To market, to market to buy a fat pig. It has been a particularly tough time for stocks globally and in particular emerging market companies who have since the beginning of the month had their heads handed to them. I thought of making a short clip of Mark Mobius being wrong and a liar, but I was not sure if satire was my thing. Perhaps I should try it. The new Instagram video feature is perfect, 15 seconds is about the attention span of an ordinary person nowadays. So what if we are not as patient as our grandparents, they didn't have 100 channels to choose from and cheese was just cheese, as was milk.

Emerging market exposure has been slashed, outflows match the outflows from 2008 and the middle of 2007. Paul sent me this little graphic: Third largest ever weekly outflows from EM assets. Wow. It looks kind of wild when you see it! I also stuck a one month comparison of the iShares MSCI index and compared it to the S&P 500. Emerging markets have been pole axed, underperforming by more than ten percent! One month. Ten percent. And all the "blame" can be squarely put at the door of the ten year US treasury yield, which has spiked post the Ben Bernanke FOMC delivery.

The ten year yield over the last ten years has gone from 2.01 percent to 2.56 percent as of close last evening. It was yielding 2.66 percent at one point. Now, from a percentage point of view, a yield spike of 25 percent on US ten year treasuries in 30 days is not something that happens very often. In fact, it almost never happens this way. Many are suggesting that this is the anxiety point that is warranted. Not sure, perhaps the bond markets have gone too fast, tightening is not exactly going to take place immediately. A while, some time next year, and late at that.

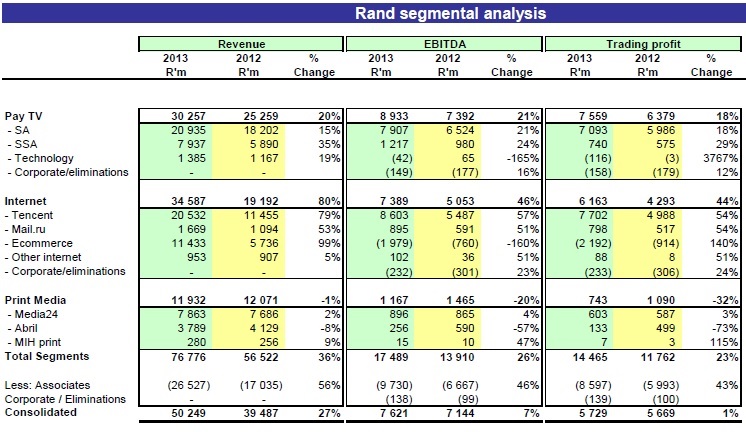

Naspers hit screens with full year numbers this morning. The company managed to top 50 billion Rands of consolidated revenues for the first time, a 27 percent improvement on the prior year. The internet business revenues exceeded pay TV for the very first time, so I am guessing that this is a milestone of sorts for the company. Bearing in mind that the roots of the company trace back to 1915 in the Mother City with the business of newspaper and magazine (and a little while later book) publishing being their primary business. The name Naspers is a diminutive for the original Afrikaans name, De Nationale Pers, which translates in English to The National Press. A company nowadays that hardly resembles its name in any shape or form, but we will get into that.

One of the big changing points in their history was when the company decided to enter into the pay TV business. It was twenty years ago in October that they split the businesses between MNet and other, which includes the DStv business that you are familiar with today. Remember "open time" and the spare channel that was before that?!?! Those were the days my friends. They (Naspers) were quick to realise that their media assets needed to be housed elsewhere and organised the whole lot under one banner, the Media24 umbrella in 2000.

And then perhaps an amazing inspired move in May 2001, whilst the dotcom landscape looked like the Terminator 2 opening scenes, Naspers bought a 46.5 percent stake in a Chinese business called Tencent Holdings. That business Tencent listed in 2004, and the stake was diluted to 35.04 percent as at 2009. That remains, in our minds, the future of the business and the real reason why the stock has become nearly a 30 bagger over a decade. Yes. I remember a time when Naspers traded at 25 ZAR a share, the 52 week high is 758 ZAR. There is your 30 bagger right there!

