms) and double their innovation patterns. Air Max launches some new models in a few days time (to celebrate 30 years, retro designs) and Air VaporMax is the newer shoe, launched this Saturday."

To market to market to buy a fat pig The truck backed up .... you could hear the beep-beep-beep ringing out. The inevitable headlines came through, Trump reforms may not happen, etc. It was not even a heavy decline, by the smooth sailing market standards, a percent and some more down was the first for US equity markets since October last year. Wow. I guess when your pattern recognition recency bias becomes used to a certain "structure", the inevitable stock market sell off comes as a little shock. Pattern recognition is why people love looking at charts, it helps them either validate a sale or purchase.

There was a little more than that, political again, with the Trump administration unable to take apart "Obamacare", and push forward the republican agenda. Politics impacts on markets. How? Well ..... if the Trump administration does not have the necessary support from the rest of the politicians, that does not exactly bode well for further policy pushes, if you know what I mean. Should it worry you? Nope. Can the market fall further from here? Of course, equities markets can always fall fiercely and at speeds you don't expect, humans and money make a funny concoction. Fear, greed and all the other emotions that go into market.

Session end the Dow jones industrial Average had given up over a percent, down 1.14 percent, the nerds of NASDAQ had been slammed, down 1.83 percent and the broader market S&P 500 had lost around one and one-quarter of a percent. Financials and basic materials had been sold off particularly hard, Alphabet lost over two percent, Wells Fargo and Bank of America lost around three apiece. No ability to push through big plans and implement huge sweeping reforms equals market sell off. If you can imagine that the healthcare reforms (on the reforms from before) would be pushed through with the Republican agenda intact, then you would no doubt see the reverse. Investing based on politics and political agendas is dangerous.

Stocks in Jozi skipped the trading session day yesterday, in celebration/memoriam of an important day in our history, a sad day in which 57 years ago, 69 souls lost their lives at a police station in what is modern Southern Gauteng, right on the border of the Free State. The South African constitution was signed at Sharpeville on the 10th of December 1996 by Nelson Mandela, it is an important place and event in our history, and some would argue that international opposition heightened at this point, ultimately leading to a free and open society for all the people who live in this land. I just wish that these celebrations would fall on Mondays or Fridays.

On Monday stocks enjoyed an up day, nearly four-tenths of a percent to the good. Industrials were the real drivers, Naspers was at the top of the leaderboard, around three and one-third of a percent to the good. Amplats, South32 and Kumba were all at the opposite end, down with sliding commodity prices and a strengthening Rand, not an event that happens too often in conjunction with one another. There were multiple twelve month highs for the likes of Discovery and Capitec, Adcock and Exxaro, as well as Santam and Astral. Chickens, insurance, banking/loans and coal, as well as pills. A lot of those businesses are firmly SA inc. in nature, leading one to believe that the economy may be in better shape, as far as those in the stock market are concerned. i.e. Share prices move ahead of the event, predicting better earnings. Today we may look a little worse for wear, being in catchup mode from the red US market last night.

Company corner

Nike, the footwear and sports apparel company, perhaps the best known of all of them, alongside competitors like Puma, Adidas (experiencing a renaissance) and more recently Under Armour, reported results last evening that beat on the bottom line handsomely. Unfortunately the top line was not within expectations, once again fuelling the naysayers who are predicting a slow down globally in their brand. This investment theme is a firm favourite here at Vestact, the thesis being that more and more people are active and are taking their exercising more seriously. The rise of awareness and linkage of dread diseases to sedentary behaviour has prompted many to take up exercise. i.e. My body is my temple, that whole theme, right!

I recall that when I ran my first major ultra marathon (Two Oceans), over a decade and a half back, there were three odd thousand people at the start line. "Serious athletes". What was more telling however, wasn't the field size of the "major" event, it was that the lesser half marathon started after the ultra. Nowadays, getting entry into the half marathon is not guaranteed, there are arduous processes and lotteries and heartache for those that missed out on an entry. That tells you, that even in South Africa, people want to set goals and compete in higher endurance events. With that, and the theme is a global one, there are a growing number of entries into Iron Man/Woman (and the half), multiple cycle races and the rise of non-traditional sporting codes, anything from dancing to cross training.

All those new participants will need newer and better kit and footwear to keep up to speed with their mates and fellow participants. Wearing athletic gear is no longer something that is reserved for gym time or your running session, it now passes for casual wear. You can wear your favourite football, basketball or gridiron top without being ridiculed by your mates for when you are getting on the team. Or simply, wear what makes you feel comfortable, that is what has happened. When I look back on 1970s footage of athletic wear, I cringe at the "bad" clothes. That has all changed, and continues to rapidly evolve. There, you get why we like the investment theme, there are more participants than at any other time in history, owning and buying what are pretty expensive and evolving technology. Richer populations with more spare time to keep healthy and fit need the best quality.

Nike reported their 2017 third quarter results last evening, after the market close. Revenues grew 7 percent on a currency neutral basis, 5 percent in Dollar terms. 8.4 billion Dollars is the current quarterly run-rate, the group had targeted 50 billion Dollars by 2020 as a target. Diluted earnings grew 24 percent, to 68 cents per share, a lower share count and lower tax rate as some of the factors helping. Gross margins compressed 140 basis points as a result of sales, higher production costs and forex headwinds.

Outside of the US, the company experienced double digit growth across Western Europe excluding currencies, was up 10%; Greater China excluding currencies, up 15 %; most of their emerging markets excluding currencies, up 13 %. North America saw 3 percent growth, both across apparel and footwear. The company has roughly 44.5 percent of sales from North America, with nearly 30 percent of that being shoes alone. 3 out of every 10 Dollars in sales is a pair of sneakers in North America. Chinese sales of footwear is 9.2 percent of toatl group sales and Western Europe footwear sales is 11.8 percent for the total group sales. Roughly, those three territories, China, North America and Western Europe, represent 75 percent of all of their business. Makes you think that there is plenty of scope for them to grow globally.

The company is focusing their efforts to double the speed at which they deliver their products to the consumer on a direct basis (more through the online platforms) and double their innovation patterns. Air Max launches some new models in a few days time (to celebrate 30 years, retro designs) and Air VaporMax is the newer shoe, launched this Saturday. There are also plans afoot (excuse the pun) to cut through the two hour marathon mark with selected athletes wearing a Nike ZoomX midsole. And focus in the right areas. Inside of the unofficial transcript, the President of the Nike brand, Trevor Edwards had this to say:

Now, in China, the opportunity is massive. Just over the past five years, the number of marathons there has grown 500%, and China's government predicts a sports economy valued at $850 billion by 2025 - by far the world's biggest. Our leading brand position in China gives us confidence we will continue to see real growth from this expanding market.

That is pretty telling. Recent events in China have suggested the company had misleading advertising practices. The state broadcaster alleged that the company didn't have the right sole, as per the advertising. Not good. That said, who to trust in China, a market that is notoriously misleading to many a consumer. What this tells you is that the consumer is definitely becoming more and more aware of their products and have higher expectations. As Nike has a higher selling point, relative to some of their peers, a more affluent and aware consumer is "good news". And a more fit one too.

Whilst the rest are worried about a lack of top line growth, I suspect that we are in a lull. The brand is increasingly up against a resurgent Adidas (I like their CEO, I like their brand) and recently Under Armour (the share price has fallen hard). This is good news for all of these producers, it will force them to all work a lot harder in getting the consumer their optimum product, be it apparel or footwear. The best is yet to come, the company is now trading on the least expensive multiple in half a decade, on a relative basis (to the rest of the market), double that time period. The market has not been receptive to these results, if you are in gathering mode, this is a wonderful opportunity to gather what is a multi decade growth investment theme. We continue to recommend the stock as a buy.

Linkfest, lap it up

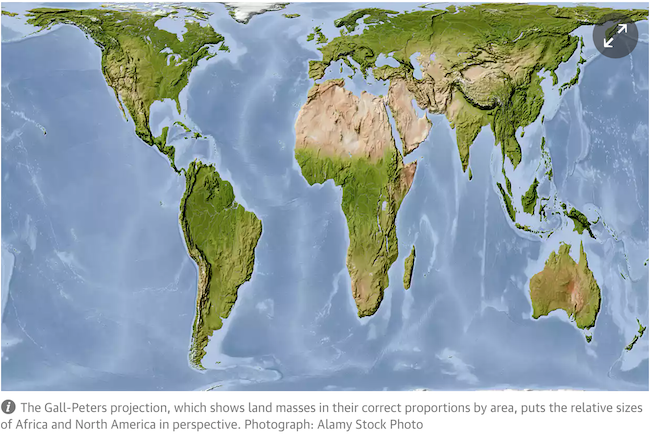

I can see this move causing much debate, what is the best way to show a globe on a flat surface? - Boston public schools map switch aims to amend 500 years of distortion

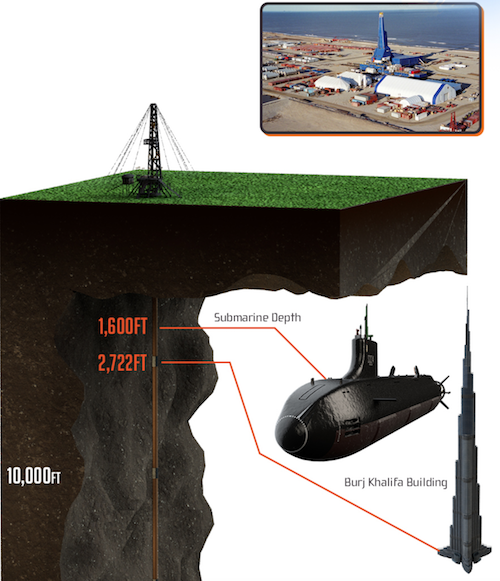

It is amazing what technology allows us to do. I wonder how long the well took to drill and how often they have to stop drilling due to mechanical issues? - Visualising The World's Deepest Oil Well. The infographic hints at the world running out of oil, that is not the case. Over the last decade, proven reserves have been on the up.

Home again, home again, jiggety-jog. Catch-up for the local market may well mean we have to sell off to begin with today, that is just the way it goes sports lovers.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment