To market, to market to buy a fat pig. I read somewhere on Friday that the monthly non-farm payroll numbers was about the worst outcome ever for cable news networks. Imagine a number that met consensus. And now there is nothing to talk about. One of the busiest and most visible news junkies on Twitter Joe Weisenthal pronounced that this was a Goldilocks number. Meaning that the headline number was not too hot (too many jobs), nor too cold (too few jobs) and in fact just right, as in the bowls of porridge that the naughty little girl tasted. How the bears made the porridge or lived in a house, I am not that sure, but it's just a story.

But Joe had a bigger point than just pointing out that the number was inline with expectations, a number much stronger would (in the eyes of the short termers) be evidence presented to the Fed to retire their stimulus program earlier than anticipated. A number very weak would have meant that the Fed would have carried on their program for longer, I honestly don't think that is a good outcome. So a number meeting expectations means that the status quo remains.

If you want the full release, then check it out from the BLS: THE EMPLOYMENT SITUATION - MAY 2013. "Total nonfarm payroll employment increased by 175,000 in May, and the unemployment rate was essentially unchanged at 7.6 percent...... Employment rose in professional and business services, food services and drinking places, and retail trade." Some folks had also pointed out that May was a five week month and that might have explained a good number. Others also suggested that the sequester should have been having more of an impact, the fact that it wasn't was a good outcome. At least for now.

There is strong growth in the food services and drinking places sector, 337 thousand new jobs have been added there over the last year. Happy people are more merry, I guess they fill their bellies accordingly. But this is the part that I guess the market wants to see, a reduction of 14 thousand US Federal government jobs last month, 45 thousand fewer people employed by uncle Sam in the last three months. That is on course for an annual run rate (reduction) of 180 thousand fewer people in employment in government. But still, 20 million people employed by the government, is that too many? Well, perhaps, bearing in mind that there are only 8.6 million folks that are in the category "Self-employed workers, unincorporated". Now this number has shrunk in the last decade, it used to comfortably be above 10 million back then, but is lower now, nearly 1 million less nowadays. I wonder why....

Just before the release on Friday, in fact late Thursday, the Chicago Fed published a piece: Estimating the trend in employment growth, in which they said something that might have startled a few people: "For the unemployment rate to decline, the U.S. economy needs to generate above-trend job growth. We currently estimate trend employment growth to be around 80,000 jobs per month, and we expect it to decline over the remainder of the decade, due largely to changing labor force demographics and slower population growth."

That is interesting. So with a changing labour force participation rate, and a declining and slowing birth rate, the jobs picture will change. And perhaps not millions of jobs are needed in the long run. The past is not the same as the future and never will be, so sometimes suggesting that x needs to return to level y just to break even is not always the best analysis. Think of the changing job market. Nowadays self motivated individuals can change their circumstances without ever leaving their desk. One can apply for a job in a far away country, do a detailed CV online (LinkedIn) and make yourself public, have an interview via Skype and away you go. That exercise didn't exist 20 years ago. In turn machines are doing more labour intensive jobs than ever before. To stay ahead you are going to have to get cleverer.

It did not really register on the radar, but it is and was massive. BHP Billiton has completed sale of 8.33% interest in the East Browse JV and 20% interest in the West Browse JV, located offshore Western Australia, to PetroChina International Investment. For 1.63 billion Dollars. Wow. At 10.17 Rands to the US Dollar, that is over 16.5 billion ZAR. Bigger than HCI and Illovo. But when your combined market cap is around 163 billion Dollars (adding the two ADR's up), that is around one percent of their market cap. Perspective is needed sometimes for size and scale.

Which Waze is this going to go? And by that, I am talking about the business called Waze, an Israeli business that did not exist in 2007. Now, the talk of the town is that Google are the most successful bidder and are willing to pay somewhere in the region of 1 billion Dollars for the business that isn't (in human terms) at junior school yet. 80 whole employees, with 10 in California, the rest in Israel. Now before you say, Israel, what is that about, remember that Israel has outside of North America the highest number of listed companies on the NASDAQ, per territory. Israel has more university graduates as a percentage of their population than any other country in the world. Israel apparently produces more scientific papers per capita and files more patents per capita than any other country in the world. Seems like relatively low rainfall, clear air and moderate temperatures mixed in with clever people make the perfect cocktail for human ingenuity!

So what do Waze do? Well, Byron actually showed me the application about 9 months ago, it helps make your life easier from a traffic flow point of view. Which makes Google a more perfect fit actually, rather than the other suitors who have been bandied around, Facebook and Apple were also suggested to have "wanted" Waze. We will see, I would like to see the announcement soon. Check out the Time piece: Here's Why Google Wants to Buy Waze, a Red Hot Map App, for $1 Billion. Good for them! Here is to fostering innovation here locally, so that we can have an innovative information technology part of our economy.