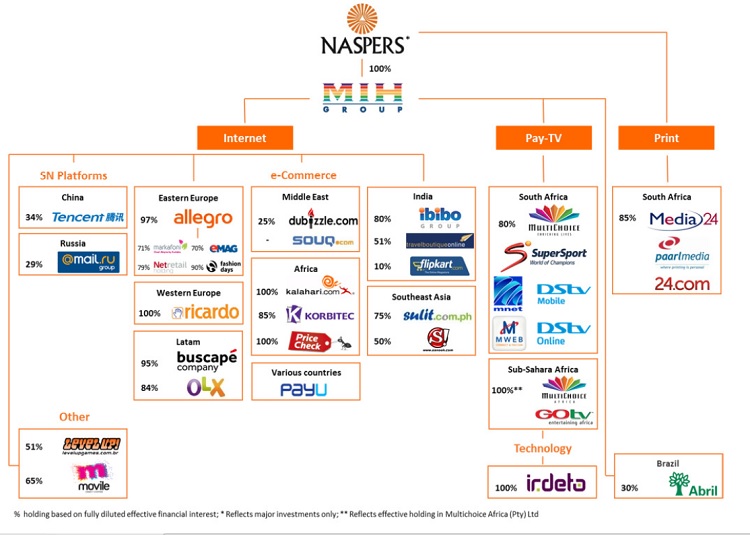

Naspers have done lots of other interesting deals along the way, their corporate profile suggests that they are going to continue to be a media and ecommerce platform outside of the traditional English speaking world. Think Amazon, eBay, Facebook, Twitter and so on in many different languages. They hold these types of internet businesses in places like Russia, Brazil, Latin America and most importantly China. Plus remember that their pay TV business is and has been better than they may have anticipated. We will focus on their emerging market internet businesses and in particular Tencent and then of course their DStv/Multichoice business, seeing as those two are the main contributors. And then their big growth business, ecommerce, that will be the third focus.

To get a full layout of what the business looks like, the company presents from time to time a really great diagram that helps investors. A picture...... you know, is supposed to tell 1000 words. In this case I am guessing that it is closer to 2000 words worth of writing:

So there you go, you now know what the group looks like for now, you can add a couple of other parts to their business over the coming months, the company never keeps still!

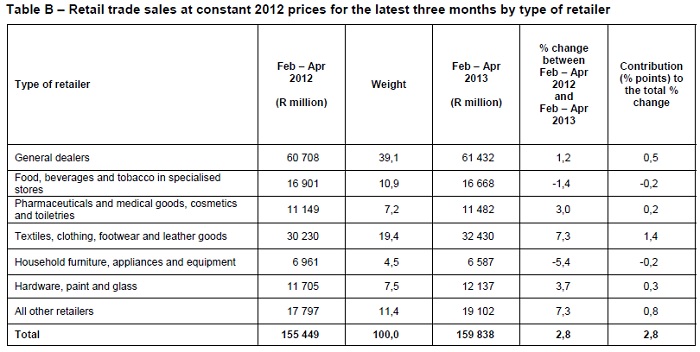

Time to chew into the meaty parts, or crunch the carrot, if that is your thing. Again, I used the company resources (Rand segmental analysis) to shrink this pdf file the correct width. Here goes, I want you to pay particular attention to the three big items there, Pay TV (both South Africa and their rest of Africa business), Tencent and ecommerce.

First things first, Tencent. The business registered a record number of concurrent users, topping 173 million users. Their total user base grew to 564 million folks, or roughly 42 percent of the entire Chinese population. That sounds like a lot! That is what the Naspers release says, the Tencent website suggests nearly 800 million users. Tencent revenues grew a whopping 79 percent, boosted in Rand terms by a weaker currency. In fact the weaker Rand boosted all international revenues. But Tencent is an interesting business, and like we said, perhaps the future of the Naspers business for now.

Tencent is a mix of chat and messaging (QQ and WeChat), gaming, ecommerce, online advertising and other online media. Tencent has market share in the worlds biggest country by population, and offer the services that multiple companies do in the US. The business is run by the founders, Pony Ma, who is a remarkable entrepreneurial fellow. Together with Tony Zhang the chief technology officer, another founder and Daniel Xu who is the chief information officer (another founder), the business has a very good team! Naspers continues to back this team and their business, the risks are always present with Chinese internet policy looking inwards. When the walls come down, the challenge will be to compete hard against their developed world peers looking for market share. The longer the walls stay up, I guess the better for Tencent.

Next, their DStv business, their giant that they were able to leverage off and acquire all these other interesting businesses. I was absolutely amazed that a business that some folks view as "mature" was able to grow revenue by 20 percent. They added 1.1 million subscribers to bring the total base to 6.7 million. The greatest thing about this business is, if you don't pay, you get suspended. As we often say around here, the power of football on the sports channel is the force that takes people over the tipping point, as far as quality programming and switching to satellite TV. And as they mention in the release, Supersport contributes more to sport in Africa than all the collective governments. Think about that for a little. I am guessing however that the sports administrators have a pretty good time, because, you know, they are worth it!!! A fantastic and profitable business with trading profits 18 percent better to 7.6 billion. Although paying Rands for Dollar based programming has its drawback!

Great business. BUT! The Naspers release says the following: "A significant shift is visible in user activity moving from the personal computer to mobile devices such as smartphones and tablets. This trend simultaneously disrupts existing business models and creates new opportunities." And Koos Bekker said that the pay TV business was becoming somewhat of a sideshow. What he means is that he can see developments of a shift to tablets and smartphones for peoples viewing choices in developed markets, away from TV's. And as such, he needs to view this business as a mature business, with strong growth potential across the rest of the continent. But, its time will come, as the print media business gave way to the present giants.

Lastly, the ecommerce business grew at a crackerjack pace, but you can see that was largely acquisitive growth. Here is the trick you see, this business segment is what Koos Bekker sees as the future. The business will continue to grow rapidly in emerging markets and to a certain extent be in catch up mode with developed markets where Amazon is as available as a platform as any other. The delivery mechanisms are important, I am sure that they are working hard in that regard. For the mean time, as a collective this business is not likely to register meaningful profits any time soon. "Ecommerce revenues doubled to R11,4bn, through a combination of organic growth and a few acquisitions. We extended the breadth of our products, with particular emphasis on etailing and online classifieds. As we are in the building phase, this segment is presently loss-making and we do not expect profits in the aggregate for several more years."

OK, the valuations part of the business are perhaps the trickiest part for many to understand, including ourselves I will have you know! There are the earnings which will in one part lay out the simple fundamental valuation metrics and the stock (always) looks expensive and then there are the NAV calcs. I think that it is always worth looking at both. First, the NAV part!

I sent this email to a journalist on Friday, I have updated the amounts for this morning, both the exchange rates and the Tencent (and Naspers) market capitalisations. So the updated value of Tencent implied in the Naspers market capitalisation is as follows:

TenCent market capitalisation is 508.78 billion HKD (Hong Kong Dollars) as at the close: Tencent Holdings Ltd (HKG:0700)

1 HKD = 1.30 ZAR - HKDZAR

Naspers own 34.26 percent of TenCent. Naspers value of that in Rands is (508.78 billion HKD x 34.26%) = 174.30 billion HKD = 226.6 billion ZAR!

Current market cap of Naspers (last evenings close) = 281.320 billion ZAR. Basically 80.5 percent price you see today is TenCent.

My first instinct is to say, how can that be possible? How is it at all possible that four out of every five Rands in Naspers shares price is equal to their stake in Tencent? But it is. So, the very first part of the calculation is to say OK, the Naspers share price closed last evening at 677 ZAR, so 80 percent of that, 541.6 ZAR is their stake in Tencent. So what you have left over is 135.4 ZAR a share. Into that you have to fit their very fast growing ecommerce businesses and their more stable DStv business. Is the rest of the business only worth 55 billion Rands? Gosh, I hope not, because the DStv business is growing at a serious click.

What you have to do is to say, right, those ecommerce businesses are going to be worth a bomb, it is the same reason why Amazon makes a loss and still trades near their all time highs. Their forward multiple is eye popping, Amazon that is. But they are gearing up for a future of same day delivery and getting into the groceries business. For the time being I don't see Naspers doing that! We continue to accumulate the stock on the basis that they are comfortably ahead of the curve, and it would be generous to say that there is competition even breathing down their necks. They set their own standards, which are world class.

Byron beats the streets

This morning we received full year results from the high flying Omnia. I covered the 6 month numbers in November last year in a piece titled Omnia six month results as expected. The piece explains what the business does as well as looks at some valuations. As you can see from the fundamental analysis, we worked with an estimation of 1200c earnings for the year. Well here are the real numbers.

Profits for the year are up 40% to R880 million. This comes from group revenues of R13.5bn which is up 23.7% from last year. Per share this equates to 1332c which comfortably beat expectations from last year. Of course they had to release a trading statement which I also covered a few weeks ago. This actual number came in just above the middle of the range suggested (between 1310 and 1340). The share trades at R170.25 which puts it on a historic multiple of 12.8 which looks very cheap for a company growing earnings by 40%.

The company consists of three divisions namely Mining, Agriculture and Chemical. Let's look at each division separately.

Mining. The mining division is flying. Revenues increased 43.5% to R4.379bn on the back of strong volume growth (24%) and price increases (20%). Better operating efficiencies resulted in operating profits increasing 54% to R735 million. This division contributes nearly 60% of operating profits to the group. But why is it growing so fast? I can think of 2 things. Firstly, their explosives are mainly used in open cast mining.

Businesses like Kumba have not suffered from the strikes nearly as badly as miners who have to operate predominantly underground. The platinum miners have to hire a rock drill operator to physically dig the holes themselves. It is therefore less labour intensive. Secondly Omnia have clients all over Africa and as a mining destination the continent has massive resources and is growing fast in the industry.

Agriculture. Fertilizers have also grown quickly and the division is really benefiting from lower input costs thanks to the new nitric acid plant that started operating last year. Revenue increased 20.6% while operating profits increased by 37.2% to R443 million. The division contributes 36% to the group's overall operating profit. I have always been excited by this division. Africa has plenty of farmable land but the technologies and use of fertilizers is still in its infancy. Omnia are in the right place at the right time.

Chemicals. As is with Sasol's chemical division, revenues are high but margins are almost non-existent. This industry has been struggling off the back of weaker demand from Europe. Revenues increased 10.2% to R3.7bn but operating profits decreased 35% to R56 million or 4% of the overall groups operating number.

The company is excited about its prospects going forward. Mining and agriculture in Africa are both fast growing industries. Fortunately Omnia do not have to take the operational risk, they can just export the product to whoever needs it. As you can imagine the weaker Rand has been beneficial but I am sure much of this has been mitigated by higher input costs. You would probably find that is why the stock is quite cheap, manufacturing in South Africa has many headwinds at the moment. I am confident that this company will still grow at strong levels and that at current prices, this is a great buying opportunity.

Home again, home again, jiggety-jog. Markets are recovering a little. I suspect that all we need from here is some positive economic news to suggest to the anxiety attack that everything is going to be OK. I can't wait for earnings soon! The Rand is catching a bid, but expectations are for a hefty petrol price increase. Hmmm.... long live the strong Rand. Tomorrow, a look at the competition commissions fine dished out to the construction industry.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440