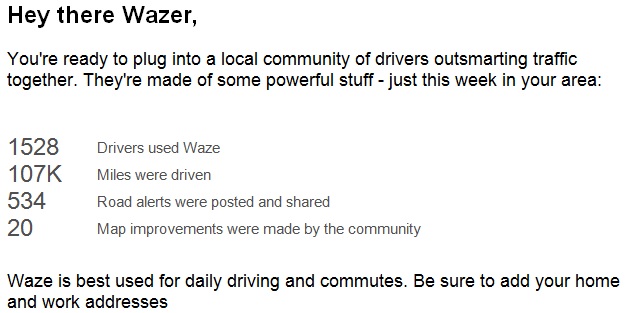

I signed up to Waze (I had the app already) and got this little starter alert:

That is just "my area" and in the last week. Amazingly this is pretty much like the Wikipedia of traffic, with the community moderating. And yet another example of how the community as a collective makes life easier for each other. I wonder whether the intention, when the founders started Waze was to make the world easier to navigate and be the premier application globally (they actually won most innovative application for 2013), or the motivation was to make money. You will probably find that by starting off with trying to make the world easier, the second outcome came.

Byron beats the streets

- On Friday we received a business update from Sasol for the 9 month period up to April. One thing I can confirm from this very long report is that this is a very busy business. They have so many things going on at the moment it is hard to keep up. Here is the release if you want to read the details. Below I will cover the points I thought were important.

In terms of financials there was not too much info given away. We will have to dig into that when the results come out. They do however give the average Rand Dollar price and average oil price received. Compared to March last year this is actually down 2%. The weaker rand has been offset by a weaker oil price.

There is also a lot of talk on macro influences in the update. Nothing new was said but there are many mentions of the unproductive and weak labour market we have in South Africa at the moment. This is causing above inflation cost increases to the business in South Africa which they are trying very hard to control. No wonder they have earmarked North America for their next big growth investment. Talking about their US investments they tell us some detailed information about their plans there.

"We are executing the front-end engineering and design (FEED) phase of the integrated, world-scale ethane cracker and downstream derivatives units, and will commence with FEED for the GTL and chemicals value-adds facility at Lake Charles in Louisiana during the second half of the 2013 calendar year."

So basically they are going to begin with an ethane cracker which produces ethylene. This will be used for many industrial functions and products. Only after that is decided on will they look at the GTL plant.

"The US GTL facility (estimated to cost between US$11 billion and US$14 billion) will produce at least a nominal 96 000 barrels per day (bbl/d) of product, with the potential to produce up to 10% more. The US GTL project will be delivered in two phases after the ethane cracker, with each phase comprising at least 48 000 bbl/d. The final investment decision for the US GTL project is expected to be taken within 18 to 24 months after that of the US ethane cracker.

Around 70% of the production of the GTL facility will be low-sulphur diesel, with naphtha and liquid petroleum gas (LPG) as co-products, and 30% of the production will be chemical products, including paraffin feedstock for linear alkyl benzene (LAB), wax products and synthetic base oils."

Very interesting. The GTL plans will only look to start producing around 2020 so patience will be key. The concept sounds amazing, implementation is vital and that is up to good management. As an investor you are entrusting management to do this right.

As far as current operations are concerned.

"We expect an overall solid production performance for the 2013 financial year with our production guidance remaining

unchanged:

Sasol Synfuels volume guidance based on current performance is anticipated to be at the top end of the previously guided range of 7,2 to 7,4 million tons for the full year;

The full year average utilisation rate at ORYX GTL in Qatar, taking into account the statutory shutdown, is expected to be approximately 80% of nameplate capacity;

Full year production at ASPC in Iran will be approximately 80% of nameplate capacity; and

Our shale gas venture in Canada will continue to show increased production compared to the prior year due to the new wells coming on stream. At present we are stabilising our production, as we have slowed down the drilling of additional wells.

We remain on track to deliver on our expectations for improved operational performance."

We remain happy and confident to hold this stock for a very long time. Management are proactive and ambitious while using their strong base here in SA to expand around the world. On top of that we are bullish about the future demand for energy, that is of course key for the future of this business.

Home again, home again, jiggety-jog. Stocks are slightly higher now, the Rand has weakened significantly, property stocks are getting messed up again. Higher rate environment coming soon I guess, that is not the greatest news, but inevitable with imported inflation accounting for another 200 basis points, as the Rand has weakened by around 16 odd percent to the US Dollar this year alone.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment